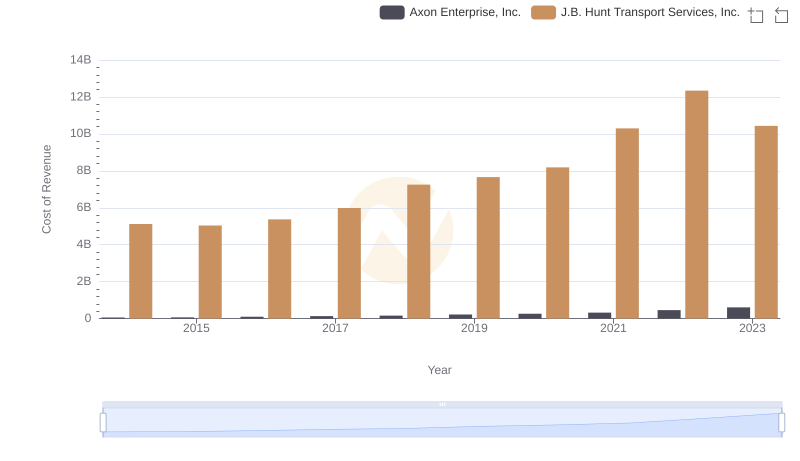

| __timestamp | Axon Enterprise, Inc. | J.B. Hunt Transport Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 1041346000 |

| Thursday, January 1, 2015 | 128647000 | 1146174000 |

| Friday, January 1, 2016 | 170536000 | 1185633000 |

| Sunday, January 1, 2017 | 207088000 | 1199293000 |

| Monday, January 1, 2018 | 258583000 | 1359217000 |

| Tuesday, January 1, 2019 | 307286000 | 1506255000 |

| Wednesday, January 1, 2020 | 416331000 | 1449876000 |

| Friday, January 1, 2021 | 540910000 | 1869819000 |

| Saturday, January 1, 2022 | 728638000 | 2472527000 |

| Sunday, January 1, 2023 | 955382000 | 2396388000 |

In pursuit of knowledge

In the ever-evolving landscape of American business, Axon Enterprise, Inc. and J.B. Hunt Transport Services, Inc. stand as titans in their respective fields. Over the past decade, these companies have demonstrated remarkable growth in gross profit, reflecting their strategic prowess and market adaptability.

Since 2014, Axon has seen its gross profit skyrocket by over 840%, from approximately $101 million to nearly $956 million in 2023. This growth underscores Axon's innovative approach in the tech industry, particularly in public safety solutions.

Meanwhile, J.B. Hunt, a leader in transportation and logistics, has maintained a robust growth trajectory. From 2014 to 2023, its gross profit increased by 130%, reaching around $2.4 billion. This steady climb highlights J.B. Hunt's resilience and operational efficiency in a competitive market.

Both companies exemplify the dynamic nature of American enterprise, each carving its path to success.

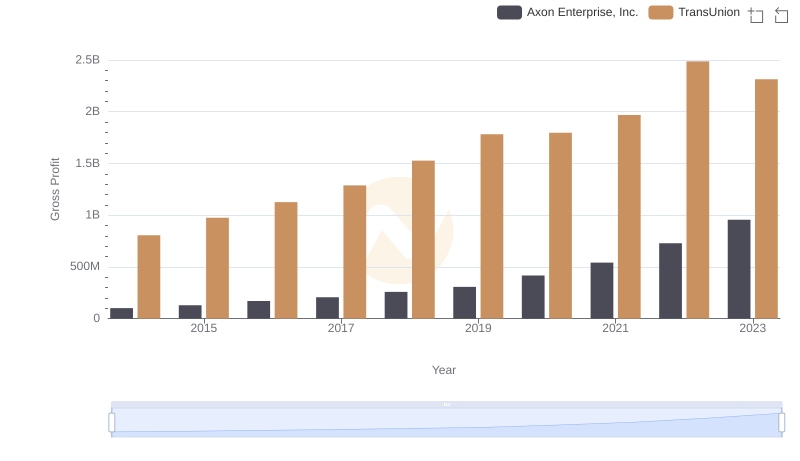

Gross Profit Comparison: Axon Enterprise, Inc. and TransUnion Trends

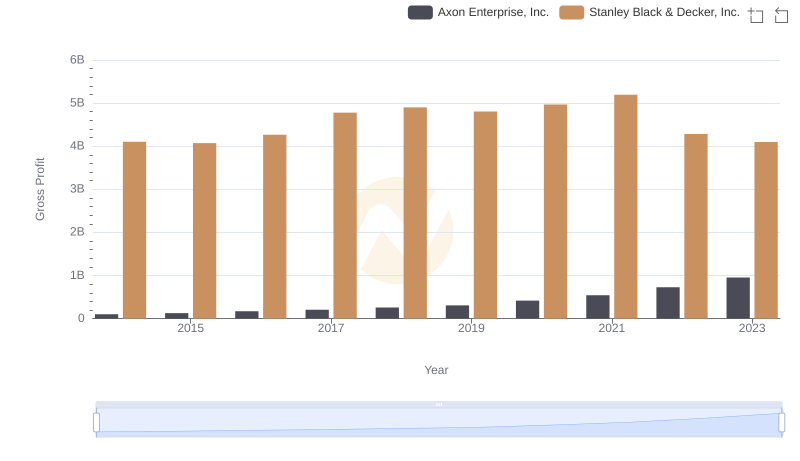

Axon Enterprise, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

Cost of Revenue Trends: Axon Enterprise, Inc. vs J.B. Hunt Transport Services, Inc.

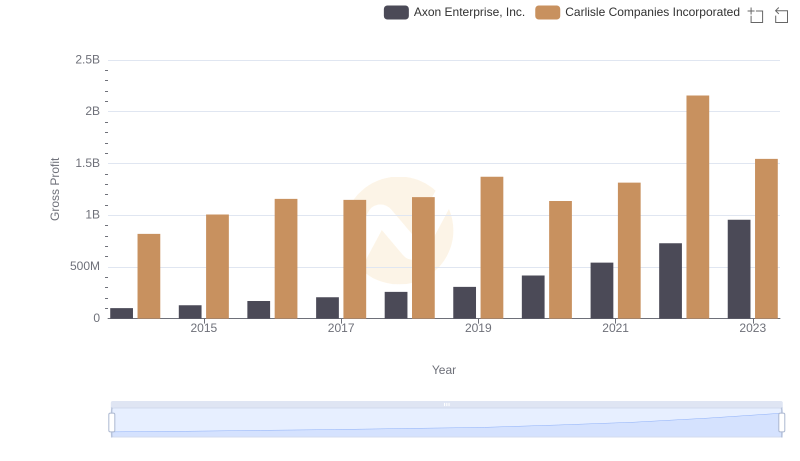

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

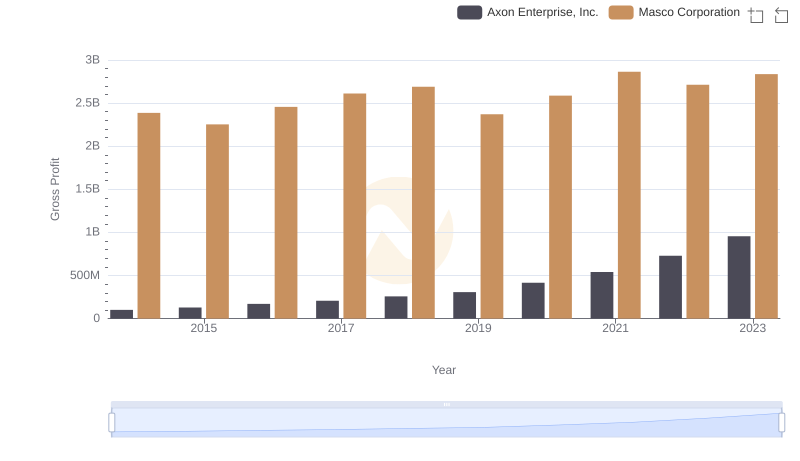

Axon Enterprise, Inc. and Masco Corporation: A Detailed Gross Profit Analysis

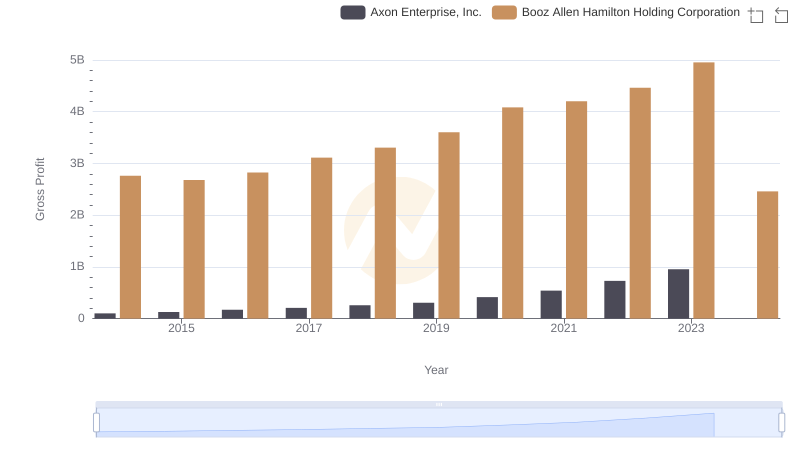

Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation: A Detailed Gross Profit Analysis

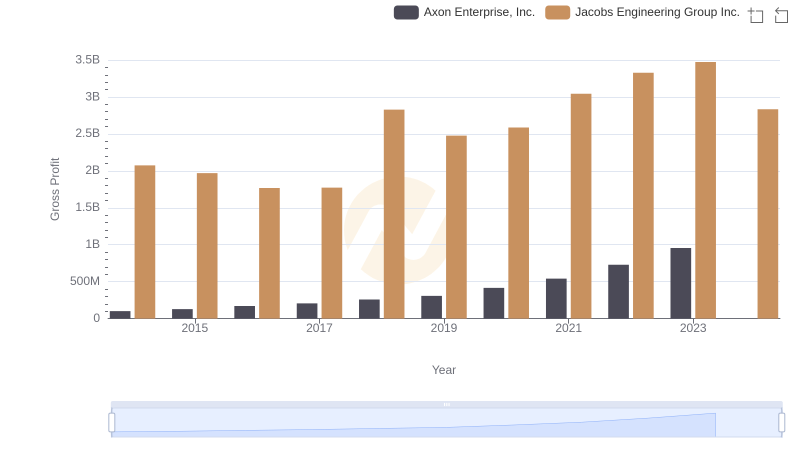

Axon Enterprise, Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

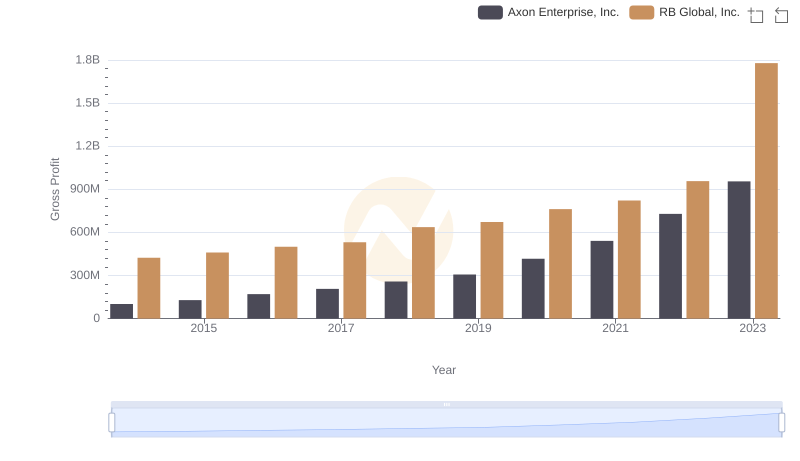

Gross Profit Trends Compared: Axon Enterprise, Inc. vs RB Global, Inc.

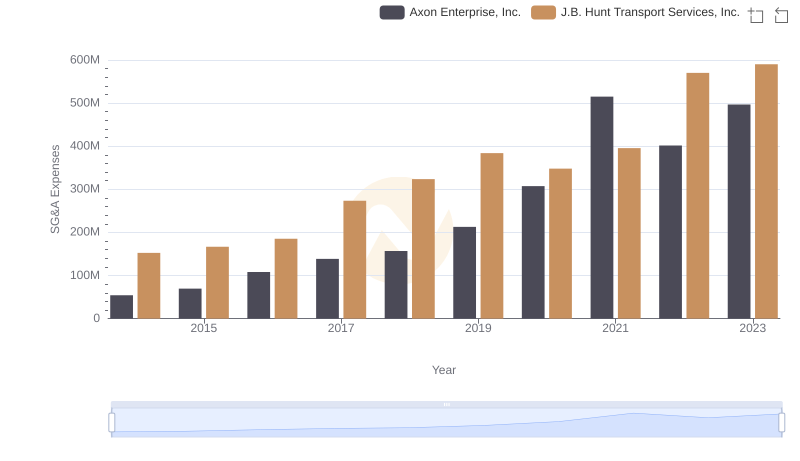

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or J.B. Hunt Transport Services, Inc.