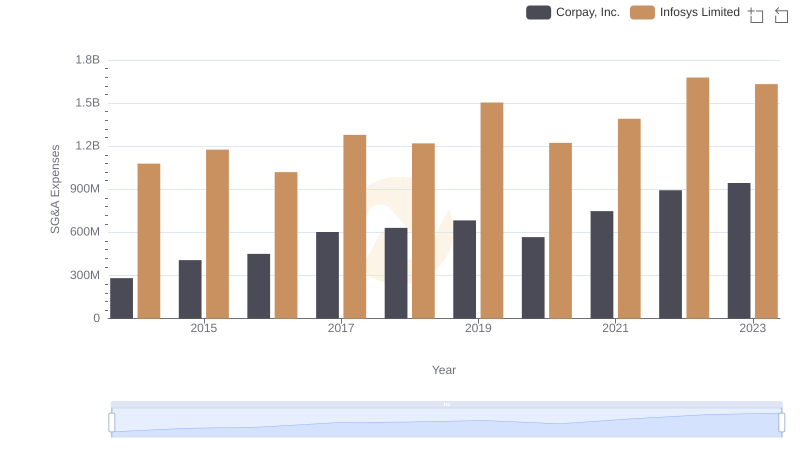

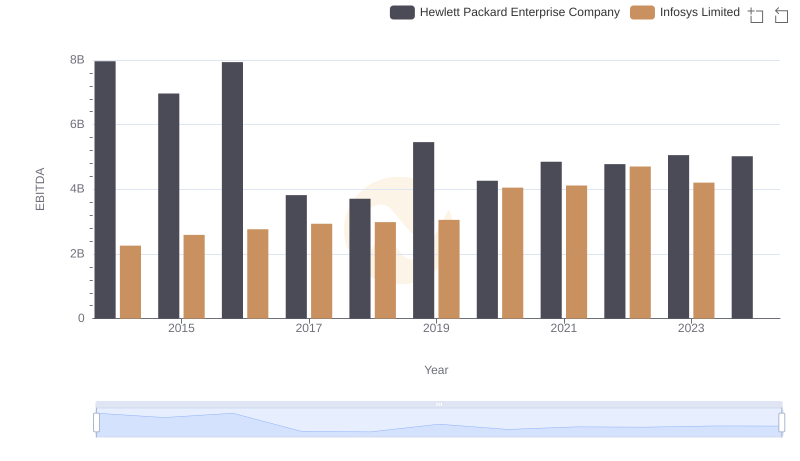

| __timestamp | Hewlett Packard Enterprise Company | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 8717000000 | 1079000000 |

| Thursday, January 1, 2015 | 8025000000 | 1176000000 |

| Friday, January 1, 2016 | 7821000000 | 1020000000 |

| Sunday, January 1, 2017 | 5006000000 | 1279000000 |

| Monday, January 1, 2018 | 4851000000 | 1220000000 |

| Tuesday, January 1, 2019 | 4907000000 | 1504000000 |

| Wednesday, January 1, 2020 | 4624000000 | 1223000000 |

| Friday, January 1, 2021 | 4929000000 | 1391000000 |

| Saturday, January 1, 2022 | 4941000000 | 1678000000 |

| Sunday, January 1, 2023 | 5160000000 | 1632000000 |

| Monday, January 1, 2024 | 4871000000 |

Unveiling the hidden dimensions of data

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Infosys Limited and Hewlett Packard Enterprise Company (HPE) have taken different paths in optimizing these costs. From 2014 to 2023, HPE's SG&A expenses decreased by approximately 44%, from $8.7 billion to $4.9 billion, showcasing a strategic focus on cost efficiency. In contrast, Infosys maintained a more stable SG&A expense profile, with a slight increase of around 51% from $1.1 billion to $1.6 billion over the same period. This divergence highlights HPE's aggressive cost-cutting measures compared to Infosys's steady growth approach. Notably, data for 2024 is incomplete, reflecting the dynamic nature of financial reporting. As these tech titans continue to evolve, their SG&A strategies will remain pivotal in shaping their financial futures.

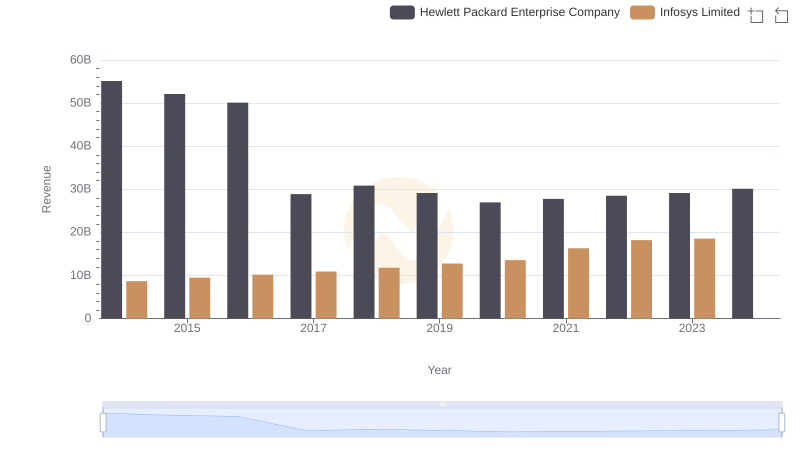

Comparing Revenue Performance: Infosys Limited or Hewlett Packard Enterprise Company?

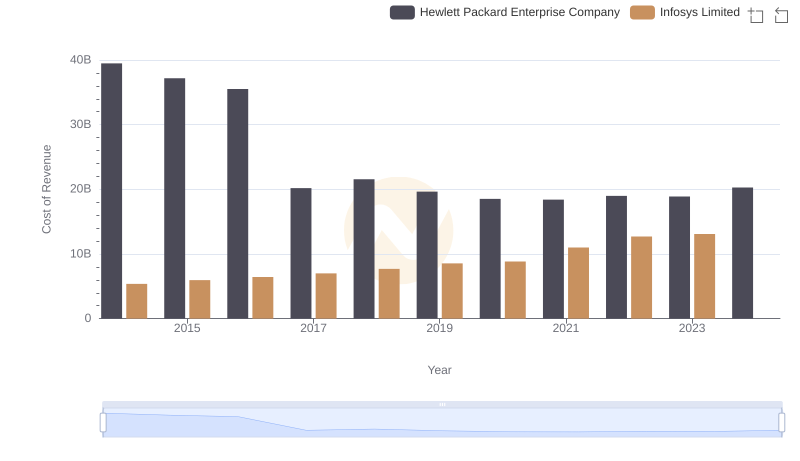

Cost of Revenue Comparison: Infosys Limited vs Hewlett Packard Enterprise Company

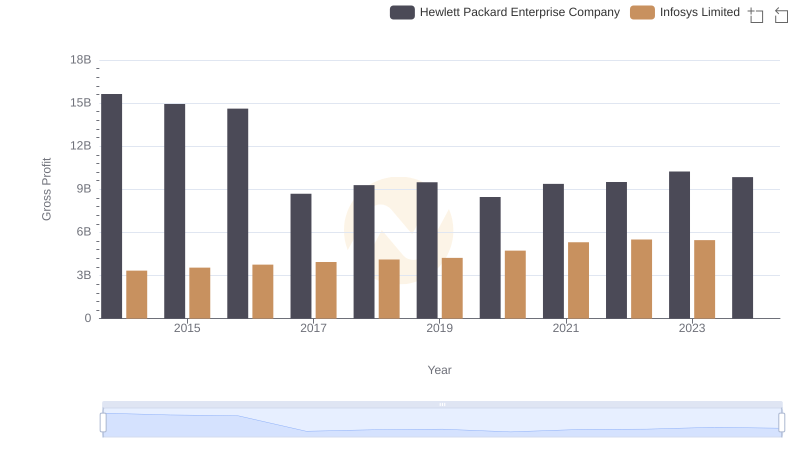

Gross Profit Trends Compared: Infosys Limited vs Hewlett Packard Enterprise Company

Comparing SG&A Expenses: Infosys Limited vs Corpay, Inc. Trends and Insights

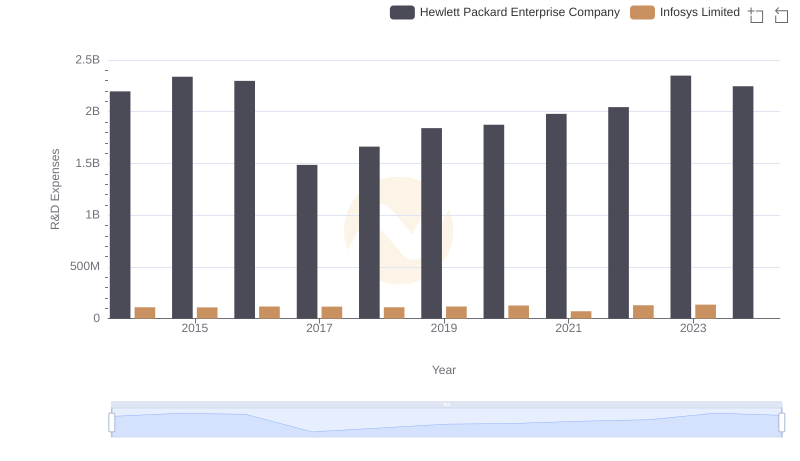

Infosys Limited vs Hewlett Packard Enterprise Company: Strategic Focus on R&D Spending

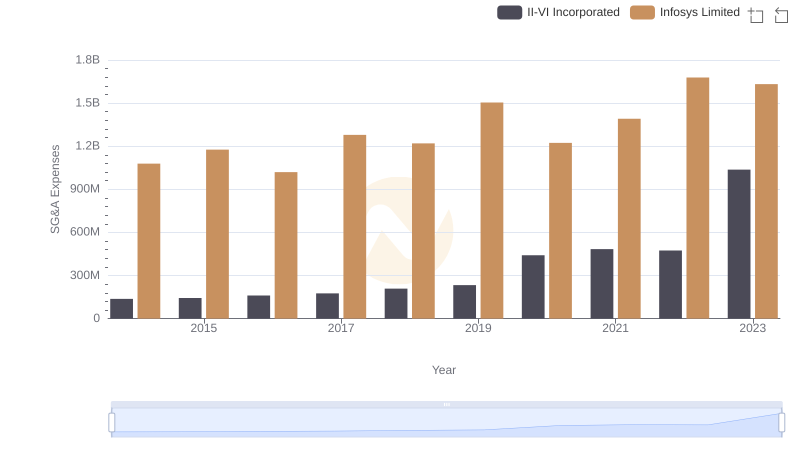

Cost Management Insights: SG&A Expenses for Infosys Limited and II-VI Incorporated

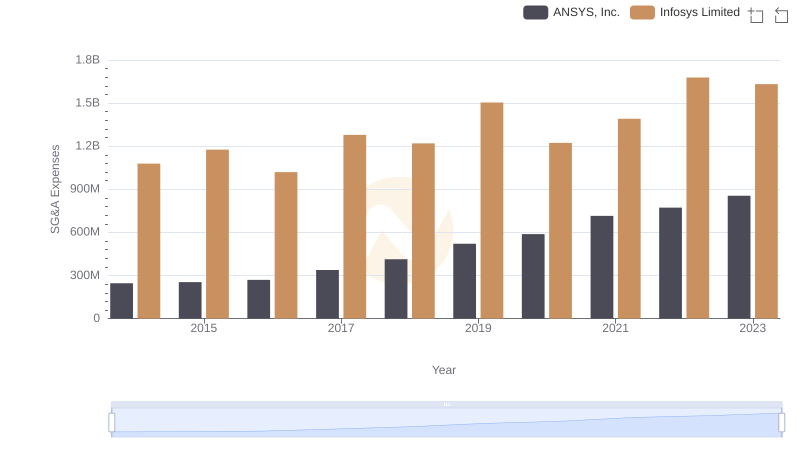

Comparing SG&A Expenses: Infosys Limited vs ANSYS, Inc. Trends and Insights

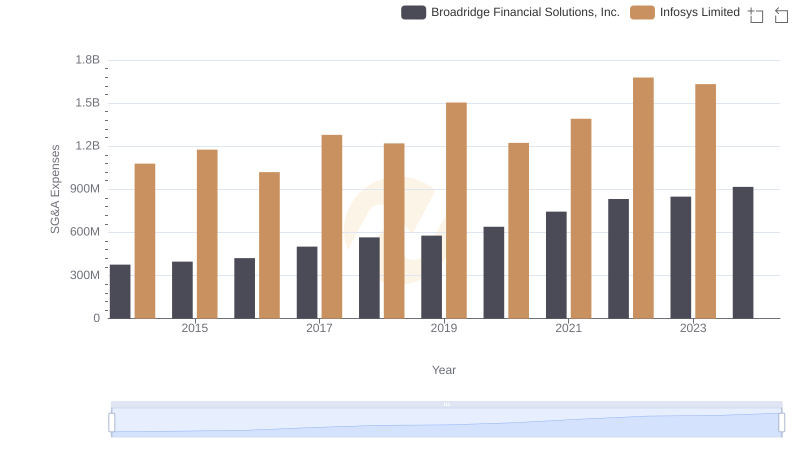

Comparing SG&A Expenses: Infosys Limited vs Broadridge Financial Solutions, Inc. Trends and Insights

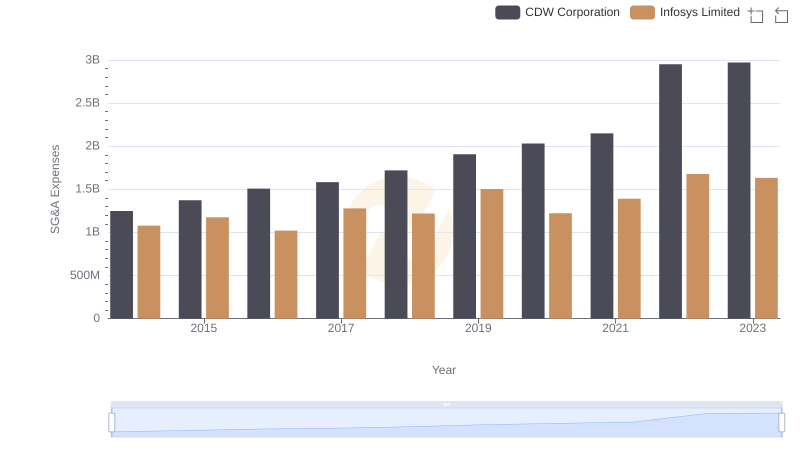

Operational Costs Compared: SG&A Analysis of Infosys Limited and CDW Corporation

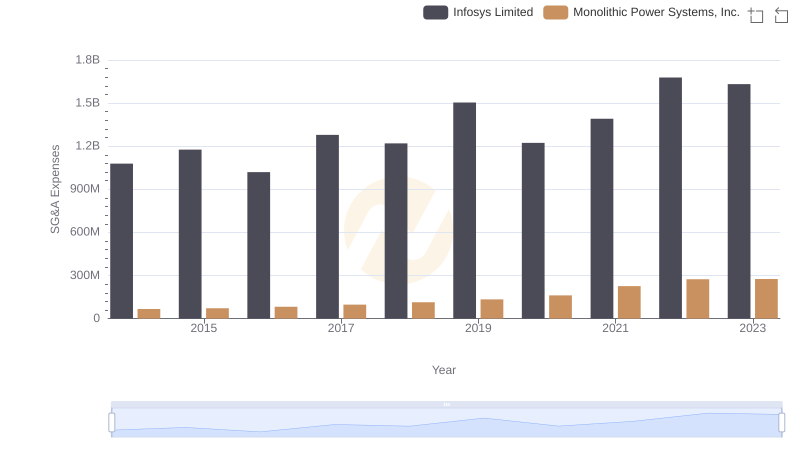

SG&A Efficiency Analysis: Comparing Infosys Limited and Monolithic Power Systems, Inc.

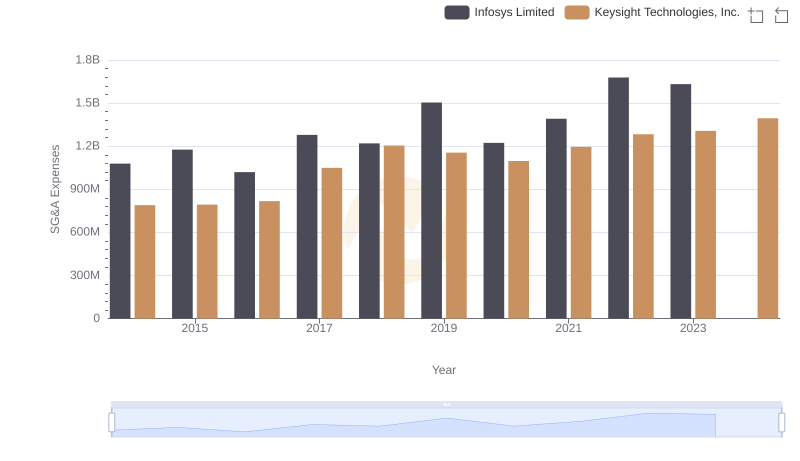

SG&A Efficiency Analysis: Comparing Infosys Limited and Keysight Technologies, Inc.

EBITDA Performance Review: Infosys Limited vs Hewlett Packard Enterprise Company