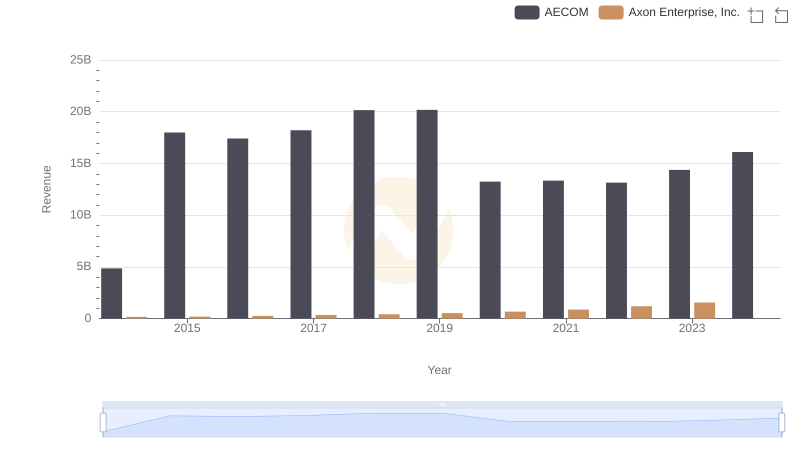

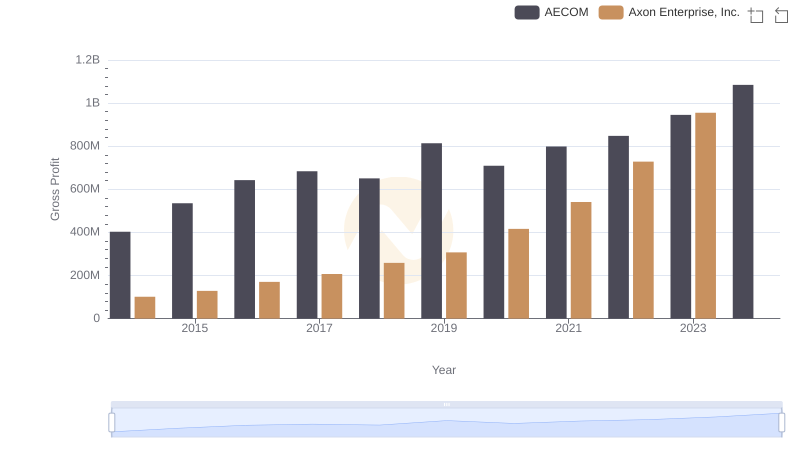

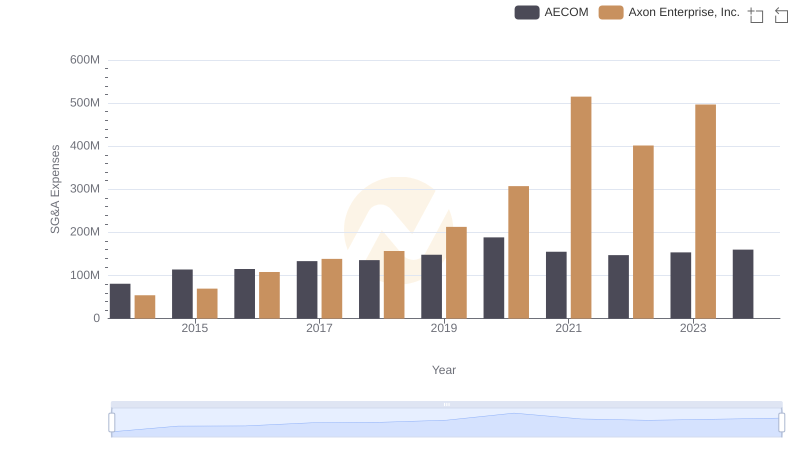

| __timestamp | AECOM | Axon Enterprise, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4452451000 | 62977000 |

| Thursday, January 1, 2015 | 17454692000 | 69245000 |

| Friday, January 1, 2016 | 16768001000 | 97709000 |

| Sunday, January 1, 2017 | 17519682000 | 136710000 |

| Monday, January 1, 2018 | 19504863000 | 161485000 |

| Tuesday, January 1, 2019 | 19359884000 | 223574000 |

| Wednesday, January 1, 2020 | 12530416000 | 264672000 |

| Friday, January 1, 2021 | 12542431000 | 322471000 |

| Saturday, January 1, 2022 | 12300208000 | 461297000 |

| Sunday, January 1, 2023 | 13432996000 | 608009000 |

| Monday, January 1, 2024 | 15021157000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis delves into the cost of revenue efficiency of two industry giants: Axon Enterprise, Inc. and AECOM, from 2014 to 2023.

AECOM, a leader in infrastructure and engineering, has consistently maintained a high cost of revenue, peaking at approximately $19.5 billion in 2018. Despite fluctuations, AECOM's cost of revenue has shown a stable trend, reflecting its robust operational scale.

In contrast, Axon Enterprise, Inc., known for its innovative public safety solutions, has demonstrated a remarkable growth trajectory. From a modest $63 million in 2014, Axon's cost of revenue surged by nearly 900% to $608 million in 2023, showcasing its rapid expansion and increasing market presence.

While AECOM's scale is impressive, Axon's growth rate highlights its dynamic evolution in the tech-driven safety sector.

Who Generates More Revenue? Axon Enterprise, Inc. or AECOM

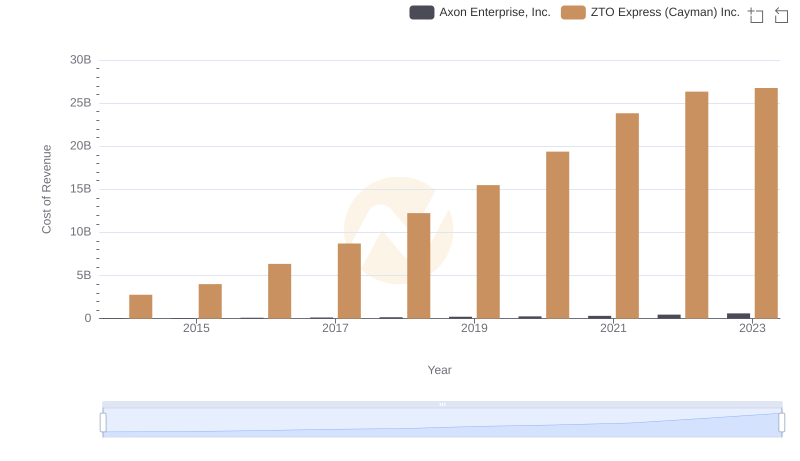

Analyzing Cost of Revenue: Axon Enterprise, Inc. and ZTO Express (Cayman) Inc.

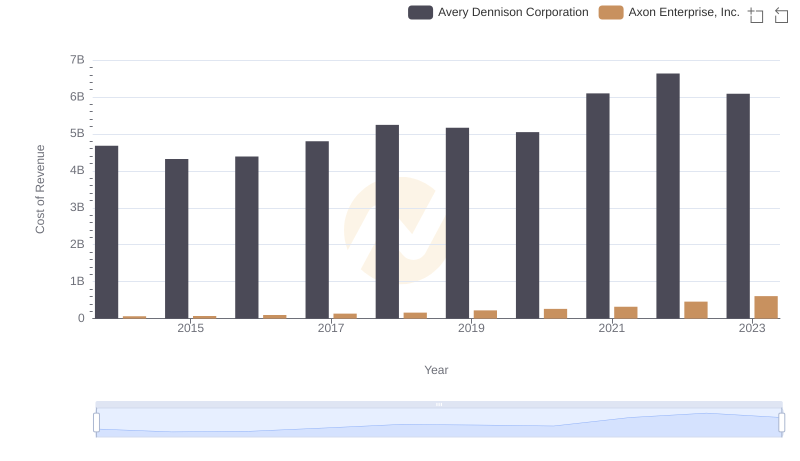

Comparing Cost of Revenue Efficiency: Axon Enterprise, Inc. vs Avery Dennison Corporation

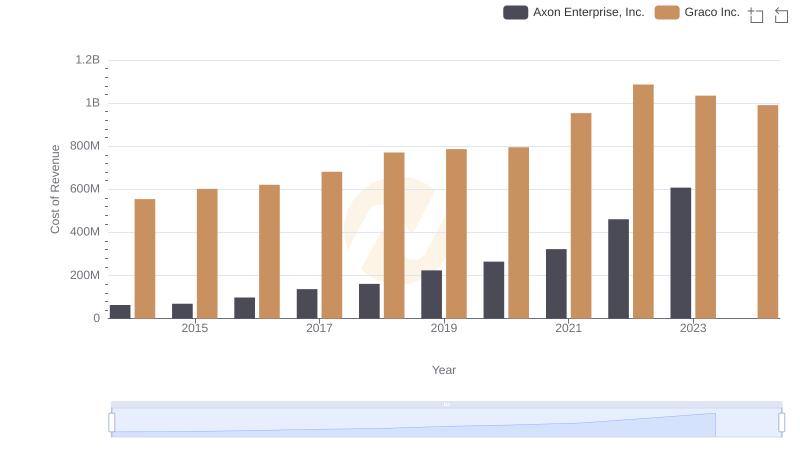

Axon Enterprise, Inc. vs Graco Inc.: Efficiency in Cost of Revenue Explored

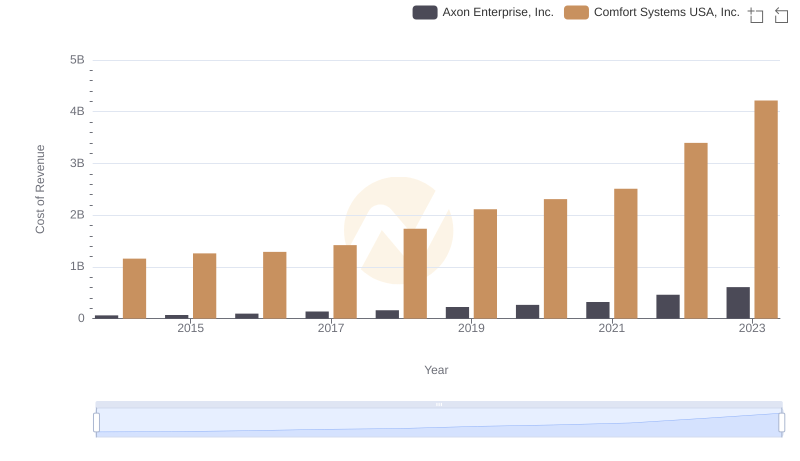

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Comfort Systems USA, Inc.

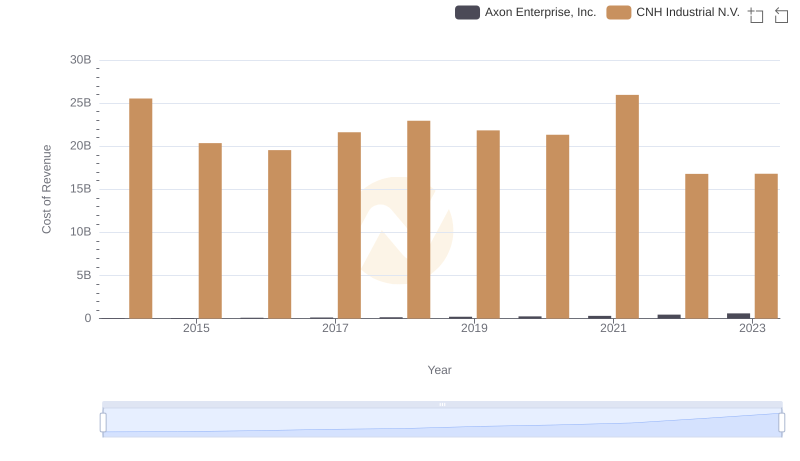

Cost Insights: Breaking Down Axon Enterprise, Inc. and CNH Industrial N.V.'s Expenses

Cost Insights: Breaking Down Axon Enterprise, Inc. and Stanley Black & Decker, Inc.'s Expenses

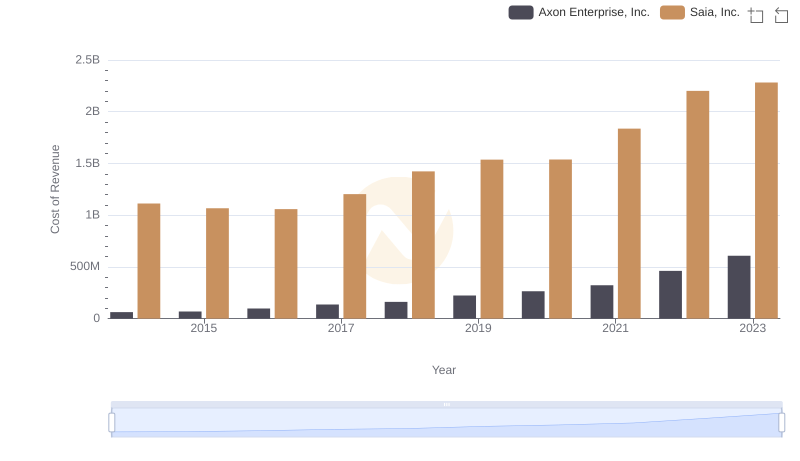

Cost of Revenue Trends: Axon Enterprise, Inc. vs Saia, Inc.

Gross Profit Comparison: Axon Enterprise, Inc. and AECOM Trends

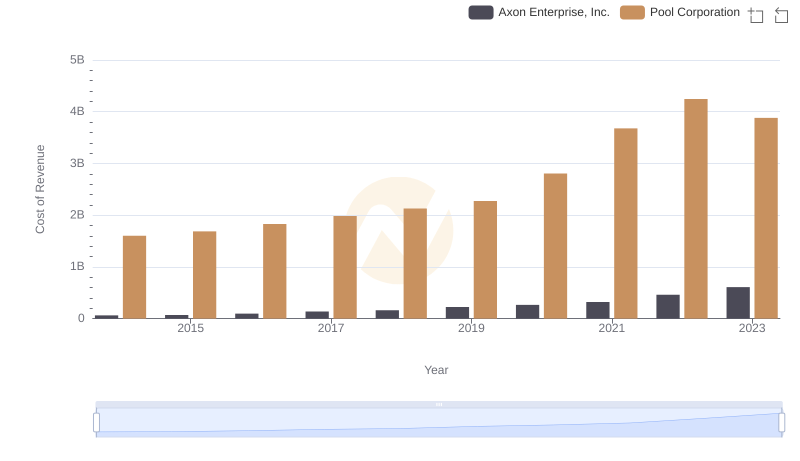

Cost of Revenue Comparison: Axon Enterprise, Inc. vs Pool Corporation

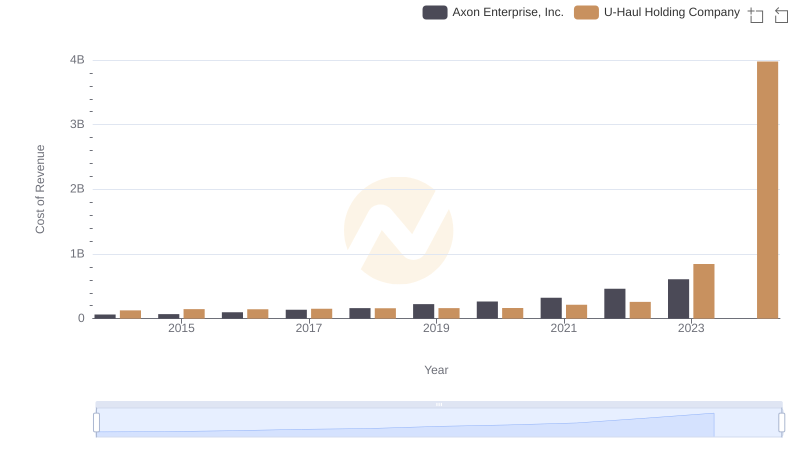

Cost Insights: Breaking Down Axon Enterprise, Inc. and U-Haul Holding Company's Expenses

Who Optimizes SG&A Costs Better? Axon Enterprise, Inc. or AECOM