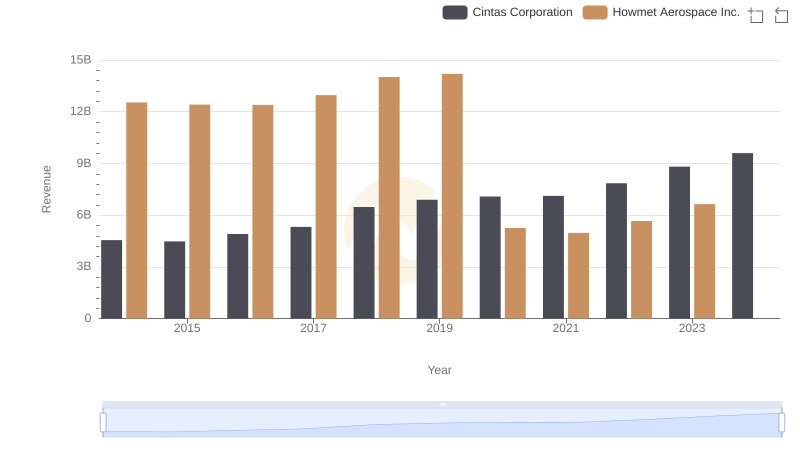

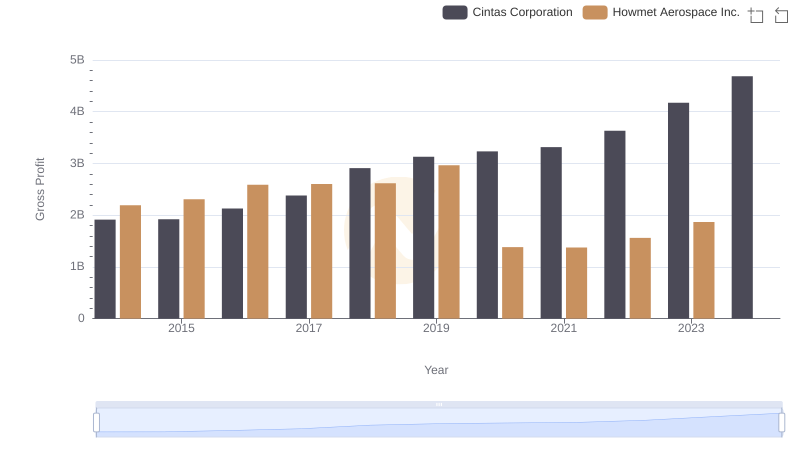

| __timestamp | Cintas Corporation | Howmet Aerospace Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 10349000000 |

| Thursday, January 1, 2015 | 2555549000 | 10104000000 |

| Friday, January 1, 2016 | 2775588000 | 9806000000 |

| Sunday, January 1, 2017 | 2943086000 | 10357000000 |

| Monday, January 1, 2018 | 3568109000 | 11397000000 |

| Tuesday, January 1, 2019 | 3763715000 | 11227000000 |

| Wednesday, January 1, 2020 | 3851372000 | 3878000000 |

| Friday, January 1, 2021 | 3801689000 | 3596000000 |

| Saturday, January 1, 2022 | 4222213000 | 4103000000 |

| Sunday, January 1, 2023 | 4642401000 | 4773000000 |

| Monday, January 1, 2024 | 4910199000 | 5119000000 |

Unleashing insights

In the ever-evolving landscape of American industry, Cintas Corporation and Howmet Aerospace Inc. stand as titans in their respective fields. From 2014 to 2023, these companies have showcased contrasting trajectories in their cost of revenue. Cintas Corporation, a leader in corporate uniforms and facility services, has seen a steady increase, with costs rising by approximately 86% over the decade. In contrast, Howmet Aerospace, a key player in the aerospace components sector, experienced a significant drop in 2020, with costs plummeting by nearly 65% compared to the previous year. This divergence highlights the resilience of Cintas amidst economic shifts and the challenges faced by Howmet during the pandemic. As we look to 2024, Cintas continues its upward trend, while Howmet's data remains incomplete, leaving room for speculation on its future performance.

Cintas Corporation vs Howmet Aerospace Inc.: Examining Key Revenue Metrics

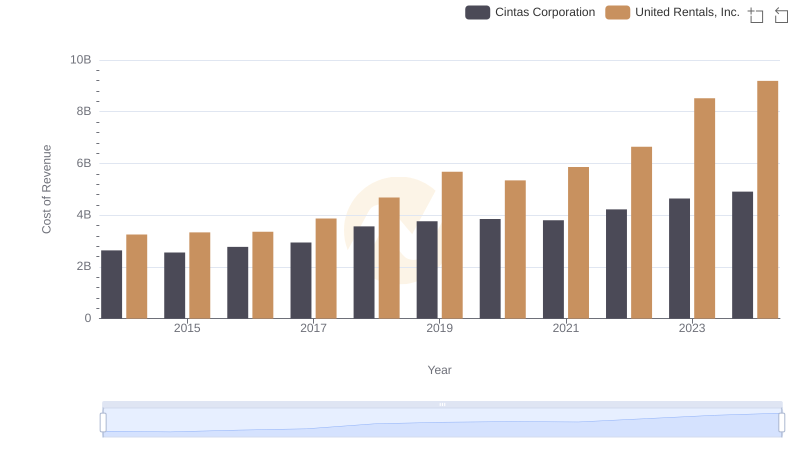

Comparing Cost of Revenue Efficiency: Cintas Corporation vs United Rentals, Inc.

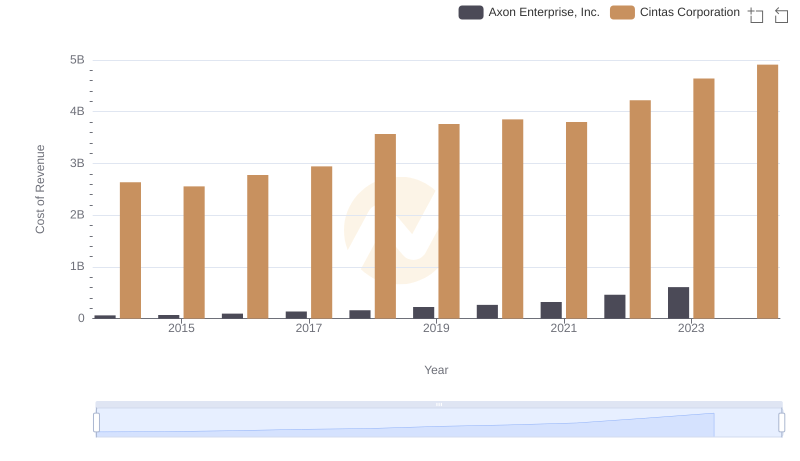

Cost of Revenue: Key Insights for Cintas Corporation and Axon Enterprise, Inc.

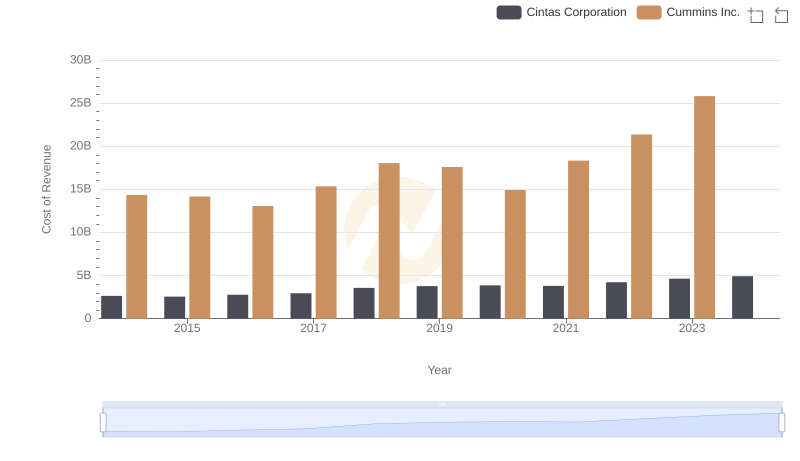

Cost Insights: Breaking Down Cintas Corporation and Cummins Inc.'s Expenses

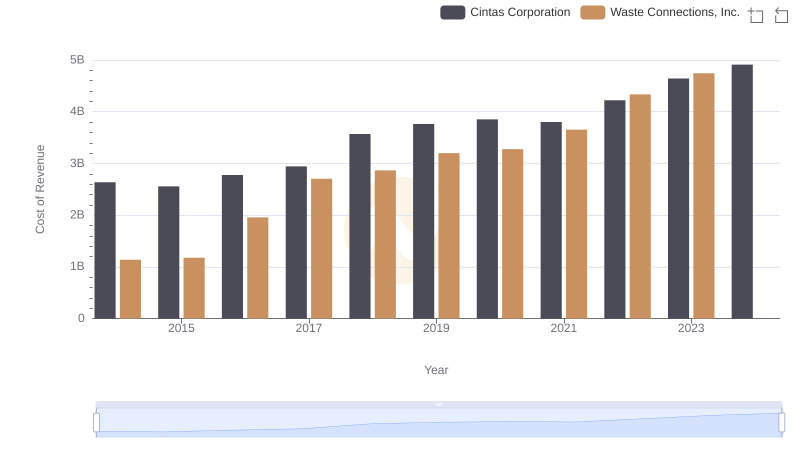

Cost of Revenue Comparison: Cintas Corporation vs Waste Connections, Inc.

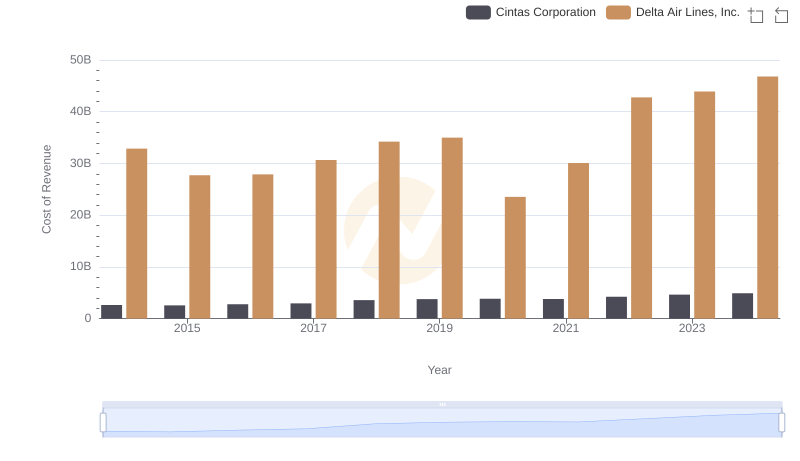

Cost Insights: Breaking Down Cintas Corporation and Delta Air Lines, Inc.'s Expenses

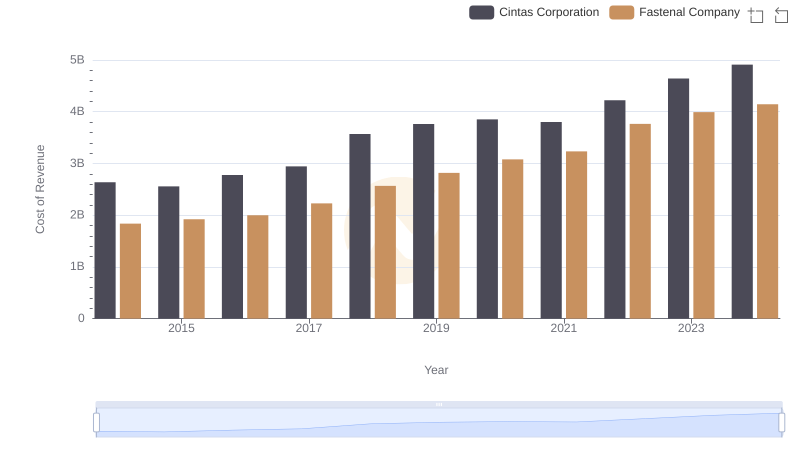

Cost of Revenue Trends: Cintas Corporation vs Fastenal Company

Who Generates Higher Gross Profit? Cintas Corporation or Howmet Aerospace Inc.

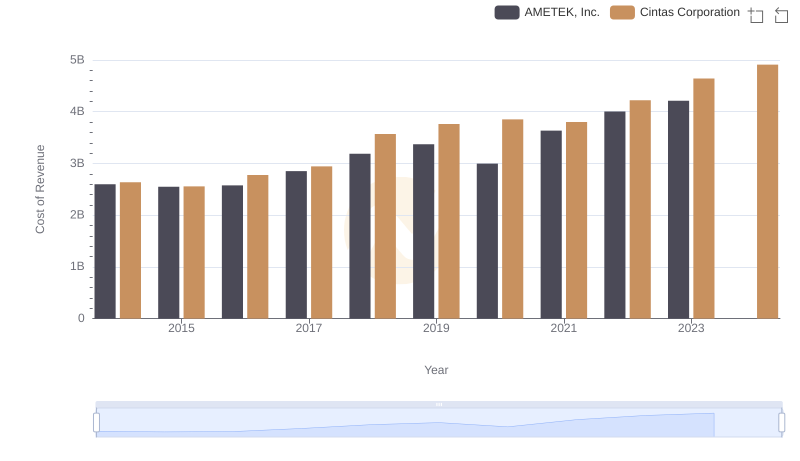

Analyzing Cost of Revenue: Cintas Corporation and AMETEK, Inc.

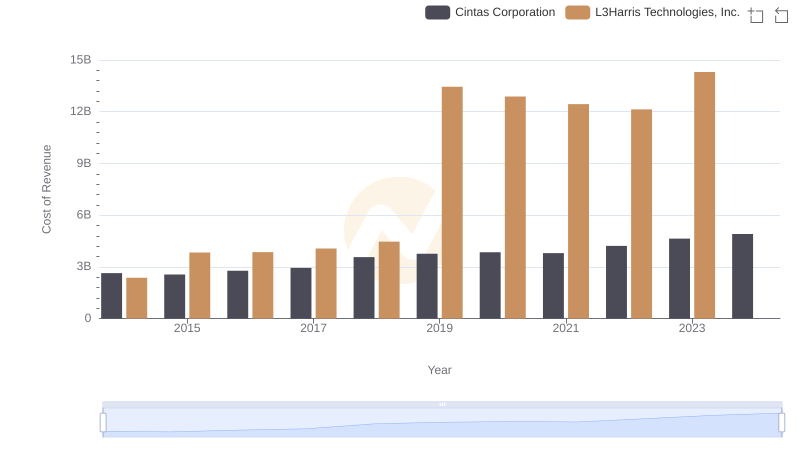

Analyzing Cost of Revenue: Cintas Corporation and L3Harris Technologies, Inc.

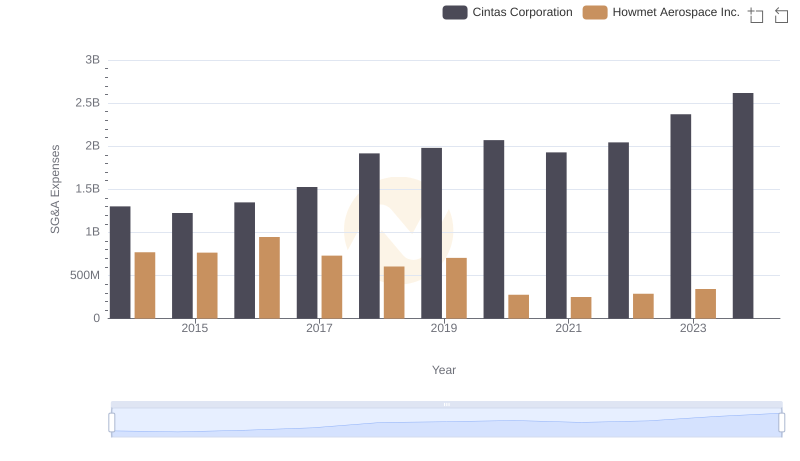

Who Optimizes SG&A Costs Better? Cintas Corporation or Howmet Aerospace Inc.

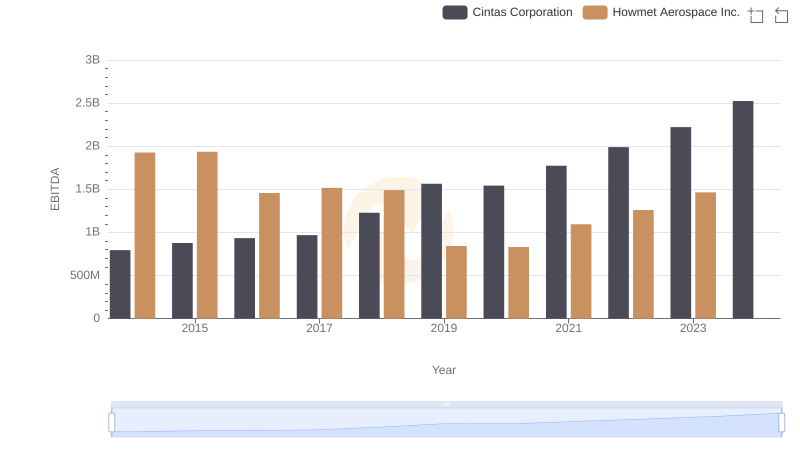

Professional EBITDA Benchmarking: Cintas Corporation vs Howmet Aerospace Inc.