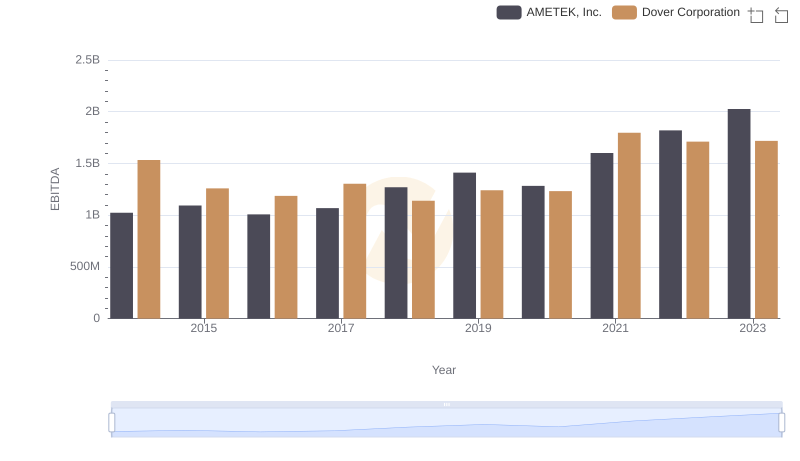

| __timestamp | AMETEK, Inc. | Dover Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 1758765000 |

| Thursday, January 1, 2015 | 448592000 | 1647382000 |

| Friday, January 1, 2016 | 462970000 | 1757523000 |

| Sunday, January 1, 2017 | 533645000 | 1975932000 |

| Monday, January 1, 2018 | 584022000 | 1716444000 |

| Tuesday, January 1, 2019 | 610280000 | 1599098000 |

| Wednesday, January 1, 2020 | 515630000 | 1541032000 |

| Friday, January 1, 2021 | 603944000 | 1688278000 |

| Saturday, January 1, 2022 | 644577000 | 1684226000 |

| Sunday, January 1, 2023 | 677006000 | 1718290000 |

| Monday, January 1, 2024 | 696905000 | 1752266000 |

Igniting the spark of knowledge

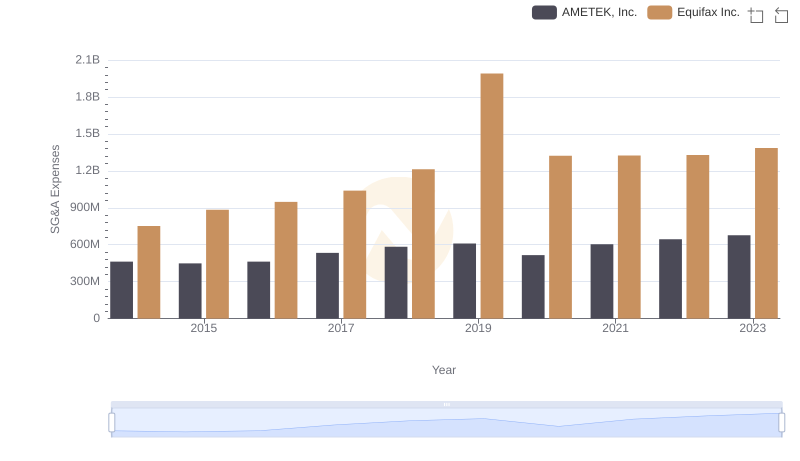

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. AMETEK, Inc. and Dover Corporation, two giants in the industry, have shown distinct approaches over the past decade. From 2014 to 2023, AMETEK's SG&A expenses grew by approximately 46%, reflecting a strategic investment in operational efficiency and market expansion. In contrast, Dover Corporation's SG&A costs remained relatively stable, with a modest increase of around 2% over the same period. This stability suggests a focus on cost control and streamlined operations. While AMETEK's approach may indicate aggressive growth strategies, Dover's steadiness could imply a commitment to maintaining a lean operational model. As these companies continue to evolve, their SG&A management strategies will likely play a pivotal role in their financial health and competitive positioning.

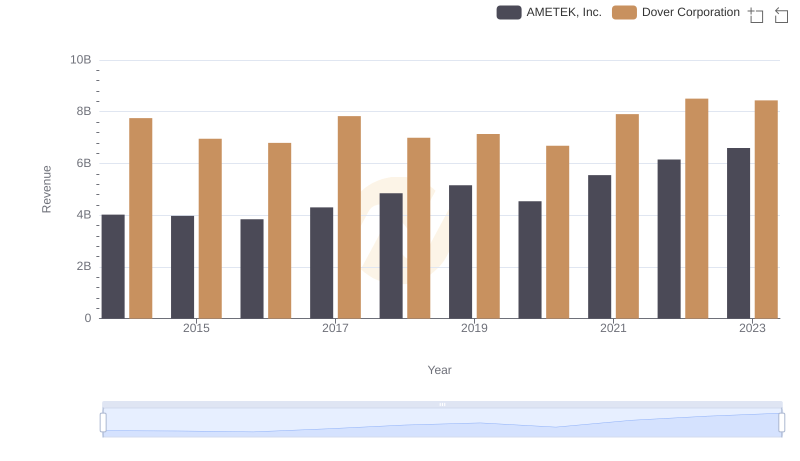

AMETEK, Inc. vs Dover Corporation: Examining Key Revenue Metrics

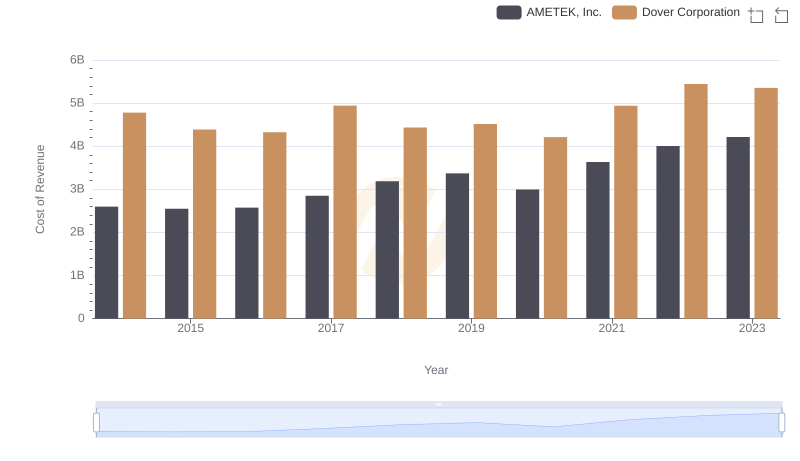

Cost of Revenue: Key Insights for AMETEK, Inc. and Dover Corporation

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Equifax Inc.

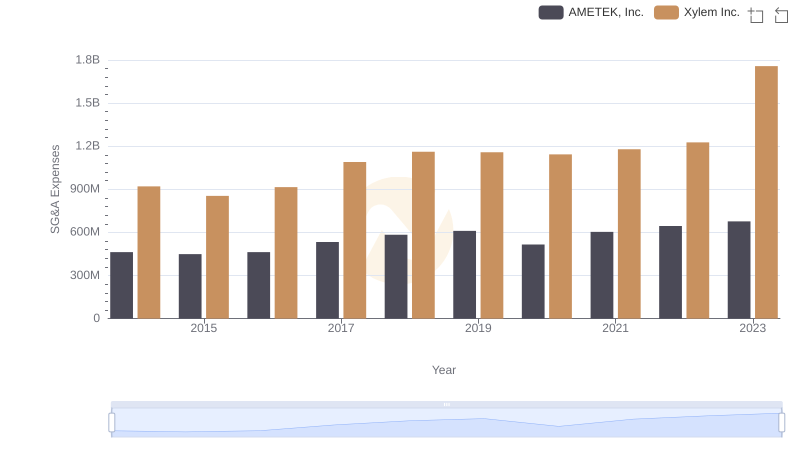

Comparing SG&A Expenses: AMETEK, Inc. vs Xylem Inc. Trends and Insights

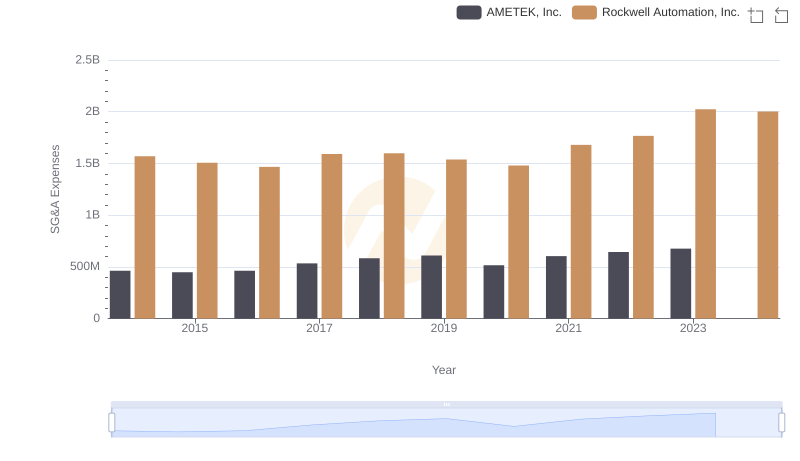

Comparing SG&A Expenses: AMETEK, Inc. vs Rockwell Automation, Inc. Trends and Insights

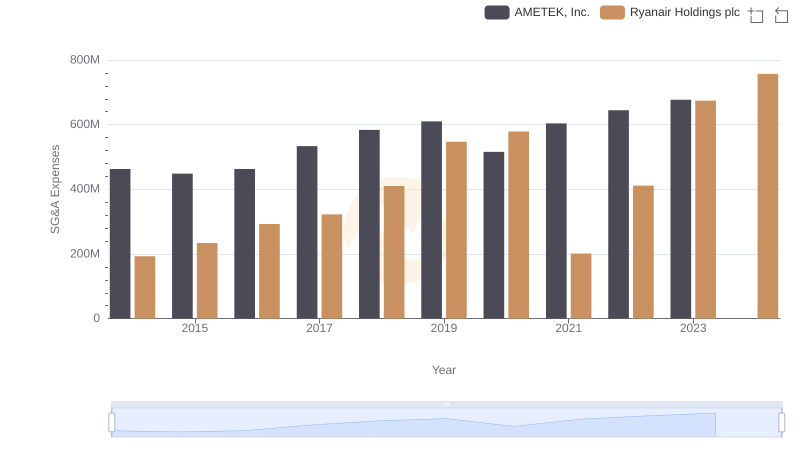

Comparing SG&A Expenses: AMETEK, Inc. vs Ryanair Holdings plc Trends and Insights

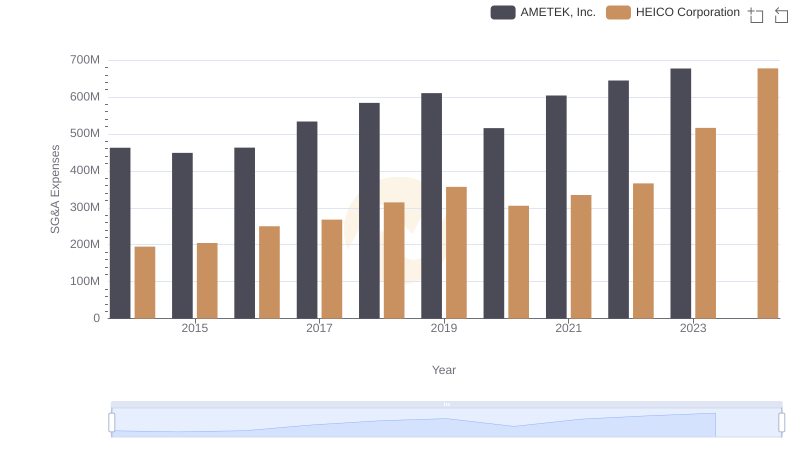

Who Optimizes SG&A Costs Better? AMETEK, Inc. or HEICO Corporation

A Professional Review of EBITDA: AMETEK, Inc. Compared to Dover Corporation

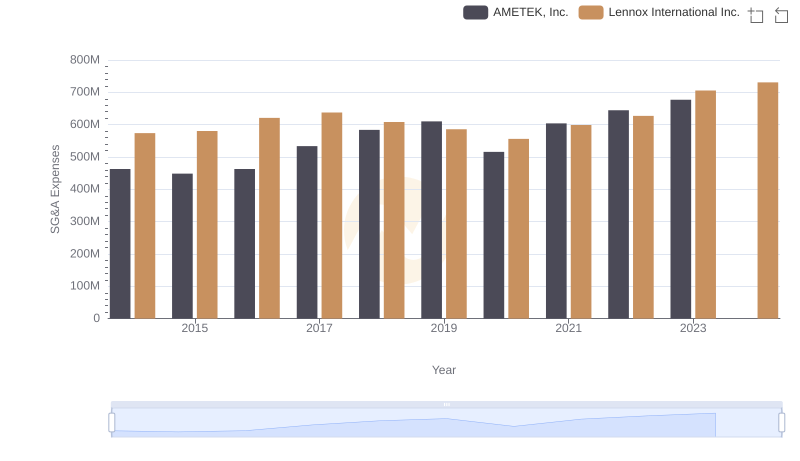

AMETEK, Inc. or Lennox International Inc.: Who Manages SG&A Costs Better?