| __timestamp | AMETEK, Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 192800000 |

| Thursday, January 1, 2015 | 448592000 | 233900000 |

| Friday, January 1, 2016 | 462970000 | 292700000 |

| Sunday, January 1, 2017 | 533645000 | 322300000 |

| Monday, January 1, 2018 | 584022000 | 410400000 |

| Tuesday, January 1, 2019 | 610280000 | 547300000 |

| Wednesday, January 1, 2020 | 515630000 | 578800000 |

| Friday, January 1, 2021 | 603944000 | 201500000 |

| Saturday, January 1, 2022 | 644577000 | 411300000 |

| Sunday, January 1, 2023 | 677006000 | 674400000 |

| Monday, January 1, 2024 | 696905000 | 757200000 |

Unlocking the unknown

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of a company's operational efficiency. This article delves into the SG&A trends of AMETEK, Inc. and Ryanair Holdings plc from 2014 to 2023.

AMETEK, Inc. has shown a consistent upward trend in SG&A expenses, growing approximately 46% over the decade. This steady increase reflects the company's expanding operations and strategic investments. Notably, 2023 marked a peak with expenses reaching nearly 677 million, a 10% rise from the previous year.

Ryanair's SG&A expenses have been more volatile, with a significant dip in 2021, likely due to pandemic-related disruptions. However, by 2023, expenses surged to 674 million, a remarkable 235% increase from 2014, showcasing the airline's robust recovery and growth strategy.

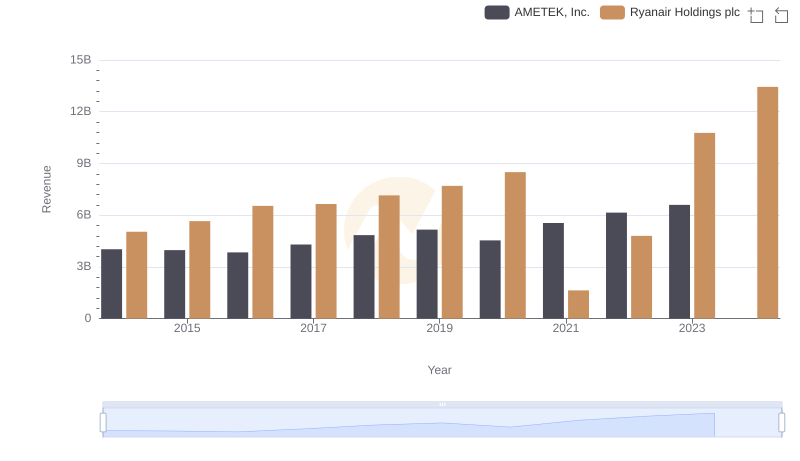

AMETEK, Inc. vs Ryanair Holdings plc: Examining Key Revenue Metrics

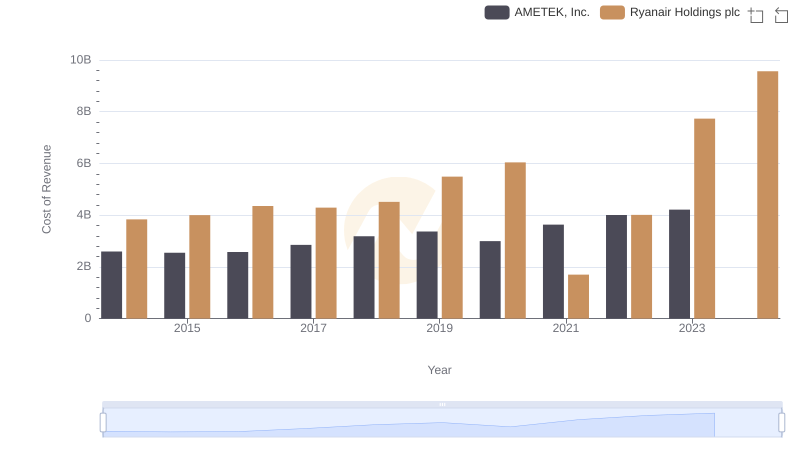

AMETEK, Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored

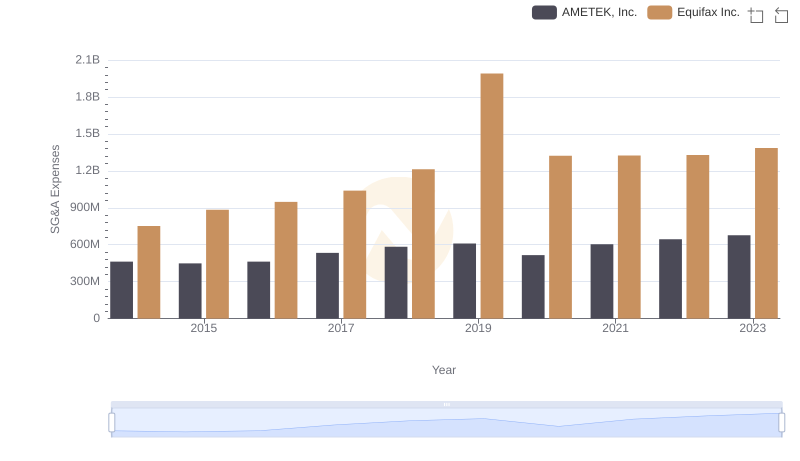

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Equifax Inc.

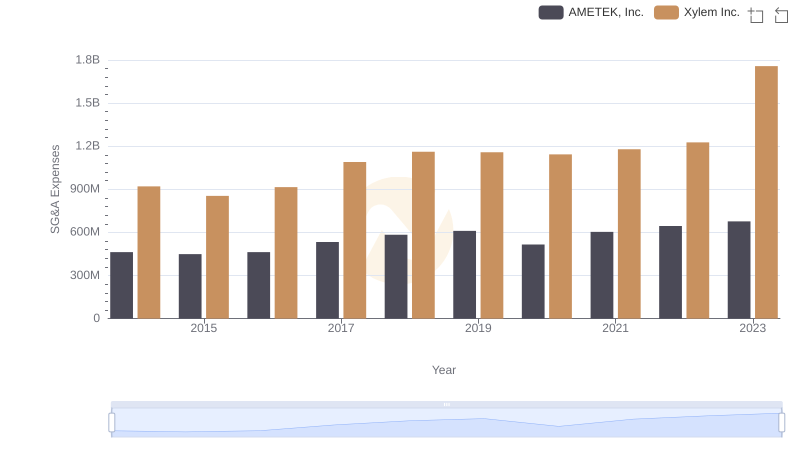

Comparing SG&A Expenses: AMETEK, Inc. vs Xylem Inc. Trends and Insights

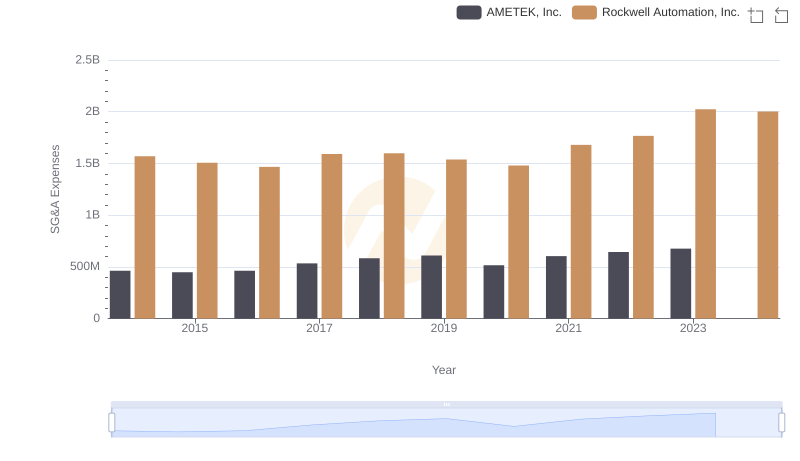

Comparing SG&A Expenses: AMETEK, Inc. vs Rockwell Automation, Inc. Trends and Insights

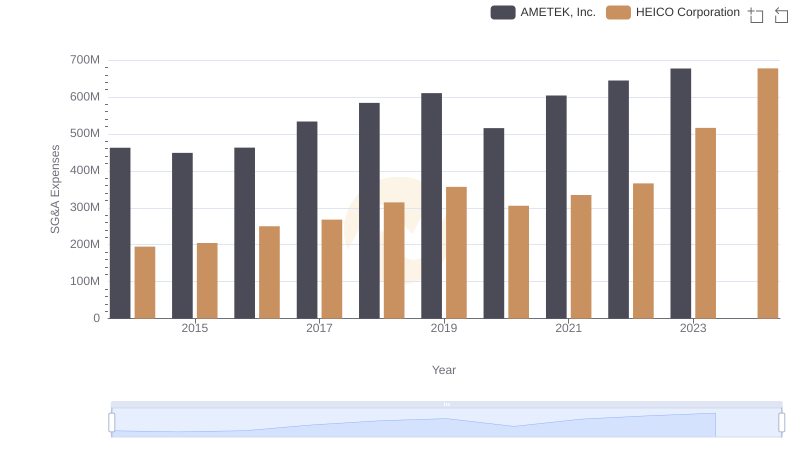

Who Optimizes SG&A Costs Better? AMETEK, Inc. or HEICO Corporation

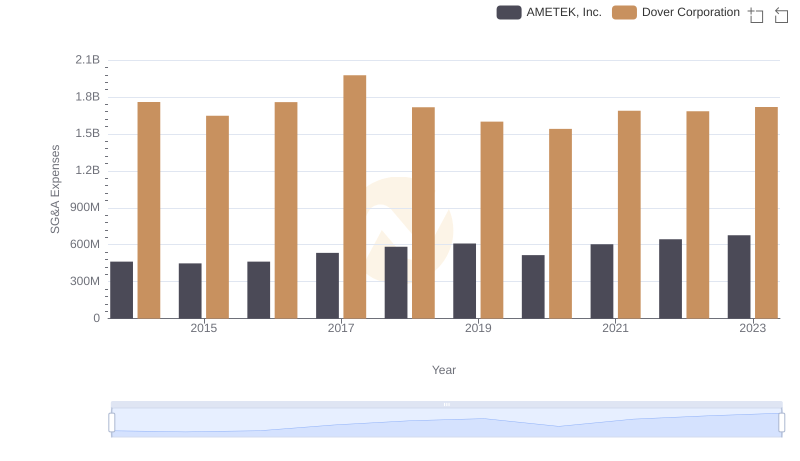

AMETEK, Inc. or Dover Corporation: Who Manages SG&A Costs Better?

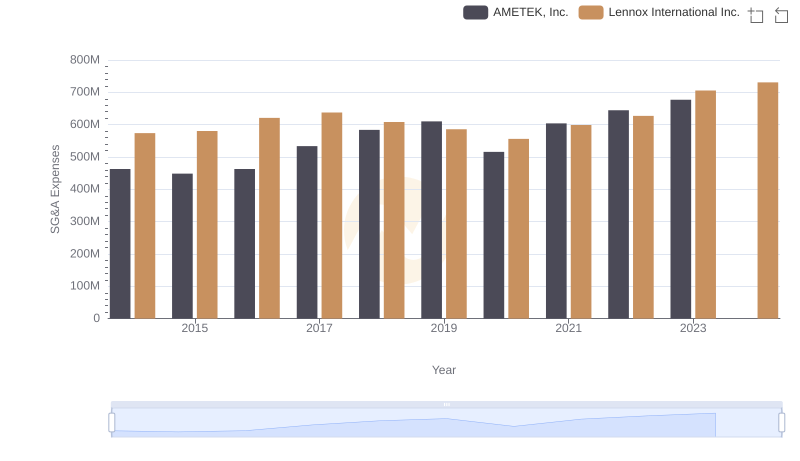

AMETEK, Inc. or Lennox International Inc.: Who Manages SG&A Costs Better?