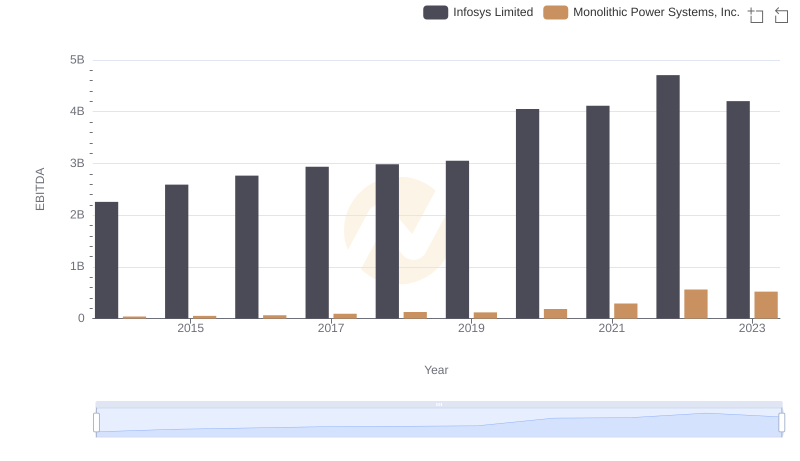

| __timestamp | Infosys Limited | Monolithic Power Systems, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 66755000 |

| Thursday, January 1, 2015 | 1176000000 | 72312000 |

| Friday, January 1, 2016 | 1020000000 | 83012000 |

| Sunday, January 1, 2017 | 1279000000 | 97257000 |

| Monday, January 1, 2018 | 1220000000 | 113803000 |

| Tuesday, January 1, 2019 | 1504000000 | 133542000 |

| Wednesday, January 1, 2020 | 1223000000 | 161670000 |

| Friday, January 1, 2021 | 1391000000 | 226190000 |

| Saturday, January 1, 2022 | 1678000000 | 273595000 |

| Sunday, January 1, 2023 | 1632000000 | 275740000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Infosys Limited and Monolithic Power Systems, Inc. have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Infosys Limited has seen a consistent increase in SG&A expenses, peaking in 2022 with a 55% rise from 2014. This growth reflects the company's strategic investments in expanding its global footprint and enhancing operational capabilities.

Conversely, Monolithic Power Systems, Inc. has experienced a dramatic surge, with SG&A expenses quadrupling over the same period. This rapid increase underscores the company's aggressive market expansion and innovation-driven growth strategy.

As these two giants continue to evolve, their SG&A efficiency will remain a key indicator of their strategic priorities and market positioning.

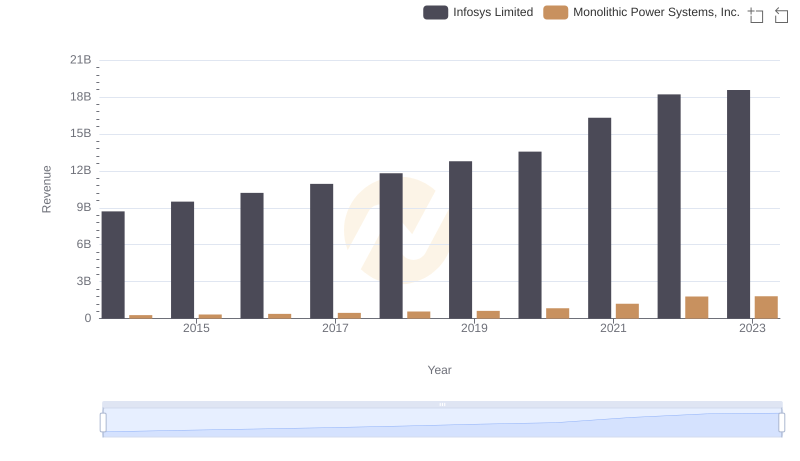

Infosys Limited vs Monolithic Power Systems, Inc.: Annual Revenue Growth Compared

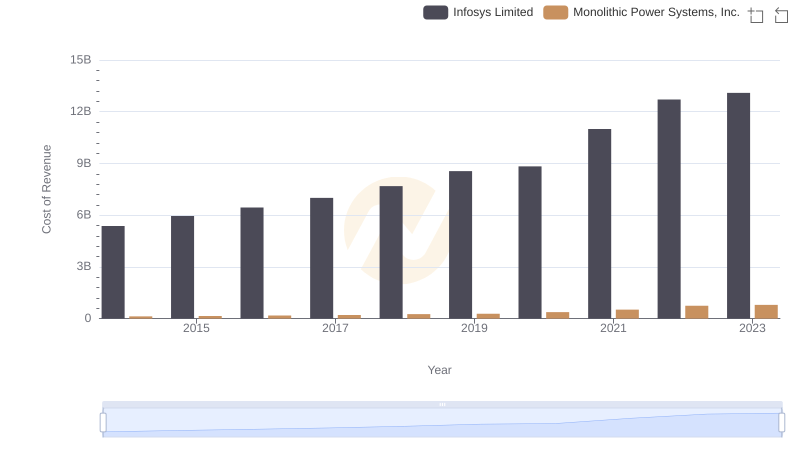

Analyzing Cost of Revenue: Infosys Limited and Monolithic Power Systems, Inc.

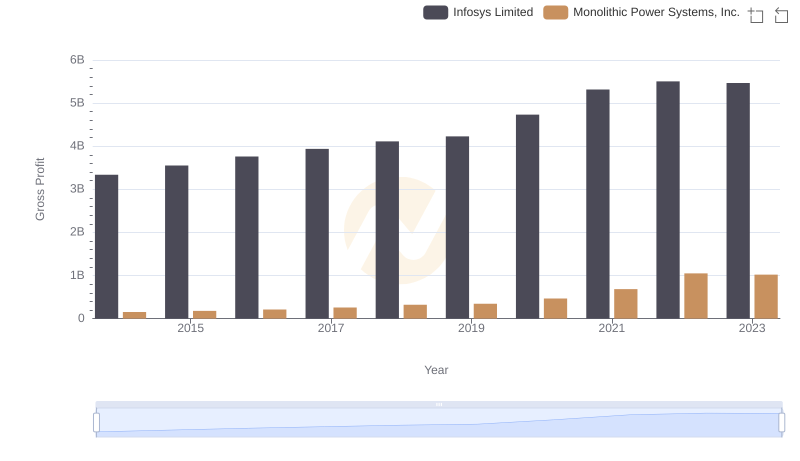

Infosys Limited and Monolithic Power Systems, Inc.: A Detailed Gross Profit Analysis

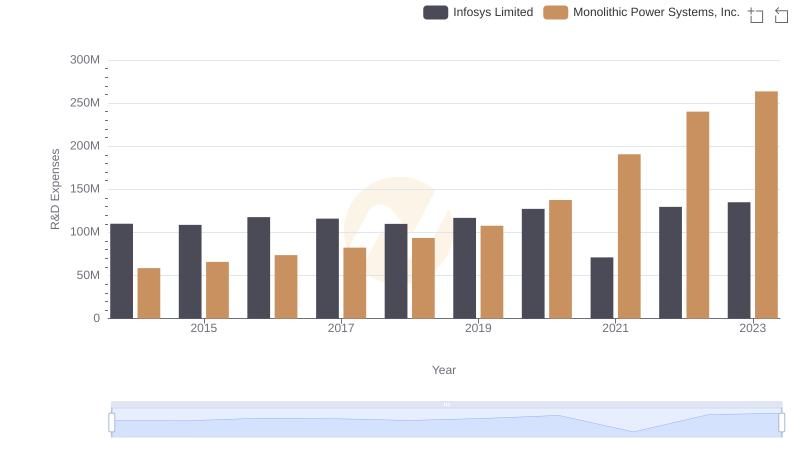

Infosys Limited or Monolithic Power Systems, Inc.: Who Invests More in Innovation?

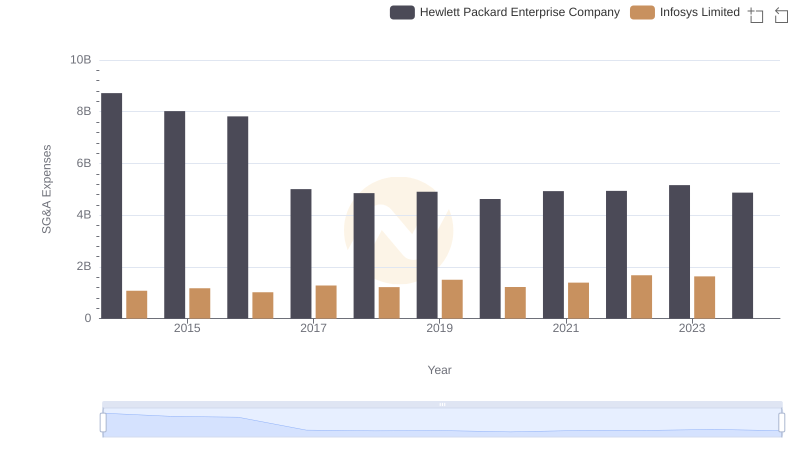

Who Optimizes SG&A Costs Better? Infosys Limited or Hewlett Packard Enterprise Company

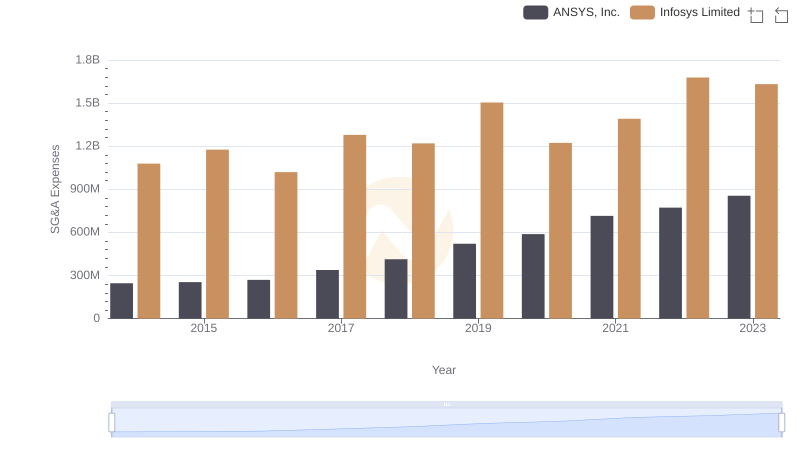

Comparing SG&A Expenses: Infosys Limited vs ANSYS, Inc. Trends and Insights

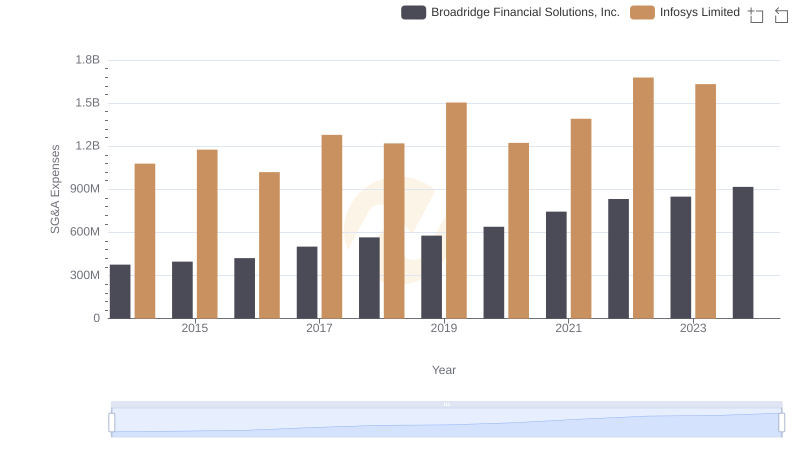

Comparing SG&A Expenses: Infosys Limited vs Broadridge Financial Solutions, Inc. Trends and Insights

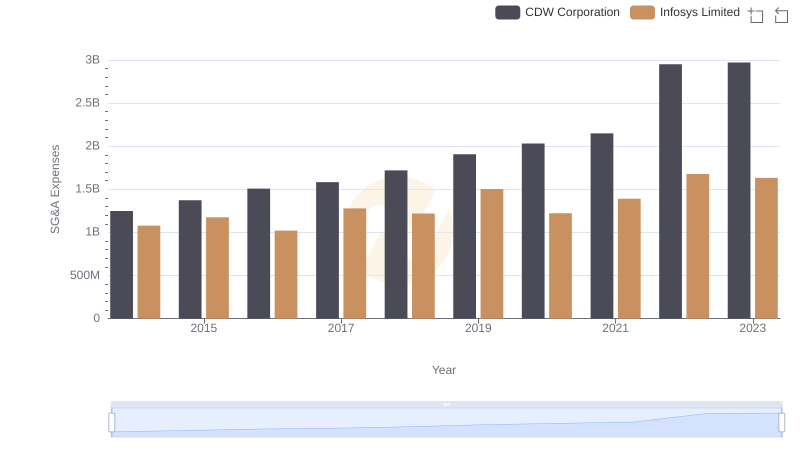

Operational Costs Compared: SG&A Analysis of Infosys Limited and CDW Corporation

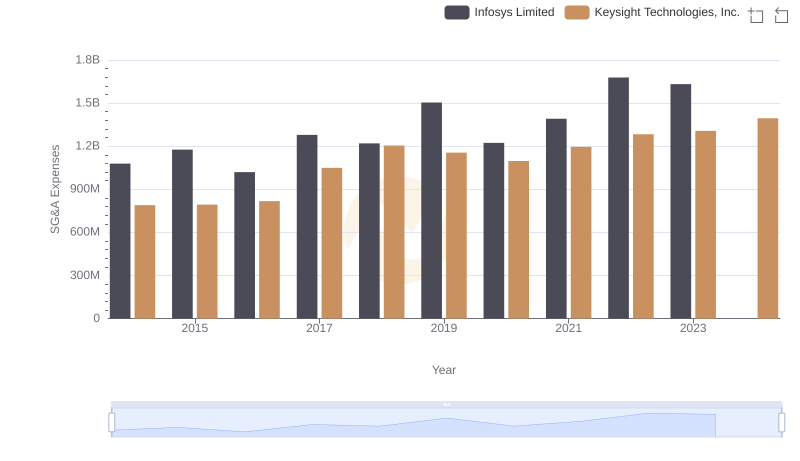

SG&A Efficiency Analysis: Comparing Infosys Limited and Keysight Technologies, Inc.

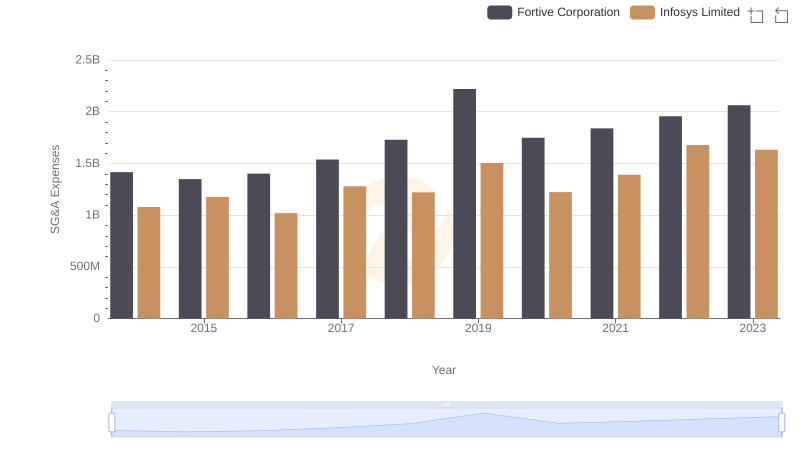

Infosys Limited vs Fortive Corporation: SG&A Expense Trends

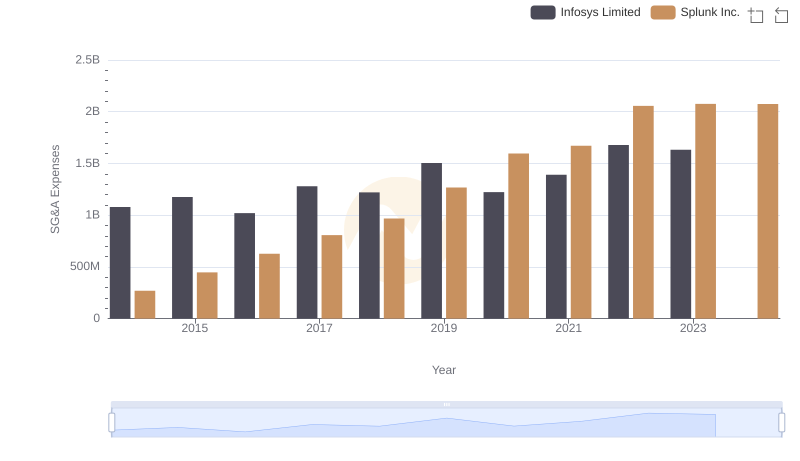

Infosys Limited vs Splunk Inc.: SG&A Expense Trends

Comparative EBITDA Analysis: Infosys Limited vs Monolithic Power Systems, Inc.