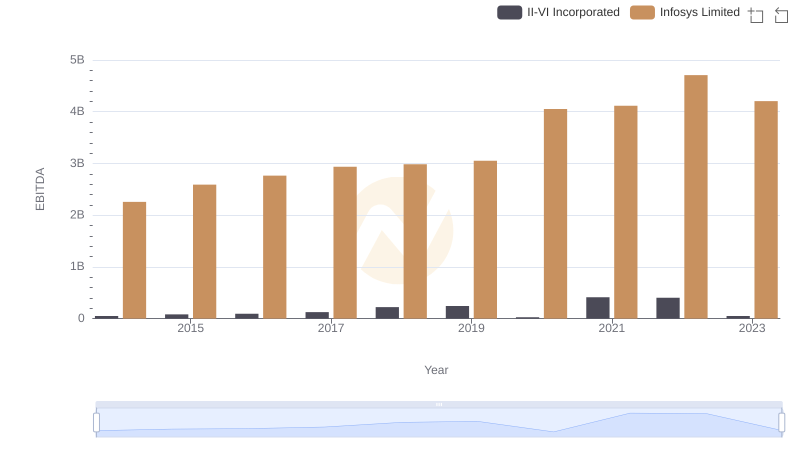

| __timestamp | II-VI Incorporated | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 137707000 | 1079000000 |

| Thursday, January 1, 2015 | 143539000 | 1176000000 |

| Friday, January 1, 2016 | 160646000 | 1020000000 |

| Sunday, January 1, 2017 | 176002000 | 1279000000 |

| Monday, January 1, 2018 | 208565000 | 1220000000 |

| Tuesday, January 1, 2019 | 233518000 | 1504000000 |

| Wednesday, January 1, 2020 | 440998000 | 1223000000 |

| Friday, January 1, 2021 | 483989000 | 1391000000 |

| Saturday, January 1, 2022 | 474096000 | 1678000000 |

| Sunday, January 1, 2023 | 1036699000 | 1632000000 |

| Monday, January 1, 2024 | 854001000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A expenses of two industry giants: Infosys Limited and II-VI Incorporated, from 2014 to 2023.

Infosys, a leader in IT services, has consistently managed its SG&A expenses, with a notable increase of approximately 51% over the decade. Starting at 1.08 billion in 2014, the expenses peaked at 1.68 billion in 2022, reflecting strategic investments in global expansion and innovation.

In contrast, II-VI Incorporated, a key player in engineered materials, witnessed a dramatic rise in SG&A expenses, surging by over 650% from 2014 to 2023. This sharp increase, culminating in 1.04 billion in 2023, underscores the company's aggressive growth strategy and market diversification.

Understanding these trends offers valuable insights into how companies navigate financial challenges and opportunities in a dynamic market.

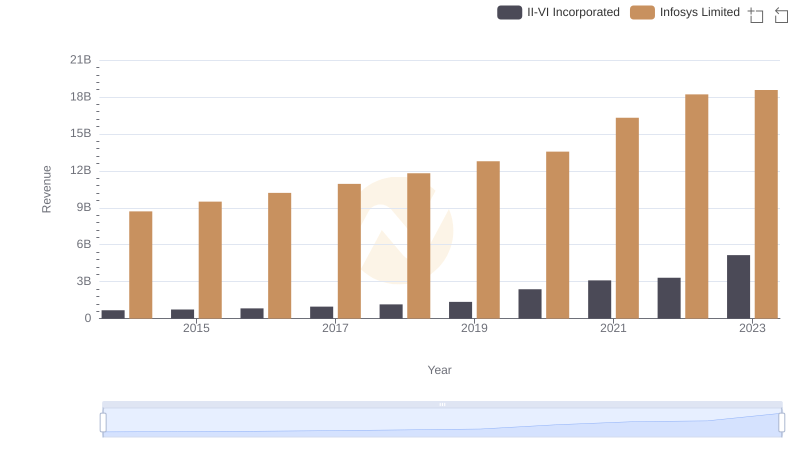

Comparing Revenue Performance: Infosys Limited or II-VI Incorporated?

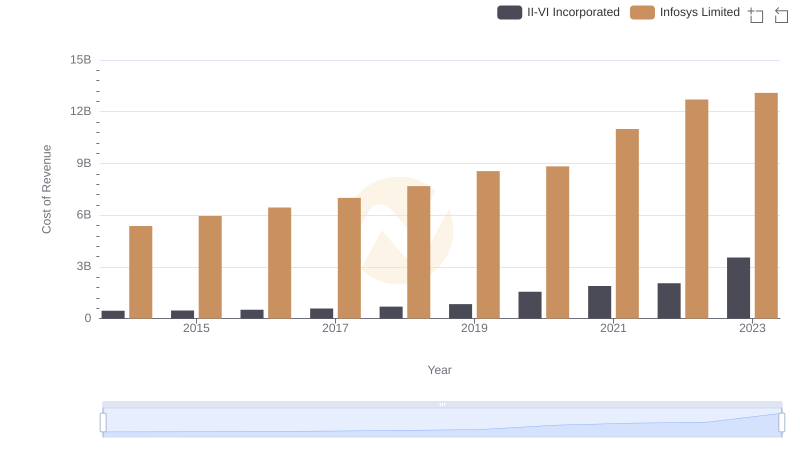

Analyzing Cost of Revenue: Infosys Limited and II-VI Incorporated

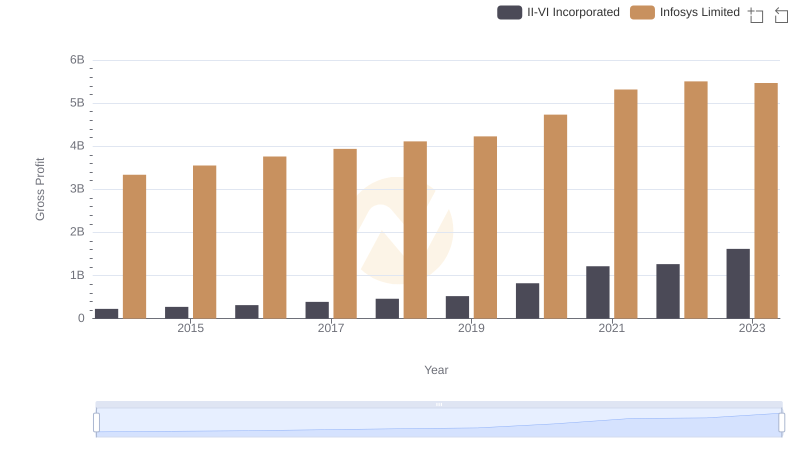

Key Insights on Gross Profit: Infosys Limited vs II-VI Incorporated

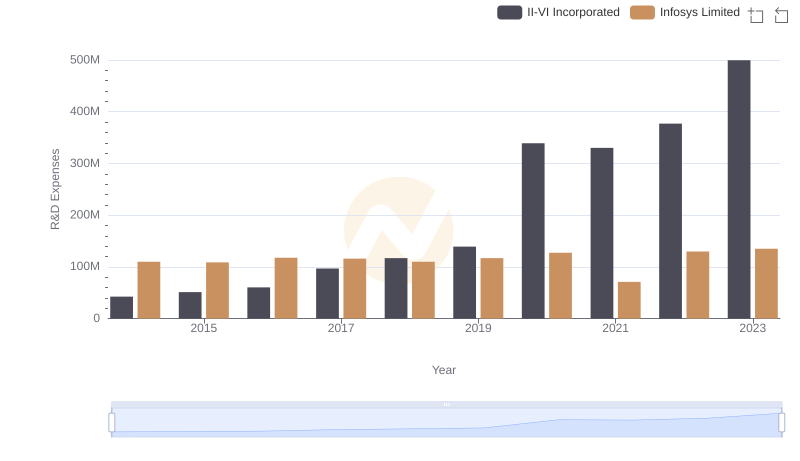

Comparing Innovation Spending: Infosys Limited and II-VI Incorporated

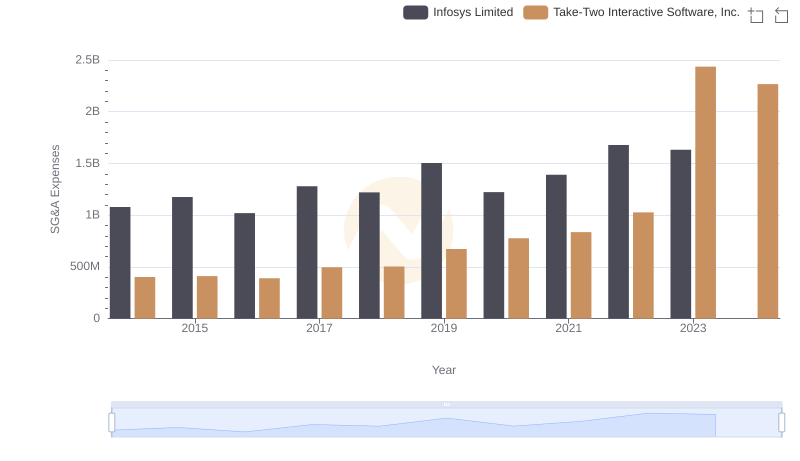

Who Optimizes SG&A Costs Better? Infosys Limited or Take-Two Interactive Software, Inc.

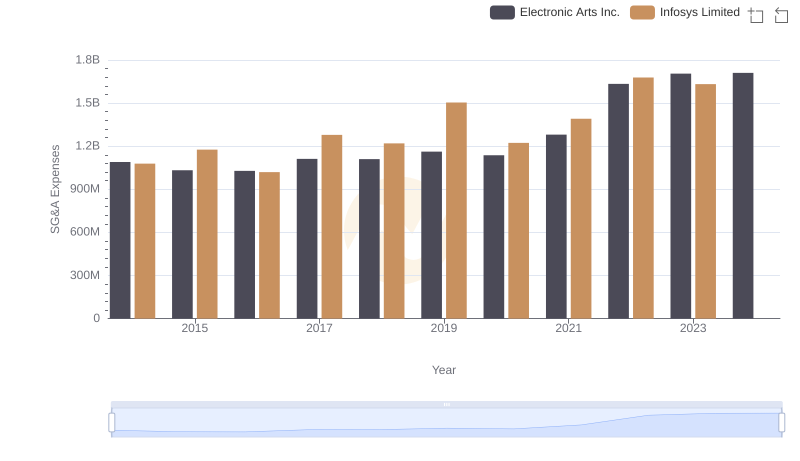

Infosys Limited or Electronic Arts Inc.: Who Manages SG&A Costs Better?

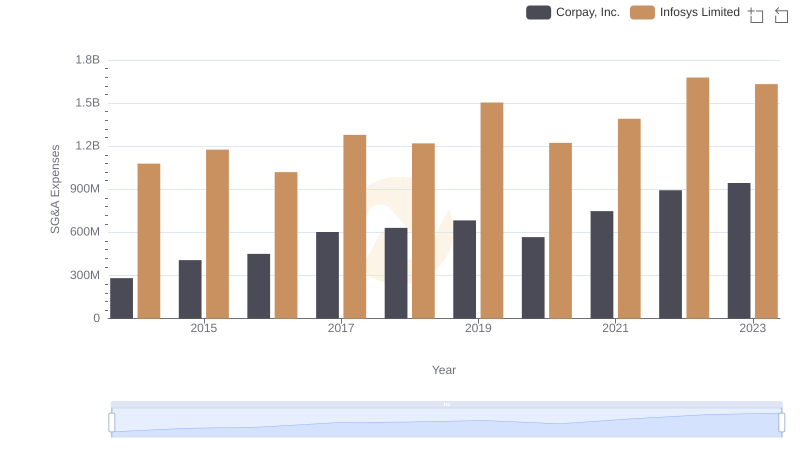

Comparing SG&A Expenses: Infosys Limited vs Corpay, Inc. Trends and Insights

A Professional Review of EBITDA: Infosys Limited Compared to II-VI Incorporated

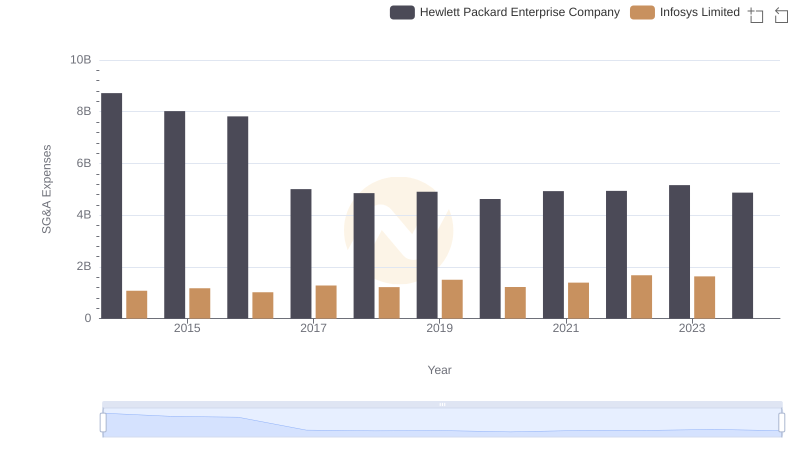

Who Optimizes SG&A Costs Better? Infosys Limited or Hewlett Packard Enterprise Company

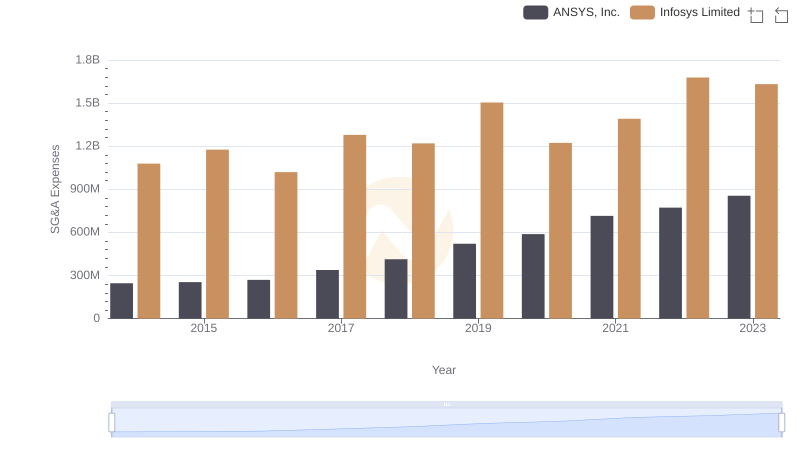

Comparing SG&A Expenses: Infosys Limited vs ANSYS, Inc. Trends and Insights

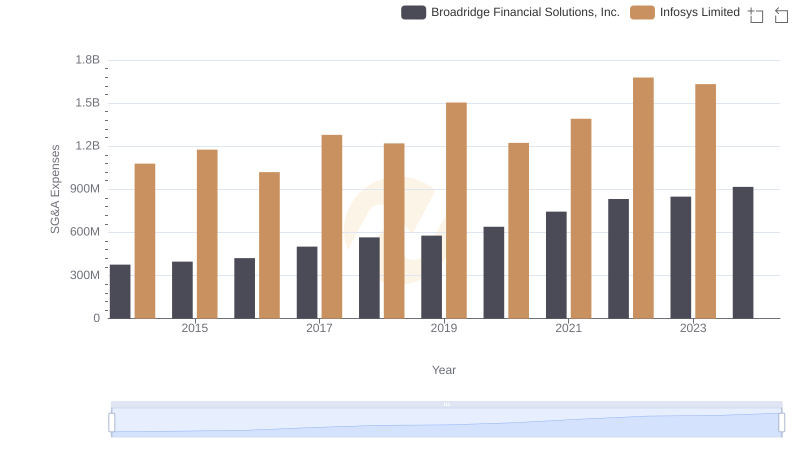

Comparing SG&A Expenses: Infosys Limited vs Broadridge Financial Solutions, Inc. Trends and Insights

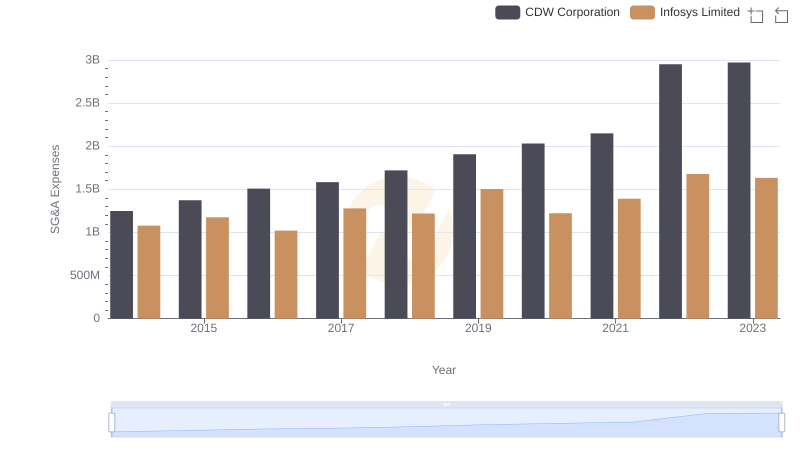

Operational Costs Compared: SG&A Analysis of Infosys Limited and CDW Corporation