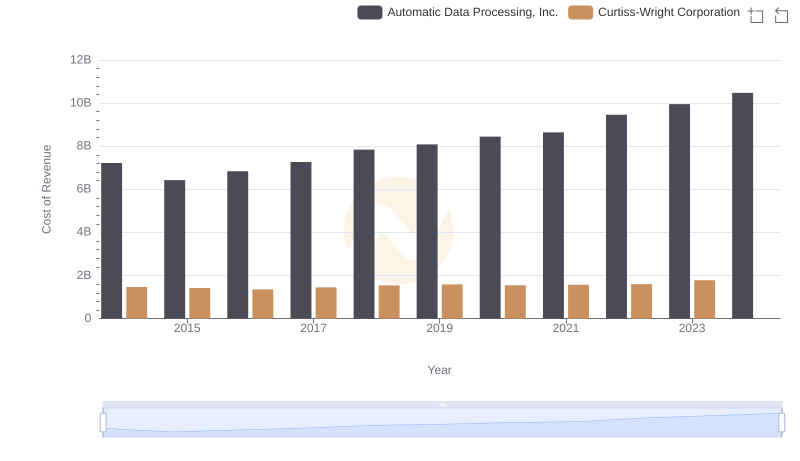

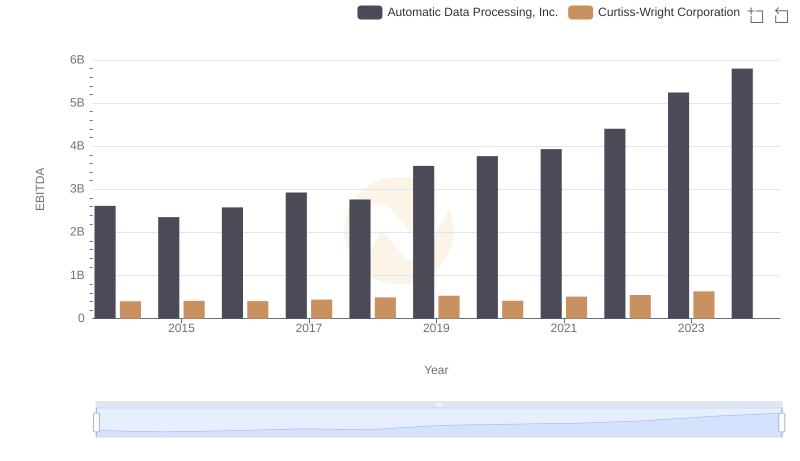

| __timestamp | Automatic Data Processing, Inc. | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 776516000 |

| Thursday, January 1, 2015 | 4133200000 | 783255000 |

| Friday, January 1, 2016 | 4450200000 | 750483000 |

| Sunday, January 1, 2017 | 4712600000 | 818595000 |

| Monday, January 1, 2018 | 5016700000 | 871261000 |

| Tuesday, January 1, 2019 | 5526700000 | 898745000 |

| Wednesday, January 1, 2020 | 6144700000 | 841227000 |

| Friday, January 1, 2021 | 6365100000 | 933356000 |

| Saturday, January 1, 2022 | 7036400000 | 954609000 |

| Sunday, January 1, 2023 | 8058800000 | 1067178000 |

| Monday, January 1, 2024 | 8725900000 | 1153549000 |

Unveiling the hidden dimensions of data

In the world of corporate finance, understanding which companies generate higher gross profits can offer valuable insights into their operational efficiency and market dominance. Over the past decade, Automatic Data Processing, Inc. (ADP) has consistently outperformed Curtiss-Wright Corporation in terms of gross profit. From 2014 to 2023, ADP's gross profit surged by approximately 89%, peaking at an impressive $8.7 billion in 2023. In contrast, Curtiss-Wright's growth was more modest, with a 37% increase, reaching just over $1 billion in the same year.

This stark difference highlights ADP's robust business model and market strategy, which has allowed it to maintain a significant lead. However, it's worth noting that data for 2024 is incomplete, leaving room for future developments. As investors and analysts look to the future, these trends provide a crucial lens through which to assess potential investment opportunities.

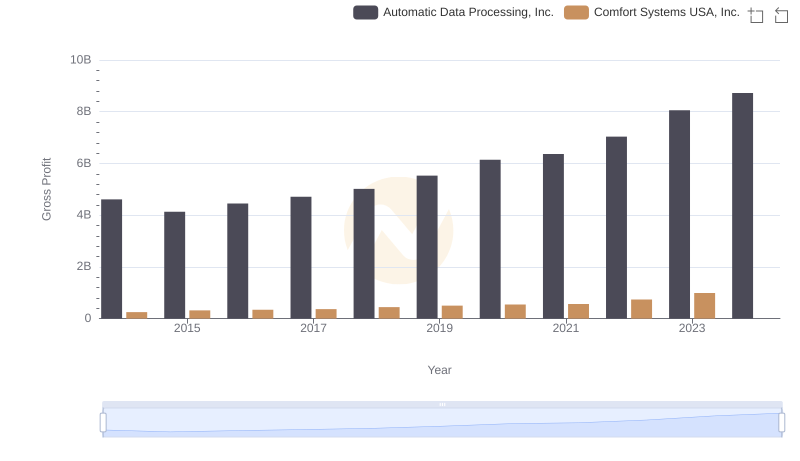

Gross Profit Comparison: Automatic Data Processing, Inc. and Comfort Systems USA, Inc. Trends

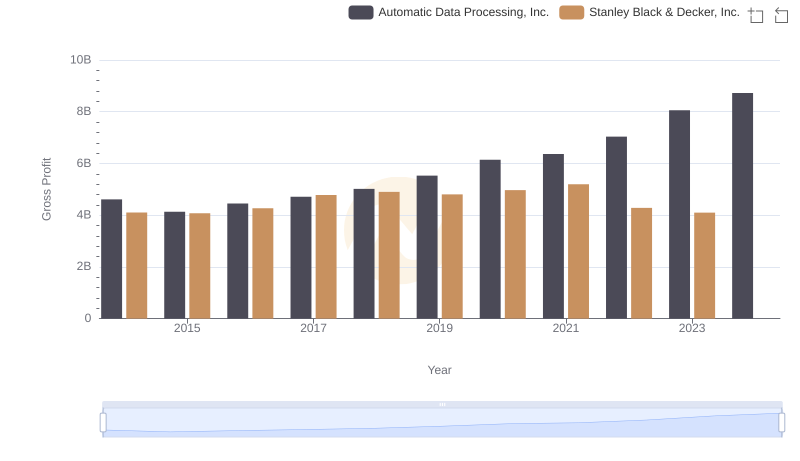

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.

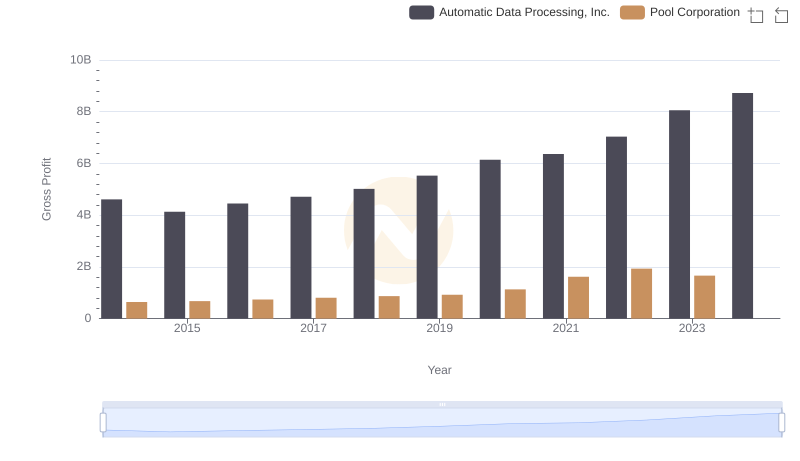

Gross Profit Comparison: Automatic Data Processing, Inc. and Pool Corporation Trends

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Curtiss-Wright Corporation

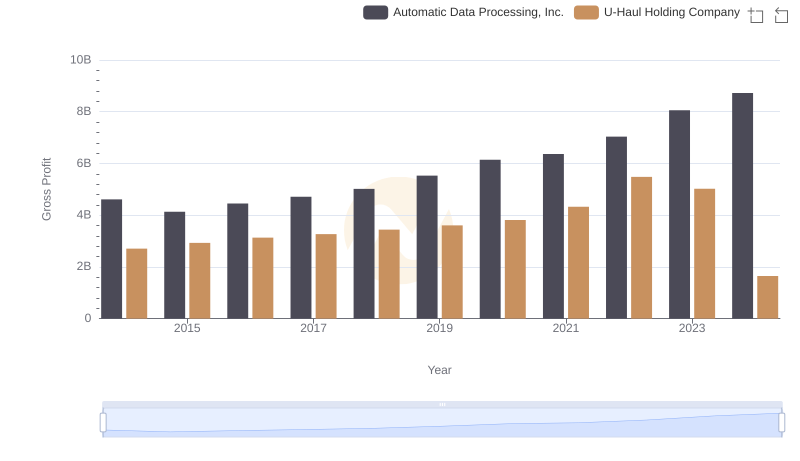

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and U-Haul Holding Company

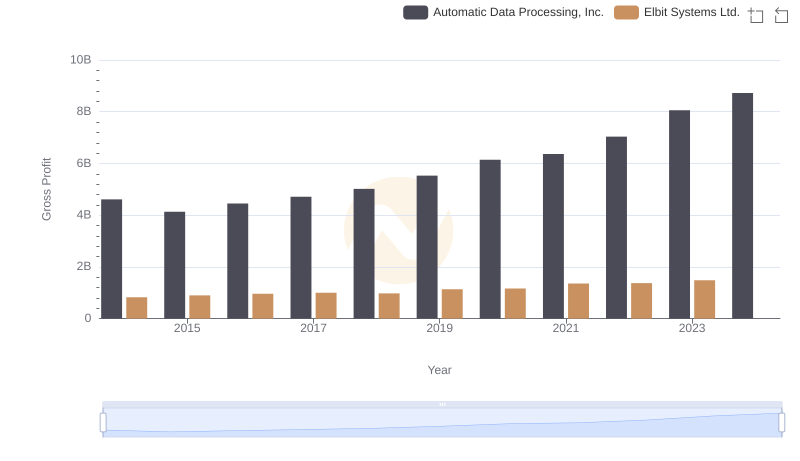

Automatic Data Processing, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs C.H. Robinson Worldwide, Inc.

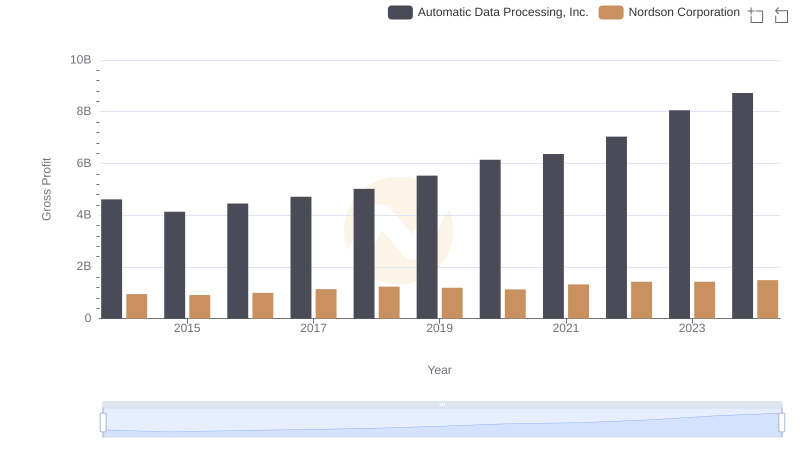

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Nordson Corporation

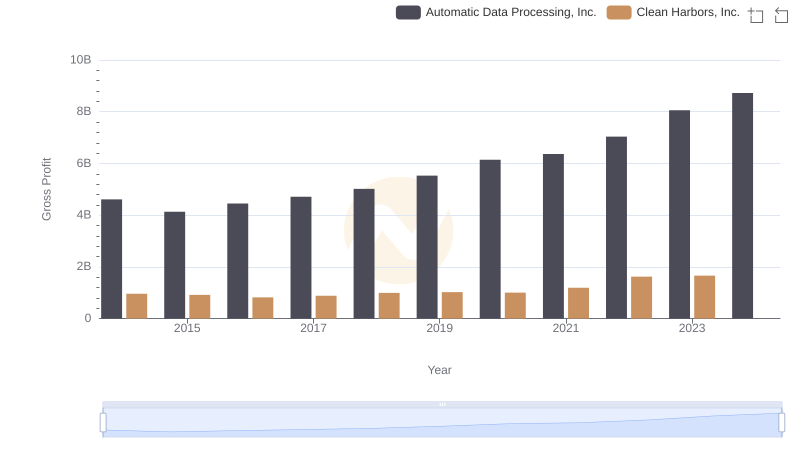

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Clean Harbors, Inc.

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Curtiss-Wright Corporation