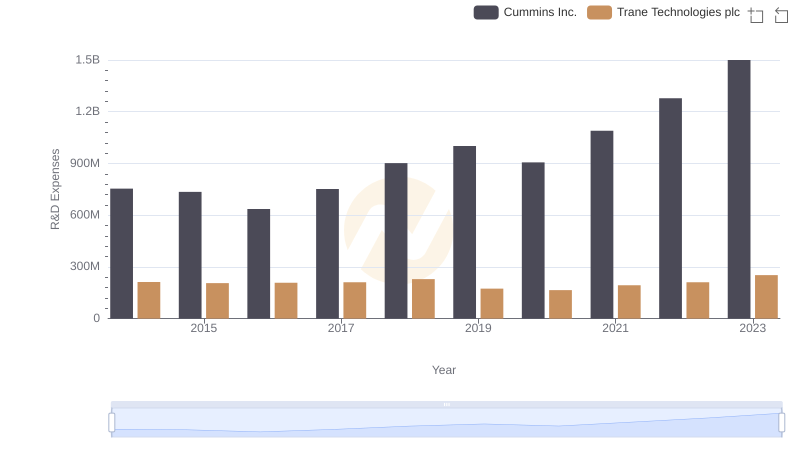

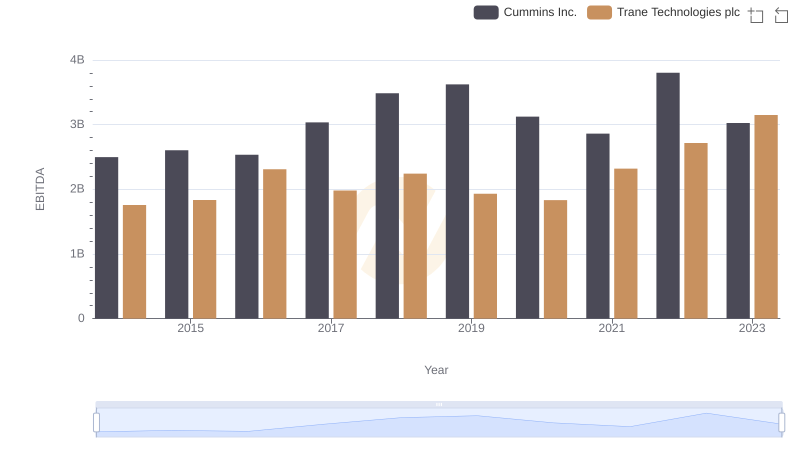

| __timestamp | Cummins Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2095000000 | 2503900000 |

| Thursday, January 1, 2015 | 2092000000 | 2541100000 |

| Friday, January 1, 2016 | 2046000000 | 2606500000 |

| Sunday, January 1, 2017 | 2390000000 | 2720700000 |

| Monday, January 1, 2018 | 2437000000 | 2903200000 |

| Tuesday, January 1, 2019 | 2454000000 | 3129800000 |

| Wednesday, January 1, 2020 | 2125000000 | 2270600000 |

| Friday, January 1, 2021 | 2374000000 | 2446300000 |

| Saturday, January 1, 2022 | 2687000000 | 2545900000 |

| Sunday, January 1, 2023 | 3208000000 | 2963200000 |

| Monday, January 1, 2024 | 3275000000 | 3580400000 |

Cracking the code

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Trane Technologies plc and Cummins Inc., two industry titans, have shown distinct approaches over the past decade. From 2014 to 2023, Trane Technologies consistently reported higher SG&A expenses, peaking at approximately $3.13 billion in 2019. However, Cummins Inc. demonstrated a more stable trajectory, with a notable increase of around 53% from 2014 to 2023, reaching $3.21 billion. This suggests a strategic expansion or investment in operational capabilities. While Trane's expenses fluctuated, Cummins maintained a steadier growth, potentially indicating more efficient cost management. As these companies continue to evolve, their ability to control SG&A costs will remain a key indicator of their financial health and competitive edge.

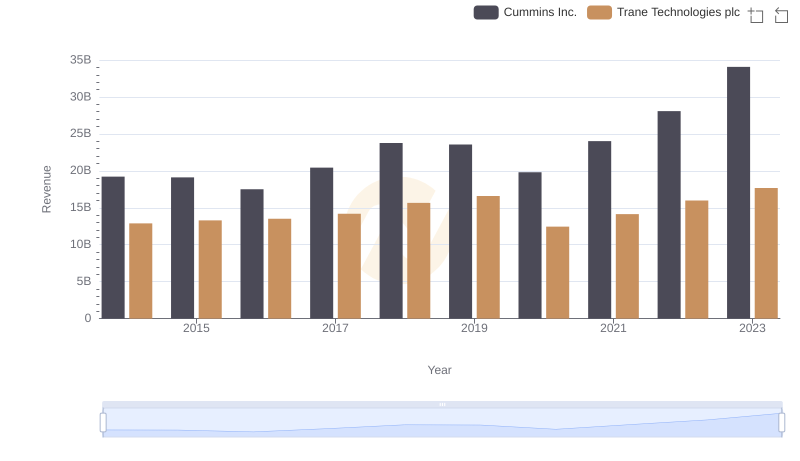

Revenue Showdown: Trane Technologies plc vs Cummins Inc.

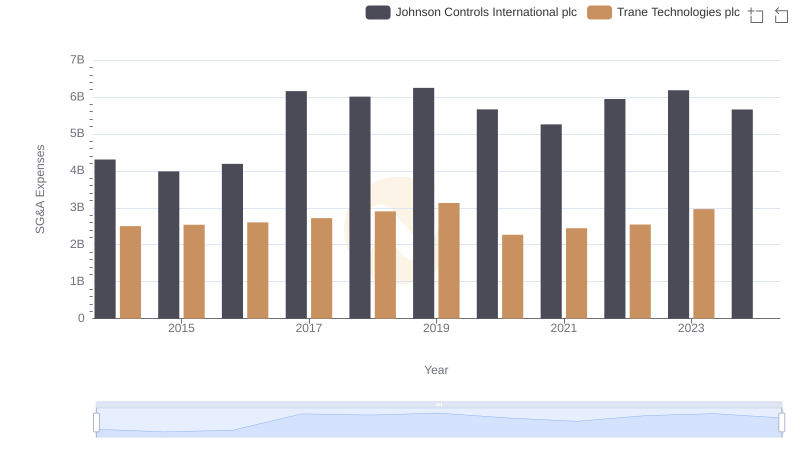

Breaking Down SG&A Expenses: Trane Technologies plc vs Johnson Controls International plc

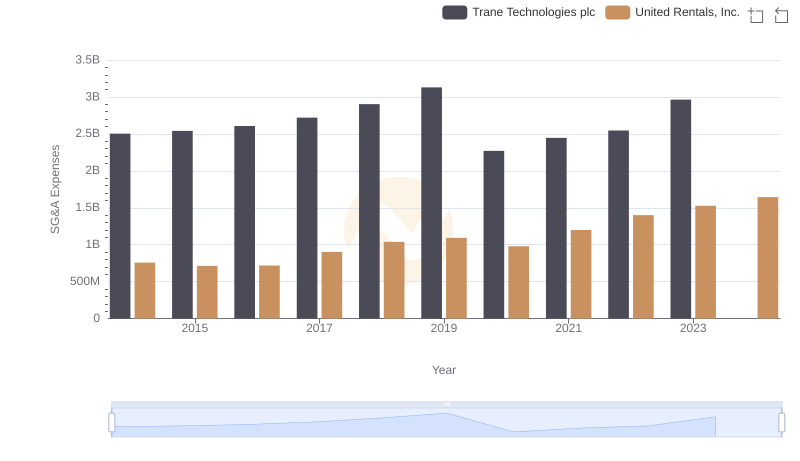

Trane Technologies plc or United Rentals, Inc.: Who Manages SG&A Costs Better?

Trane Technologies plc or Cummins Inc.: Who Invests More in Innovation?

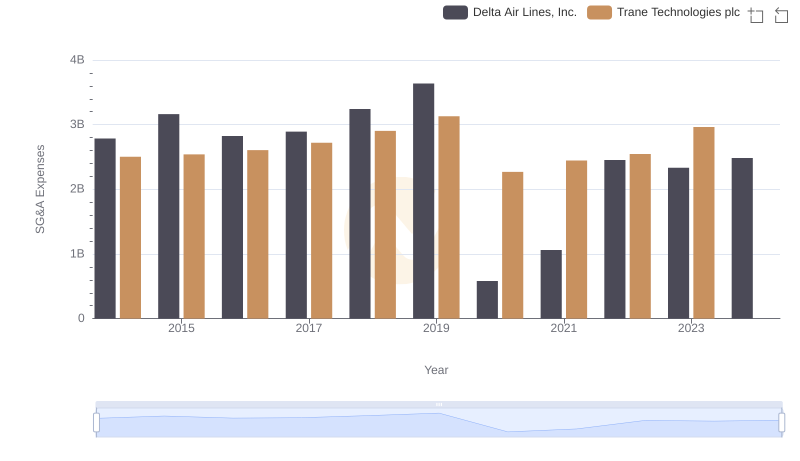

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Delta Air Lines, Inc.

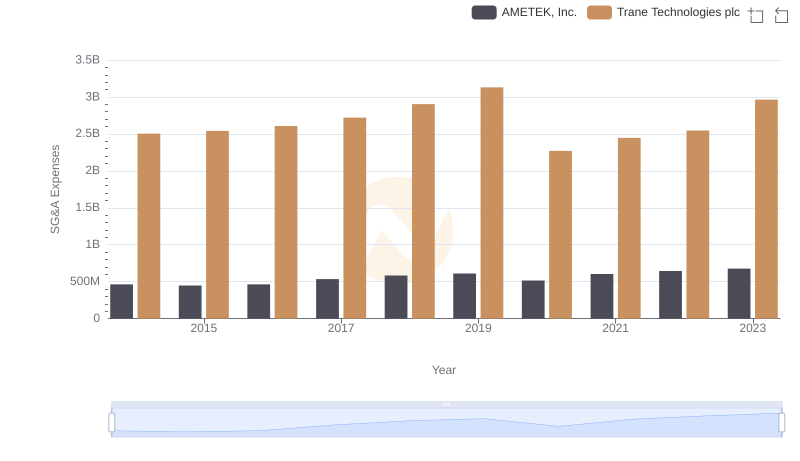

Trane Technologies plc vs AMETEK, Inc.: SG&A Expense Trends

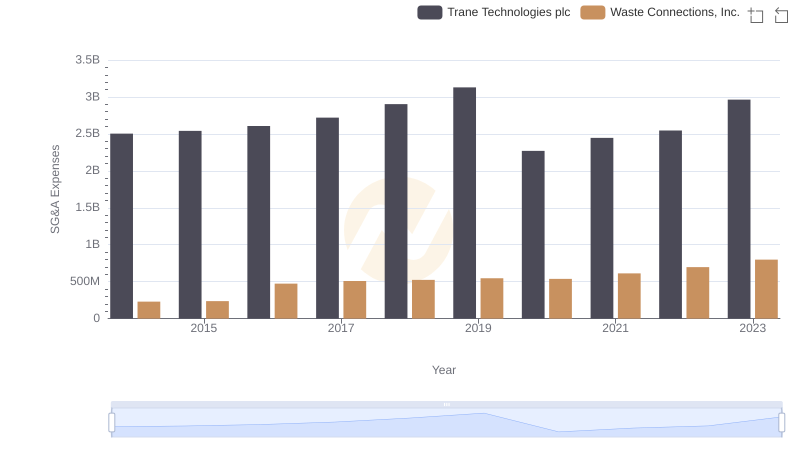

Cost Management Insights: SG&A Expenses for Trane Technologies plc and Waste Connections, Inc.

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Cummins Inc.