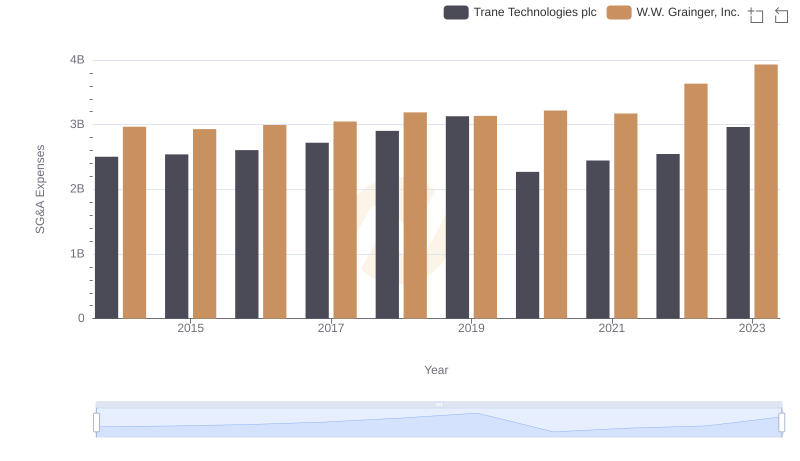

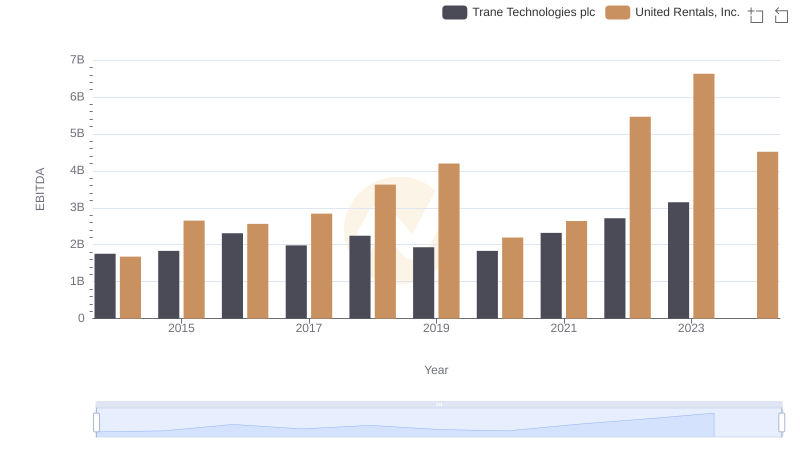

| __timestamp | Trane Technologies plc | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2503900000 | 758000000 |

| Thursday, January 1, 2015 | 2541100000 | 714000000 |

| Friday, January 1, 2016 | 2606500000 | 719000000 |

| Sunday, January 1, 2017 | 2720700000 | 903000000 |

| Monday, January 1, 2018 | 2903200000 | 1038000000 |

| Tuesday, January 1, 2019 | 3129800000 | 1092000000 |

| Wednesday, January 1, 2020 | 2270600000 | 979000000 |

| Friday, January 1, 2021 | 2446300000 | 1199000000 |

| Saturday, January 1, 2022 | 2545900000 | 1400000000 |

| Sunday, January 1, 2023 | 2963200000 | 1527000000 |

| Monday, January 1, 2024 | 3580400000 | 1645000000 |

In pursuit of knowledge

In the competitive landscape of industrial services, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Trane Technologies plc and United Rentals, Inc. have been navigating this financial terrain since 2014. Over the years, Trane Technologies has consistently reported higher SG&A expenses, peaking at approximately $3 billion in 2019. In contrast, United Rentals has maintained a more modest SG&A profile, with expenses reaching around $1.6 billion in 2024.

Despite Trane's higher absolute costs, their expenses have shown a more stable trend, with a notable dip in 2020. United Rentals, however, has seen a steady increase, doubling their SG&A costs over the decade. This divergence highlights different strategic approaches: Trane's focus on maintaining operational efficiency versus United Rentals' aggressive expansion strategy. As we look to the future, the missing data for Trane in 2024 leaves room for speculation on their next financial move.

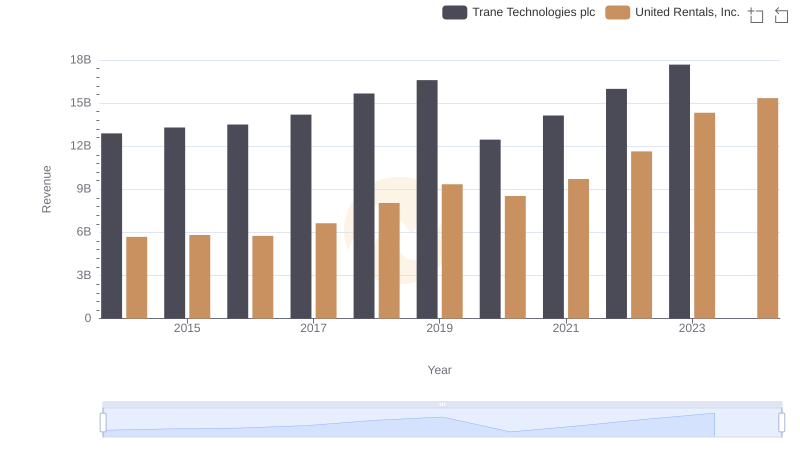

Who Generates More Revenue? Trane Technologies plc or United Rentals, Inc.

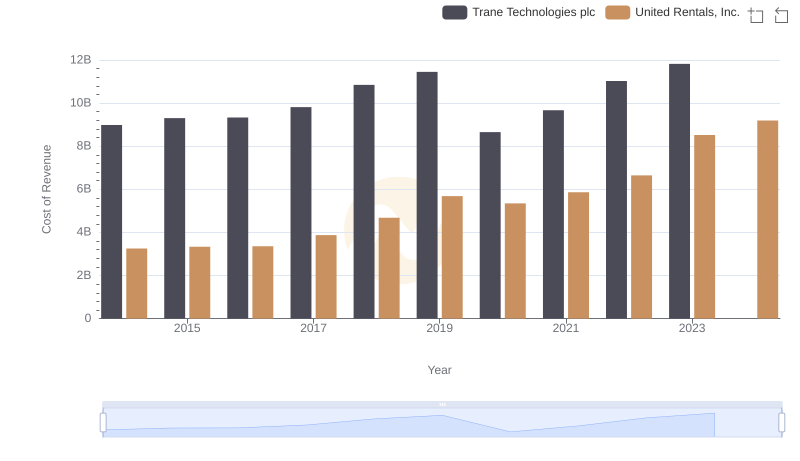

Cost of Revenue Trends: Trane Technologies plc vs United Rentals, Inc.

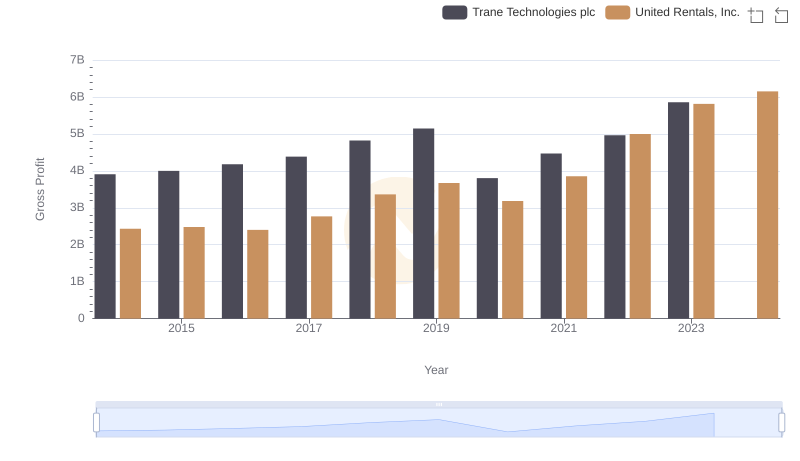

Trane Technologies plc vs United Rentals, Inc.: A Gross Profit Performance Breakdown

Who Optimizes SG&A Costs Better? Trane Technologies plc or W.W. Grainger, Inc.

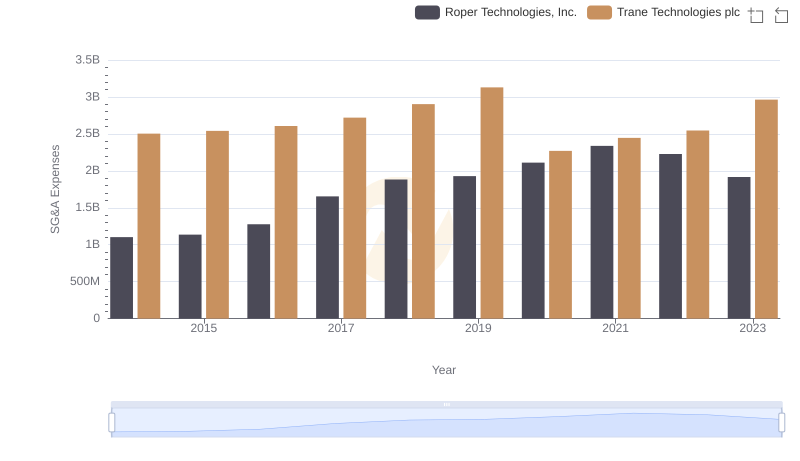

Trane Technologies plc or Roper Technologies, Inc.: Who Manages SG&A Costs Better?

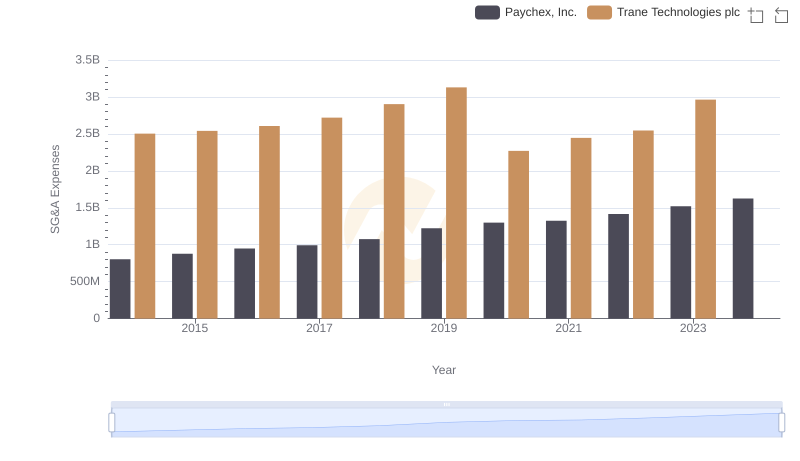

Who Optimizes SG&A Costs Better? Trane Technologies plc or Paychex, Inc.

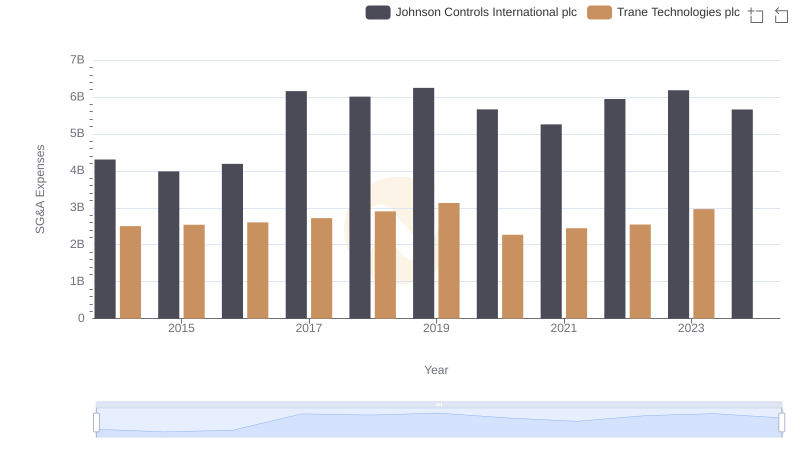

Breaking Down SG&A Expenses: Trane Technologies plc vs Johnson Controls International plc

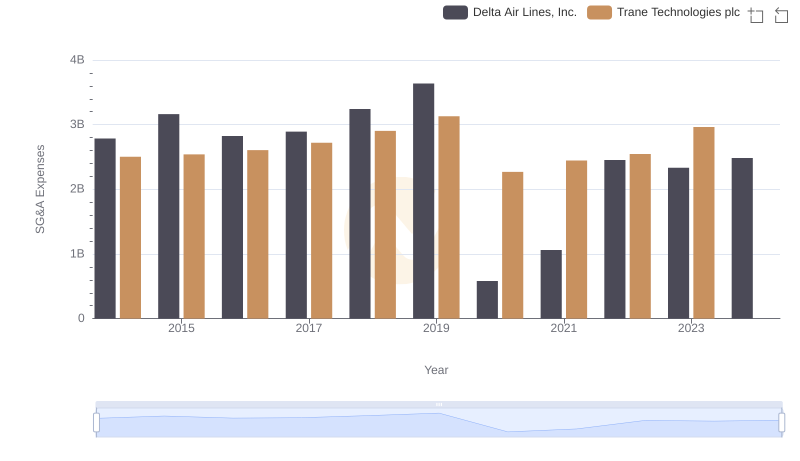

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Delta Air Lines, Inc.

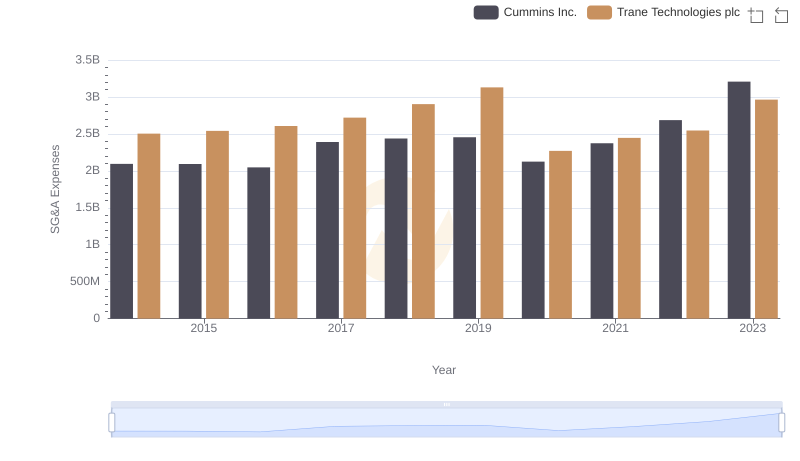

Trane Technologies plc or Cummins Inc.: Who Manages SG&A Costs Better?

Comparative EBITDA Analysis: Trane Technologies plc vs United Rentals, Inc.

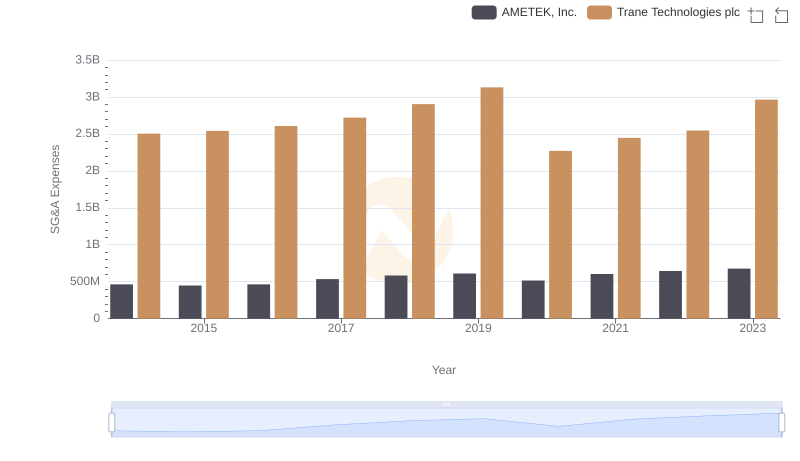

Trane Technologies plc vs AMETEK, Inc.: SG&A Expense Trends