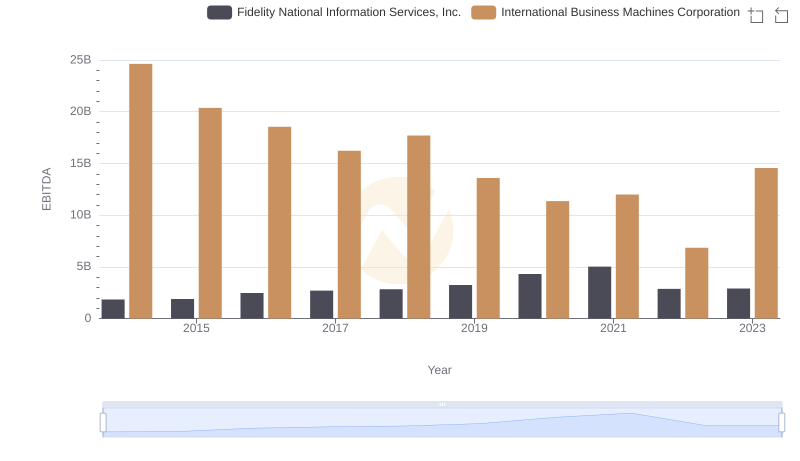

| __timestamp | Fidelity National Information Services, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 810500000 | 22472000000 |

| Thursday, January 1, 2015 | 1102800000 | 19894000000 |

| Friday, January 1, 2016 | 1710000000 | 20279000000 |

| Sunday, January 1, 2017 | 1442000000 | 19680000000 |

| Monday, January 1, 2018 | 1301000000 | 19366000000 |

| Tuesday, January 1, 2019 | 2667000000 | 18724000000 |

| Wednesday, January 1, 2020 | 3516000000 | 20561000000 |

| Friday, January 1, 2021 | 3938000000 | 18745000000 |

| Saturday, January 1, 2022 | 4118000000 | 17483000000 |

| Sunday, January 1, 2023 | 2096000000 | 17997000000 |

| Monday, January 1, 2024 | 2185000000 | 29536000000 |

In pursuit of knowledge

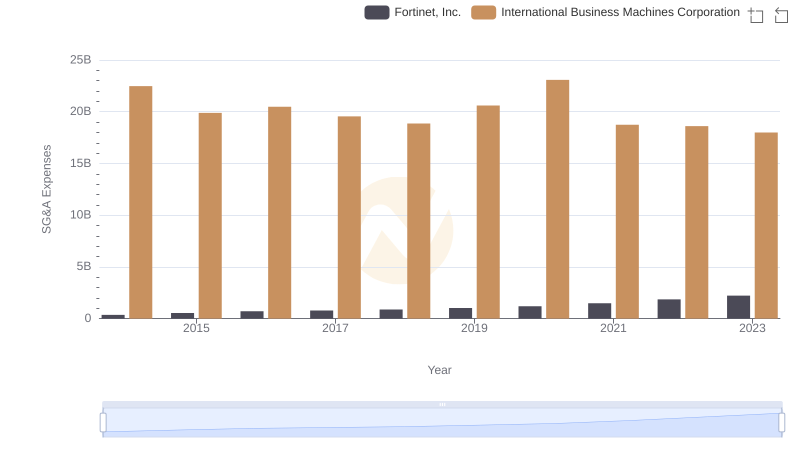

In the ever-evolving landscape of technology and financial services, understanding the financial health of industry leaders is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two titans: International Business Machines Corporation (IBM) and Fidelity National Information Services, Inc. (FIS), from 2014 to 2023.

IBM has consistently maintained a higher SG&A expense, peaking at approximately $29.5 billion in 2024. Despite fluctuations, IBM's expenses have remained robust, reflecting its expansive global operations and strategic investments.

FIS, on the other hand, showcased a dynamic growth trajectory, with expenses rising by over 400% from 2014 to 2022, before a notable dip in 2023. This trend underscores FIS's aggressive expansion and adaptation strategies in the financial services sector.

While IBM's expenses highlight its established market presence, FIS's growth indicates its rising influence. Missing data for 2024 suggests potential shifts in FIS's strategy. Investors and analysts should consider these trends when evaluating future prospects.

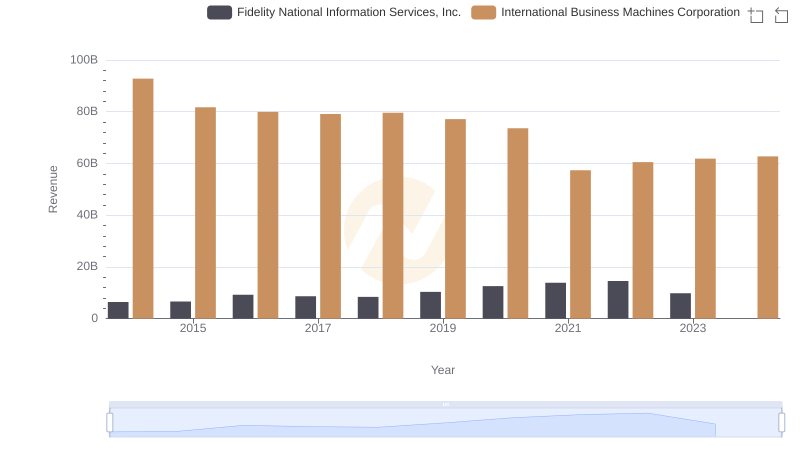

International Business Machines Corporation and Fidelity National Information Services, Inc.: A Comprehensive Revenue Analysis

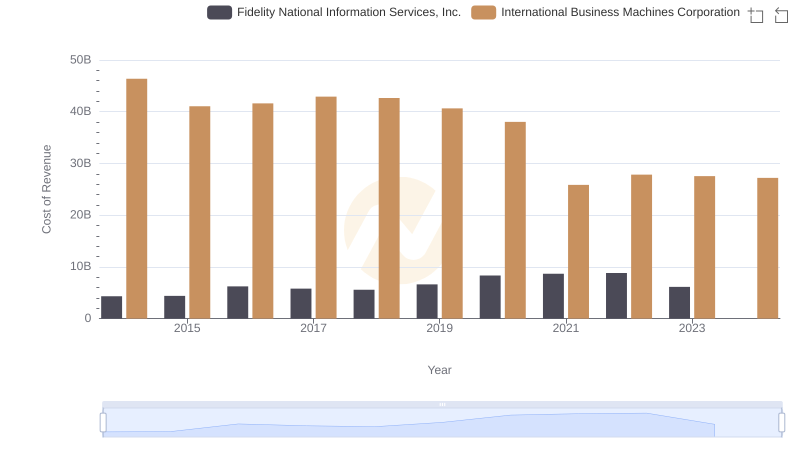

Analyzing Cost of Revenue: International Business Machines Corporation and Fidelity National Information Services, Inc.

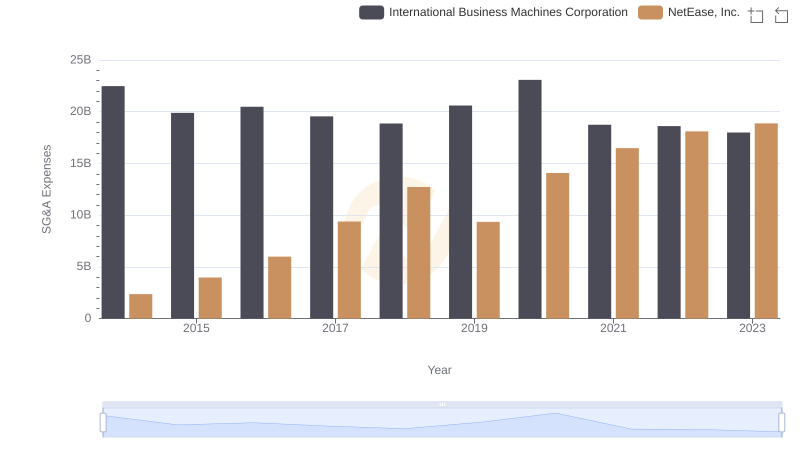

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and NetEase, Inc.

Cost Management Insights: SG&A Expenses for International Business Machines Corporation and Fortinet, Inc.

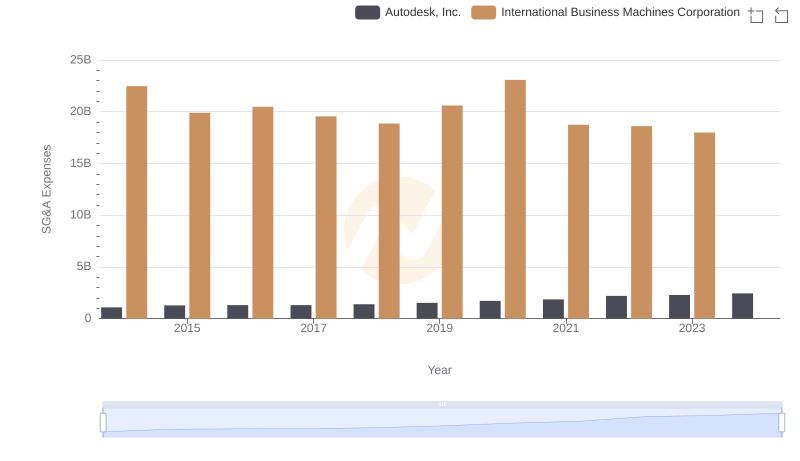

International Business Machines Corporation vs Autodesk, Inc.: SG&A Expense Trends

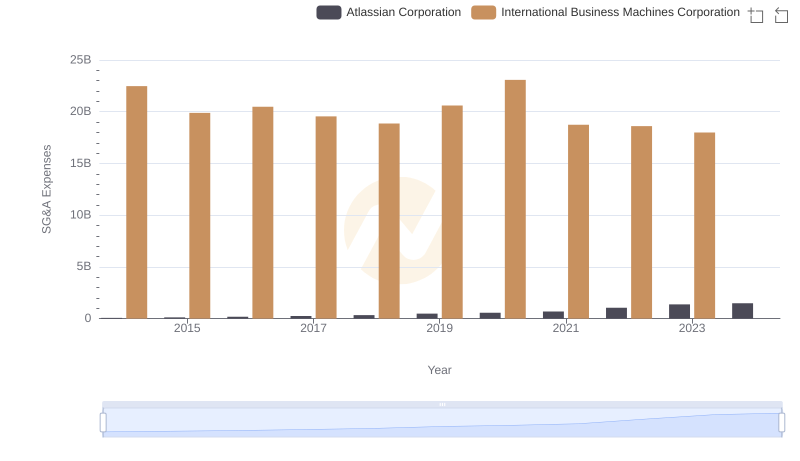

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Atlassian Corporation

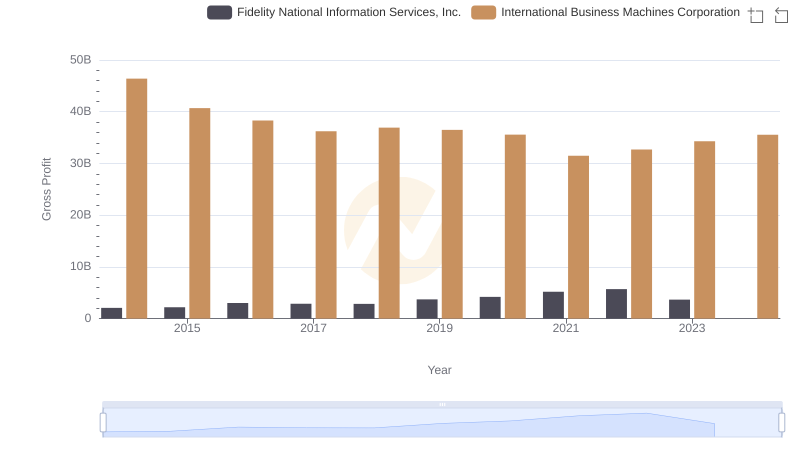

Who Generates Higher Gross Profit? International Business Machines Corporation or Fidelity National Information Services, Inc.

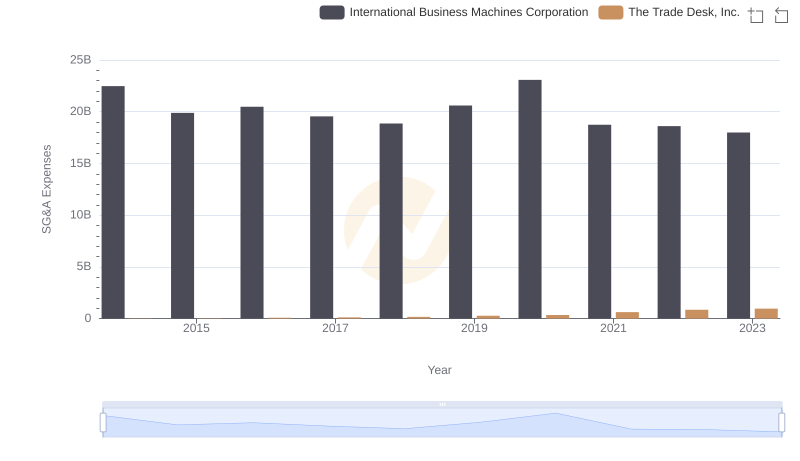

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and The Trade Desk, Inc.

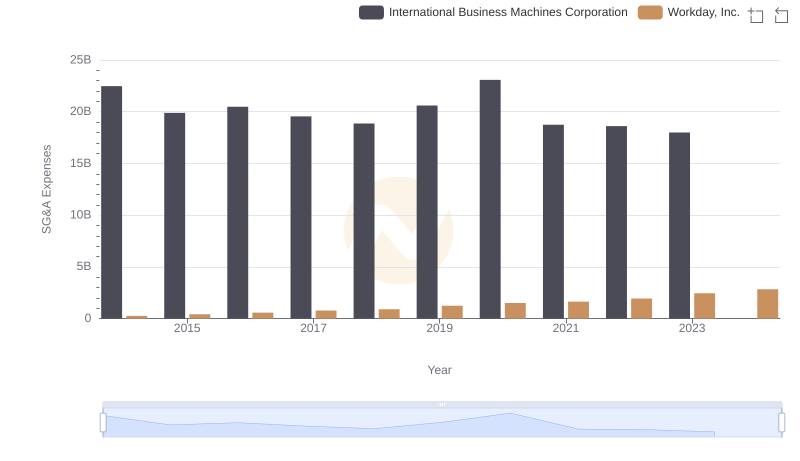

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Workday, Inc.

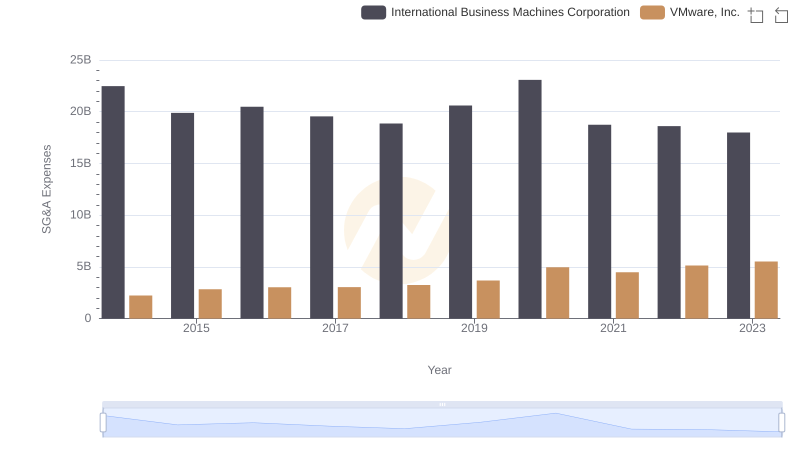

Breaking Down SG&A Expenses: International Business Machines Corporation vs VMware, Inc.

Selling, General, and Administrative Costs: International Business Machines Corporation vs NXP Semiconductors N.V.

International Business Machines Corporation vs Fidelity National Information Services, Inc.: In-Depth EBITDA Performance Comparison