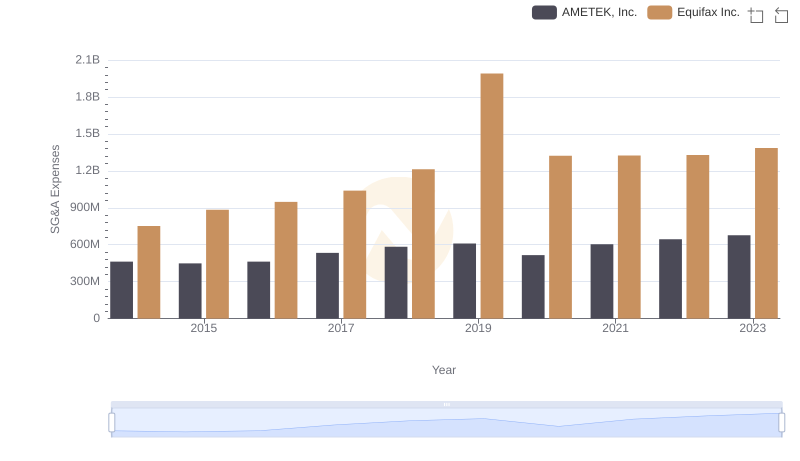

| __timestamp | AMETEK, Inc. | HEICO Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 194924000 |

| Thursday, January 1, 2015 | 448592000 | 204523000 |

| Friday, January 1, 2016 | 462970000 | 250147000 |

| Sunday, January 1, 2017 | 533645000 | 268067000 |

| Monday, January 1, 2018 | 584022000 | 314470000 |

| Tuesday, January 1, 2019 | 610280000 | 356743000 |

| Wednesday, January 1, 2020 | 515630000 | 305479000 |

| Friday, January 1, 2021 | 603944000 | 334523000 |

| Saturday, January 1, 2022 | 644577000 | 365915000 |

| Sunday, January 1, 2023 | 677006000 | 516292000 |

| Monday, January 1, 2024 | 696905000 | 677271000 |

Unleashing the power of data

In the competitive landscape of industrial manufacturing, AMETEK, Inc. and HEICO Corporation have been pivotal players. Over the past decade, from 2014 to 2023, these companies have demonstrated distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses. AMETEK, Inc. has seen a steady increase in SG&A costs, peaking at approximately 677 million in 2023, reflecting a 46% rise since 2014. In contrast, HEICO Corporation's SG&A expenses surged by 165% over the same period, reaching around 516 million in 2023. This divergence highlights AMETEK's more consistent cost management approach compared to HEICO's rapid expansion strategy. As we look to 2024, with data still emerging, the question remains: which strategy will prove more sustainable in the long run? Stay tuned as these industry giants continue to navigate the complexities of cost optimization.

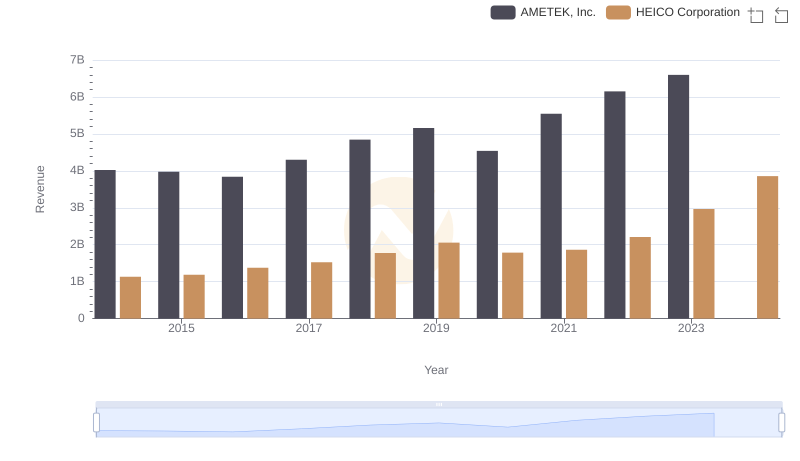

AMETEK, Inc. and HEICO Corporation: A Comprehensive Revenue Analysis

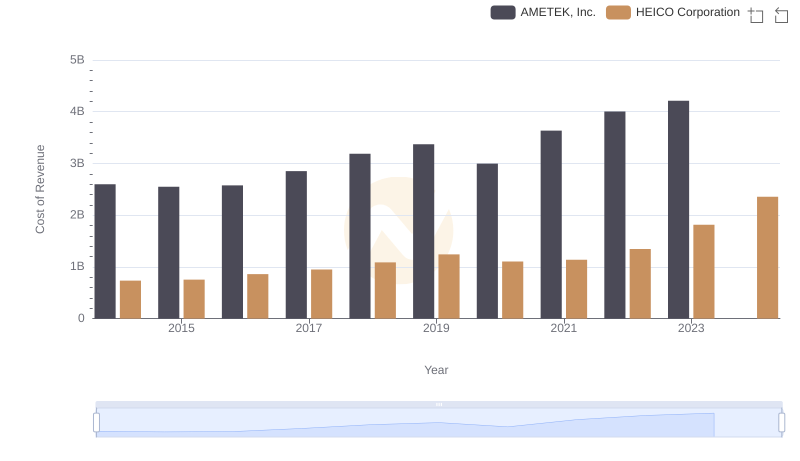

Cost of Revenue Comparison: AMETEK, Inc. vs HEICO Corporation

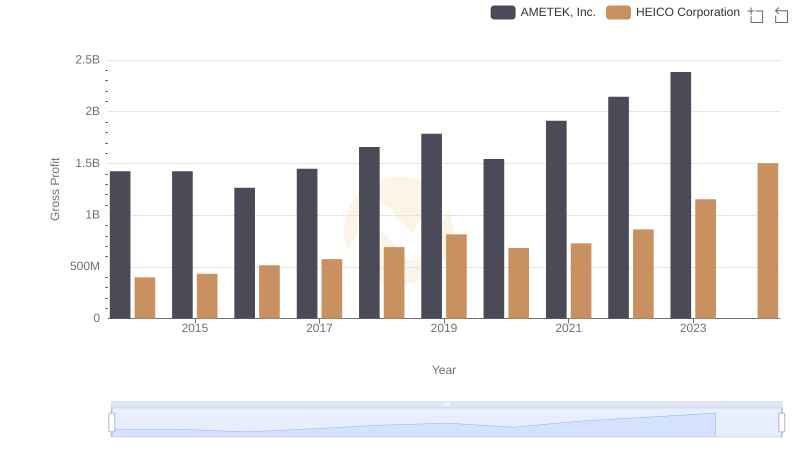

Gross Profit Trends Compared: AMETEK, Inc. vs HEICO Corporation

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Equifax Inc.

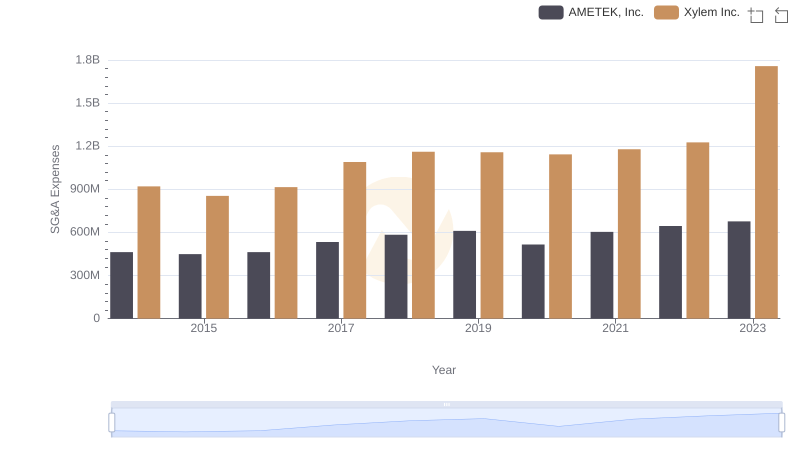

Comparing SG&A Expenses: AMETEK, Inc. vs Xylem Inc. Trends and Insights

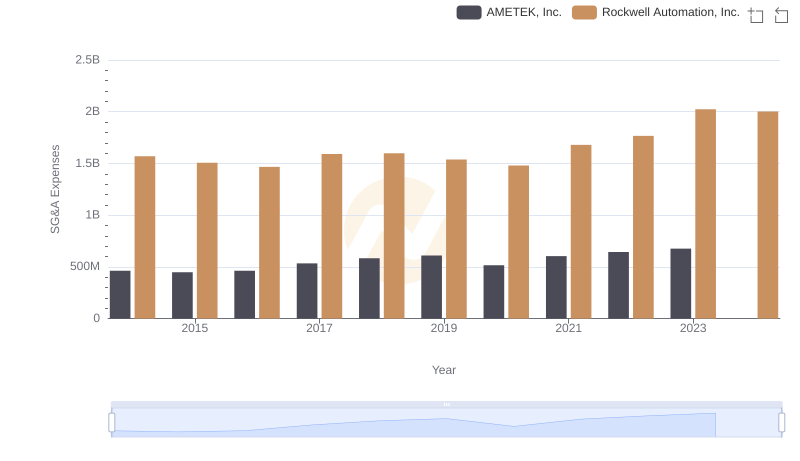

Comparing SG&A Expenses: AMETEK, Inc. vs Rockwell Automation, Inc. Trends and Insights

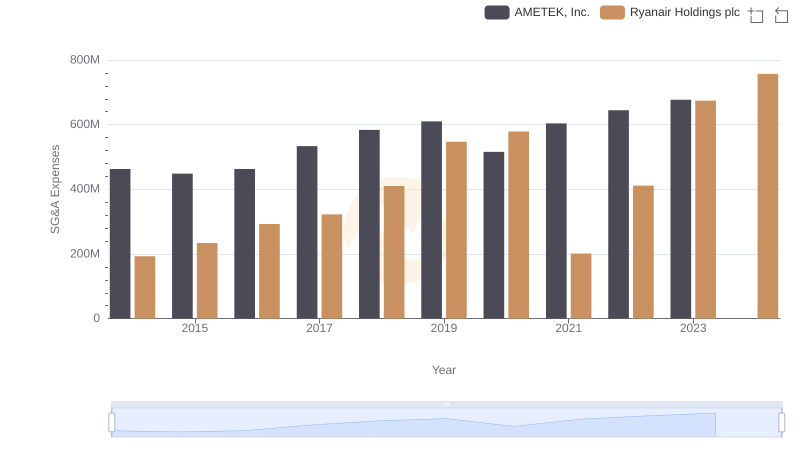

Comparing SG&A Expenses: AMETEK, Inc. vs Ryanair Holdings plc Trends and Insights

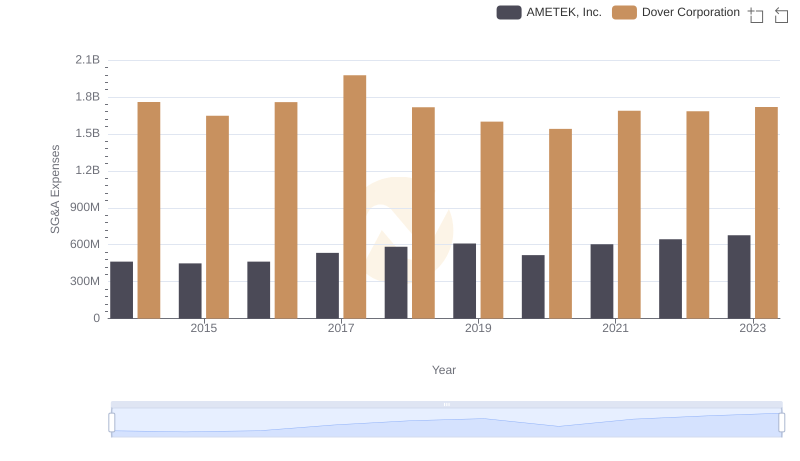

AMETEK, Inc. or Dover Corporation: Who Manages SG&A Costs Better?

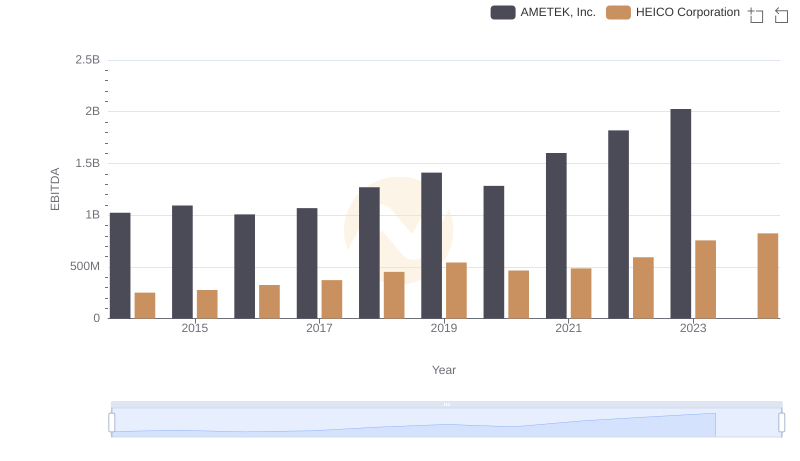

AMETEK, Inc. and HEICO Corporation: A Detailed Examination of EBITDA Performance