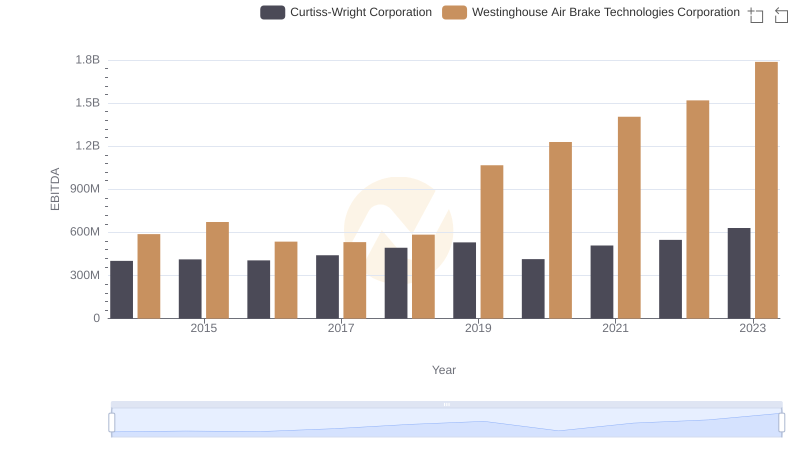

| __timestamp | Curtiss-Wright Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 426301000 | 324539000 |

| Thursday, January 1, 2015 | 411801000 | 319173000 |

| Friday, January 1, 2016 | 383793000 | 327505000 |

| Sunday, January 1, 2017 | 418544000 | 482852000 |

| Monday, January 1, 2018 | 433110000 | 573644000 |

| Tuesday, January 1, 2019 | 422272000 | 936600000 |

| Wednesday, January 1, 2020 | 412825000 | 877100000 |

| Friday, January 1, 2021 | 443096000 | 1005000000 |

| Saturday, January 1, 2022 | 445679000 | 1020000000 |

| Sunday, January 1, 2023 | 496812000 | 1139000000 |

| Monday, January 1, 2024 | 518857000 | 1248000000 |

Unveiling the hidden dimensions of data

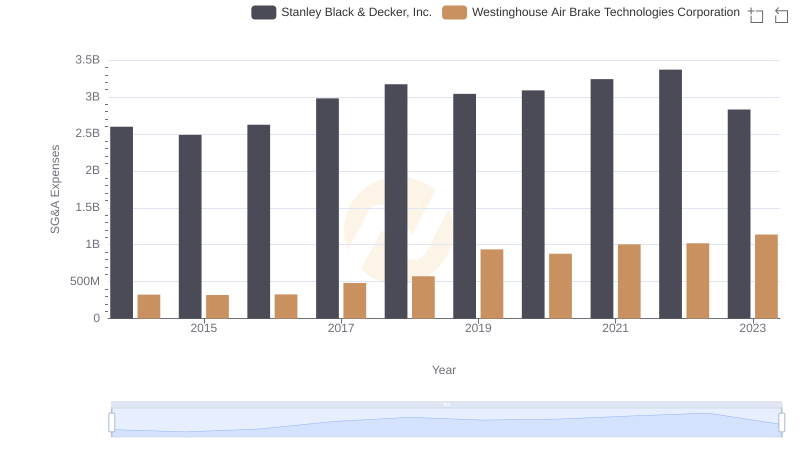

In the competitive landscape of industrial manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation have demonstrated contrasting trends in their SG&A expenditures. From 2014 to 2023, Westinghouse's SG&A expenses surged by approximately 250%, peaking at $1.139 billion in 2023. In contrast, Curtiss-Wright maintained a more stable trajectory, with a modest increase of around 17% over the same period, reaching $496 million in 2023. This divergence highlights Westinghouse's aggressive expansion strategy, while Curtiss-Wright's steady approach suggests a focus on operational efficiency. As these companies navigate the evolving industrial landscape, their SG&A strategies will be pivotal in shaping their competitive edge.

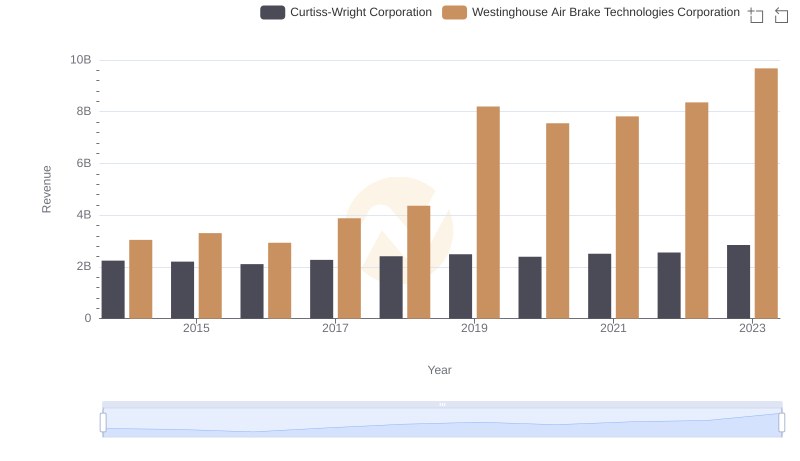

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or Curtiss-Wright Corporation

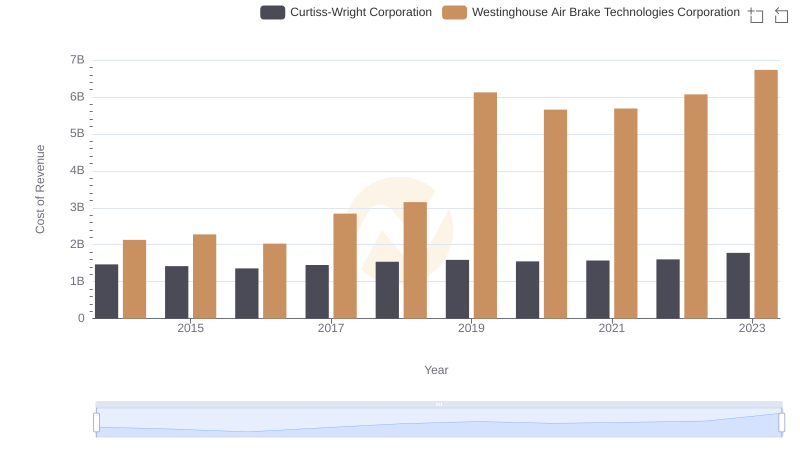

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: Efficiency in Cost of Revenue Explored

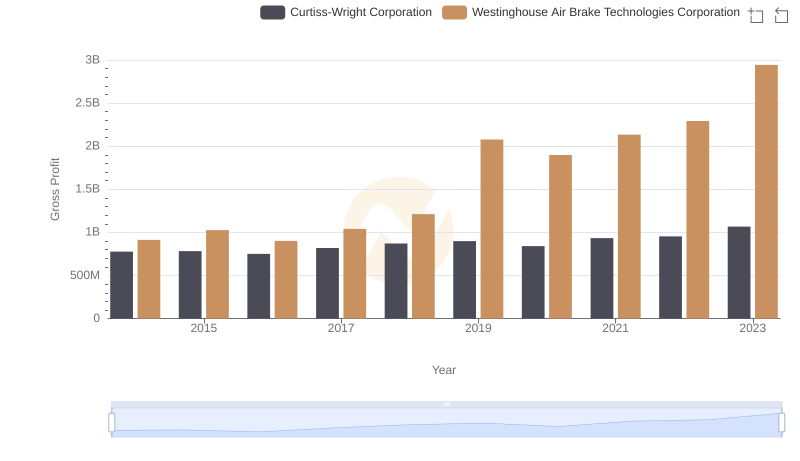

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

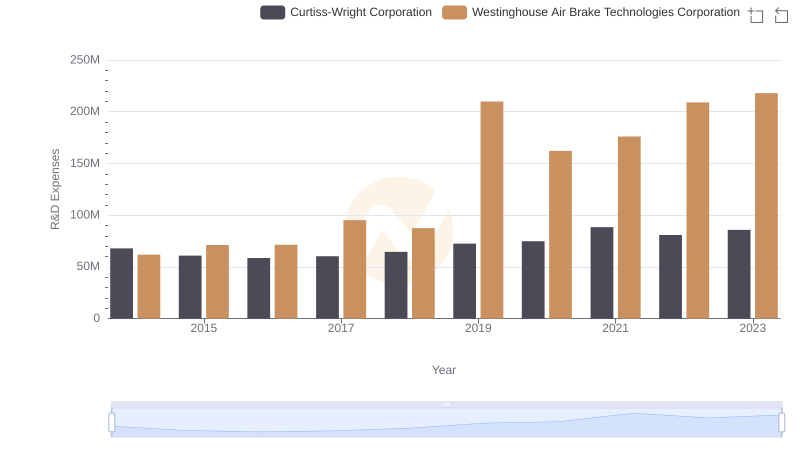

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation Allocate Funds

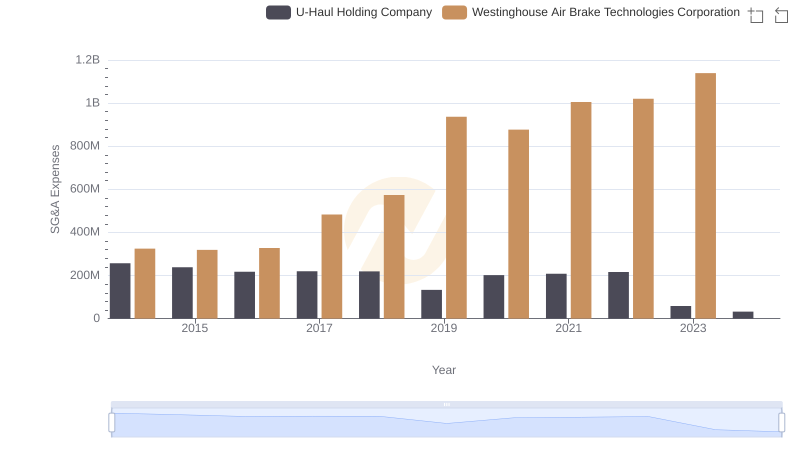

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

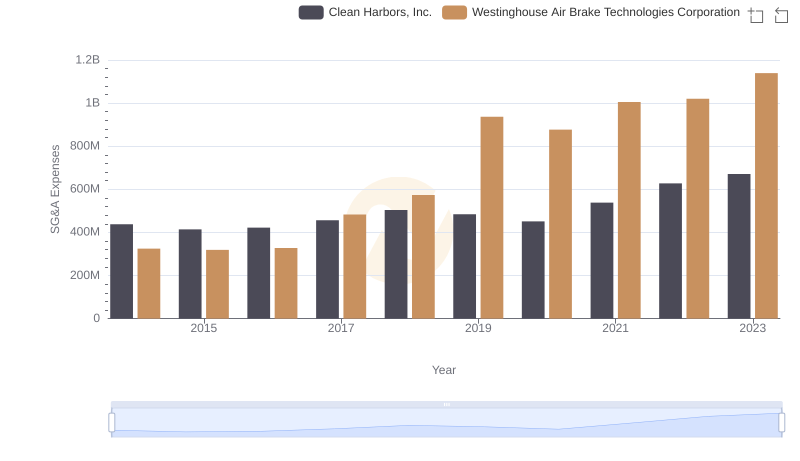

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Clean Harbors, Inc.

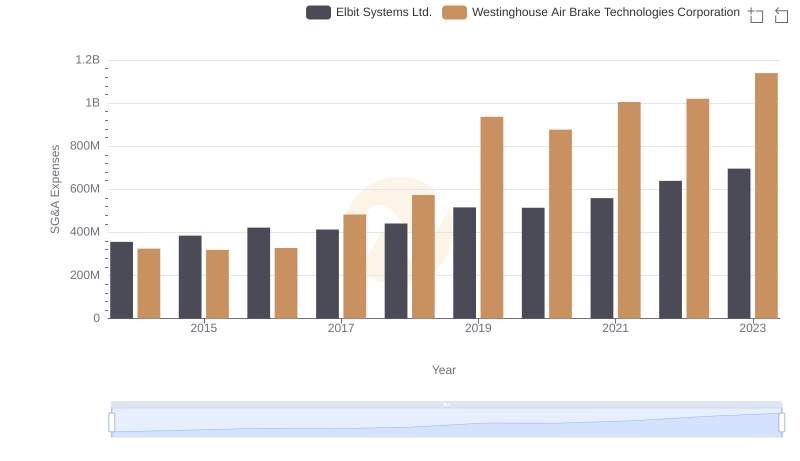

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd. Trends and Insights

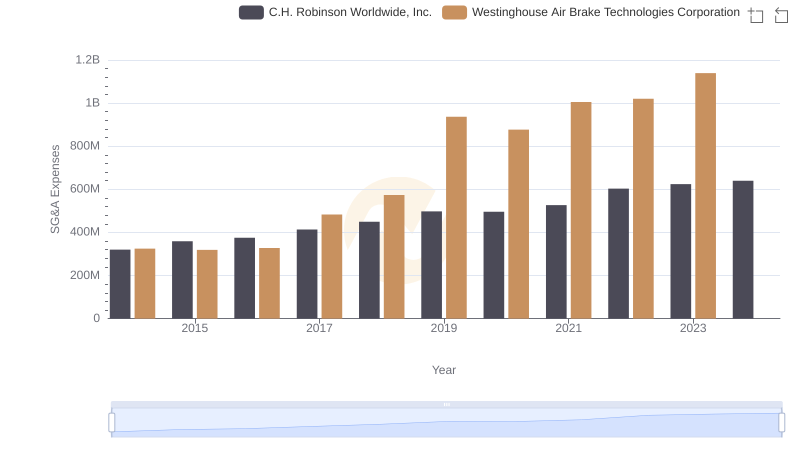

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

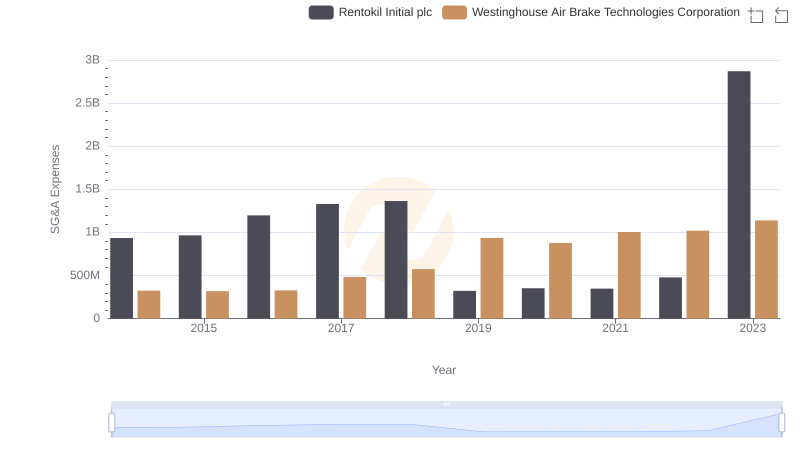

Westinghouse Air Brake Technologies Corporation and Rentokil Initial plc: SG&A Spending Patterns Compared

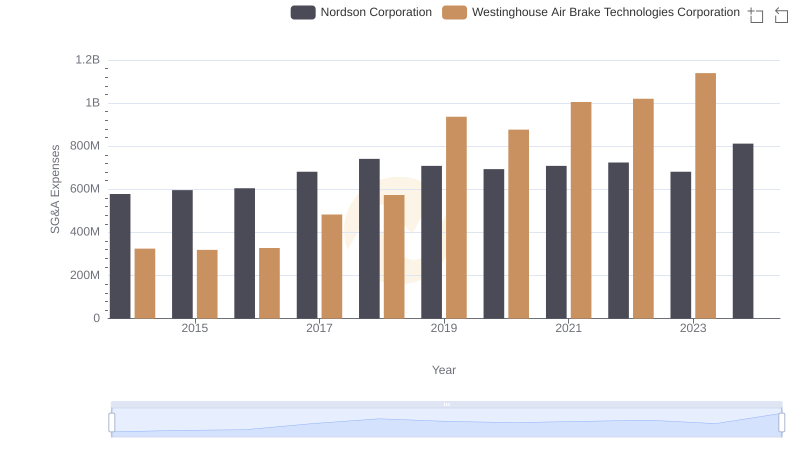

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Nordson Corporation

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Curtiss-Wright Corporation