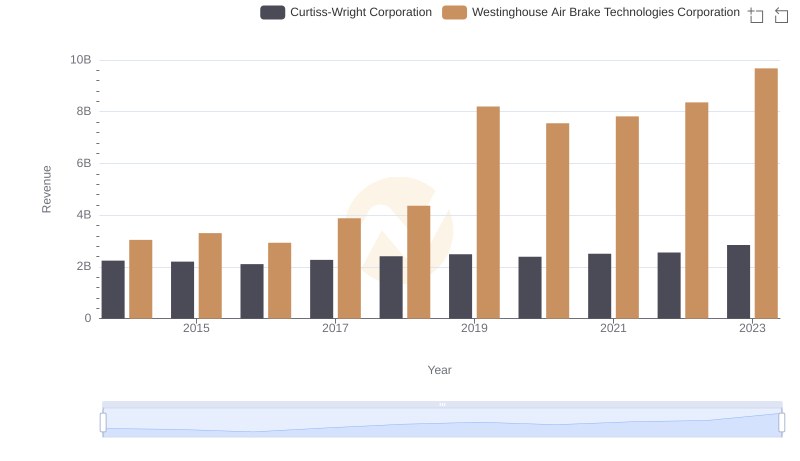

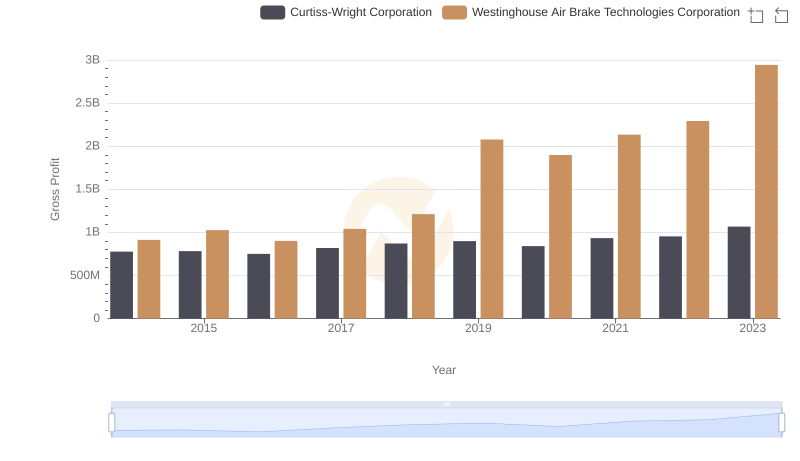

| __timestamp | Curtiss-Wright Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1466610000 | 2130920000 |

| Thursday, January 1, 2015 | 1422428000 | 2281845000 |

| Friday, January 1, 2016 | 1358448000 | 2029647000 |

| Sunday, January 1, 2017 | 1452431000 | 2841159000 |

| Monday, January 1, 2018 | 1540574000 | 3151816000 |

| Tuesday, January 1, 2019 | 1589216000 | 6122400000 |

| Wednesday, January 1, 2020 | 1550109000 | 5657400000 |

| Friday, January 1, 2021 | 1572575000 | 5687000000 |

| Saturday, January 1, 2022 | 1602416000 | 6070000000 |

| Sunday, January 1, 2023 | 1778195000 | 6733000000 |

| Monday, January 1, 2024 | 1967640000 | 7021000000 |

Unleashing insights

In the competitive landscape of industrial manufacturing, cost efficiency is a critical metric. This analysis delves into the cost of revenue trends for Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation from 2014 to 2023. Over this period, Westinghouse Air Brake consistently outpaced Curtiss-Wright, with its cost of revenue peaking at approximately $6.7 billion in 2023, a staggering 280% increase from 2014. In contrast, Curtiss-Wright's cost of revenue grew by a modest 21%, reaching around $1.8 billion in 2023. This disparity highlights Westinghouse's aggressive expansion and market penetration strategies. The data suggests that while both companies have shown growth, Westinghouse's ability to scale its operations more efficiently has set it apart. As the industrial sector evolves, these insights provide a glimpse into the strategic maneuvers that define industry leaders.

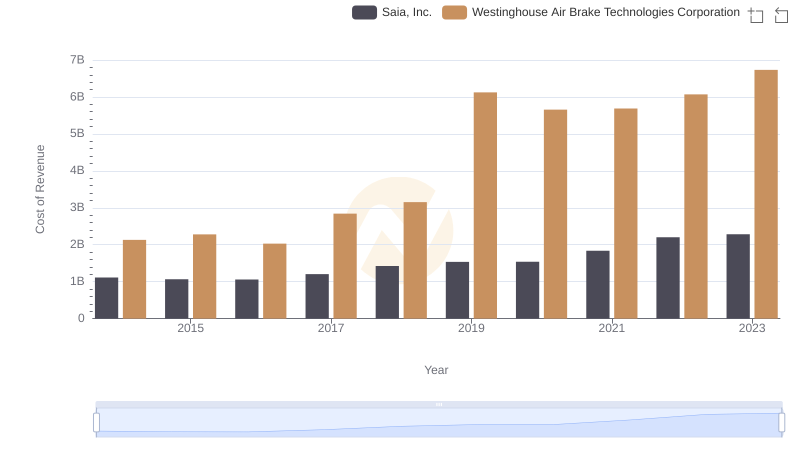

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Saia, Inc.

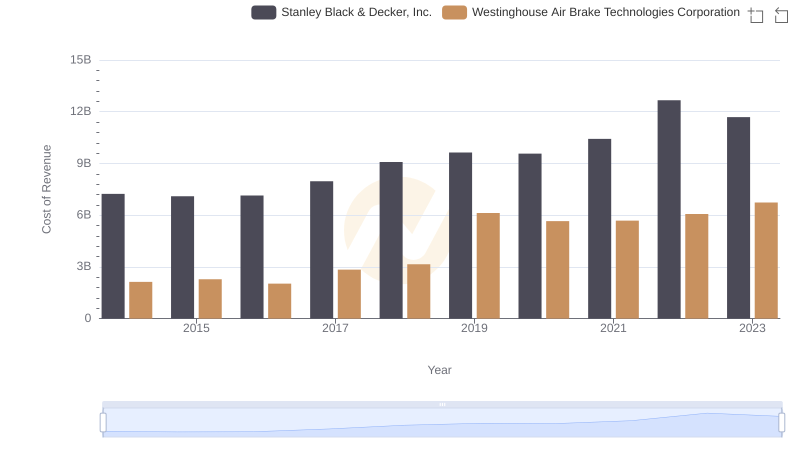

Cost of Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or Curtiss-Wright Corporation

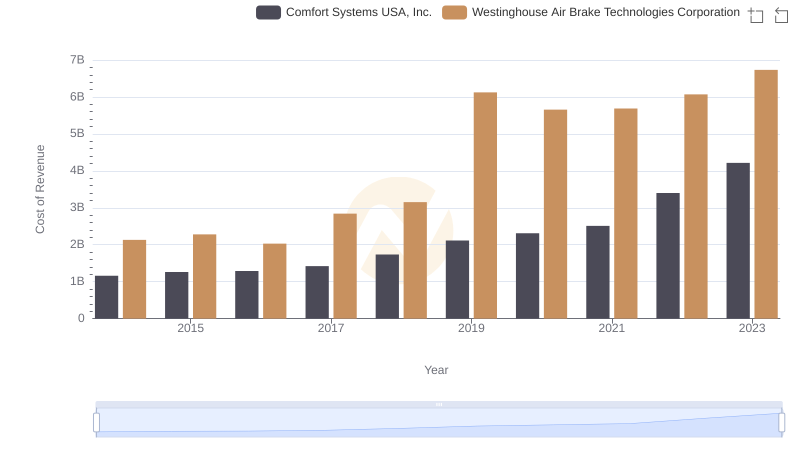

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.

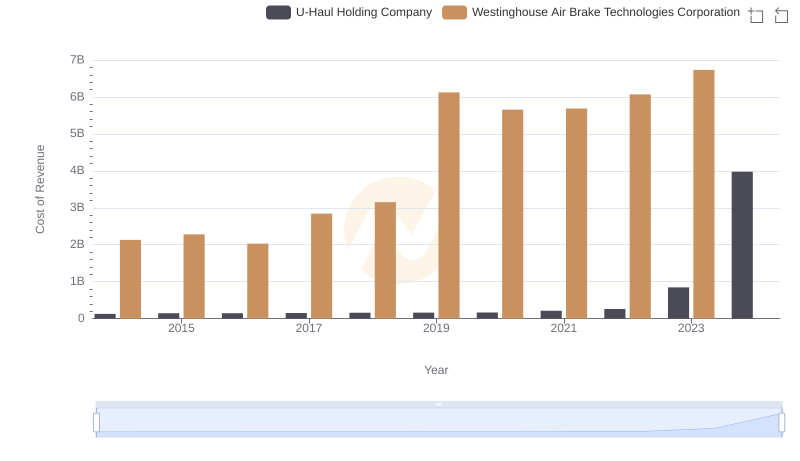

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company's Expenses

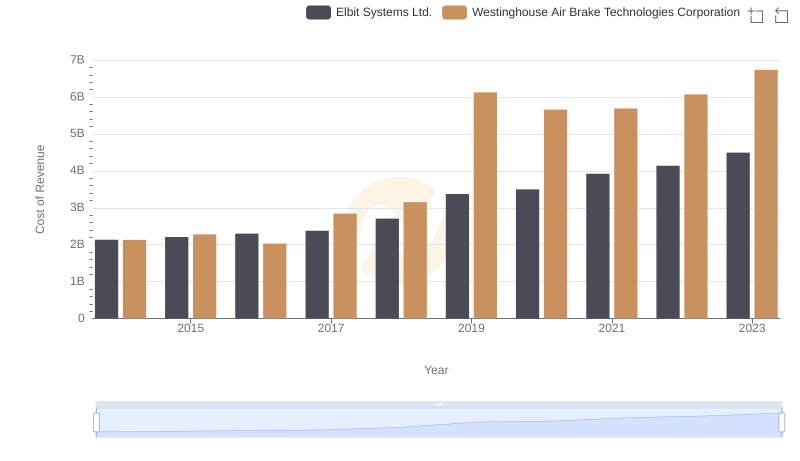

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd.

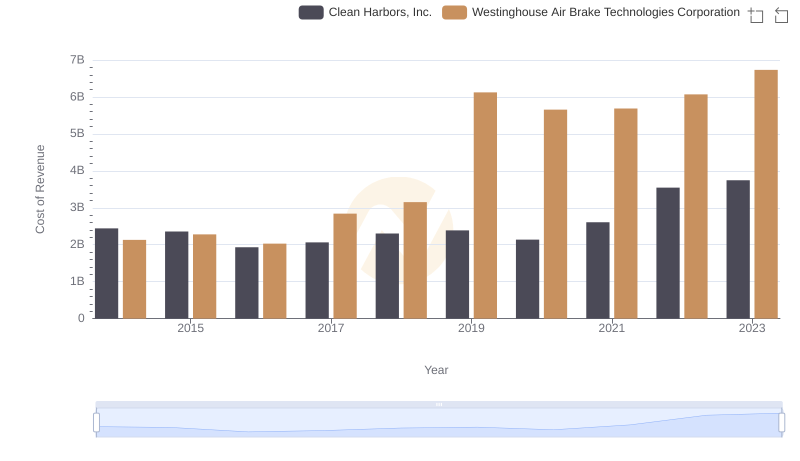

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

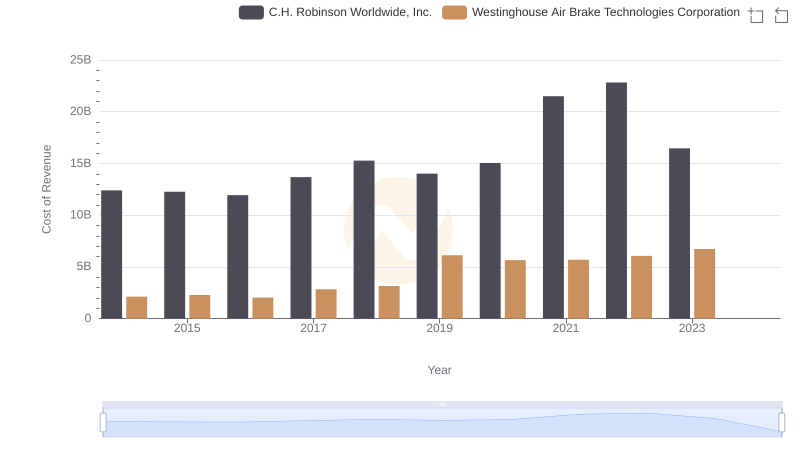

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.

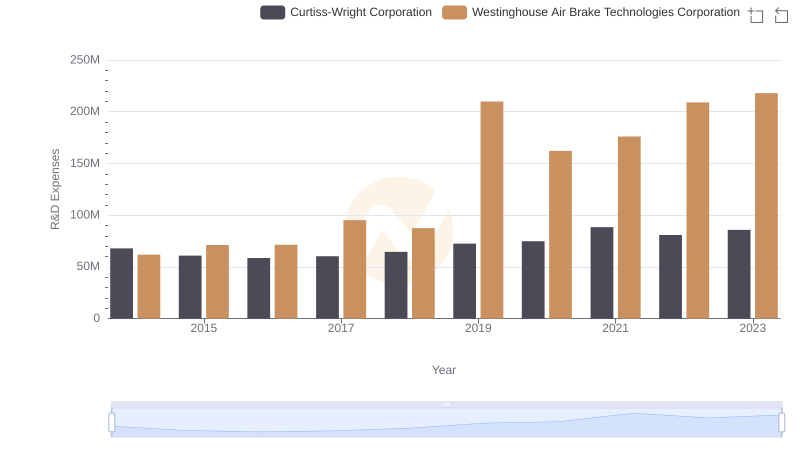

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation Allocate Funds

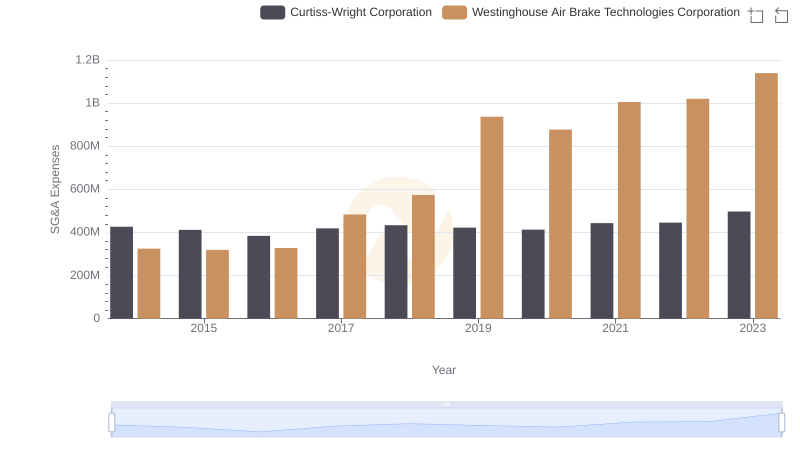

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

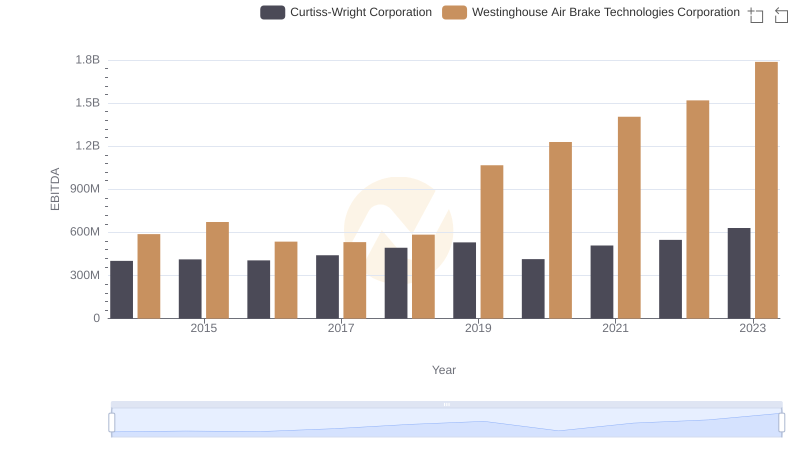

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Curtiss-Wright Corporation