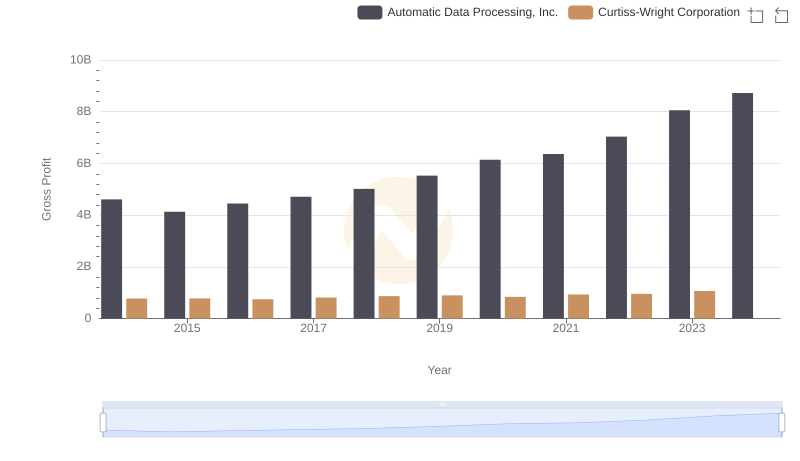

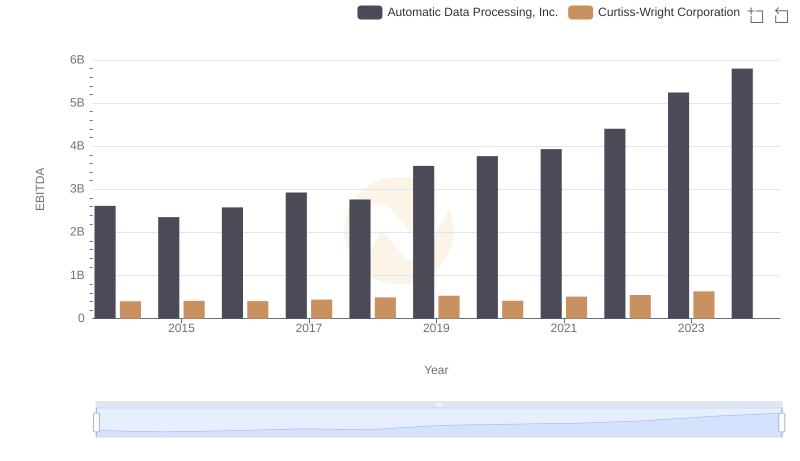

| __timestamp | Automatic Data Processing, Inc. | Curtiss-Wright Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 1466610000 |

| Thursday, January 1, 2015 | 6427600000 | 1422428000 |

| Friday, January 1, 2016 | 6840300000 | 1358448000 |

| Sunday, January 1, 2017 | 7269800000 | 1452431000 |

| Monday, January 1, 2018 | 7842600000 | 1540574000 |

| Tuesday, January 1, 2019 | 8086600000 | 1589216000 |

| Wednesday, January 1, 2020 | 8445100000 | 1550109000 |

| Friday, January 1, 2021 | 8640300000 | 1572575000 |

| Saturday, January 1, 2022 | 9461900000 | 1602416000 |

| Sunday, January 1, 2023 | 9953400000 | 1778195000 |

| Monday, January 1, 2024 | 10476700000 | 1967640000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. Automatic Data Processing, Inc. (ADP) and Curtiss-Wright Corporation (CW) offer a fascinating study in contrasts. Over the past decade, ADP has consistently demonstrated a robust cost of revenue, peaking at approximately $10.5 billion in 2024, marking a 45% increase since 2014. In contrast, Curtiss-Wright's cost of revenue has shown a steadier trajectory, with a 21% rise, reaching around $1.8 billion in 2023.

This comparison highlights ADP's aggressive growth strategy, while CW maintains a more conservative approach. The data from 2014 to 2023 reveals ADP's dynamic expansion, with a notable surge post-2020, whereas CW's growth, though steady, reflects a more cautious fiscal strategy. Missing data for 2024 in CW's records suggests a need for further analysis to complete the picture.

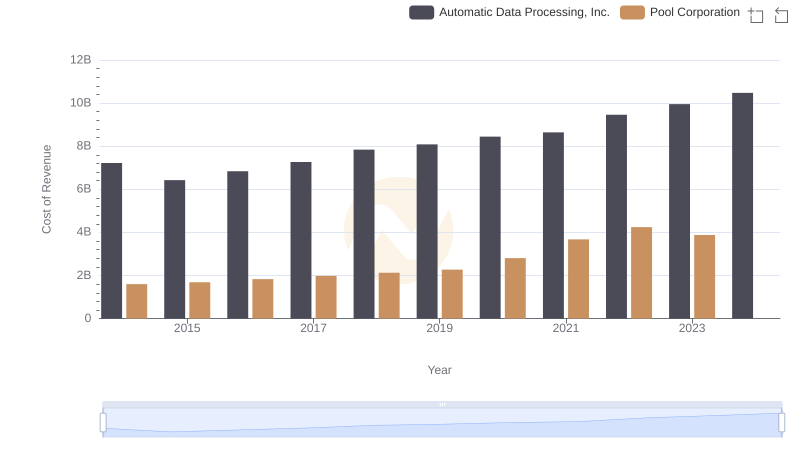

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Pool Corporation

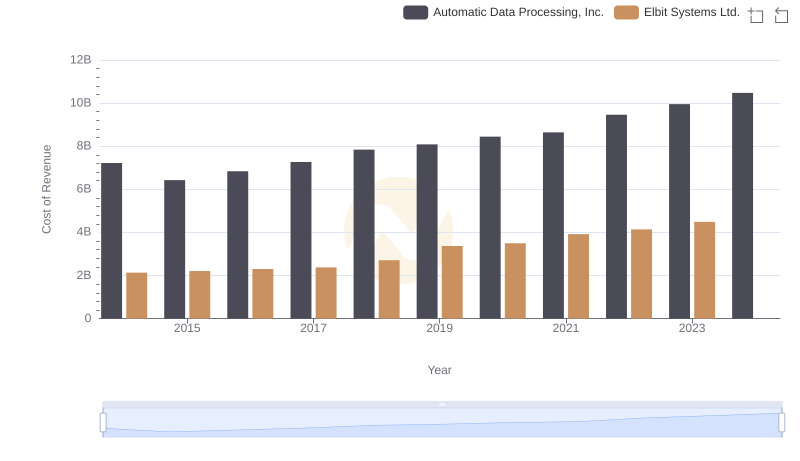

Automatic Data Processing, Inc. vs Elbit Systems Ltd.: Efficiency in Cost of Revenue Explored

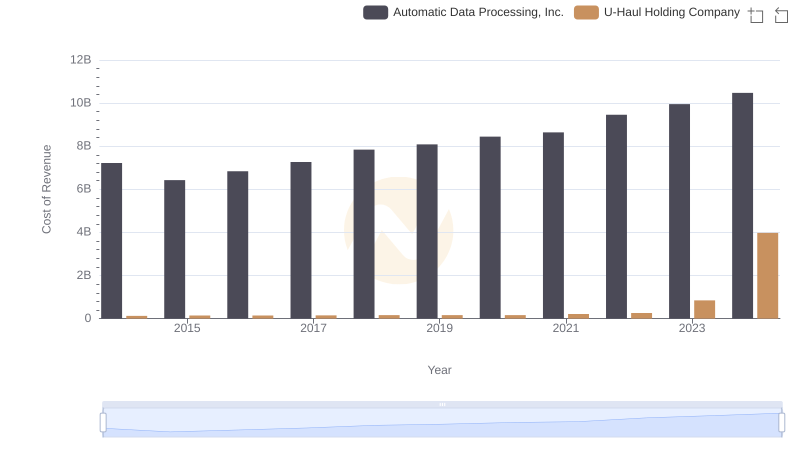

Cost of Revenue Trends: Automatic Data Processing, Inc. vs U-Haul Holding Company

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Curtiss-Wright Corporation

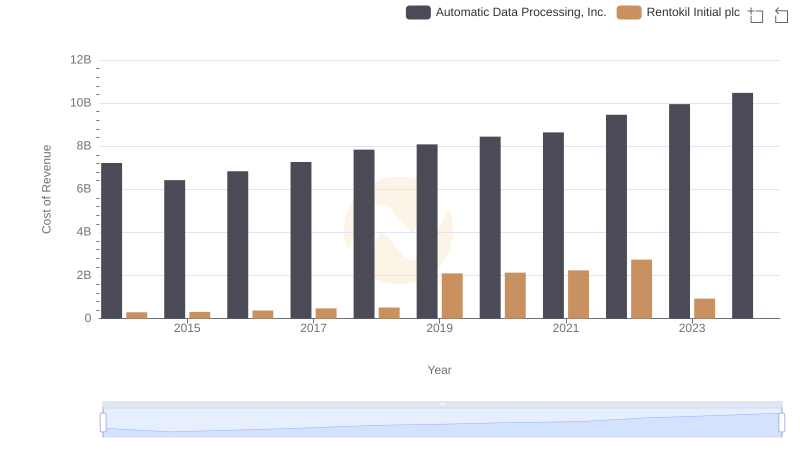

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Rentokil Initial plc

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Curtiss-Wright Corporation