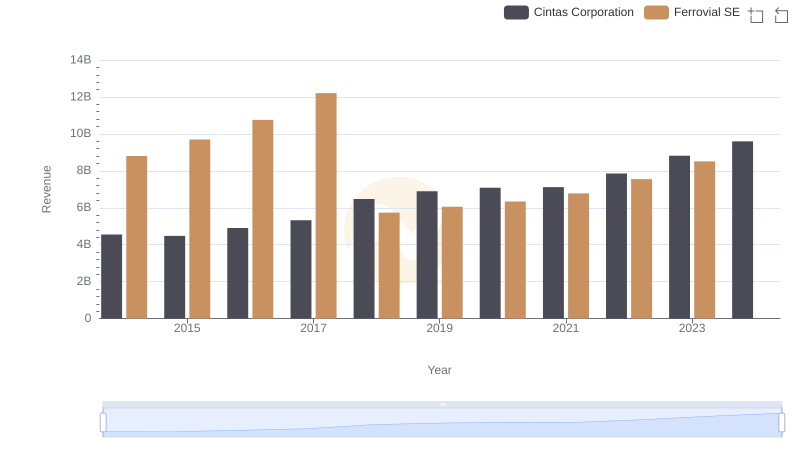

| __timestamp | Cintas Corporation | Ferrovial SE |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 7671000000 |

| Thursday, January 1, 2015 | 1921337000 | 8556000000 |

| Friday, January 1, 2016 | 2129870000 | 9491000000 |

| Sunday, January 1, 2017 | 2380295000 | 10864000000 |

| Monday, January 1, 2018 | 2908523000 | 4752000000 |

| Tuesday, January 1, 2019 | 3128588000 | 5105000000 |

| Wednesday, January 1, 2020 | 3233748000 | 5336000000 |

| Friday, January 1, 2021 | 3314651000 | 5701000000 |

| Saturday, January 1, 2022 | 3632246000 | 6354000000 |

| Sunday, January 1, 2023 | 4173368000 | 7385000000 |

| Monday, January 1, 2024 | 4686416000 |

Igniting the spark of knowledge

In the world of corporate finance, gross profit is a key indicator of a company's financial health. Over the past decade, Cintas Corporation and Ferrovial SE have showcased contrasting trajectories in their gross profit margins. From 2014 to 2023, Cintas Corporation has seen a steady rise, with a remarkable 145% increase, peaking at $4.17 billion in 2023. This growth reflects Cintas's robust business model and strategic market positioning.

Conversely, Ferrovial SE experienced fluctuations, with a notable dip in 2018, but managed to recover, reaching $7.39 billion in 2023. However, data for 2024 remains elusive, leaving room for speculation. This comparison highlights the resilience and adaptability of these industry leaders, offering valuable insights for investors and market analysts alike. As we look to the future, the evolving dynamics between these two corporations will undoubtedly continue to captivate the financial world.

Cintas Corporation or Ferrovial SE: Who Leads in Yearly Revenue?

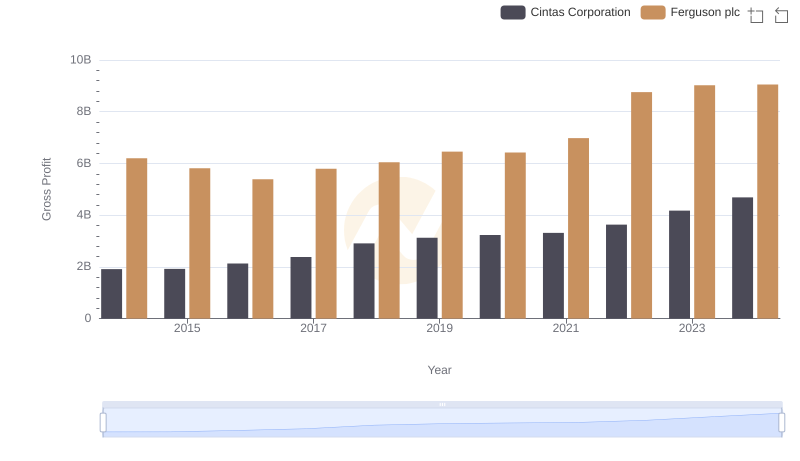

Gross Profit Trends Compared: Cintas Corporation vs Ferguson plc

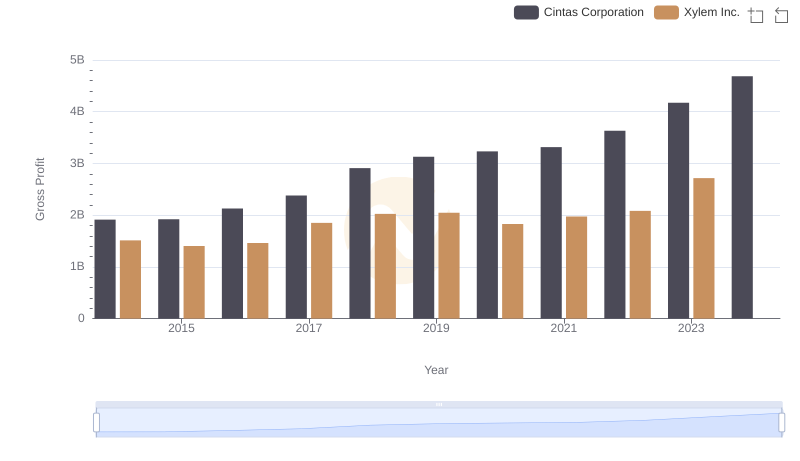

Gross Profit Analysis: Comparing Cintas Corporation and Xylem Inc.

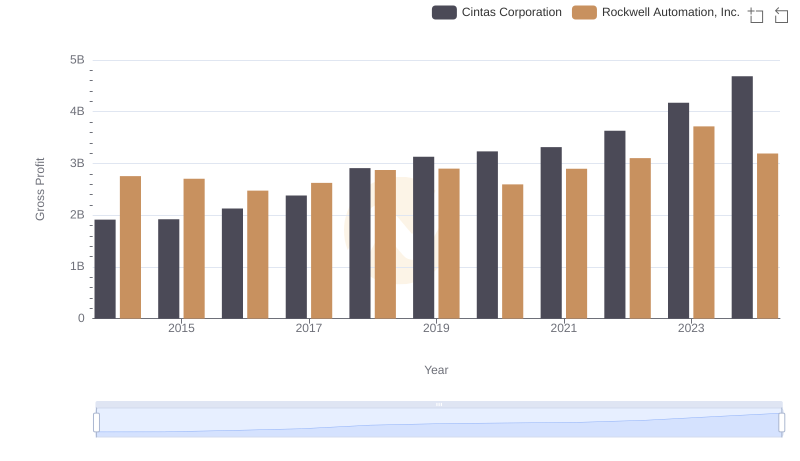

Who Generates Higher Gross Profit? Cintas Corporation or Rockwell Automation, Inc.

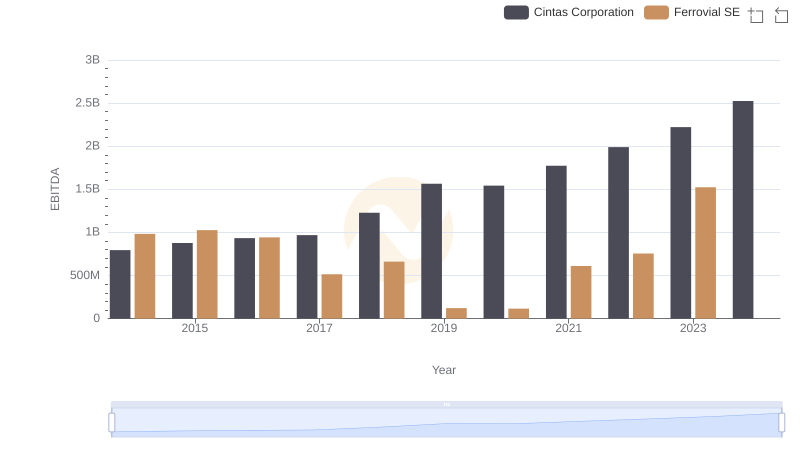

Comparative EBITDA Analysis: Cintas Corporation vs Ferrovial SE

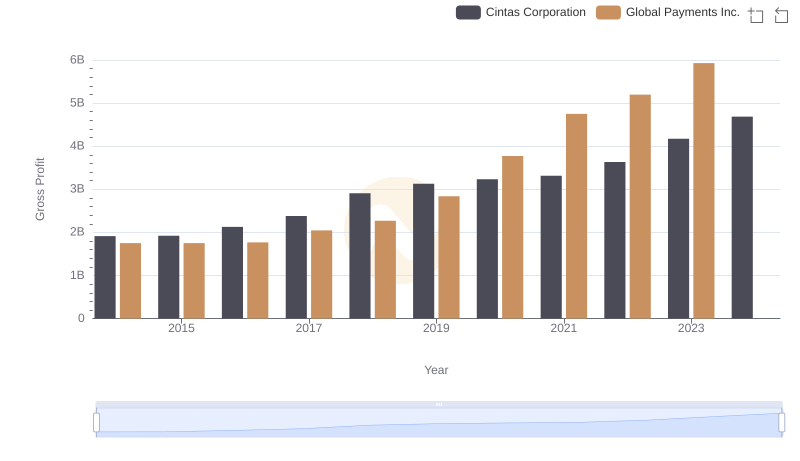

Who Generates Higher Gross Profit? Cintas Corporation or Global Payments Inc.

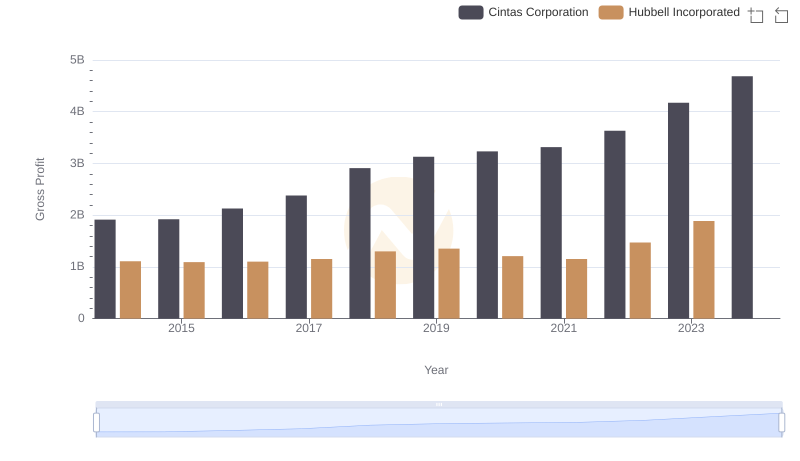

Gross Profit Comparison: Cintas Corporation and Hubbell Incorporated Trends

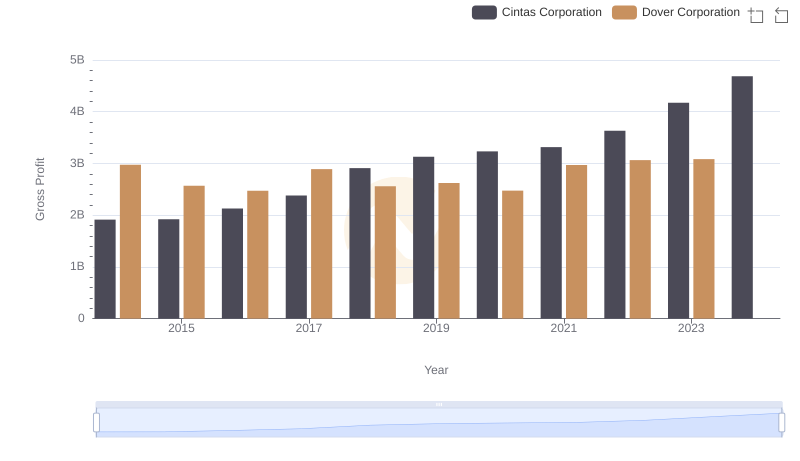

Gross Profit Analysis: Comparing Cintas Corporation and Dover Corporation

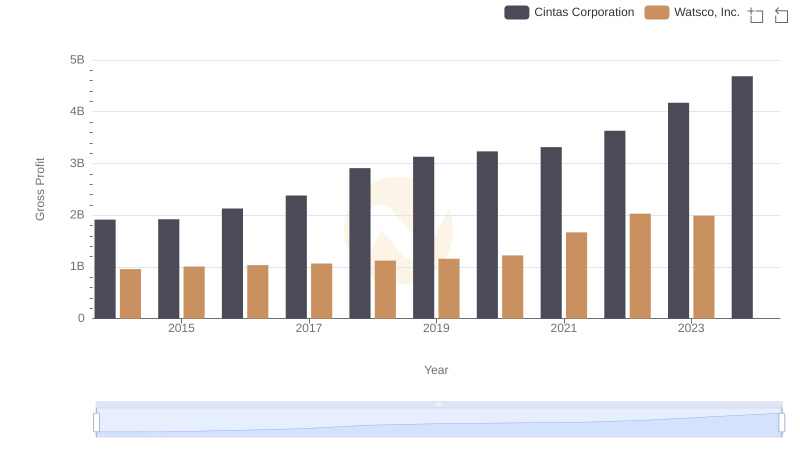

Cintas Corporation and Watsco, Inc.: A Detailed Gross Profit Analysis

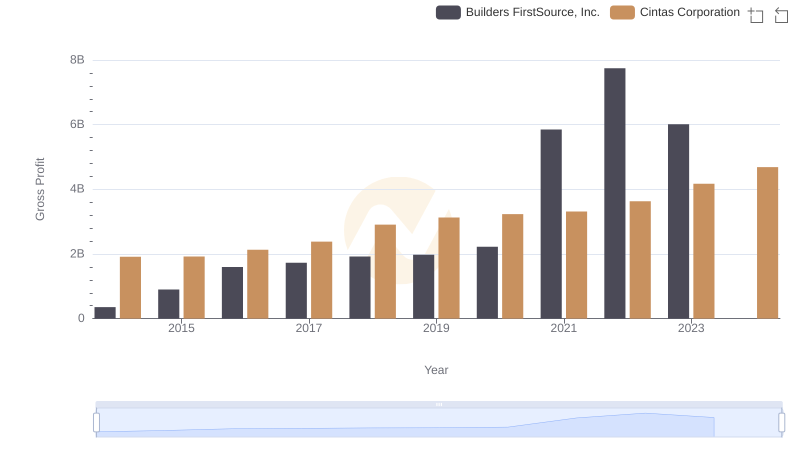

Key Insights on Gross Profit: Cintas Corporation vs Builders FirstSource, Inc.