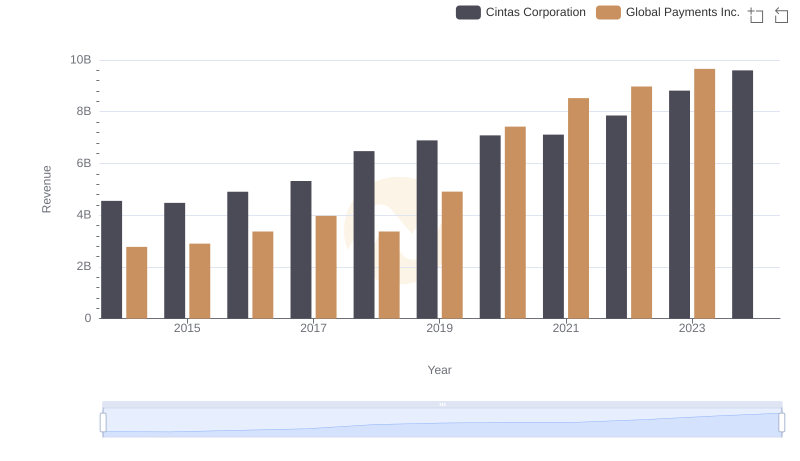

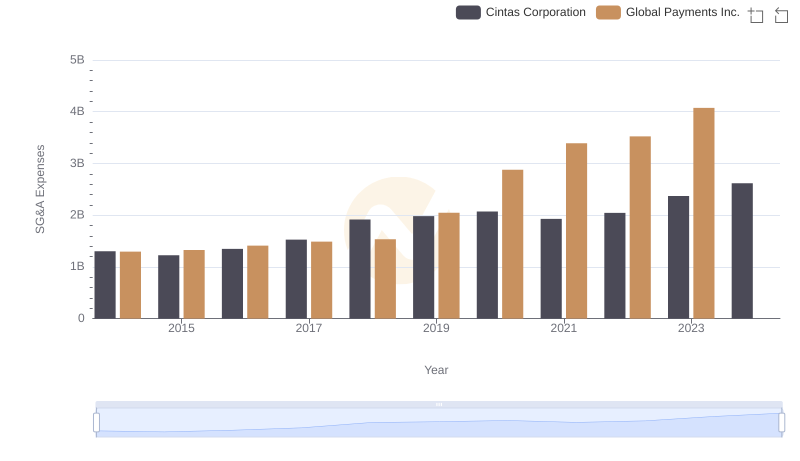

| __timestamp | Cintas Corporation | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 1751611000 |

| Thursday, January 1, 2015 | 1921337000 | 1750511000 |

| Friday, January 1, 2016 | 2129870000 | 1767444000 |

| Sunday, January 1, 2017 | 2380295000 | 2047126000 |

| Monday, January 1, 2018 | 2908523000 | 2271352000 |

| Tuesday, January 1, 2019 | 3128588000 | 2838089000 |

| Wednesday, January 1, 2020 | 3233748000 | 3772831000 |

| Friday, January 1, 2021 | 3314651000 | 4750037000 |

| Saturday, January 1, 2022 | 3632246000 | 5196898000 |

| Sunday, January 1, 2023 | 4173368000 | 5926898000 |

| Monday, January 1, 2024 | 4686416000 | 6345778000 |

Unleashing the power of data

In the ever-evolving landscape of corporate America, the battle for supremacy in gross profit generation is fierce. Cintas Corporation and Global Payments Inc. have been at the forefront of this competition since 2014. Over the past decade, Global Payments Inc. has consistently outperformed Cintas, boasting a 20% higher average gross profit. Notably, in 2023, Global Payments Inc. achieved a staggering 5.93 billion, marking a 40% increase from 2014. Meanwhile, Cintas Corporation has shown steady growth, reaching 4.69 billion in 2024, a 145% rise from its 2014 figures. However, data for Global Payments Inc. in 2024 remains elusive, leaving room for speculation. This dynamic rivalry highlights the strategic maneuvers and market adaptability of these industry titans, offering valuable insights into their financial prowess and future trajectories.

Comparing Revenue Performance: Cintas Corporation or Global Payments Inc.?

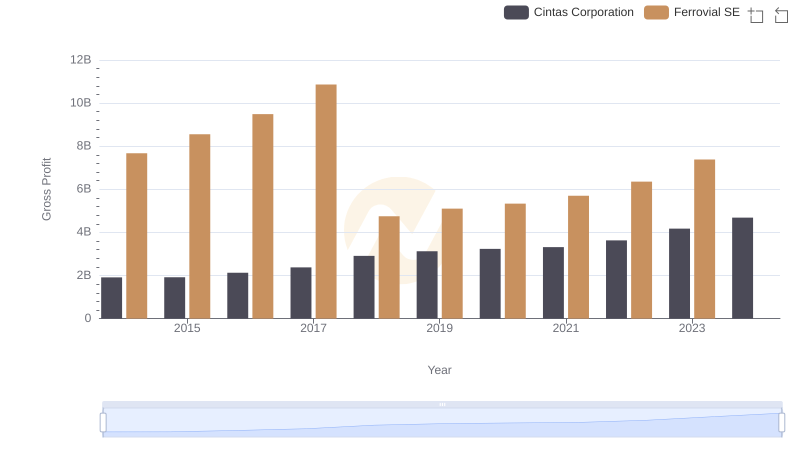

Key Insights on Gross Profit: Cintas Corporation vs Ferrovial SE

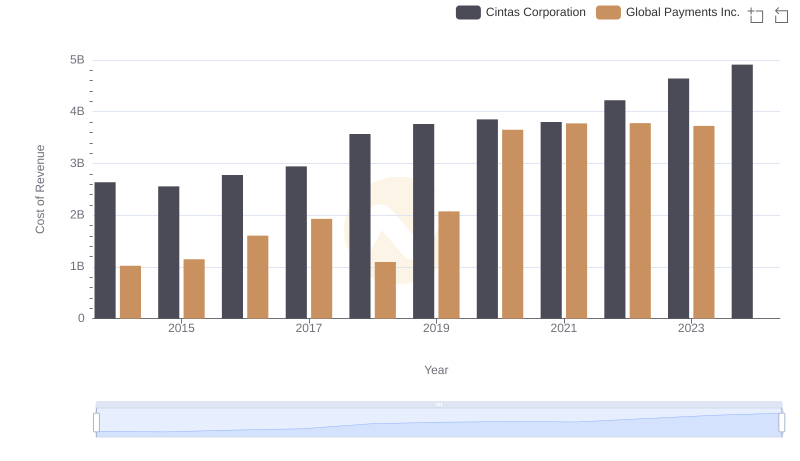

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Global Payments Inc.

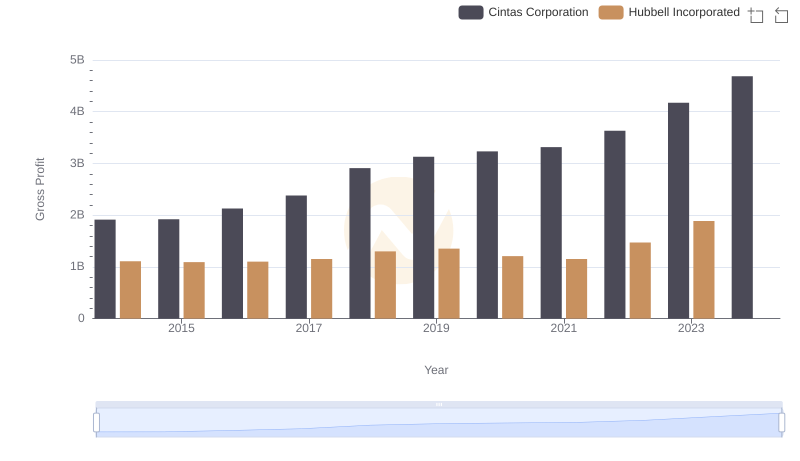

Gross Profit Comparison: Cintas Corporation and Hubbell Incorporated Trends

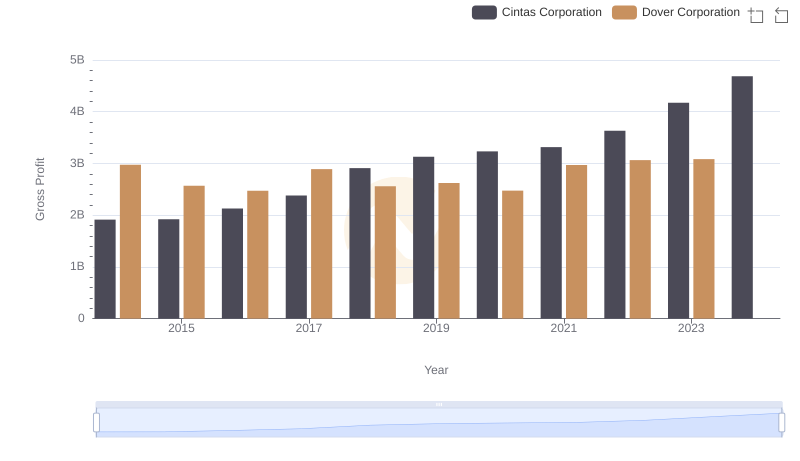

Gross Profit Analysis: Comparing Cintas Corporation and Dover Corporation

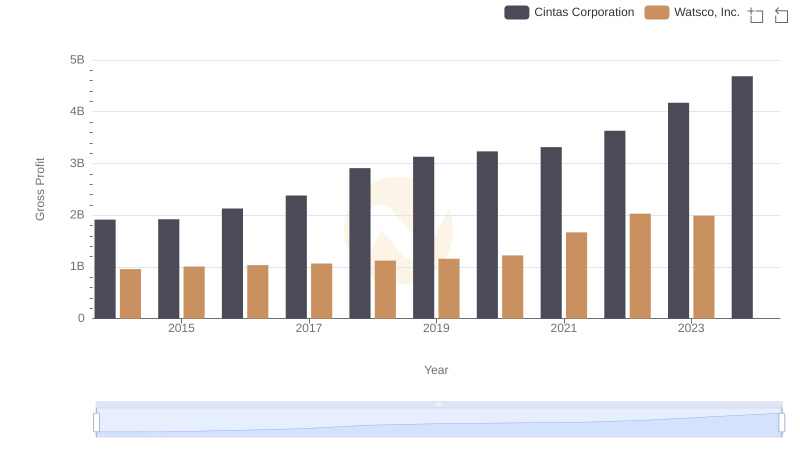

Cintas Corporation and Watsco, Inc.: A Detailed Gross Profit Analysis

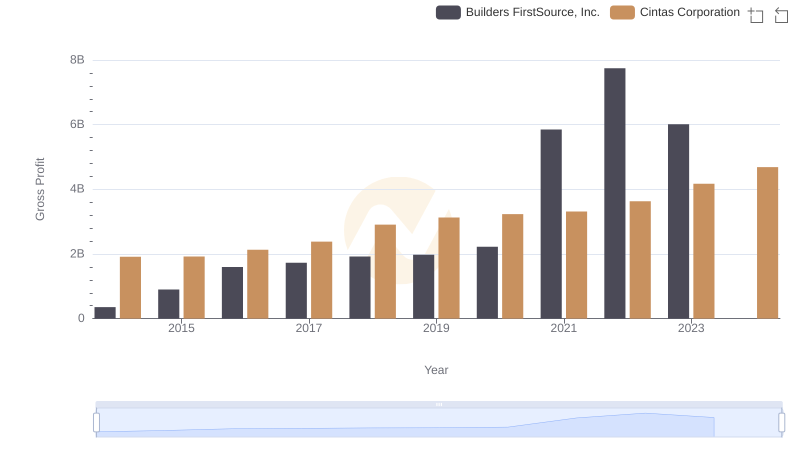

Key Insights on Gross Profit: Cintas Corporation vs Builders FirstSource, Inc.

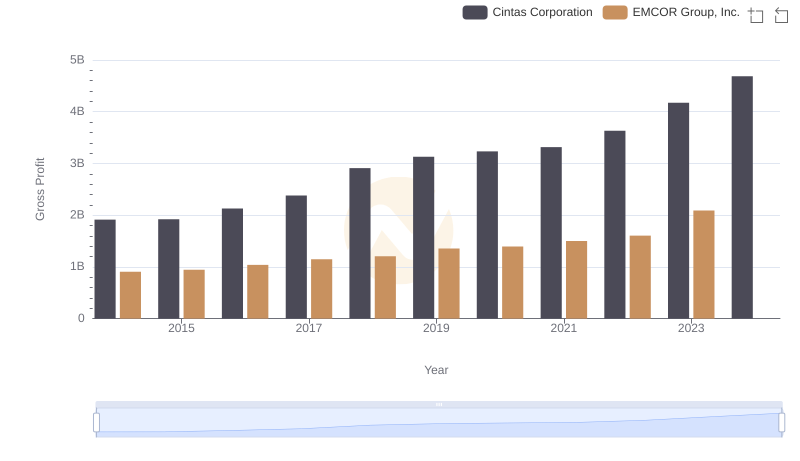

Gross Profit Trends Compared: Cintas Corporation vs EMCOR Group, Inc.

Cintas Corporation and Global Payments Inc.: SG&A Spending Patterns Compared

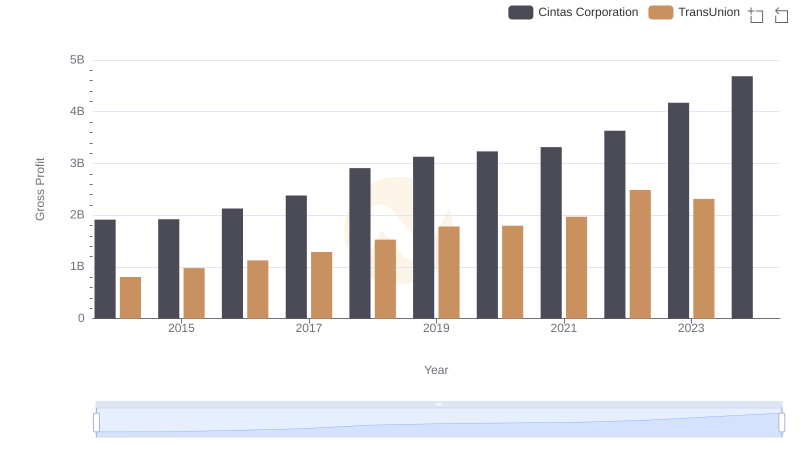

Gross Profit Trends Compared: Cintas Corporation vs TransUnion