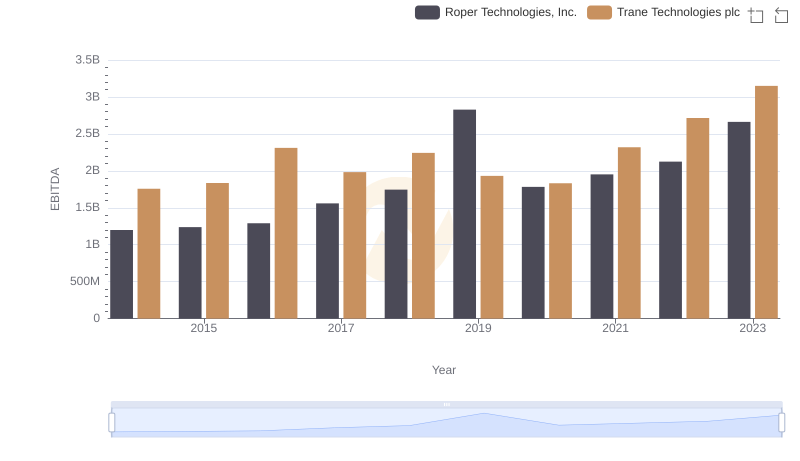

| __timestamp | Roper Technologies, Inc. | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 1102426000 | 2503900000 |

| Thursday, January 1, 2015 | 1136728000 | 2541100000 |

| Friday, January 1, 2016 | 1277847000 | 2606500000 |

| Sunday, January 1, 2017 | 1654552000 | 2720700000 |

| Monday, January 1, 2018 | 1883100000 | 2903200000 |

| Tuesday, January 1, 2019 | 1928700000 | 3129800000 |

| Wednesday, January 1, 2020 | 2111900000 | 2270600000 |

| Friday, January 1, 2021 | 2337700000 | 2446300000 |

| Saturday, January 1, 2022 | 2228300000 | 2545900000 |

| Sunday, January 1, 2023 | 1915900000 | 2963200000 |

| Monday, January 1, 2024 | 2881500000 | 3580400000 |

Data in motion

In the competitive landscape of industrial technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, Trane Technologies and Roper Technologies have shown distinct strategies in handling these costs. Trane Technologies, with an average SG&A expense of approximately $2.66 billion, has consistently outspent Roper Technologies, which averaged around $1.76 billion. However, the trend reveals a more nuanced story. While Trane's expenses peaked in 2019, Roper's costs have shown a more stable trajectory, peaking in 2021. Notably, in 2023, Roper managed to reduce its SG&A expenses by about 18% from its 2021 peak, while Trane's expenses increased by 17% from 2020. This data suggests that Roper Technologies may have a more effective cost management strategy, especially in recent years, despite Trane's larger scale of operations.

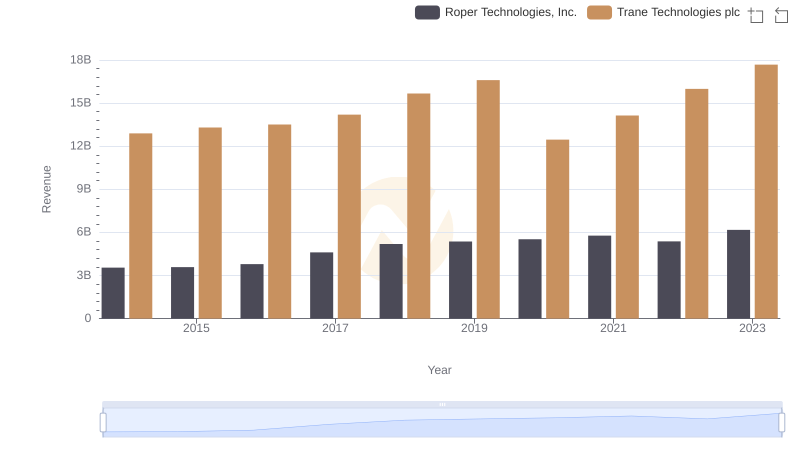

Trane Technologies plc vs Roper Technologies, Inc.: Examining Key Revenue Metrics

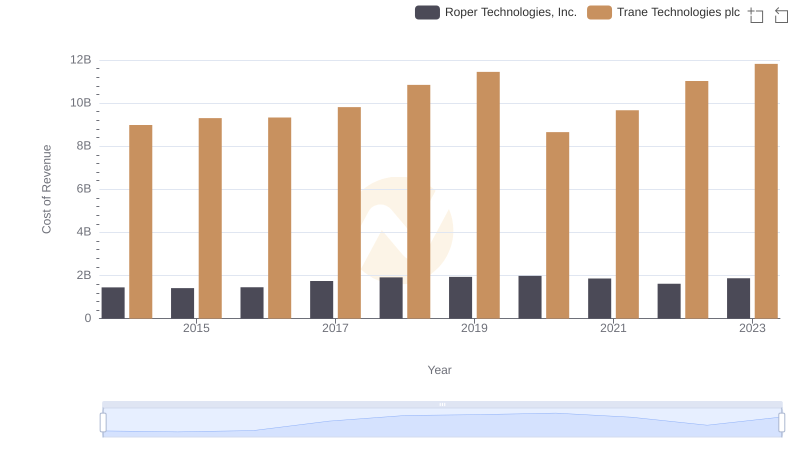

Cost of Revenue Comparison: Trane Technologies plc vs Roper Technologies, Inc.

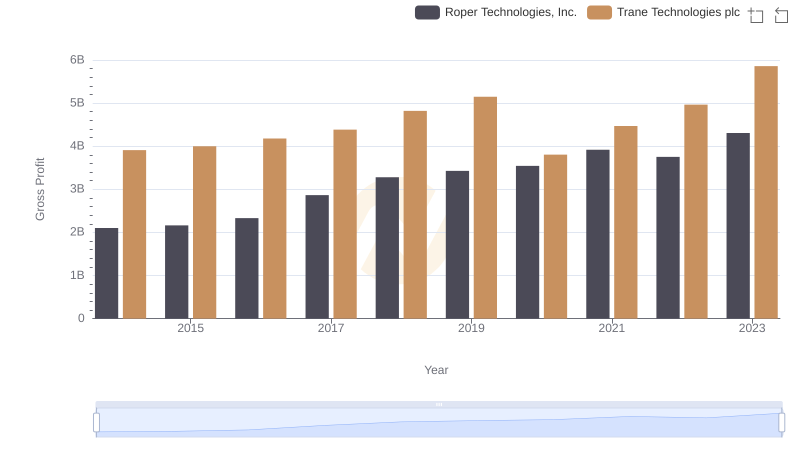

Trane Technologies plc vs Roper Technologies, Inc.: A Gross Profit Performance Breakdown

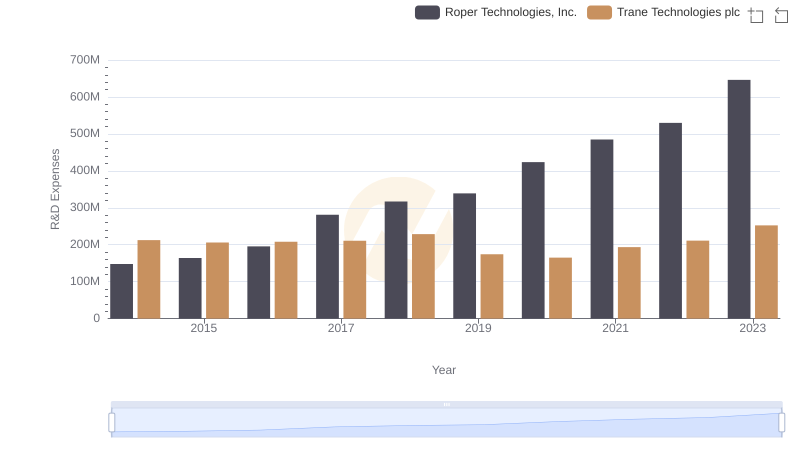

Trane Technologies plc or Roper Technologies, Inc.: Who Invests More in Innovation?

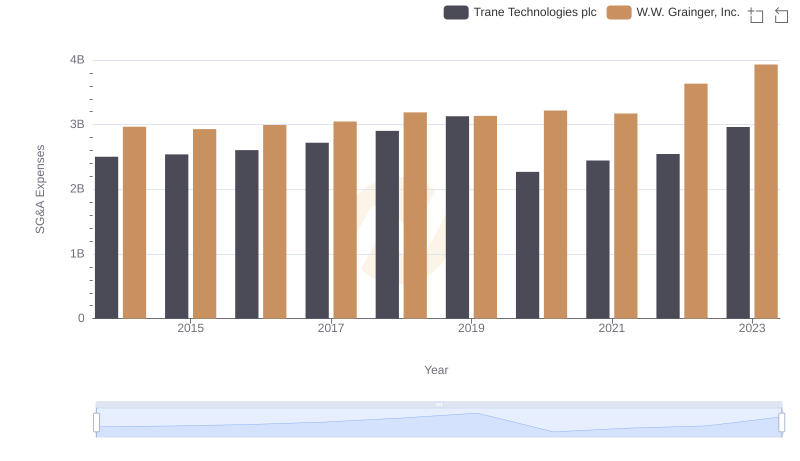

Who Optimizes SG&A Costs Better? Trane Technologies plc or W.W. Grainger, Inc.

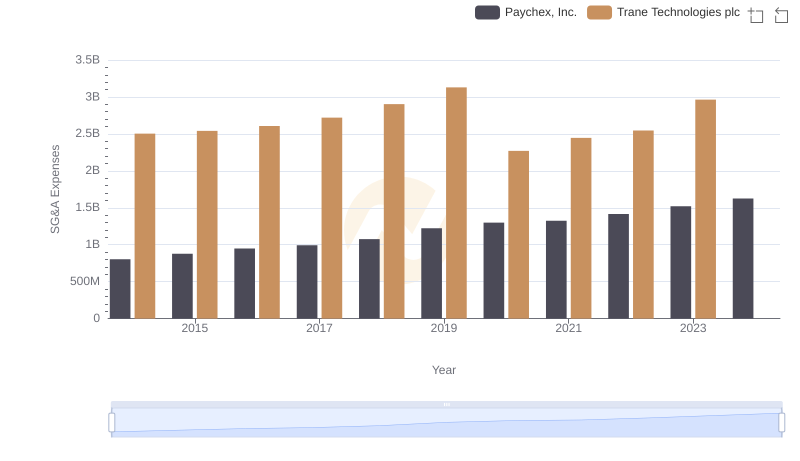

Who Optimizes SG&A Costs Better? Trane Technologies plc or Paychex, Inc.

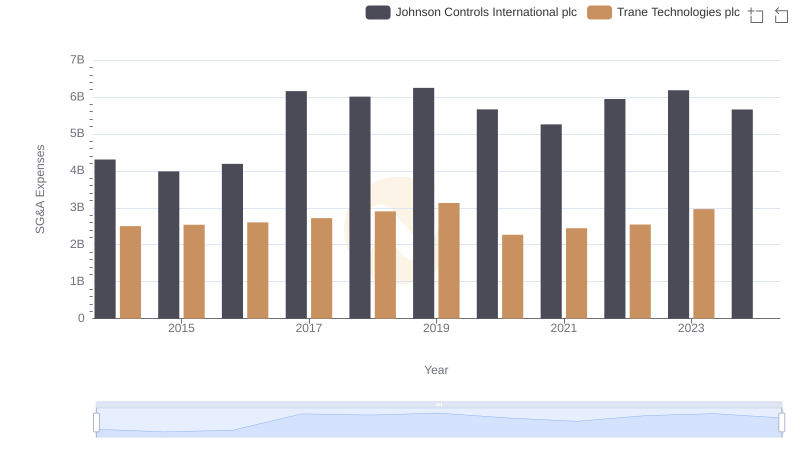

Breaking Down SG&A Expenses: Trane Technologies plc vs Johnson Controls International plc

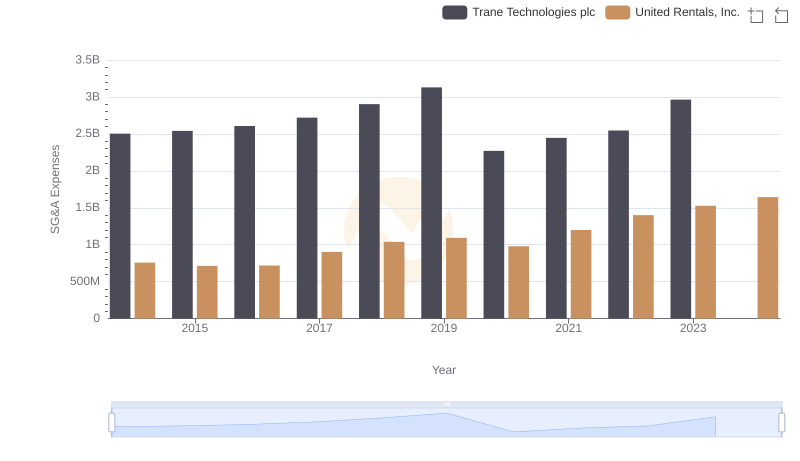

Trane Technologies plc or United Rentals, Inc.: Who Manages SG&A Costs Better?

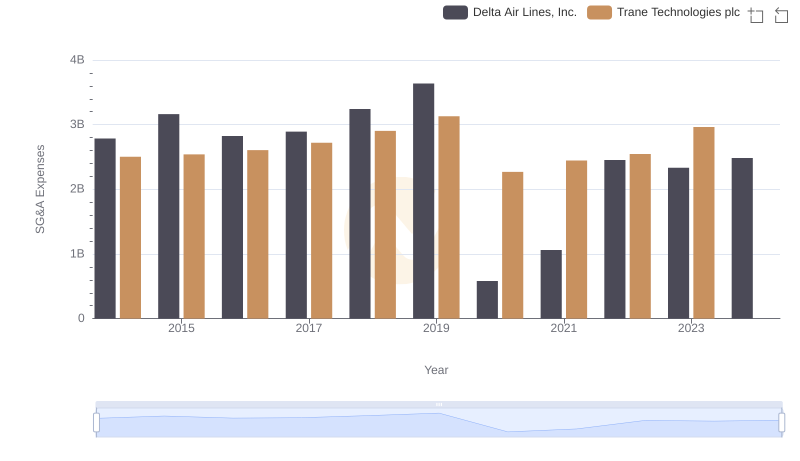

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Delta Air Lines, Inc.

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Roper Technologies, Inc.

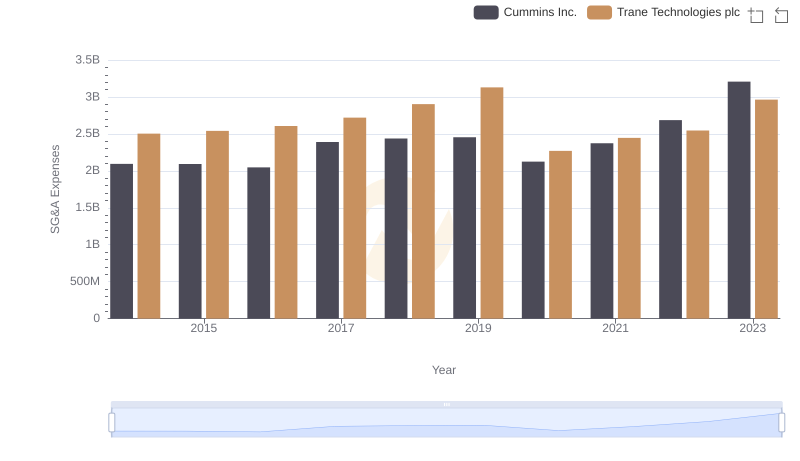

Trane Technologies plc or Cummins Inc.: Who Manages SG&A Costs Better?