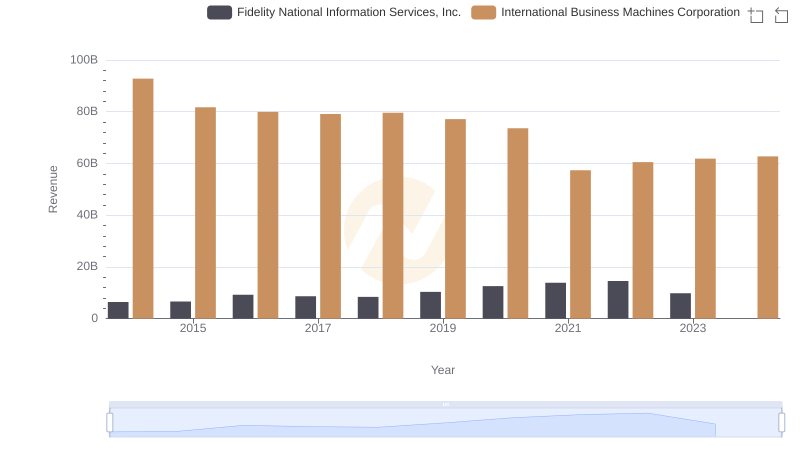

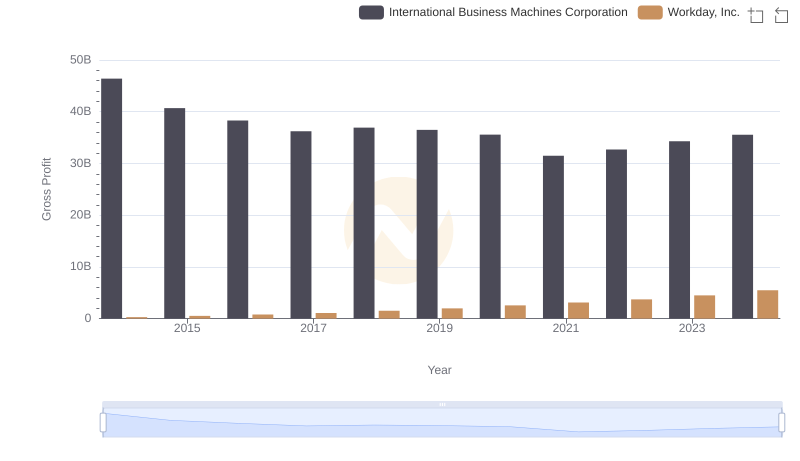

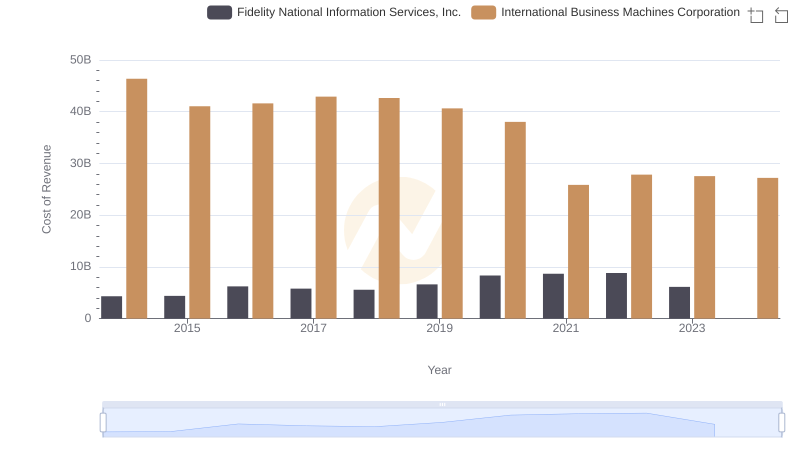

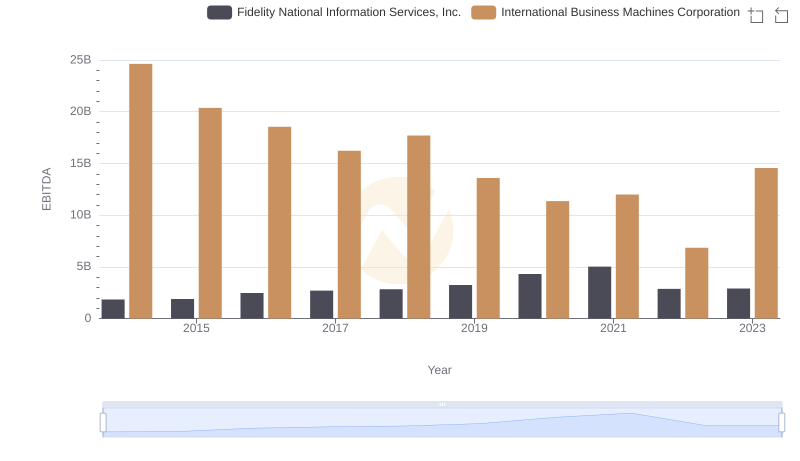

| __timestamp | Fidelity National Information Services, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2081100000 | 46407000000 |

| Thursday, January 1, 2015 | 2202000000 | 40684000000 |

| Friday, January 1, 2016 | 3008000000 | 38516000000 |

| Sunday, January 1, 2017 | 2874000000 | 36943000000 |

| Monday, January 1, 2018 | 2854000000 | 36936000000 |

| Tuesday, January 1, 2019 | 3723000000 | 31533000000 |

| Wednesday, January 1, 2020 | 4204000000 | 30865000000 |

| Friday, January 1, 2021 | 5195000000 | 31486000000 |

| Saturday, January 1, 2022 | 5708000000 | 32687000000 |

| Sunday, January 1, 2023 | 3676000000 | 34300000000 |

| Monday, January 1, 2024 | 3804000000 | 35551000000 |

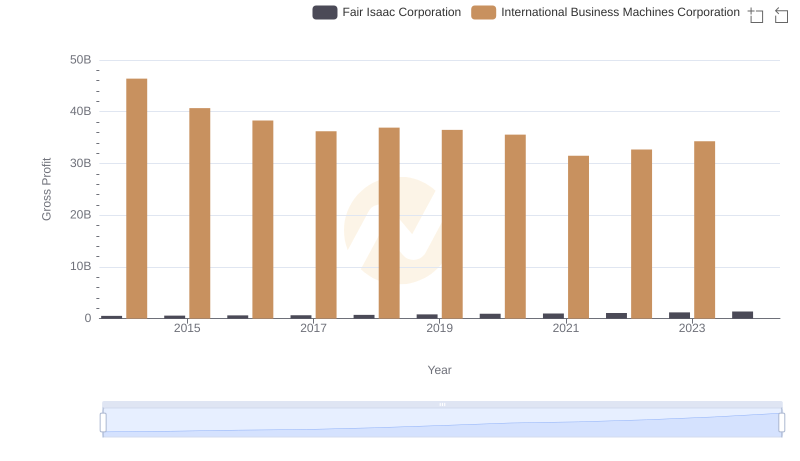

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology and financial services, two titans stand out: International Business Machines Corporation (IBM) and Fidelity National Information Services, Inc. (FIS). Over the past decade, IBM has consistently outperformed FIS in terms of gross profit, showcasing its dominance in the tech industry. From 2014 to 2023, IBM's gross profit averaged around $36.8 billion annually, dwarfing FIS's average of approximately $3.6 billion. This stark contrast highlights IBM's robust business model and its ability to generate substantial revenue.

However, FIS has shown impressive growth, with its gross profit increasing by over 70% from 2014 to 2022. This growth trajectory underscores FIS's strategic expansions and its rising influence in the financial services sector. As we look to the future, the competition between these two giants will undoubtedly shape the industry landscape.

International Business Machines Corporation and Fidelity National Information Services, Inc.: A Comprehensive Revenue Analysis

Key Insights on Gross Profit: International Business Machines Corporation vs Workday, Inc.

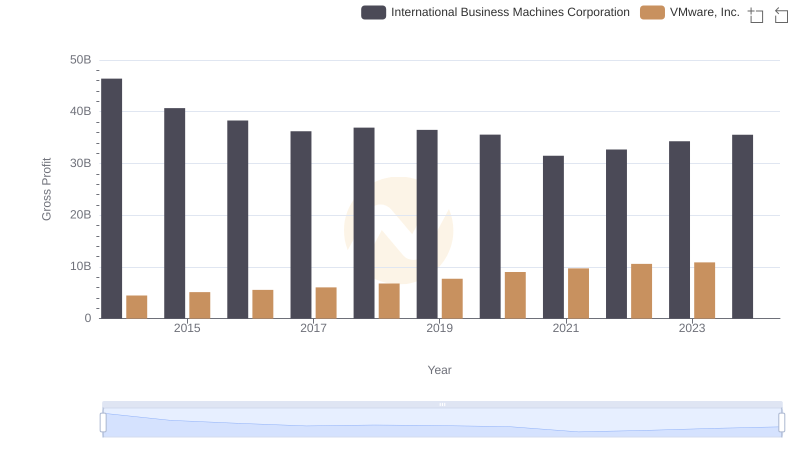

Gross Profit Analysis: Comparing International Business Machines Corporation and VMware, Inc.

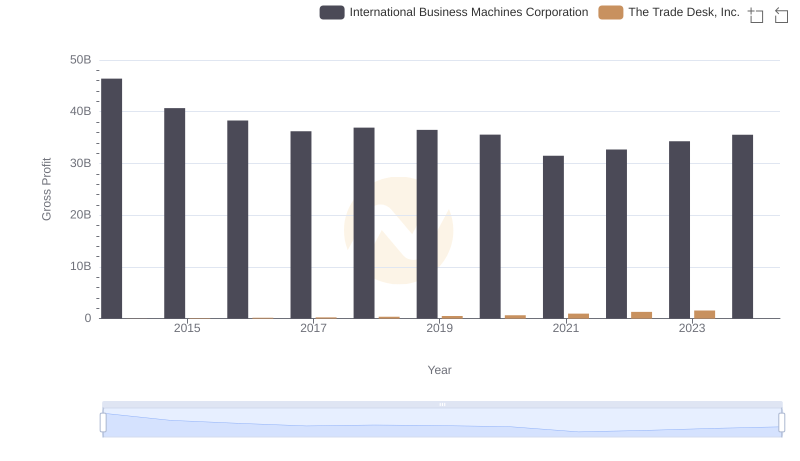

Key Insights on Gross Profit: International Business Machines Corporation vs The Trade Desk, Inc.

Analyzing Cost of Revenue: International Business Machines Corporation and Fidelity National Information Services, Inc.

Gross Profit Comparison: International Business Machines Corporation and NXP Semiconductors N.V. Trends

Who Generates Higher Gross Profit? International Business Machines Corporation or Fair Isaac Corporation

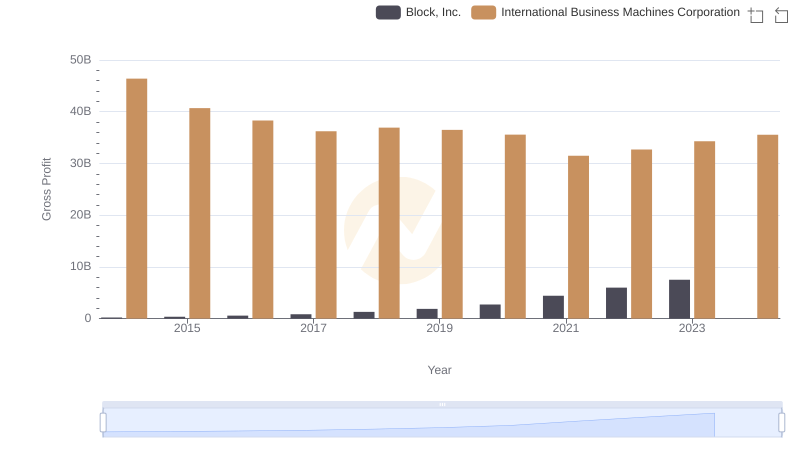

Who Generates Higher Gross Profit? International Business Machines Corporation or Block, Inc.

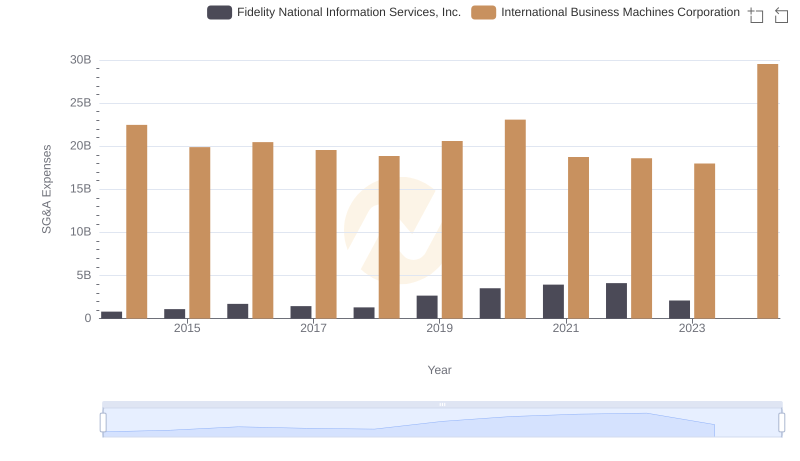

Comparing SG&A Expenses: International Business Machines Corporation vs Fidelity National Information Services, Inc. Trends and Insights

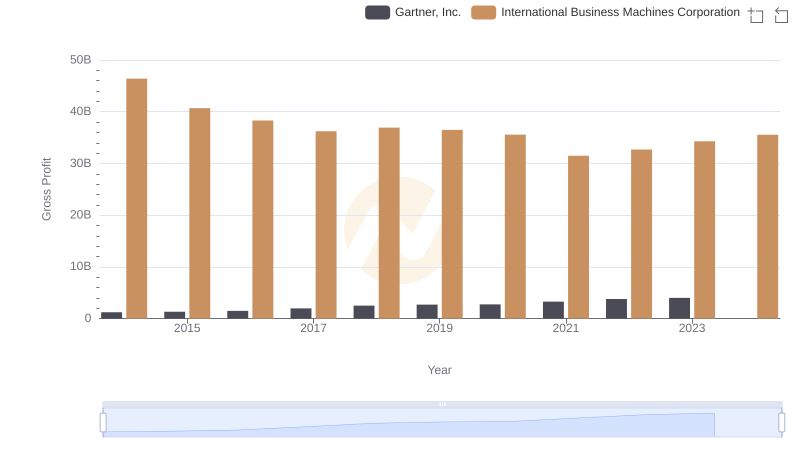

Who Generates Higher Gross Profit? International Business Machines Corporation or Gartner, Inc.

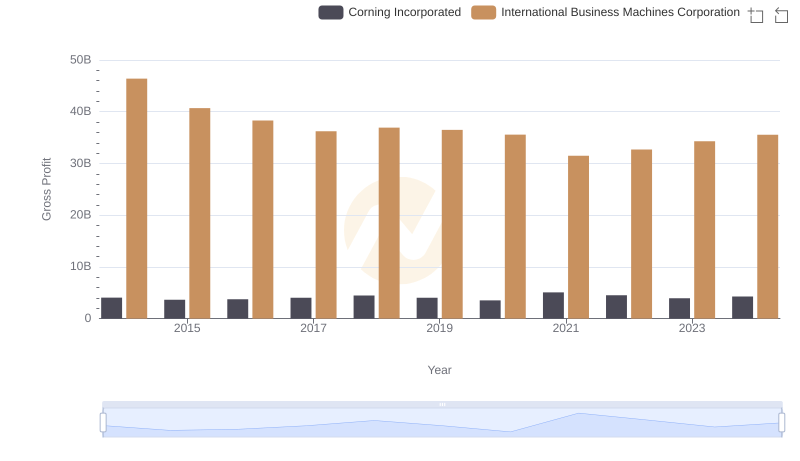

Key Insights on Gross Profit: International Business Machines Corporation vs Corning Incorporated

International Business Machines Corporation vs Fidelity National Information Services, Inc.: In-Depth EBITDA Performance Comparison