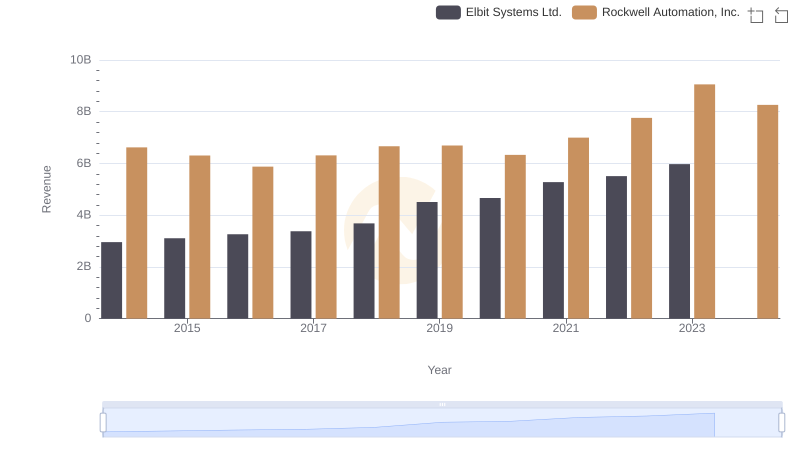

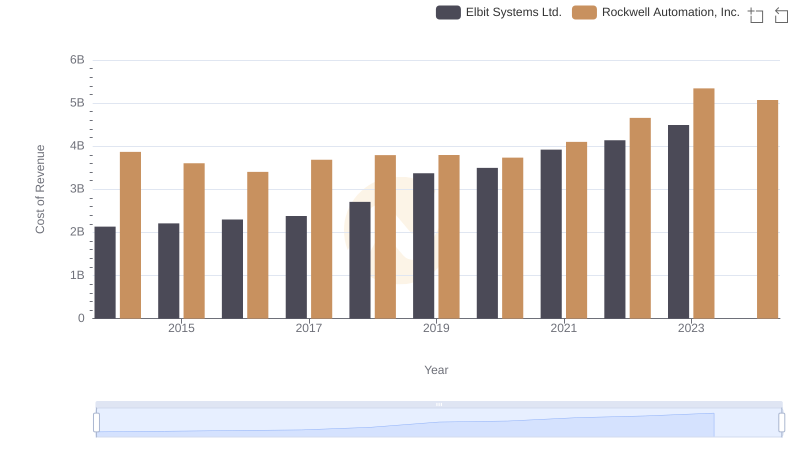

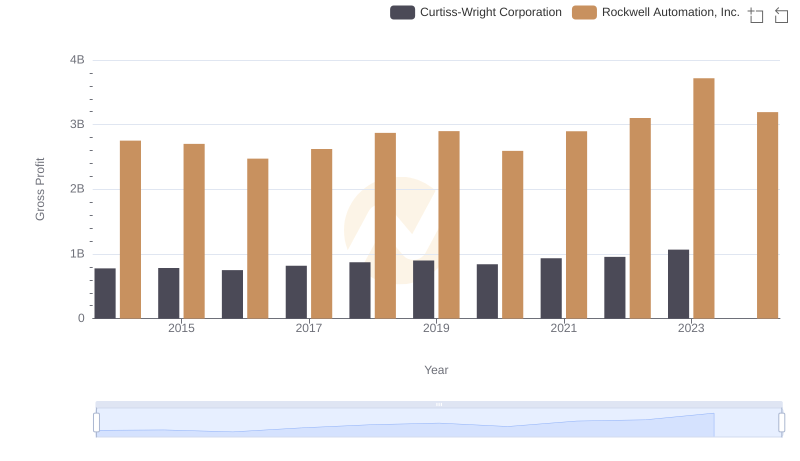

| __timestamp | Elbit Systems Ltd. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 825097000 | 2753900000 |

| Thursday, January 1, 2015 | 897053000 | 2703100000 |

| Friday, January 1, 2016 | 959583000 | 2475500000 |

| Sunday, January 1, 2017 | 997920000 | 2624200000 |

| Monday, January 1, 2018 | 976179000 | 2872200000 |

| Tuesday, January 1, 2019 | 1136467000 | 2900100000 |

| Wednesday, January 1, 2020 | 1165107000 | 2595200000 |

| Friday, January 1, 2021 | 1358048000 | 2897700000 |

| Saturday, January 1, 2022 | 1373283000 | 3102000000 |

| Sunday, January 1, 2023 | 1482954000 | 3717000000 |

| Monday, January 1, 2024 | 3193400000 |

Igniting the spark of knowledge

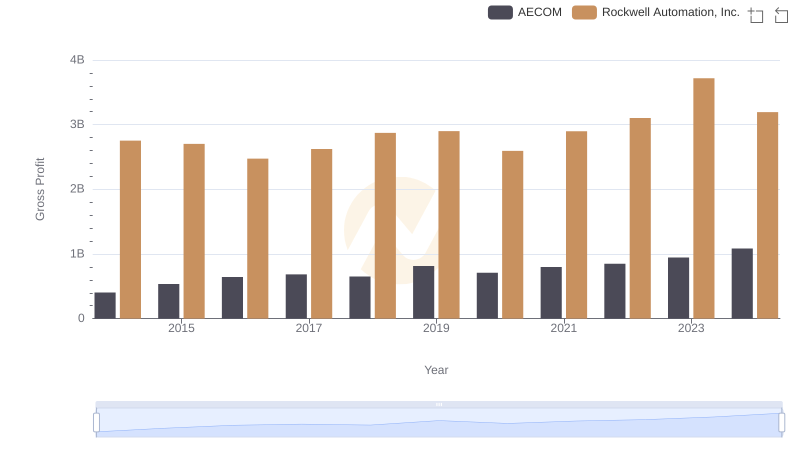

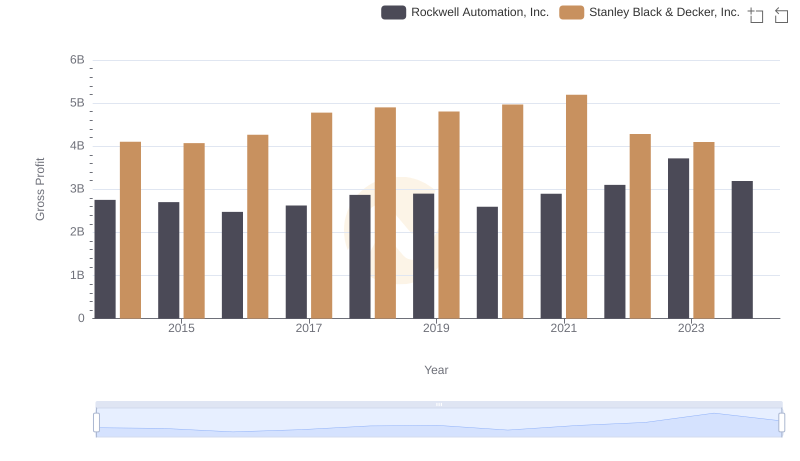

In the ever-evolving landscape of industrial automation and defense technology, Rockwell Automation, Inc. and Elbit Systems Ltd. have emerged as key players. Over the past decade, Rockwell Automation has consistently outperformed Elbit Systems in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Rockwell Automation's gross profit surged by approximately 35%, peaking in 2023. In contrast, Elbit Systems demonstrated a steady increase of around 80% over the same period, albeit from a smaller base. Notably, 2023 marked a significant year for both companies, with Rockwell Automation achieving its highest gross profit, while Elbit Systems also reached a new peak. However, data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis underscores the dynamic nature of these industries and the strategic maneuvers of these corporations.

Revenue Showdown: Rockwell Automation, Inc. vs Elbit Systems Ltd.

Cost Insights: Breaking Down Rockwell Automation, Inc. and Elbit Systems Ltd.'s Expenses

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and AECOM

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

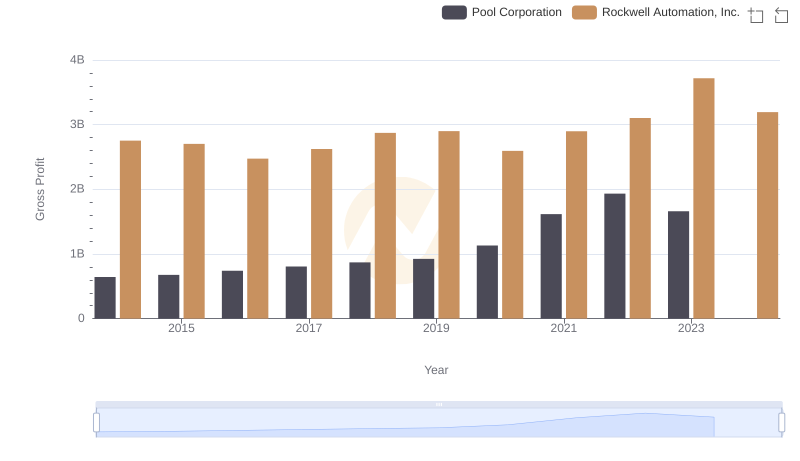

Rockwell Automation, Inc. and Pool Corporation: A Detailed Gross Profit Analysis

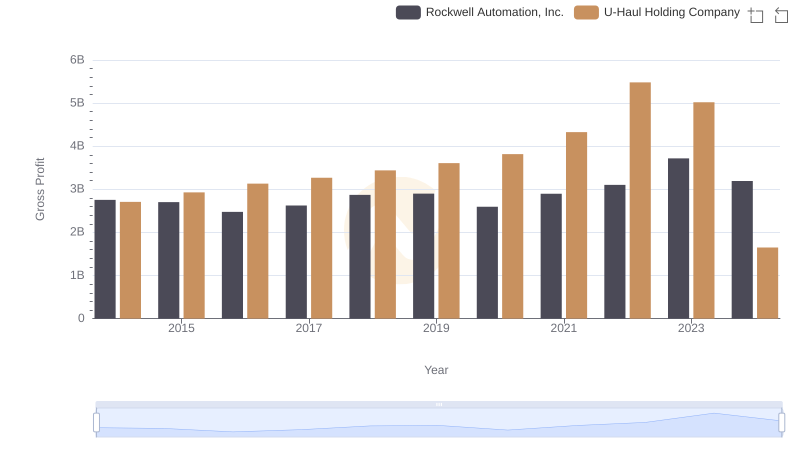

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or U-Haul Holding Company

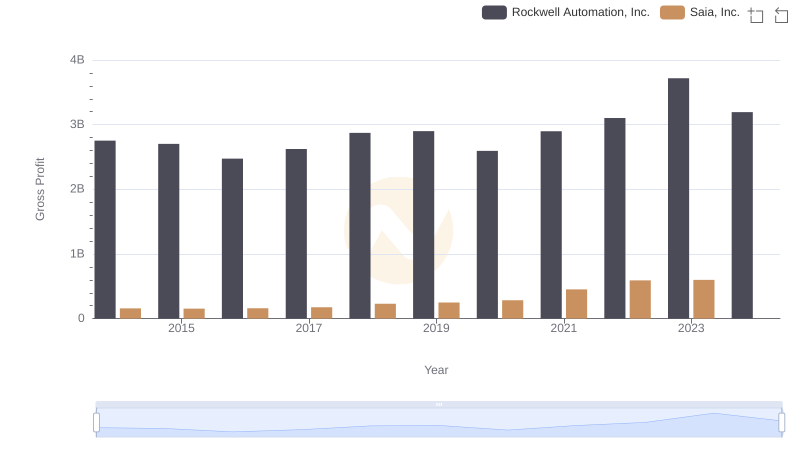

Key Insights on Gross Profit: Rockwell Automation, Inc. vs Saia, Inc.

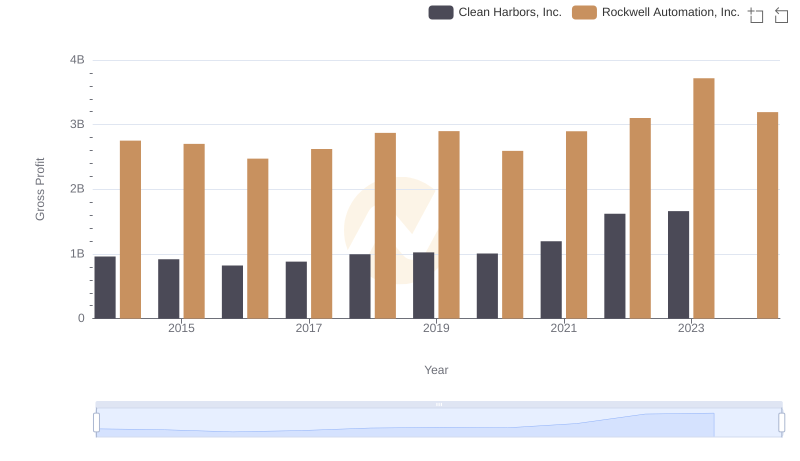

Rockwell Automation, Inc. vs Clean Harbors, Inc.: A Gross Profit Performance Breakdown

Rockwell Automation, Inc. and Curtiss-Wright Corporation: A Detailed Gross Profit Analysis

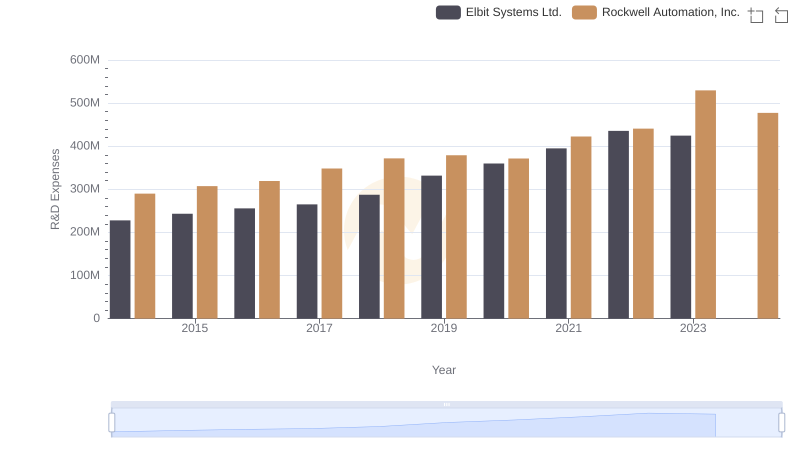

Research and Development Expenses Breakdown: Rockwell Automation, Inc. vs Elbit Systems Ltd.

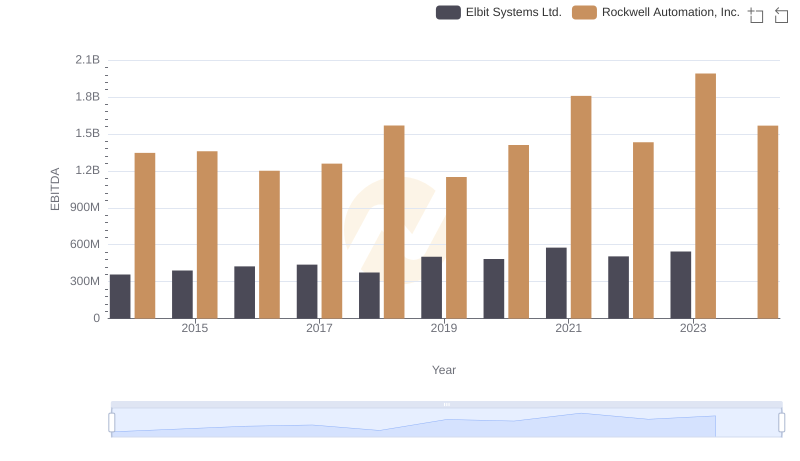

EBITDA Performance Review: Rockwell Automation, Inc. vs Elbit Systems Ltd.