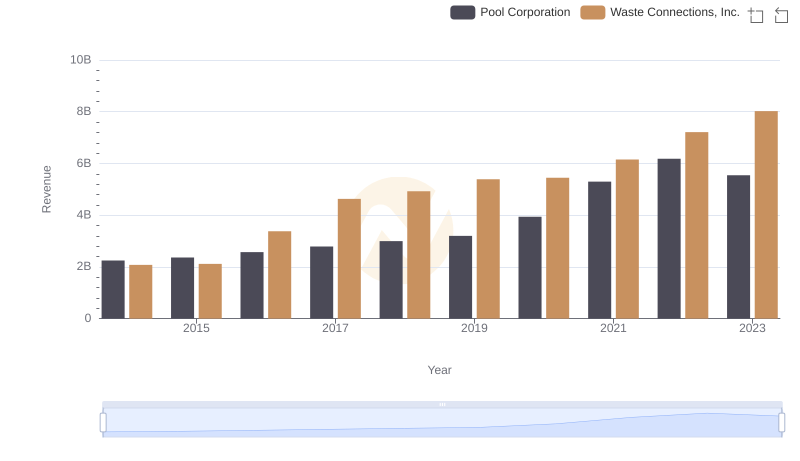

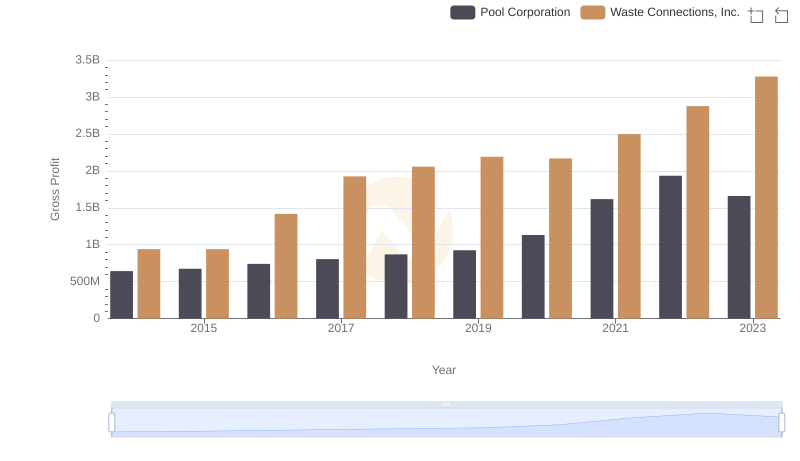

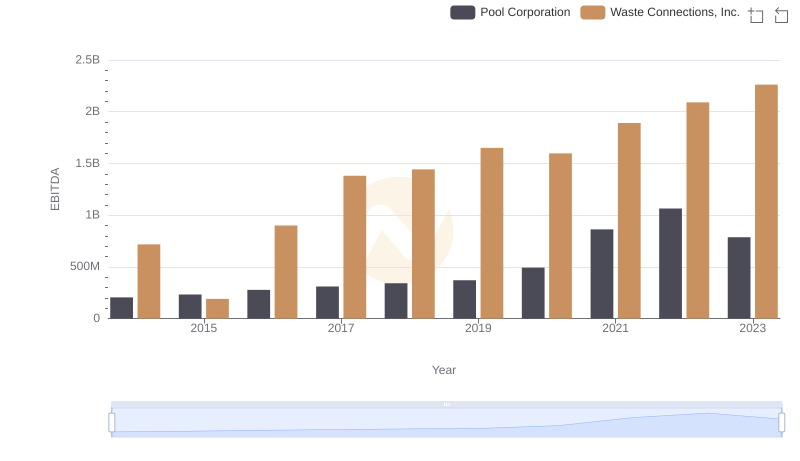

| __timestamp | Pool Corporation | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1603222000 | 1138388000 |

| Thursday, January 1, 2015 | 1687495000 | 1177409000 |

| Friday, January 1, 2016 | 1829716000 | 1957712000 |

| Sunday, January 1, 2017 | 1982899000 | 2704775000 |

| Monday, January 1, 2018 | 2127924000 | 2865704000 |

| Tuesday, January 1, 2019 | 2274592000 | 3198757000 |

| Wednesday, January 1, 2020 | 2805721000 | 3276808000 |

| Friday, January 1, 2021 | 3678492000 | 3654074000 |

| Saturday, January 1, 2022 | 4246315000 | 4336012000 |

| Sunday, January 1, 2023 | 3881551000 | 4744513000 |

| Monday, January 1, 2024 | 5191706000 |

Unveiling the hidden dimensions of data

In the competitive landscape of the waste management and pool supply industries, cost efficiency is paramount. From 2014 to 2023, Waste Connections, Inc. and Pool Corporation have demonstrated distinct trajectories in managing their cost of revenue. Waste Connections, Inc. has seen a remarkable increase of approximately 317% in their cost of revenue, peaking in 2023. Meanwhile, Pool Corporation experienced a 142% rise over the same period, with a notable dip in 2023. This divergence highlights Waste Connections, Inc.'s aggressive expansion strategy, while Pool Corporation's recent decline suggests potential operational challenges. As both companies navigate economic fluctuations, their ability to optimize costs will be crucial in maintaining market leadership. Investors and industry analysts should closely monitor these trends to gauge future performance and strategic direction.

Breaking Down Revenue Trends: Waste Connections, Inc. vs Pool Corporation

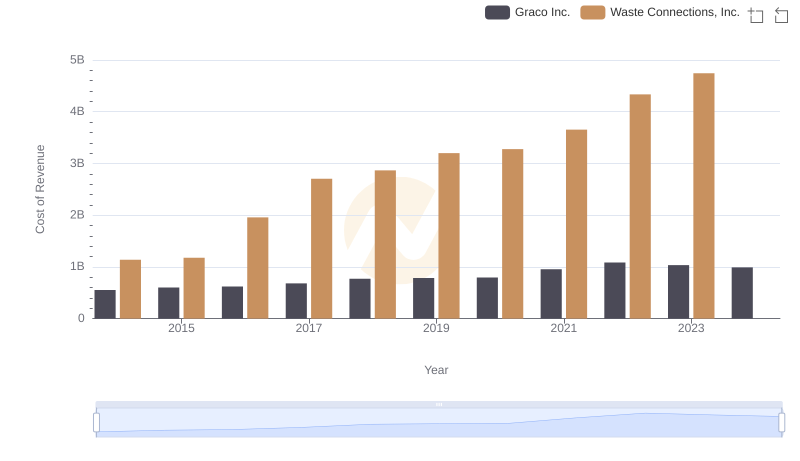

Cost of Revenue: Key Insights for Waste Connections, Inc. and Graco Inc.

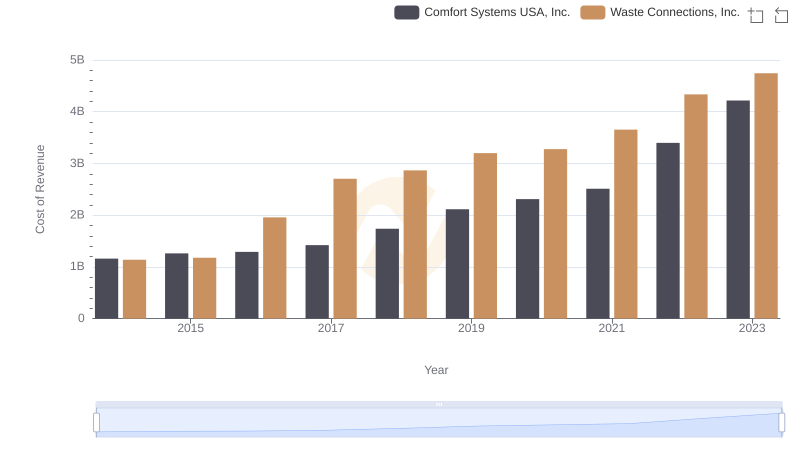

Cost of Revenue Comparison: Waste Connections, Inc. vs Comfort Systems USA, Inc.

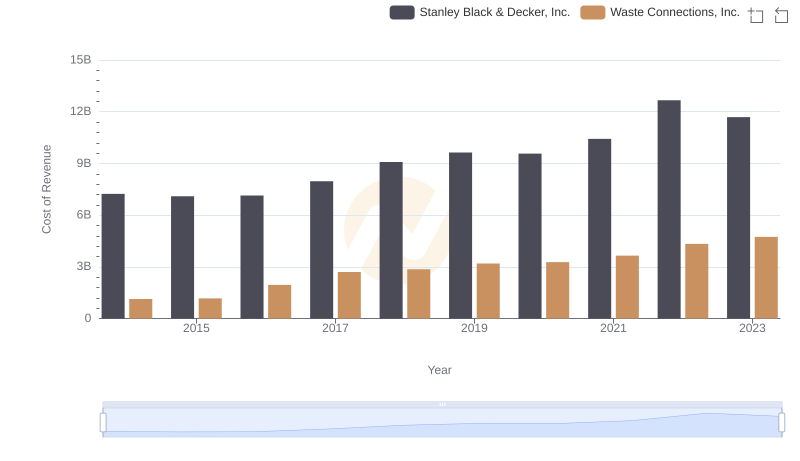

Cost Insights: Breaking Down Waste Connections, Inc. and Stanley Black & Decker, Inc.'s Expenses

Cost of Revenue Trends: Waste Connections, Inc. vs U-Haul Holding Company

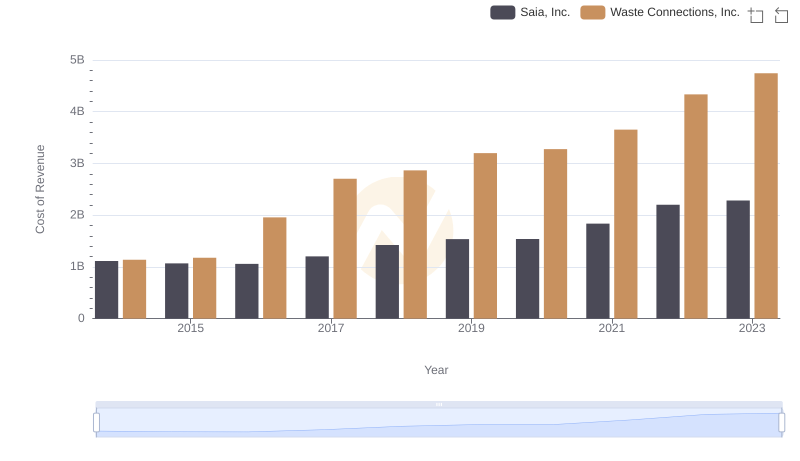

Cost Insights: Breaking Down Waste Connections, Inc. and Saia, Inc.'s Expenses

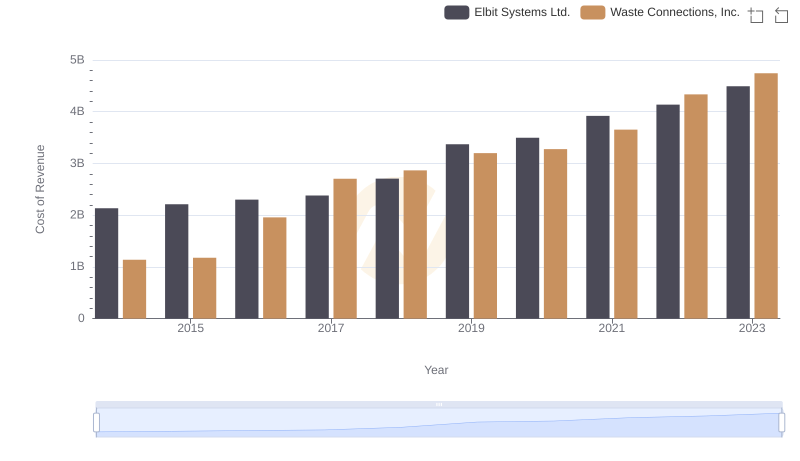

Cost of Revenue Trends: Waste Connections, Inc. vs Elbit Systems Ltd.

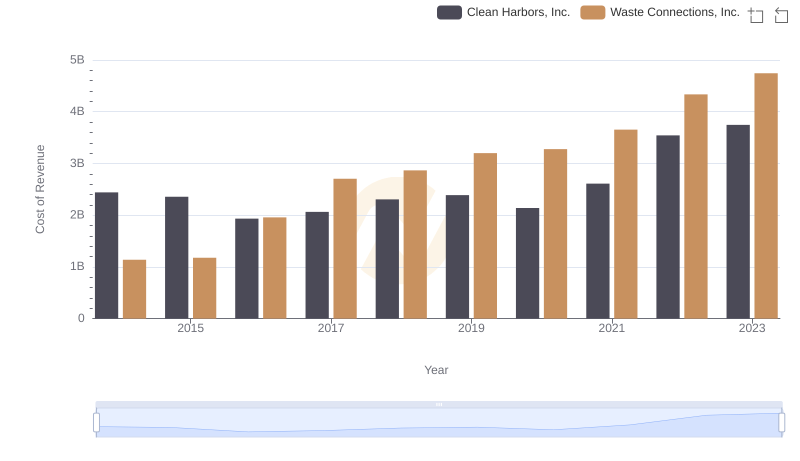

Waste Connections, Inc. vs Clean Harbors, Inc.: Efficiency in Cost of Revenue Explored

Key Insights on Gross Profit: Waste Connections, Inc. vs Pool Corporation

A Professional Review of EBITDA: Waste Connections, Inc. Compared to Pool Corporation