| __timestamp | Quanta Services, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 671899000 | 1678000000 |

| Thursday, January 1, 2015 | 497247000 | 2653000000 |

| Friday, January 1, 2016 | 524498000 | 2566000000 |

| Sunday, January 1, 2017 | 647748000 | 2843000000 |

| Monday, January 1, 2018 | 824909000 | 3628000000 |

| Tuesday, January 1, 2019 | 862368000 | 4200000000 |

| Wednesday, January 1, 2020 | 911029000 | 2195000000 |

| Friday, January 1, 2021 | 1052832000 | 2642000000 |

| Saturday, January 1, 2022 | 1483091000 | 5464000000 |

| Sunday, January 1, 2023 | 1770669000 | 6627000000 |

| Monday, January 1, 2024 | 4516000000 |

Data in motion

In the ever-evolving landscape of industrial services, United Rentals, Inc. and Quanta Services, Inc. have emerged as formidable players. Over the past decade, United Rentals has consistently outperformed Quanta Services in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, United Rentals' EBITDA surged by nearly 295%, peaking in 2023. In contrast, Quanta Services experienced a more modest growth of approximately 164% over the same period.

United Rentals' strategic acquisitions and expansion into new markets have been pivotal in its financial ascent. Meanwhile, Quanta Services has steadily increased its EBITDA, reflecting its resilience and adaptability in a competitive market. Notably, 2024 data for Quanta Services is missing, leaving room for speculation on its future performance. This comparison underscores the dynamic nature of the industry and the strategic maneuvers that drive financial success.

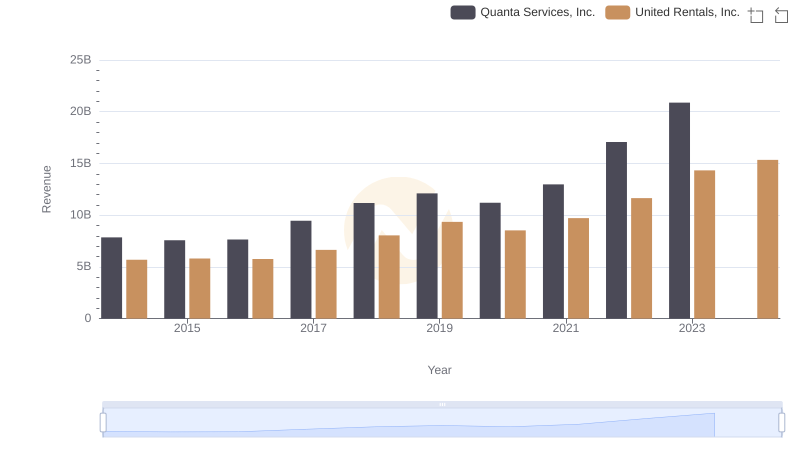

United Rentals, Inc. or Quanta Services, Inc.: Who Leads in Yearly Revenue?

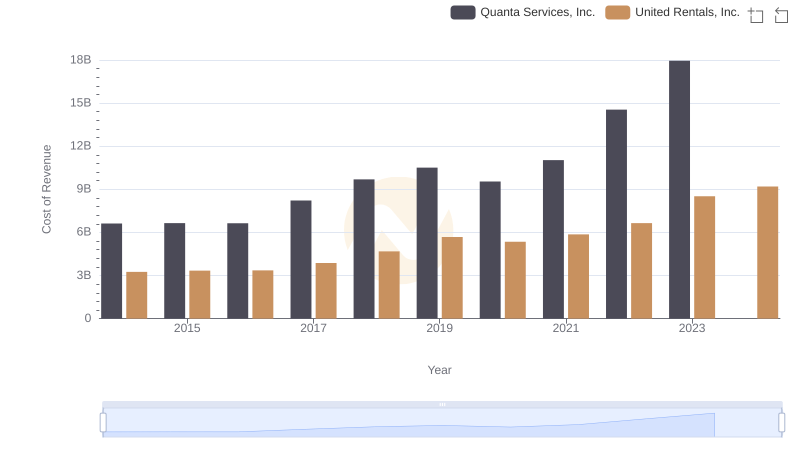

United Rentals, Inc. vs Quanta Services, Inc.: Efficiency in Cost of Revenue Explored

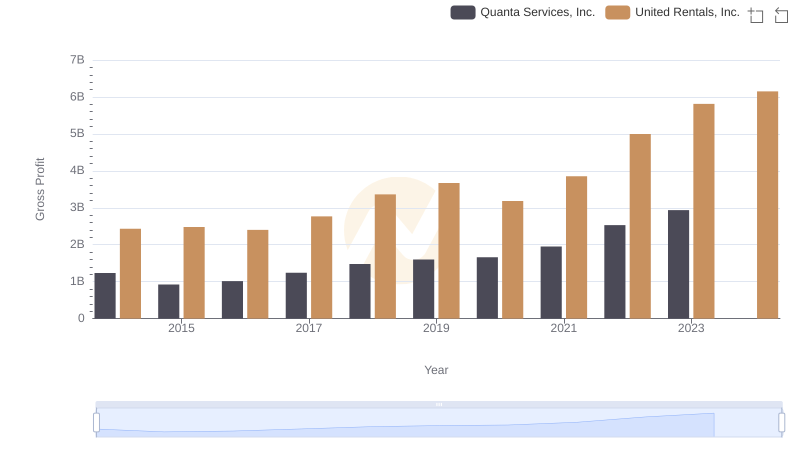

Gross Profit Comparison: United Rentals, Inc. and Quanta Services, Inc. Trends

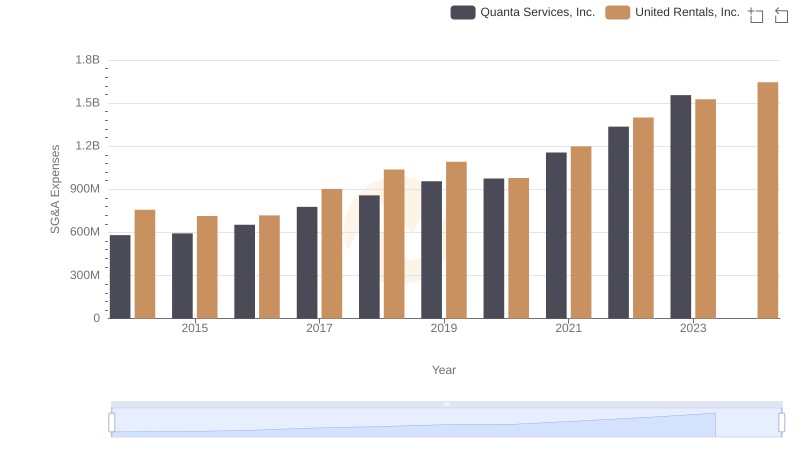

United Rentals, Inc. and Quanta Services, Inc.: SG&A Spending Patterns Compared

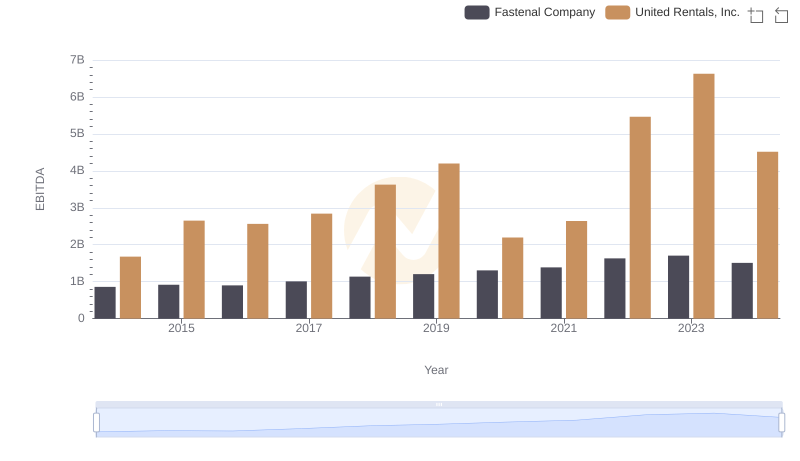

EBITDA Analysis: Evaluating United Rentals, Inc. Against Fastenal Company

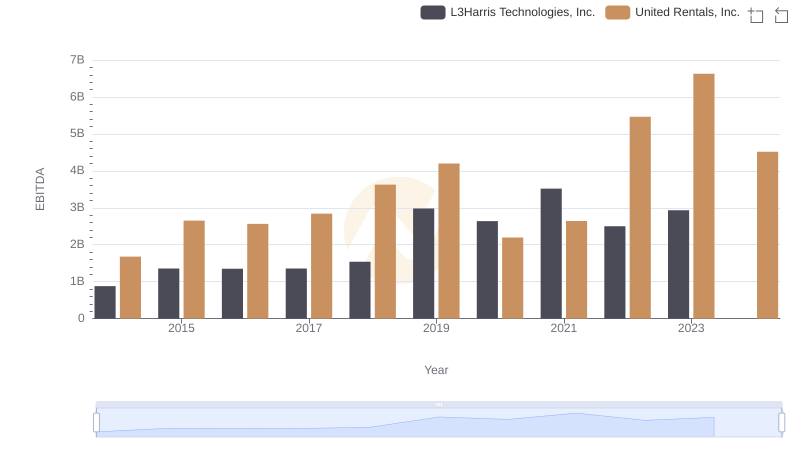

A Professional Review of EBITDA: United Rentals, Inc. Compared to L3Harris Technologies, Inc.

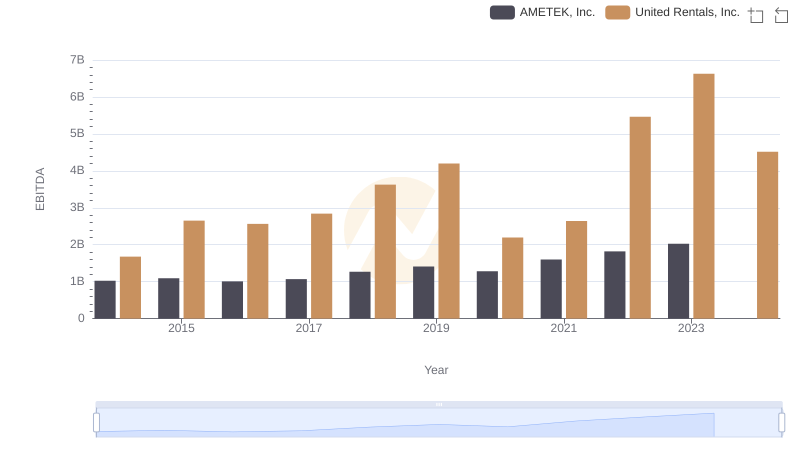

A Side-by-Side Analysis of EBITDA: United Rentals, Inc. and AMETEK, Inc.

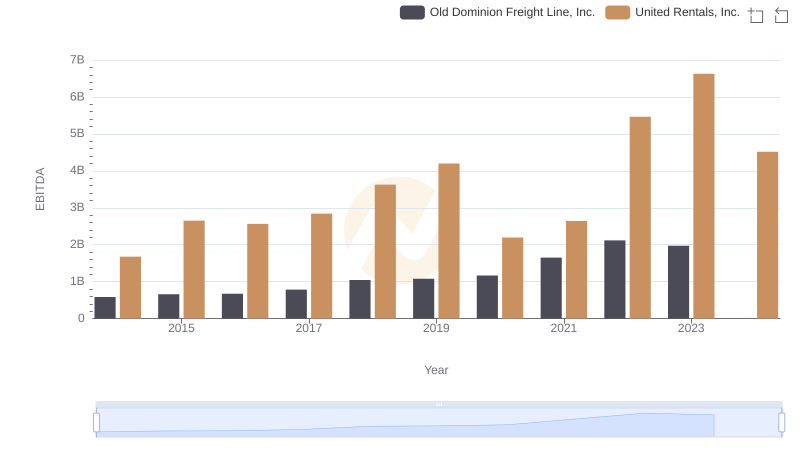

Professional EBITDA Benchmarking: United Rentals, Inc. vs Old Dominion Freight Line, Inc.

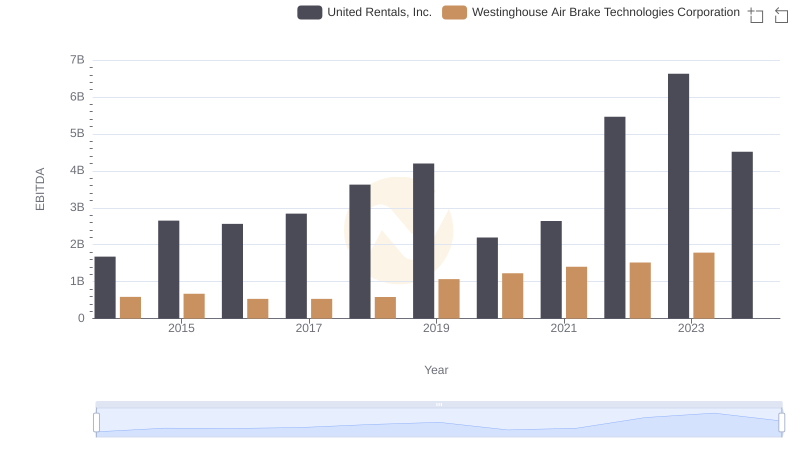

EBITDA Analysis: Evaluating United Rentals, Inc. Against Westinghouse Air Brake Technologies Corporation

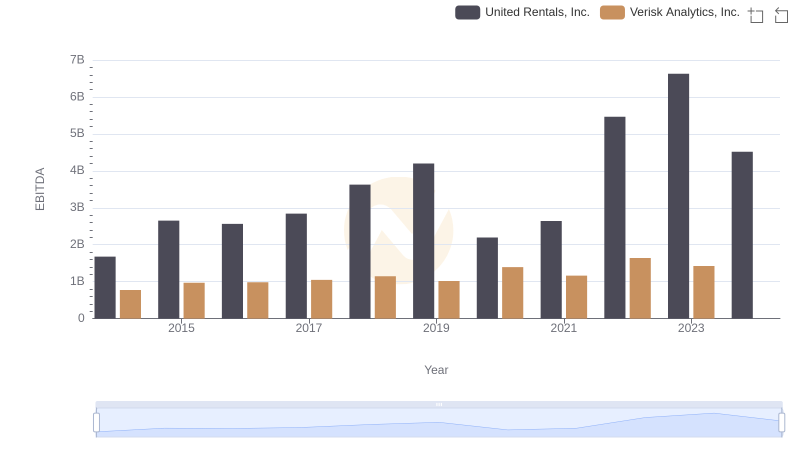

United Rentals, Inc. and Verisk Analytics, Inc.: A Detailed Examination of EBITDA Performance

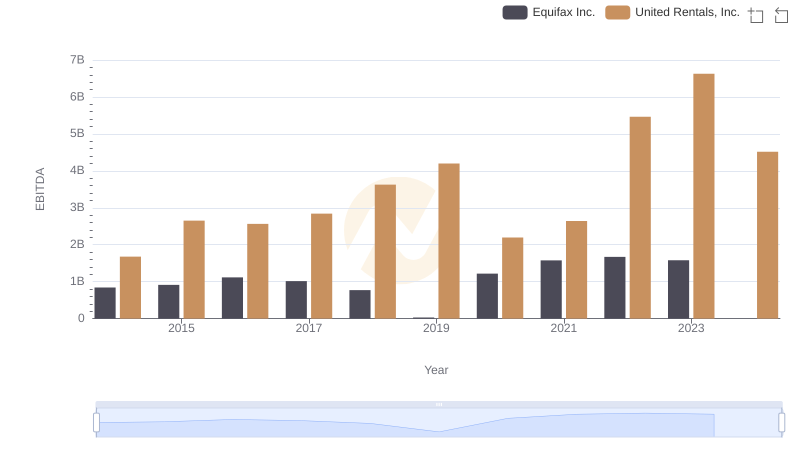

EBITDA Performance Review: United Rentals, Inc. vs Equifax Inc.

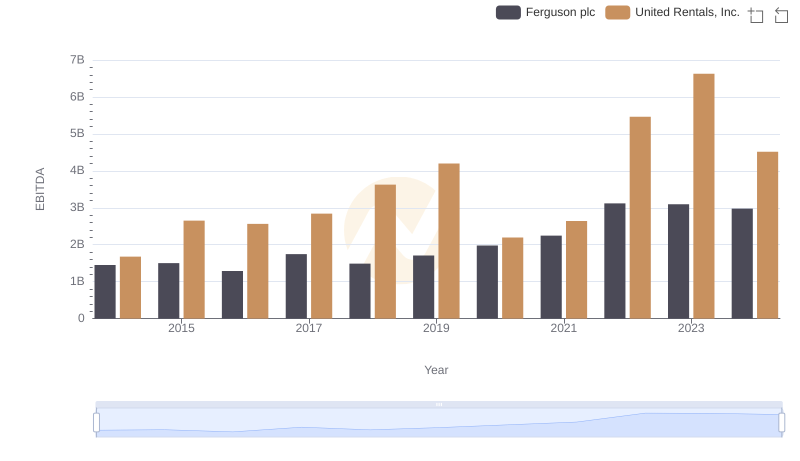

Comprehensive EBITDA Comparison: United Rentals, Inc. vs Ferguson plc