| __timestamp | U-Haul Holding Company | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 127270000 | 1138388000 |

| Thursday, January 1, 2015 | 146072000 | 1177409000 |

| Friday, January 1, 2016 | 144990000 | 1957712000 |

| Sunday, January 1, 2017 | 152485000 | 2704775000 |

| Monday, January 1, 2018 | 160489000 | 2865704000 |

| Tuesday, January 1, 2019 | 162142000 | 3198757000 |

| Wednesday, January 1, 2020 | 164018000 | 3276808000 |

| Friday, January 1, 2021 | 214059000 | 3654074000 |

| Saturday, January 1, 2022 | 259585000 | 4336012000 |

| Sunday, January 1, 2023 | 844894000 | 4744513000 |

| Monday, January 1, 2024 | 3976040000 | 5191706000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate America, Waste Connections, Inc. and U-Haul Holding Company stand as intriguing case studies in cost management. Over the past decade, Waste Connections, Inc. has seen its cost of revenue soar by approximately 316%, peaking in 2023. This growth reflects the company's aggressive expansion and operational scaling. In contrast, U-Haul Holding Company experienced a more modest increase of around 566% over the same period, with a significant spike in 2024, indicating a strategic shift or market adaptation.

The data reveals a fascinating divergence in cost strategies between these two industry giants. While Waste Connections, Inc. consistently increased its cost of revenue, U-Haul Holding Company maintained a steadier pace until a dramatic rise in 2024. This suggests potential changes in business operations or market conditions that warrant further exploration.

Comparing Revenue Performance: Waste Connections, Inc. or U-Haul Holding Company?

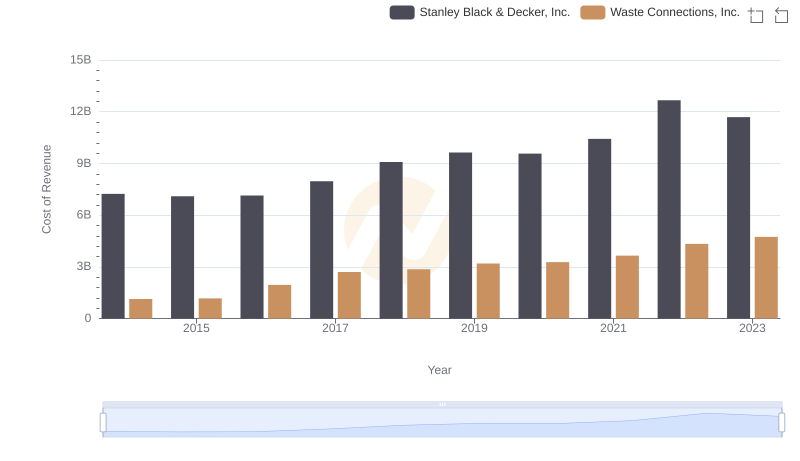

Cost Insights: Breaking Down Waste Connections, Inc. and Stanley Black & Decker, Inc.'s Expenses

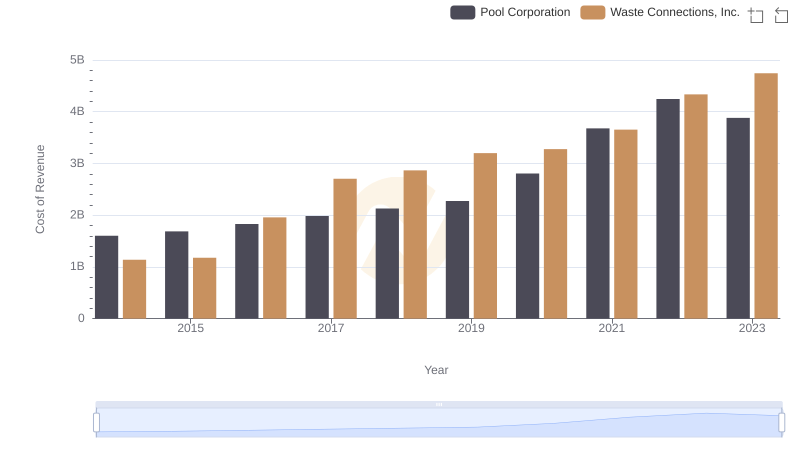

Waste Connections, Inc. vs Pool Corporation: Efficiency in Cost of Revenue Explored

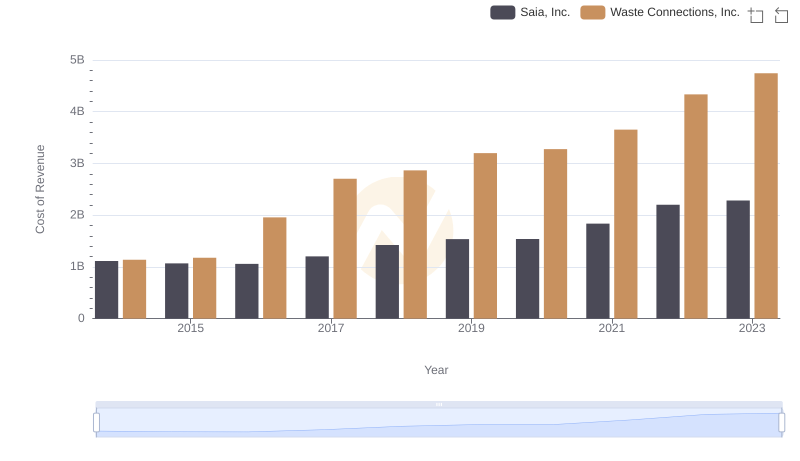

Cost Insights: Breaking Down Waste Connections, Inc. and Saia, Inc.'s Expenses

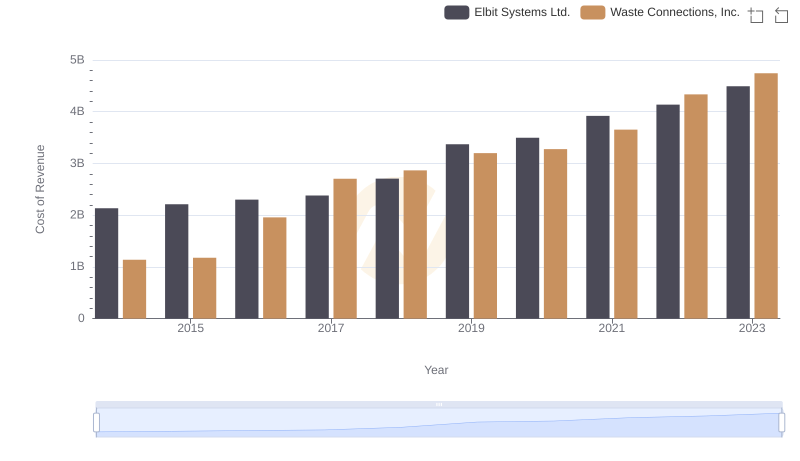

Cost of Revenue Trends: Waste Connections, Inc. vs Elbit Systems Ltd.

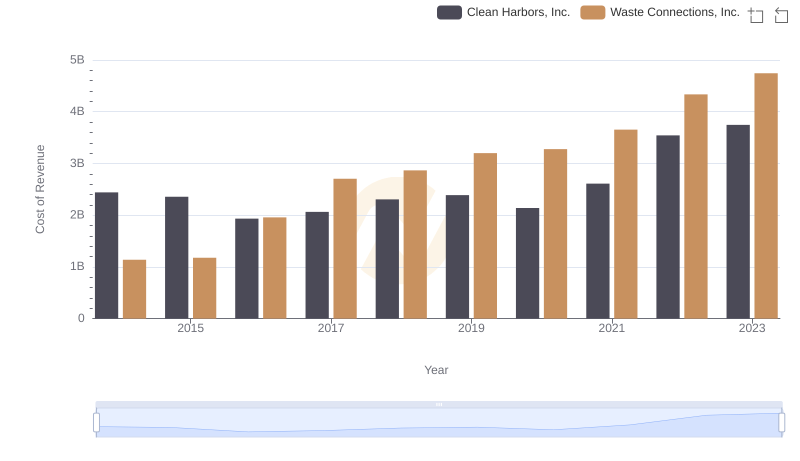

Waste Connections, Inc. vs Clean Harbors, Inc.: Efficiency in Cost of Revenue Explored

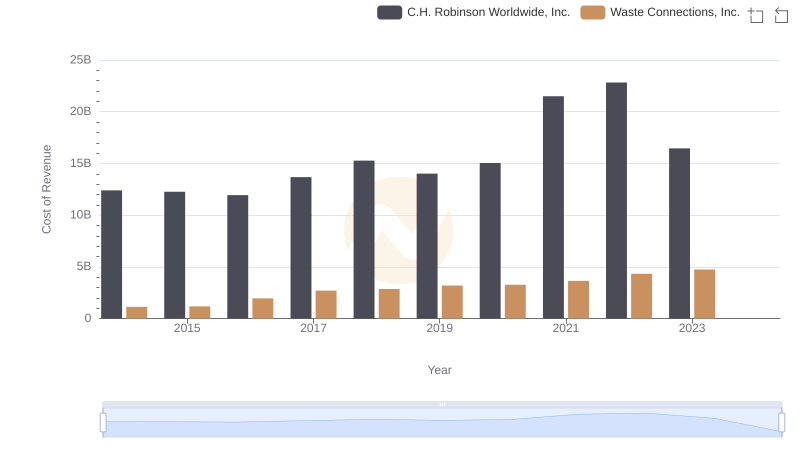

Analyzing Cost of Revenue: Waste Connections, Inc. and C.H. Robinson Worldwide, Inc.

Key Insights on Gross Profit: Waste Connections, Inc. vs U-Haul Holding Company