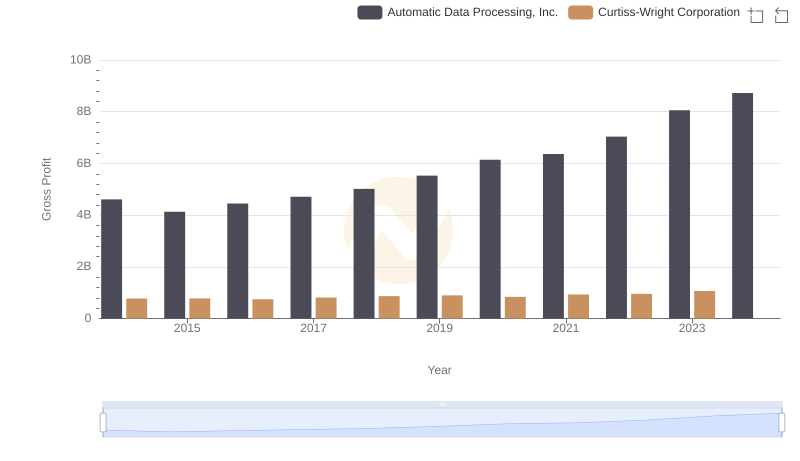

| __timestamp | Automatic Data Processing, Inc. | C.H. Robinson Worldwide, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 1068631000 |

| Thursday, January 1, 2015 | 4133200000 | 1217070000 |

| Friday, January 1, 2016 | 4450200000 | 1212592000 |

| Sunday, January 1, 2017 | 4712600000 | 1188523000 |

| Monday, January 1, 2018 | 5016700000 | 1361693000 |

| Tuesday, January 1, 2019 | 5526700000 | 1287782000 |

| Wednesday, January 1, 2020 | 6144700000 | 1169390000 |

| Friday, January 1, 2021 | 6365100000 | 1608479000 |

| Saturday, January 1, 2022 | 7036400000 | 1870197000 |

| Sunday, January 1, 2023 | 8058800000 | 1138873000 |

| Monday, January 1, 2024 | 8725900000 | 1308765000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding gross profit trends is crucial for investors and analysts alike. Over the past decade, Automatic Data Processing, Inc. (ADP) and C.H. Robinson Worldwide, Inc. have showcased distinct trajectories in their financial performance.

From 2014 to 2024, ADP's gross profit has seen a remarkable increase of approximately 89%, reflecting its robust business model and strategic growth initiatives. Notably, the year 2023 marked a significant leap, with a 15% rise from the previous year, underscoring ADP's resilience in a competitive market.

Conversely, C.H. Robinson's journey has been marked by volatility. Despite a substantial spike in 2024, with gross profit surging by over 800% compared to 2023, the company experienced fluctuations throughout the decade, highlighting the challenges in the logistics sector.

This comparative analysis offers valuable insights into the financial health and strategic directions of these industry giants.

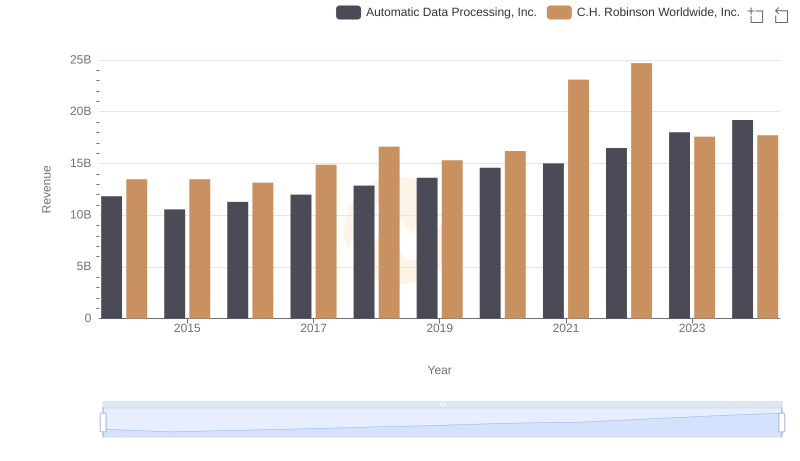

Annual Revenue Comparison: Automatic Data Processing, Inc. vs C.H. Robinson Worldwide, Inc.

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Curtiss-Wright Corporation

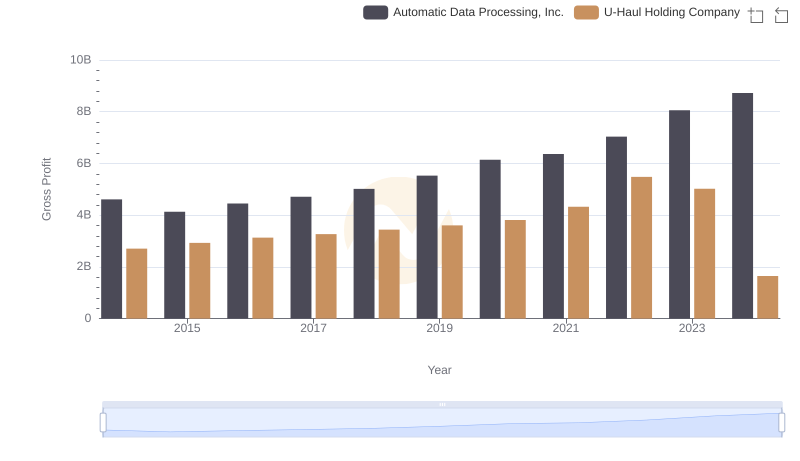

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and U-Haul Holding Company

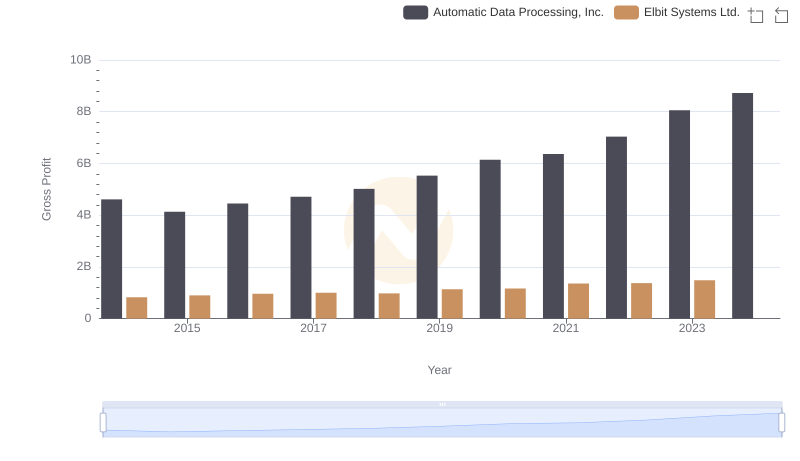

Automatic Data Processing, Inc. vs Elbit Systems Ltd.: A Gross Profit Performance Breakdown

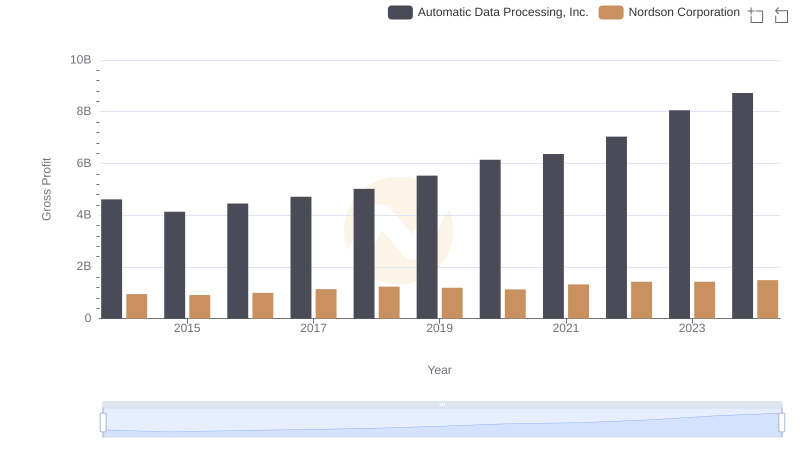

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Nordson Corporation

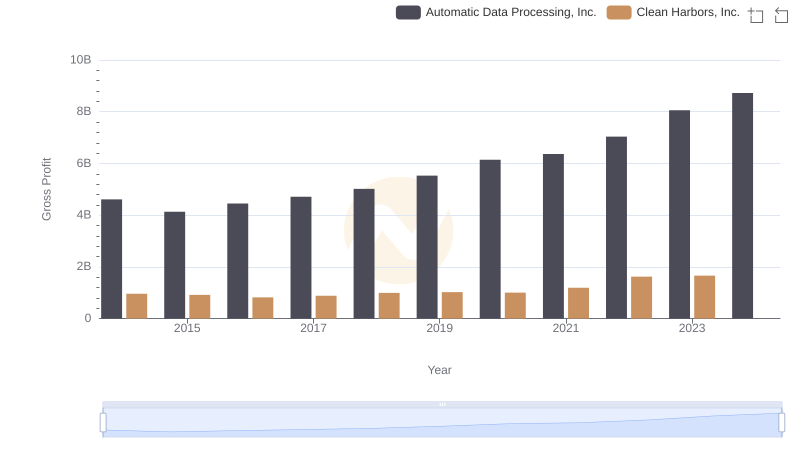

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Clean Harbors, Inc.

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or C.H. Robinson Worldwide, Inc.

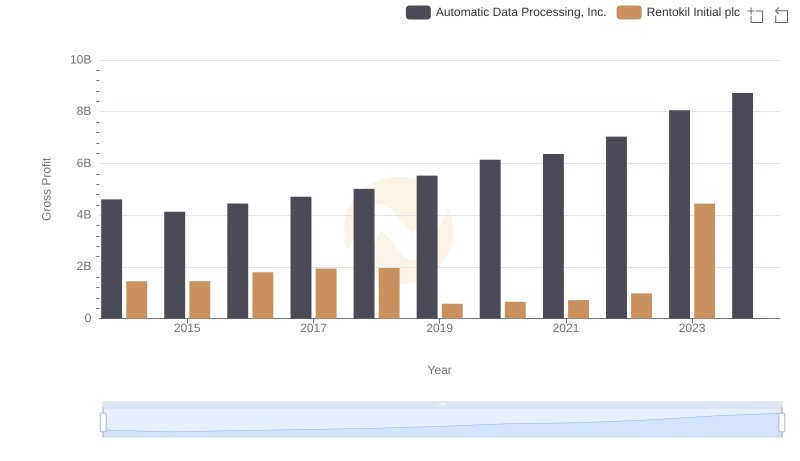

Who Generates Higher Gross Profit? Automatic Data Processing, Inc. or Rentokil Initial plc