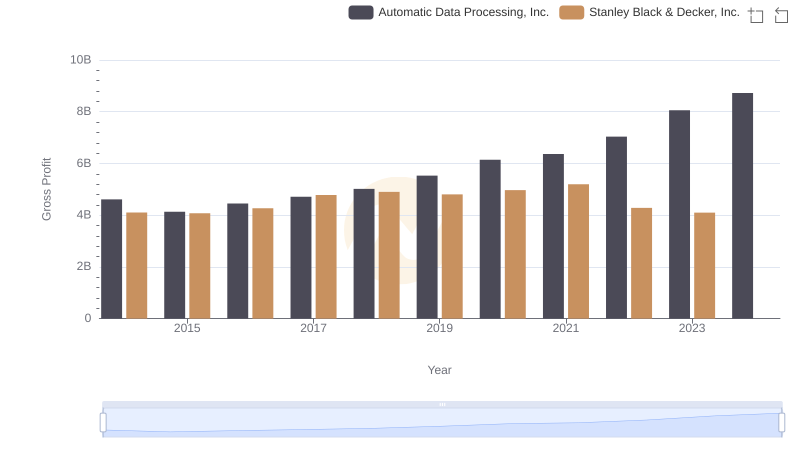

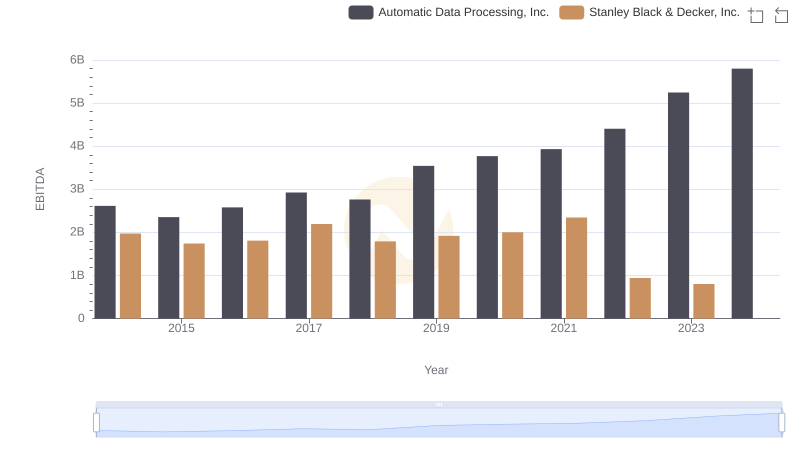

| __timestamp | Automatic Data Processing, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4611400000 | 4102700000 |

| Thursday, January 1, 2015 | 4133200000 | 4072000000 |

| Friday, January 1, 2016 | 4450200000 | 4267200000 |

| Sunday, January 1, 2017 | 4712600000 | 4778000000 |

| Monday, January 1, 2018 | 5016700000 | 4901900000 |

| Tuesday, January 1, 2019 | 5526700000 | 4805500000 |

| Wednesday, January 1, 2020 | 6144700000 | 4967900000 |

| Friday, January 1, 2021 | 6365100000 | 5194200000 |

| Saturday, January 1, 2022 | 7036400000 | 4284100000 |

| Sunday, January 1, 2023 | 8058800000 | 4098000000 |

| Monday, January 1, 2024 | 8725900000 | 4514400000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding the trajectory of gross profit is crucial. From 2014 to 2023, Automatic Data Processing, Inc. (ADP) has demonstrated a robust growth in gross profit, surging by approximately 89%, from $4.6 billion to $8.1 billion. This impressive growth reflects ADP's strategic prowess in the payroll and human resources sector. In contrast, Stanley Black & Decker, Inc., a leader in tools and storage, has experienced a more modest increase of around 25% over the same period, peaking at $5.2 billion in 2021 before a slight decline. The data for 2024 is incomplete for Stanley Black & Decker, highlighting potential challenges or strategic shifts. This comparison underscores the dynamic nature of industry-specific growth and the importance of strategic adaptation in maintaining competitive advantage.

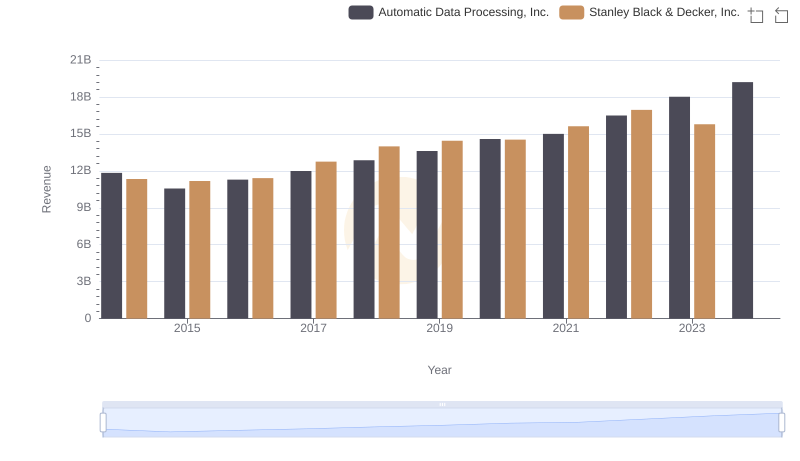

Revenue Insights: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc. Performance Compared

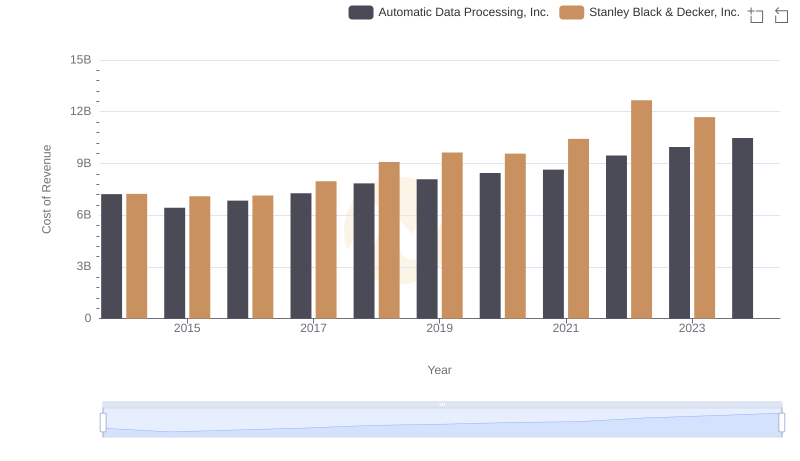

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

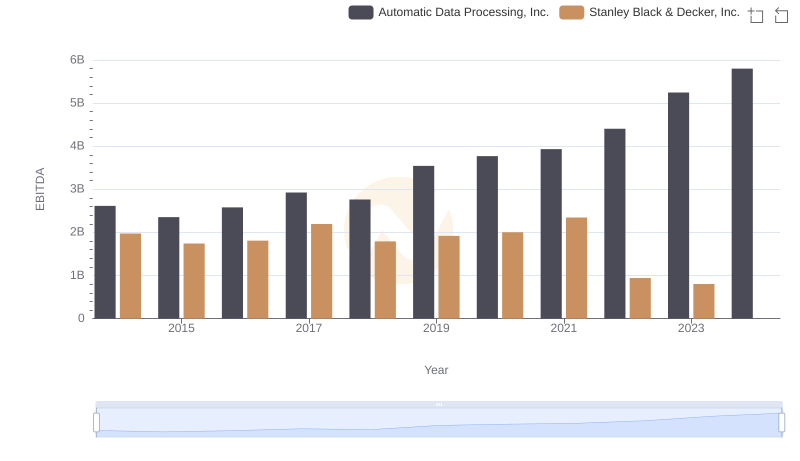

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs AECOM

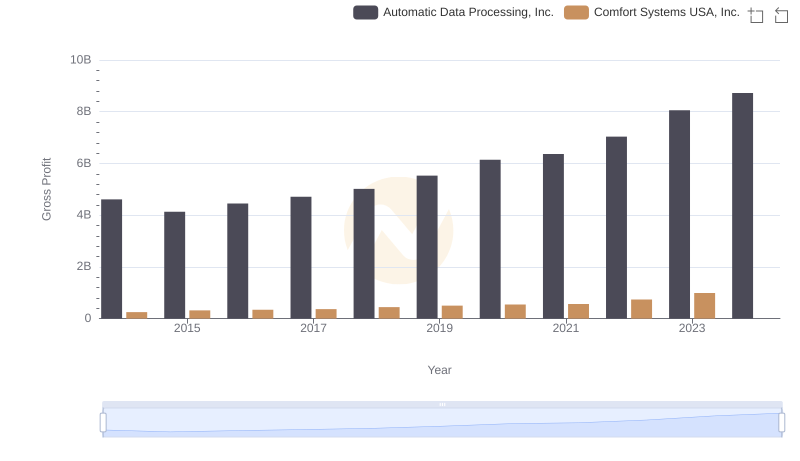

Gross Profit Comparison: Automatic Data Processing, Inc. and Comfort Systems USA, Inc. Trends

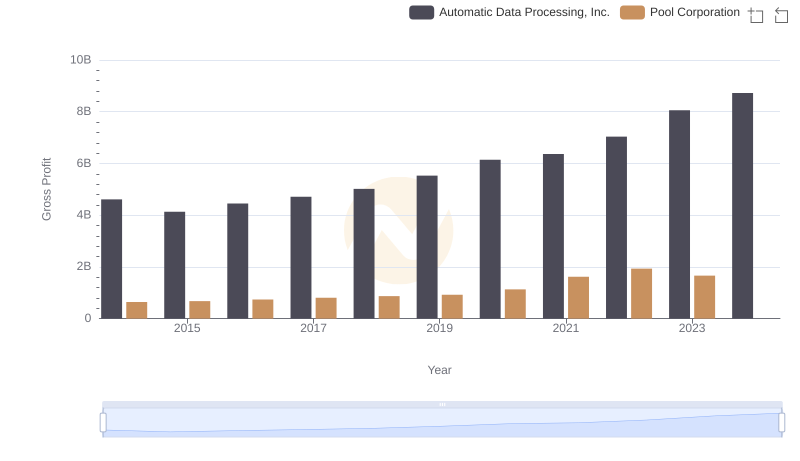

Gross Profit Comparison: Automatic Data Processing, Inc. and Pool Corporation Trends

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Stanley Black & Decker, Inc.

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison