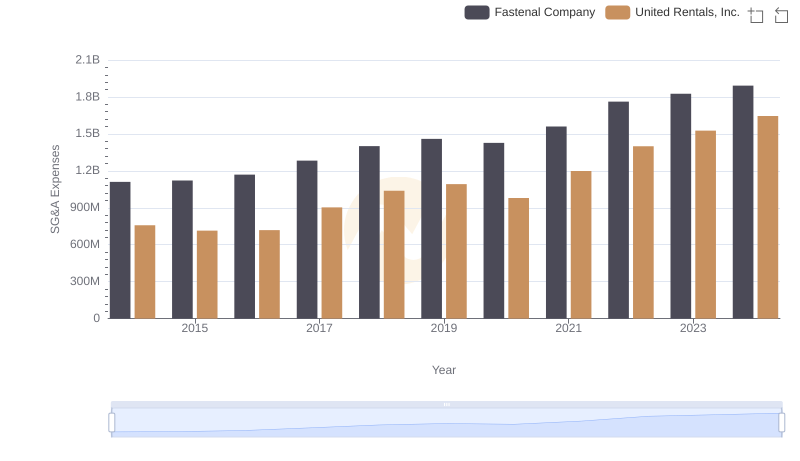

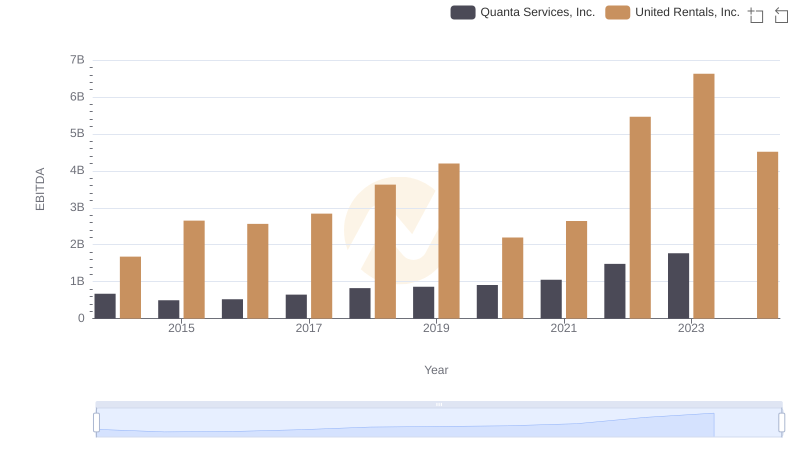

| __timestamp | Quanta Services, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 580730000 | 758000000 |

| Thursday, January 1, 2015 | 592863000 | 714000000 |

| Friday, January 1, 2016 | 653338000 | 719000000 |

| Sunday, January 1, 2017 | 777920000 | 903000000 |

| Monday, January 1, 2018 | 857574000 | 1038000000 |

| Tuesday, January 1, 2019 | 955991000 | 1092000000 |

| Wednesday, January 1, 2020 | 975074000 | 979000000 |

| Friday, January 1, 2021 | 1155956000 | 1199000000 |

| Saturday, January 1, 2022 | 1336711000 | 1400000000 |

| Sunday, January 1, 2023 | 1555137000 | 1527000000 |

| Monday, January 1, 2024 | 1645000000 |

Unlocking the unknown

In the competitive landscape of industrial services, understanding spending patterns is crucial. Over the past decade, United Rentals, Inc. and Quanta Services, Inc. have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Quanta Services saw a remarkable 168% increase in SG&A expenses, peaking at 1.56 billion in 2023. Meanwhile, United Rentals experienced a 101% rise, reaching 1.53 billion in the same year. Notably, United Rentals' SG&A expenses surpassed Quanta's until 2020, when Quanta began to outpace its competitor. This shift highlights Quanta's aggressive expansion and strategic investments. However, data for 2024 is incomplete, with Quanta's figures missing, leaving room for speculation on future trends. These insights provide a window into the financial strategies of two industry giants, offering valuable lessons for investors and analysts alike.

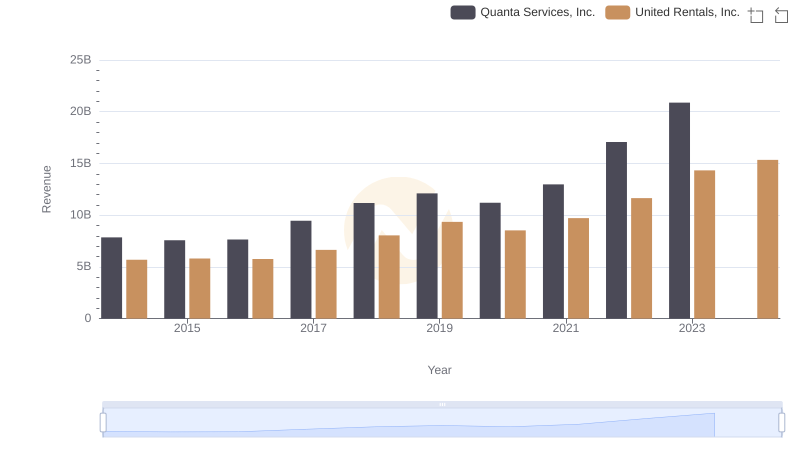

United Rentals, Inc. or Quanta Services, Inc.: Who Leads in Yearly Revenue?

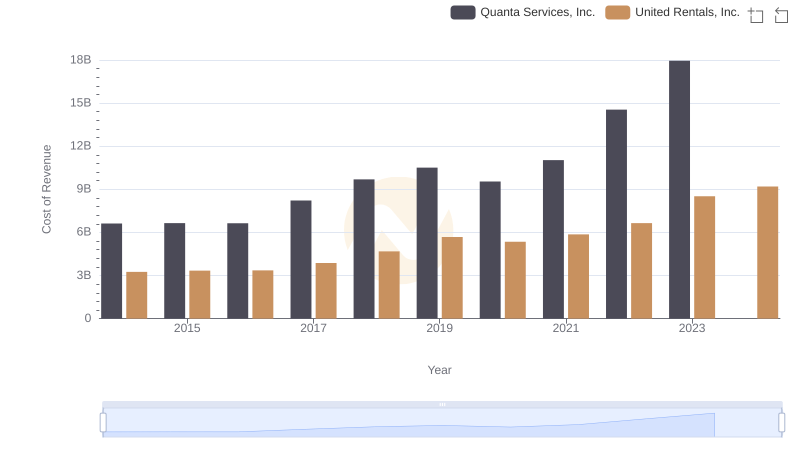

United Rentals, Inc. vs Quanta Services, Inc.: Efficiency in Cost of Revenue Explored

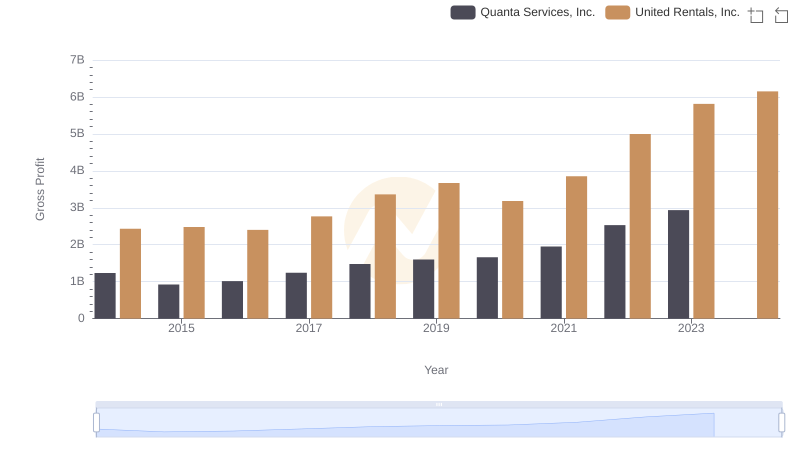

Gross Profit Comparison: United Rentals, Inc. and Quanta Services, Inc. Trends

Selling, General, and Administrative Costs: United Rentals, Inc. vs Fastenal Company

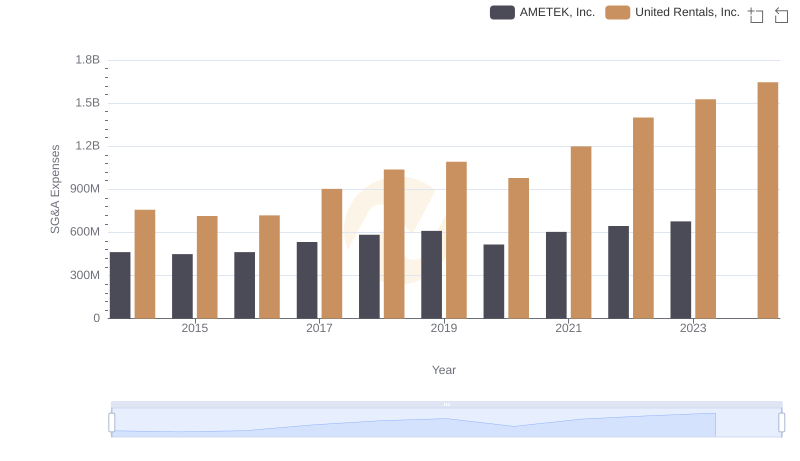

United Rentals, Inc. vs AMETEK, Inc.: SG&A Expense Trends

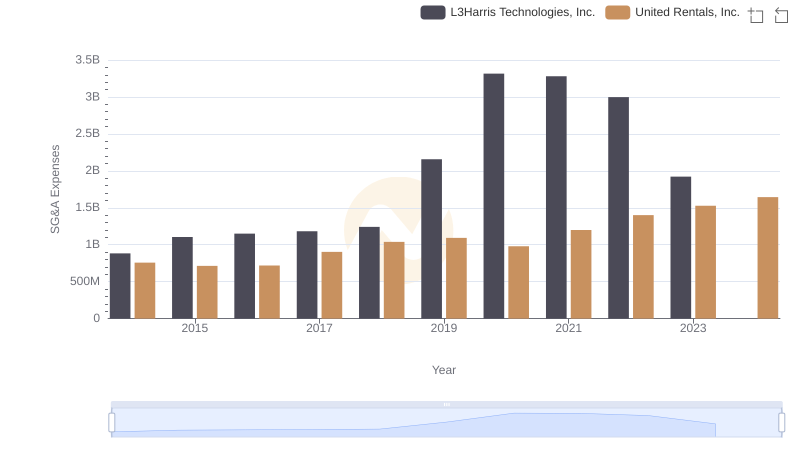

United Rentals, Inc. vs L3Harris Technologies, Inc.: SG&A Expense Trends

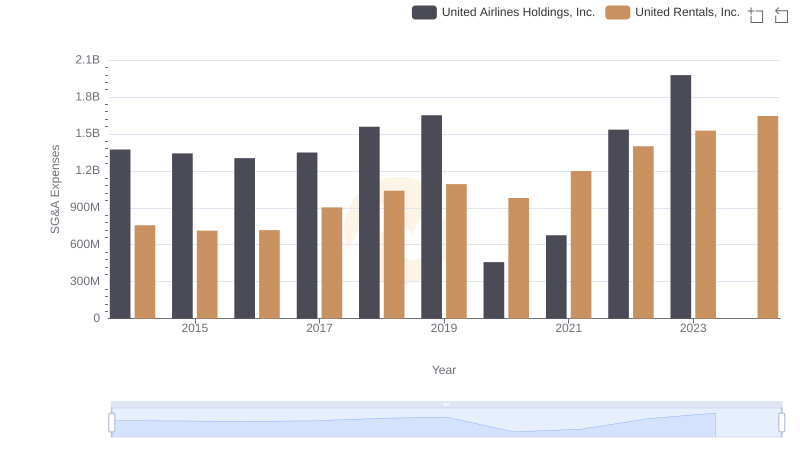

SG&A Efficiency Analysis: Comparing United Rentals, Inc. and United Airlines Holdings, Inc.

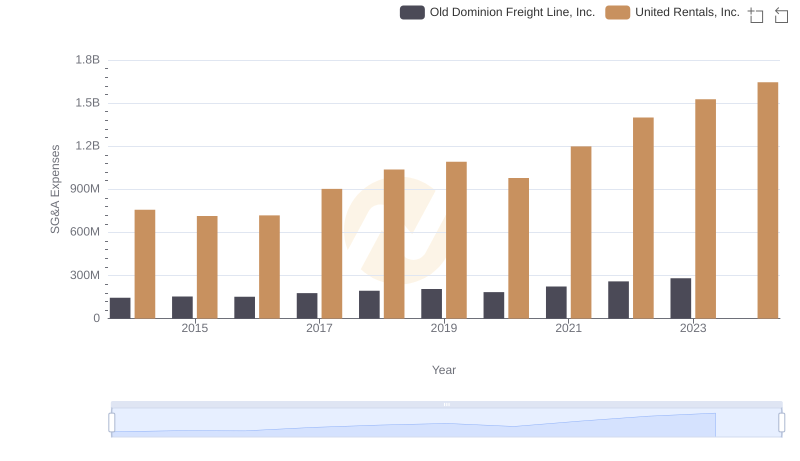

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Old Dominion Freight Line, Inc.

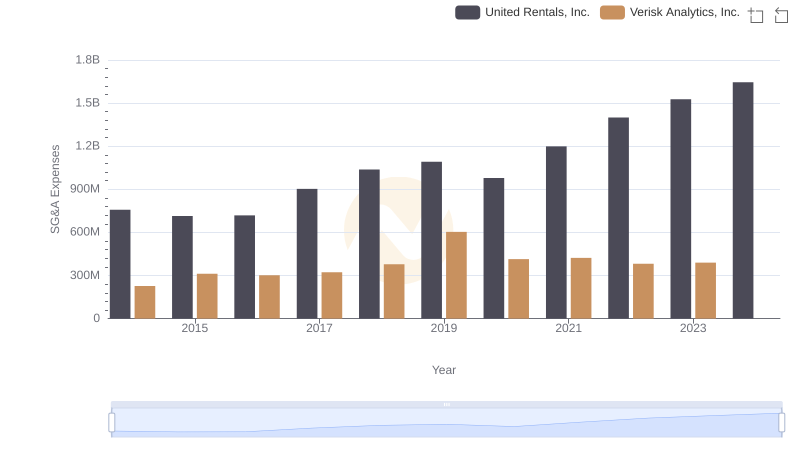

Operational Costs Compared: SG&A Analysis of United Rentals, Inc. and Verisk Analytics, Inc.

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Quanta Services, Inc.

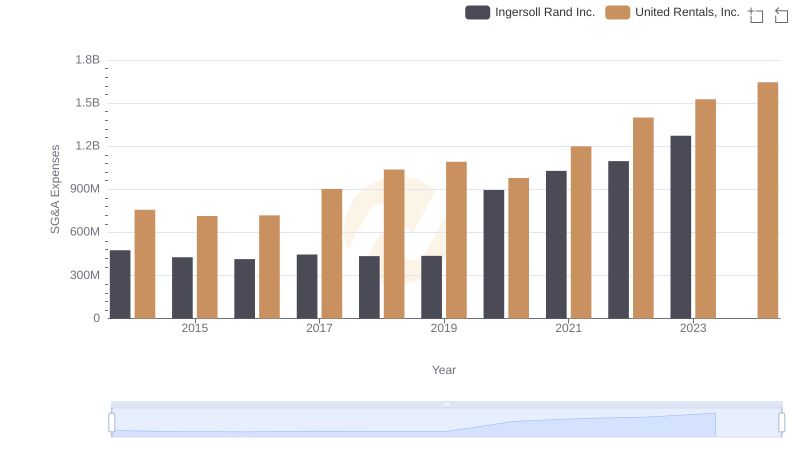

United Rentals, Inc. and Ingersoll Rand Inc.: SG&A Spending Patterns Compared

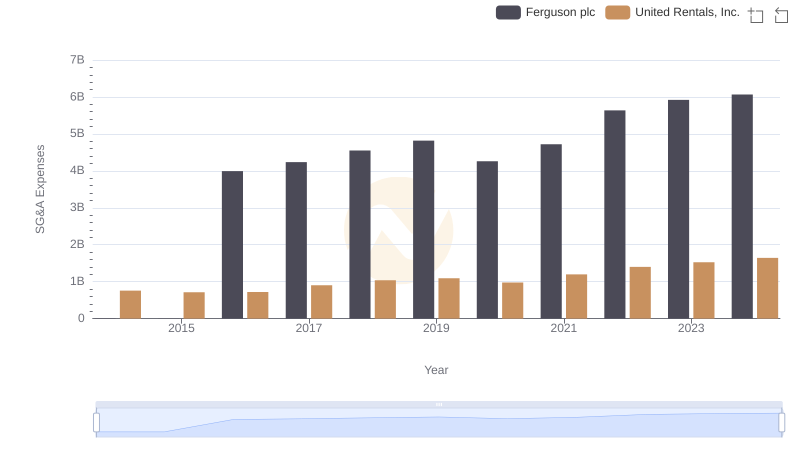

Comparing SG&A Expenses: United Rentals, Inc. vs Ferguson plc Trends and Insights