| __timestamp | Thomson Reuters Corporation | Waste Management, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4289000000 | 3509000000 |

| Thursday, January 1, 2015 | 3151000000 | 3342000000 |

| Friday, January 1, 2016 | 2999000000 | 3713000000 |

| Sunday, January 1, 2017 | 1495930891 | 3996000000 |

| Monday, January 1, 2018 | 1345686008 | 4212000000 |

| Tuesday, January 1, 2019 | 1913474675 | 4344000000 |

| Wednesday, January 1, 2020 | 2757000000 | 4149000000 |

| Friday, January 1, 2021 | 1994296441 | 4956000000 |

| Saturday, January 1, 2022 | 3010000000 | 5466000000 |

| Sunday, January 1, 2023 | 2950000000 | 5592000000 |

| Monday, January 1, 2024 | 5128000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, the EBITDA performance of Waste Management, Inc. and Thomson Reuters Corporation from 2014 to 2023 offers a fascinating glimpse into their financial trajectories. Waste Management, Inc. has consistently outperformed Thomson Reuters Corporation, with an average EBITDA of approximately $4.3 billion, compared to Thomson Reuters' $2.6 billion. Notably, Waste Management's EBITDA surged by nearly 60% over the decade, peaking at $5.6 billion in 2023. In contrast, Thomson Reuters experienced a more volatile journey, with a significant dip in 2018, reaching a low of $1.3 billion, before rebounding to $3 billion in 2022. This divergence highlights Waste Management's robust growth and resilience, while Thomson Reuters navigated through a period of financial recalibration. As we look to the future, these trends underscore the importance of strategic adaptability in maintaining financial health.

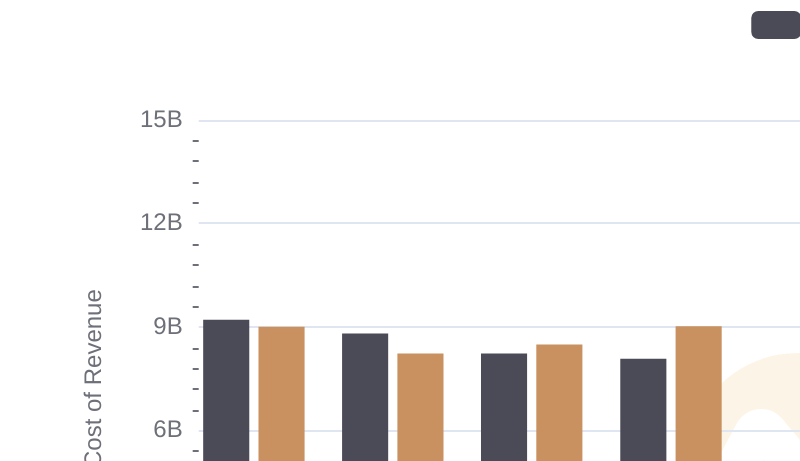

Comparing Cost of Revenue Efficiency: Waste Management, Inc. vs Thomson Reuters Corporation

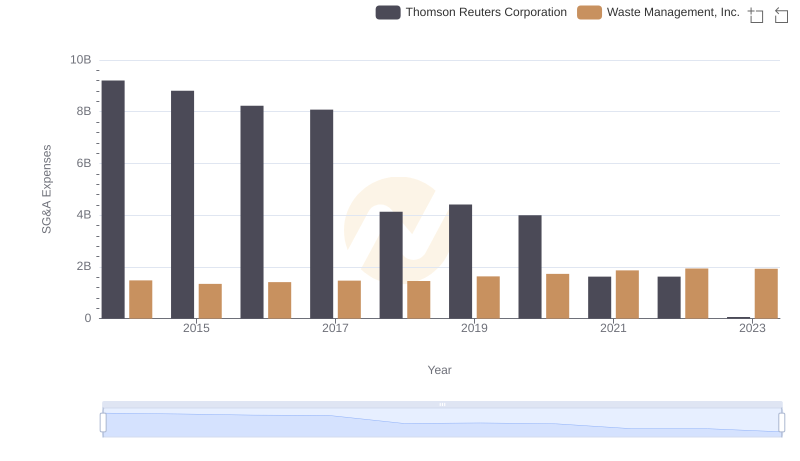

Waste Management, Inc. and Thomson Reuters Corporation: SG&A Spending Patterns Compared

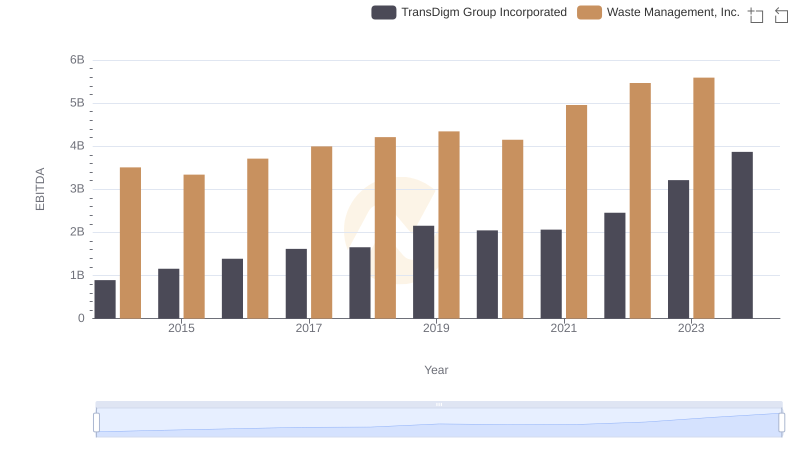

Waste Management, Inc. vs TransDigm Group Incorporated: In-Depth EBITDA Performance Comparison

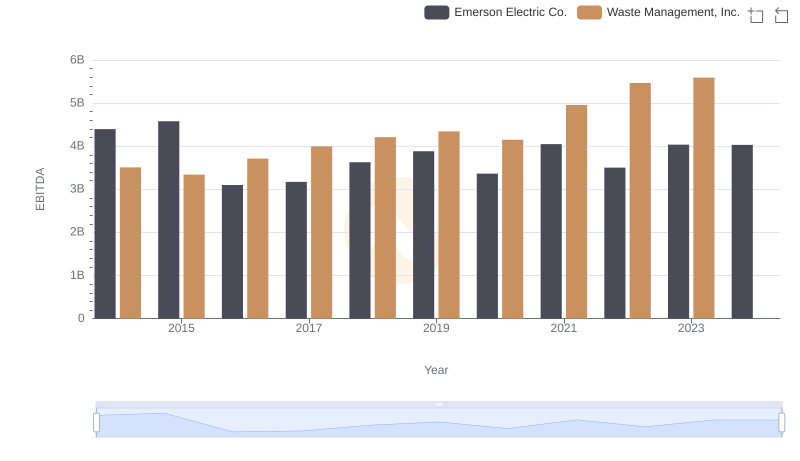

A Side-by-Side Analysis of EBITDA: Waste Management, Inc. and Emerson Electric Co.

Professional EBITDA Benchmarking: Waste Management, Inc. vs FedEx Corporation

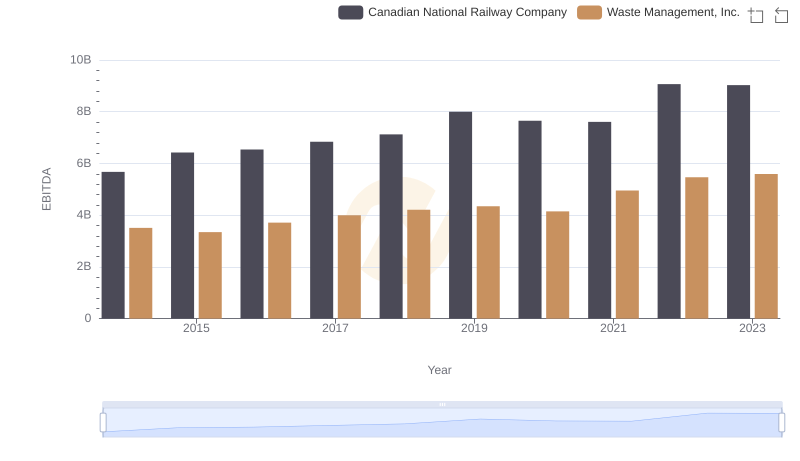

Comparative EBITDA Analysis: Waste Management, Inc. vs Canadian National Railway Company

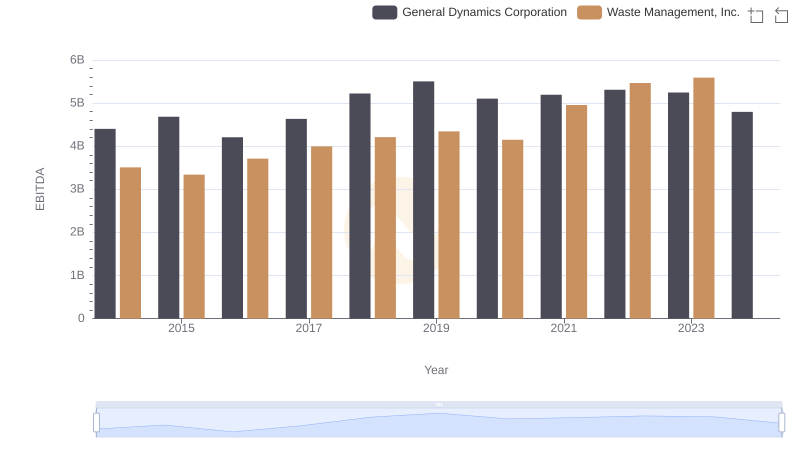

Comprehensive EBITDA Comparison: Waste Management, Inc. vs General Dynamics Corporation

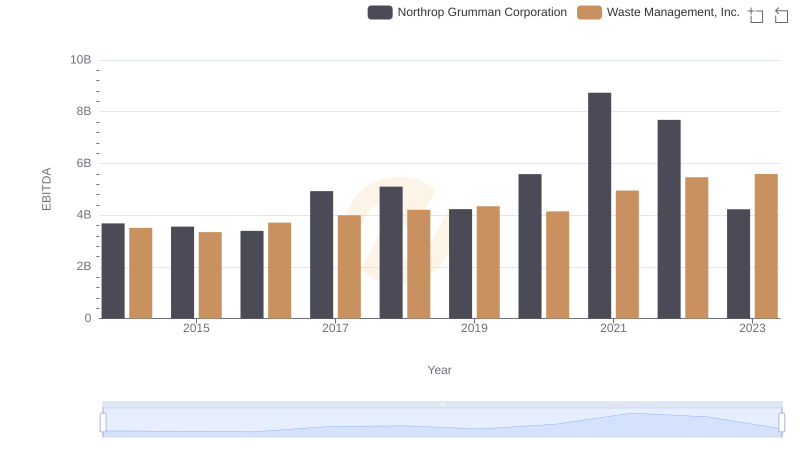

Waste Management, Inc. and Northrop Grumman Corporation: A Detailed Examination of EBITDA Performance