| __timestamp | Northrop Grumman Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3681000000 | 3509000000 |

| Thursday, January 1, 2015 | 3558000000 | 3342000000 |

| Friday, January 1, 2016 | 3394000000 | 3713000000 |

| Sunday, January 1, 2017 | 4928000000 | 3996000000 |

| Monday, January 1, 2018 | 5104000000 | 4212000000 |

| Tuesday, January 1, 2019 | 4234000000 | 4344000000 |

| Wednesday, January 1, 2020 | 5588000000 | 4149000000 |

| Friday, January 1, 2021 | 8734000000 | 4956000000 |

| Saturday, January 1, 2022 | 7684000000 | 5466000000 |

| Sunday, January 1, 2023 | 4229000000 | 5592000000 |

| Monday, January 1, 2024 | 4370000000 | 5128000000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding EBITDA trends offers invaluable insights into a company's operational efficiency. From 2014 to 2023, Waste Management, Inc. and Northrop Grumman Corporation have showcased intriguing trajectories in their EBITDA performance.

Northrop Grumman, a titan in the aerospace and defense sector, experienced a remarkable 137% increase in EBITDA from 2016 to 2021, peaking in 2021. However, by 2023, their EBITDA had receded by over 50% from its zenith. In contrast, Waste Management, a leader in environmental services, demonstrated a steady upward trend, with a 66% growth in EBITDA over the same period, culminating in 2023.

This analysis underscores the dynamic nature of these industries, highlighting the resilience of Waste Management amidst fluctuating economic conditions and the volatility faced by Northrop Grumman.

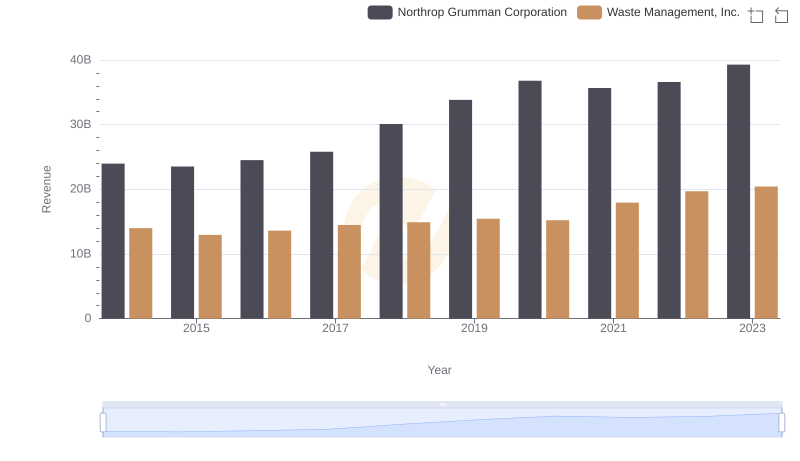

Waste Management, Inc. vs Northrop Grumman Corporation: Annual Revenue Growth Compared

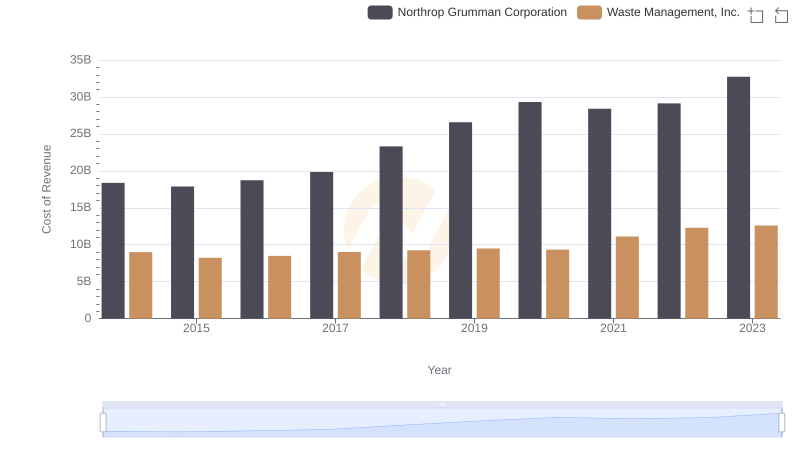

Cost Insights: Breaking Down Waste Management, Inc. and Northrop Grumman Corporation's Expenses

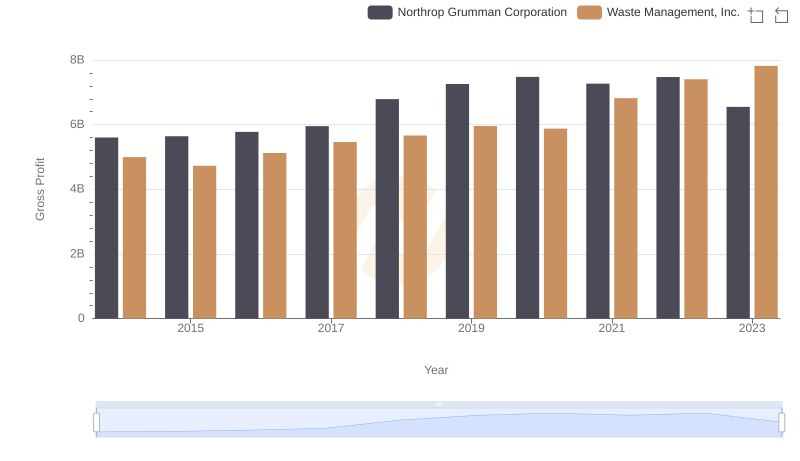

Gross Profit Analysis: Comparing Waste Management, Inc. and Northrop Grumman Corporation

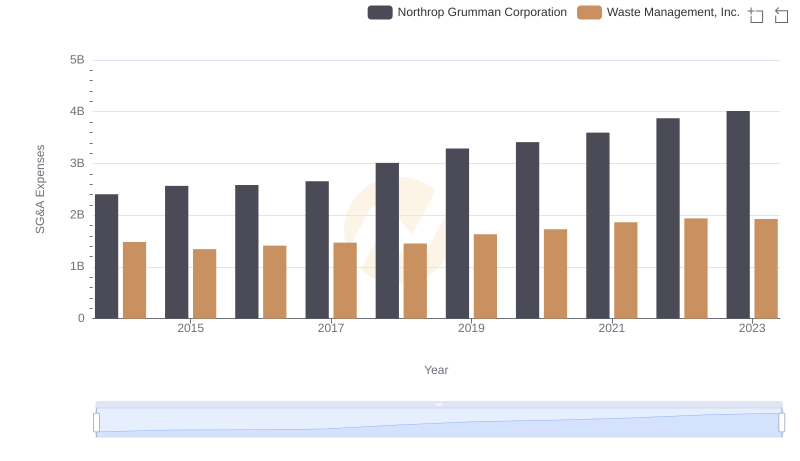

Waste Management, Inc. vs Northrop Grumman Corporation: SG&A Expense Trends

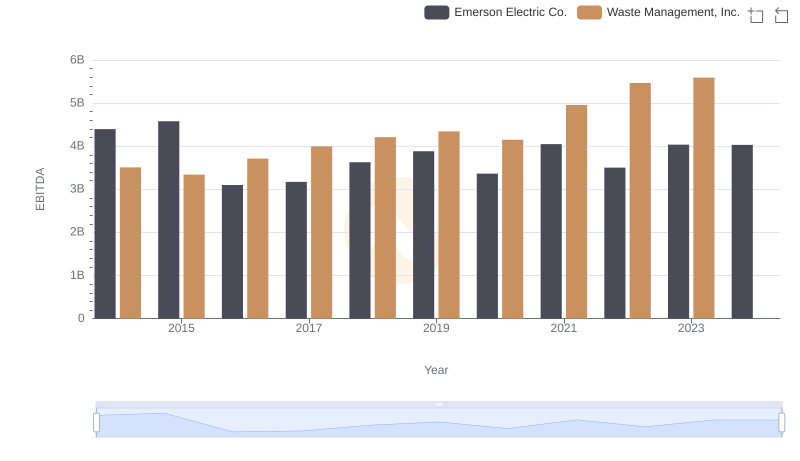

A Side-by-Side Analysis of EBITDA: Waste Management, Inc. and Emerson Electric Co.

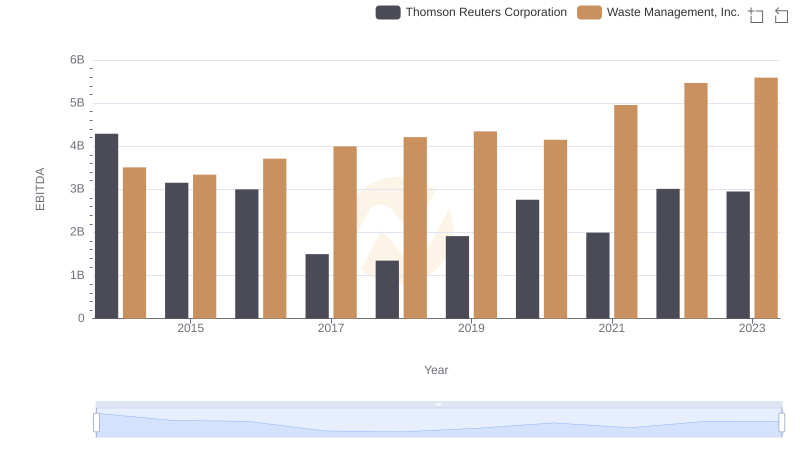

EBITDA Performance Review: Waste Management, Inc. vs Thomson Reuters Corporation

Professional EBITDA Benchmarking: Waste Management, Inc. vs FedEx Corporation

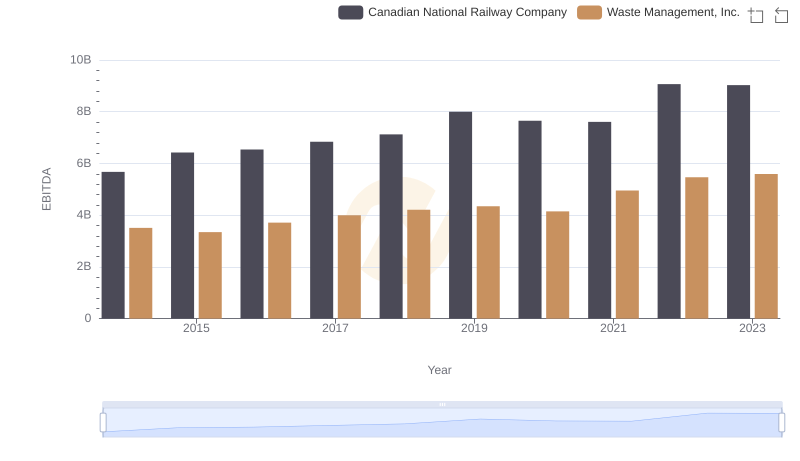

Comparative EBITDA Analysis: Waste Management, Inc. vs Canadian National Railway Company

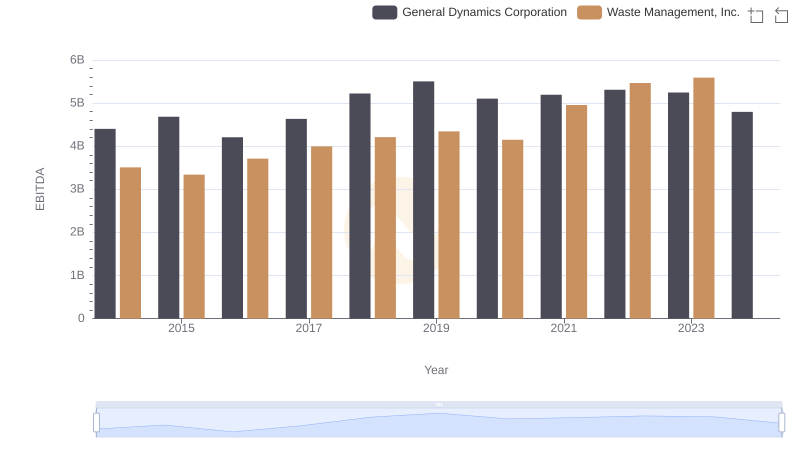

Comprehensive EBITDA Comparison: Waste Management, Inc. vs General Dynamics Corporation

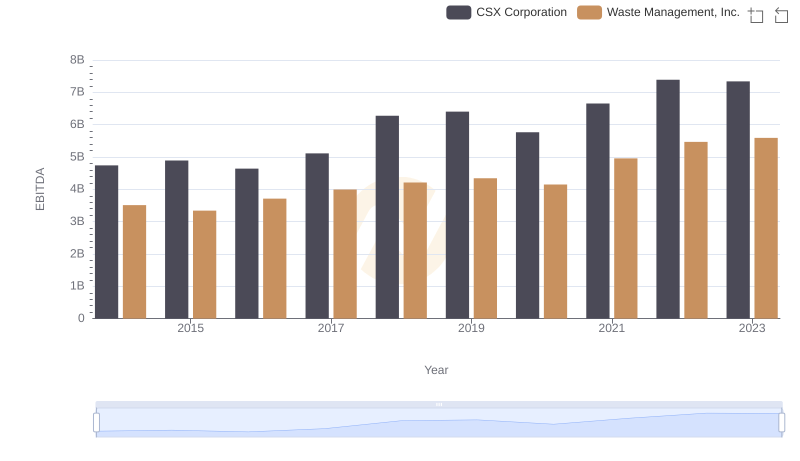

A Professional Review of EBITDA: Waste Management, Inc. Compared to CSX Corporation

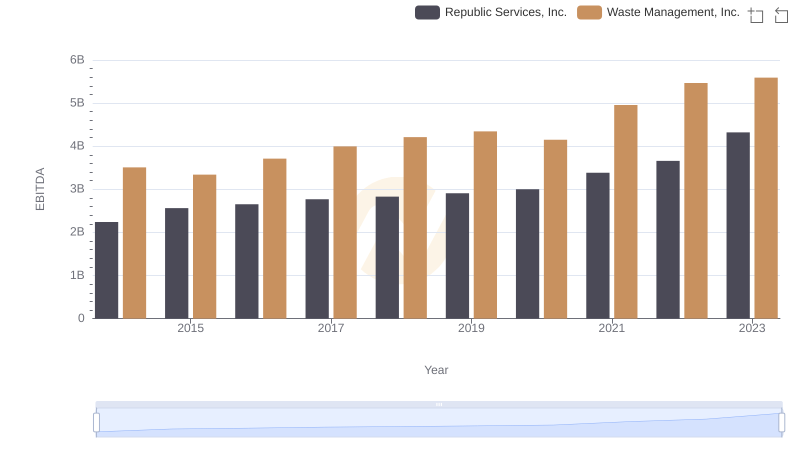

EBITDA Metrics Evaluated: Waste Management, Inc. vs Republic Services, Inc.

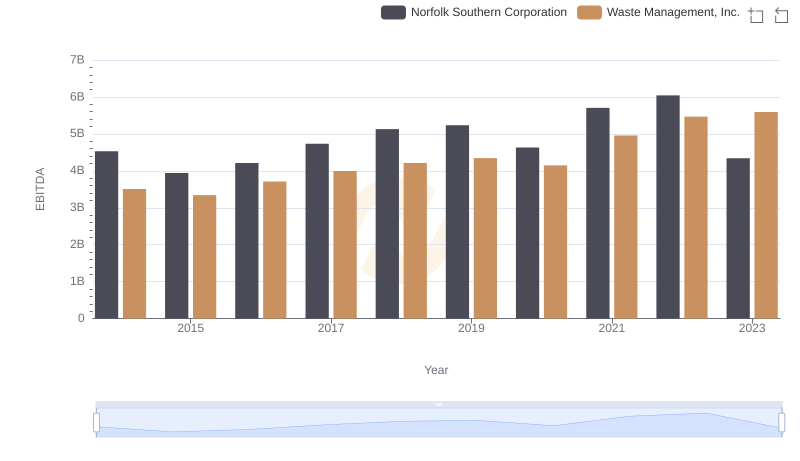

Waste Management, Inc. and Norfolk Southern Corporation: A Detailed Examination of EBITDA Performance