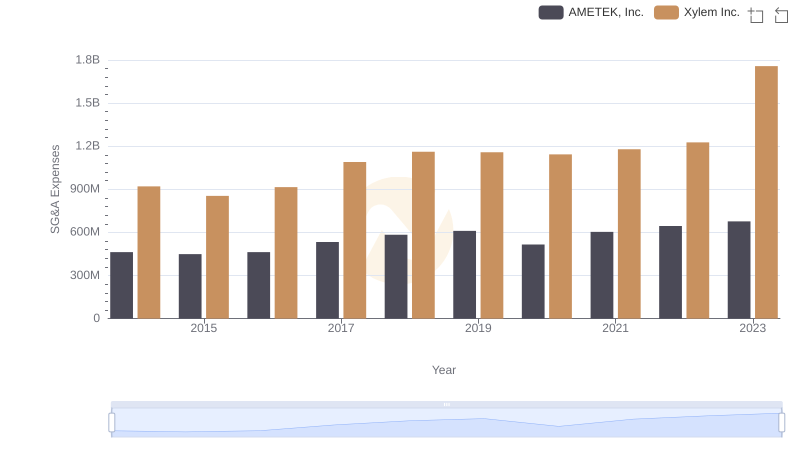

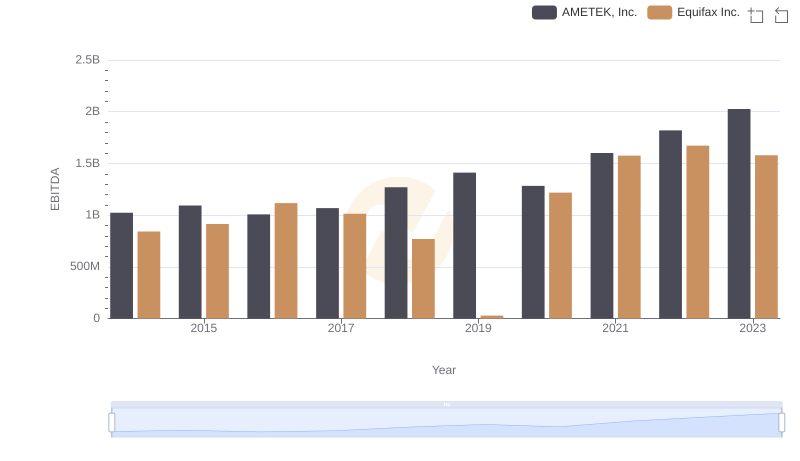

| __timestamp | AMETEK, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 751700000 |

| Thursday, January 1, 2015 | 448592000 | 884300000 |

| Friday, January 1, 2016 | 462970000 | 948200000 |

| Sunday, January 1, 2017 | 533645000 | 1039100000 |

| Monday, January 1, 2018 | 584022000 | 1213300000 |

| Tuesday, January 1, 2019 | 610280000 | 1990200000 |

| Wednesday, January 1, 2020 | 515630000 | 1322500000 |

| Friday, January 1, 2021 | 603944000 | 1324600000 |

| Saturday, January 1, 2022 | 644577000 | 1328900000 |

| Sunday, January 1, 2023 | 677006000 | 1385700000 |

| Monday, January 1, 2024 | 696905000 | 1450500000 |

Cracking the code

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, AMETEK, Inc. and Equifax Inc. have demonstrated distinct strategies in handling these costs. From 2014 to 2023, AMETEK's SG&A expenses grew by approximately 46%, reflecting a steady increase in operational investments. In contrast, Equifax's expenses surged by 84%, peaking in 2019, which may indicate strategic expansions or increased operational costs. Notably, Equifax's expenses consistently outpaced AMETEK's, averaging nearly double over the period. This divergence highlights differing corporate strategies and market responses. As businesses navigate post-pandemic recovery, understanding these trends offers valuable insights into cost management and strategic planning. Dive deeper into the data to explore how these industry leaders balance growth and efficiency.

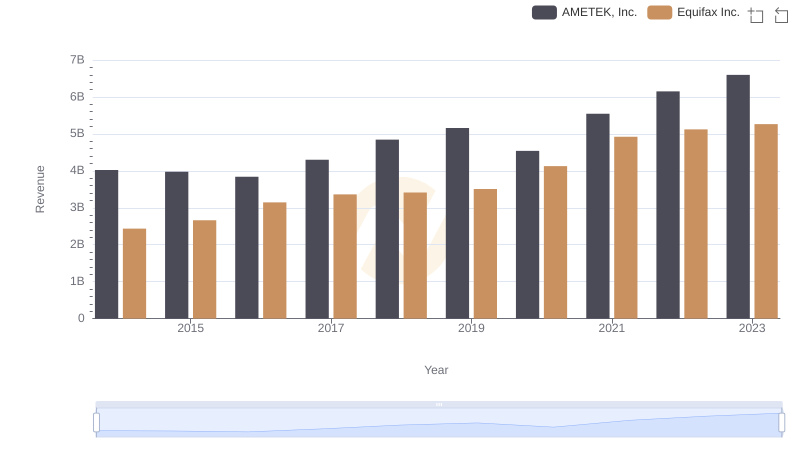

AMETEK, Inc. or Equifax Inc.: Who Leads in Yearly Revenue?

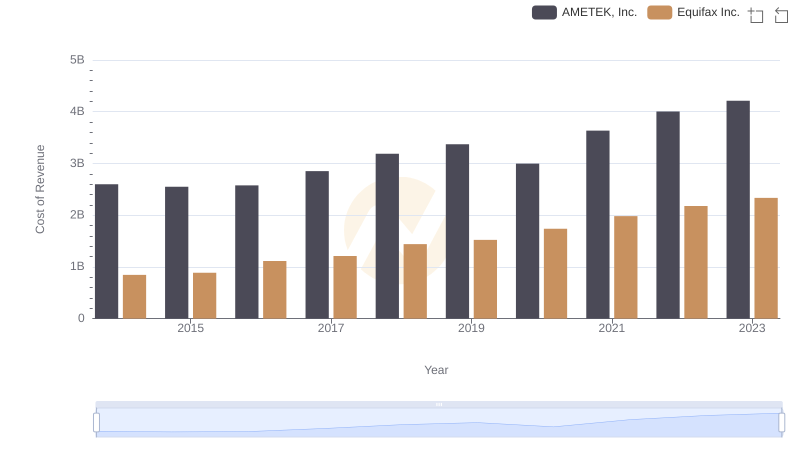

AMETEK, Inc. vs Equifax Inc.: Efficiency in Cost of Revenue Explored

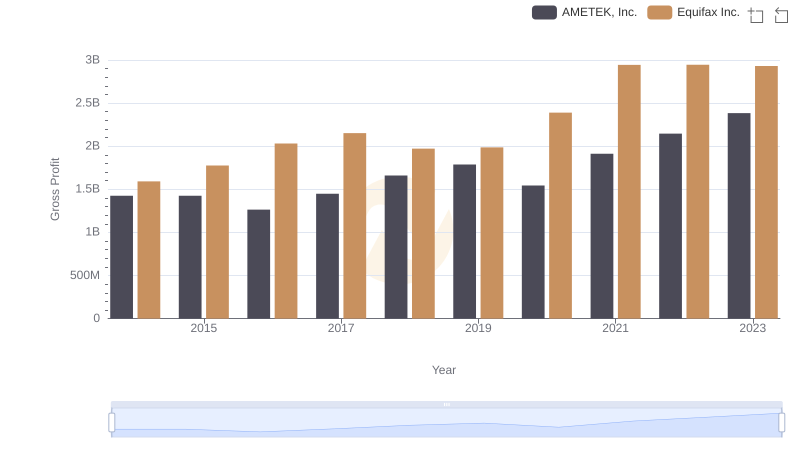

Gross Profit Trends Compared: AMETEK, Inc. vs Equifax Inc.

Comparing SG&A Expenses: AMETEK, Inc. vs Xylem Inc. Trends and Insights

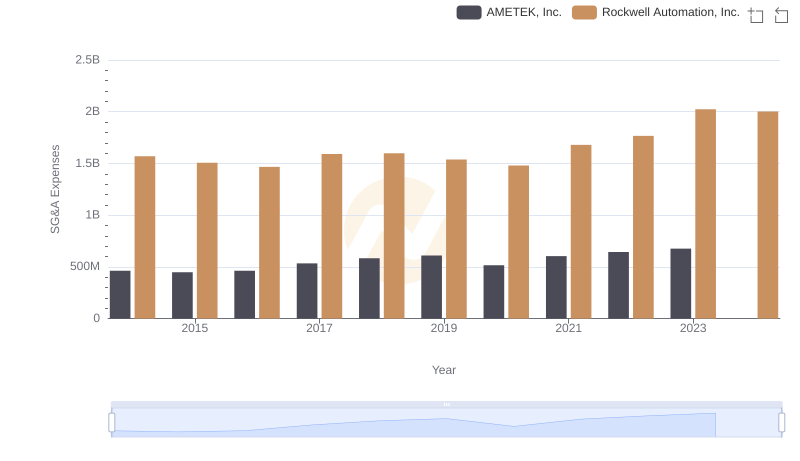

Comparing SG&A Expenses: AMETEK, Inc. vs Rockwell Automation, Inc. Trends and Insights

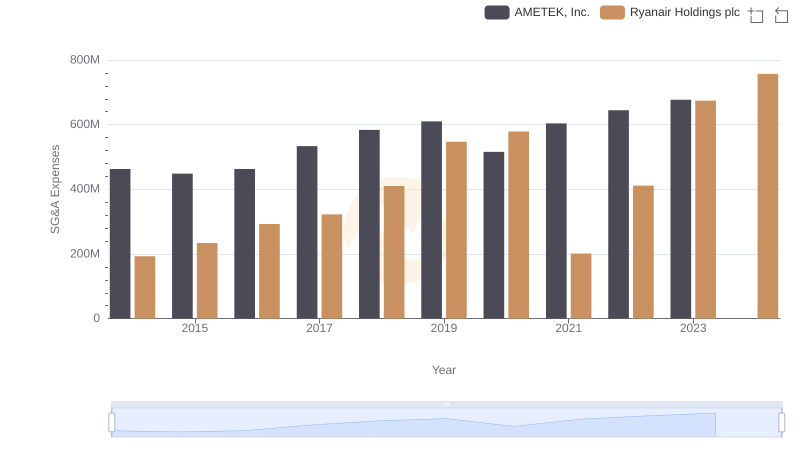

Comparing SG&A Expenses: AMETEK, Inc. vs Ryanair Holdings plc Trends and Insights

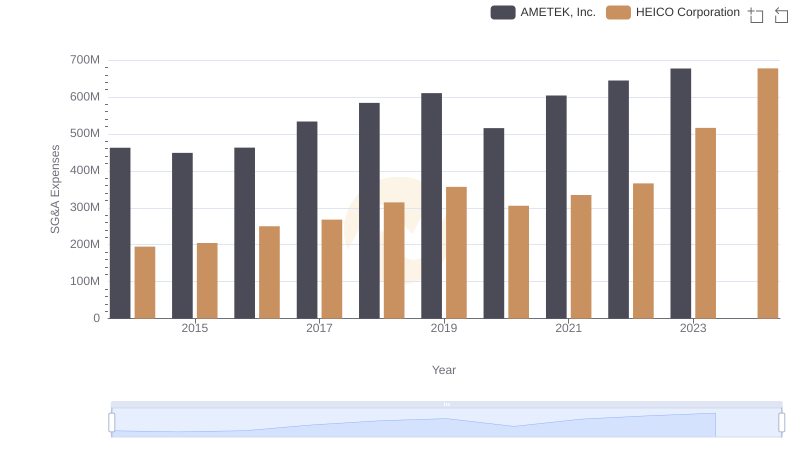

Who Optimizes SG&A Costs Better? AMETEK, Inc. or HEICO Corporation

Comparative EBITDA Analysis: AMETEK, Inc. vs Equifax Inc.

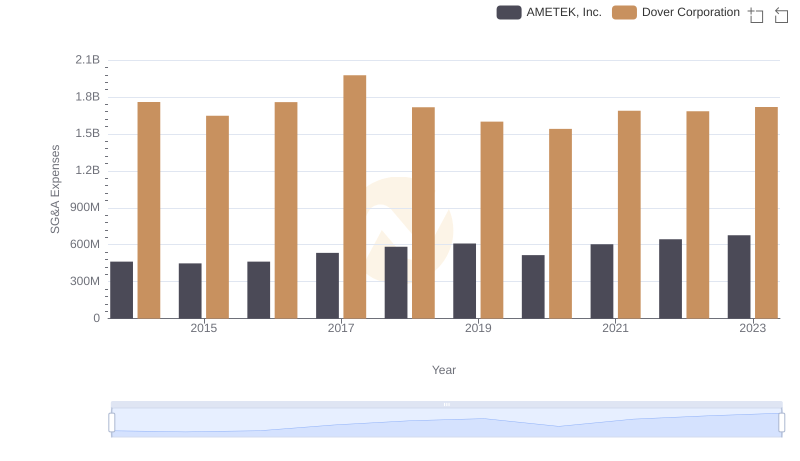

AMETEK, Inc. or Dover Corporation: Who Manages SG&A Costs Better?