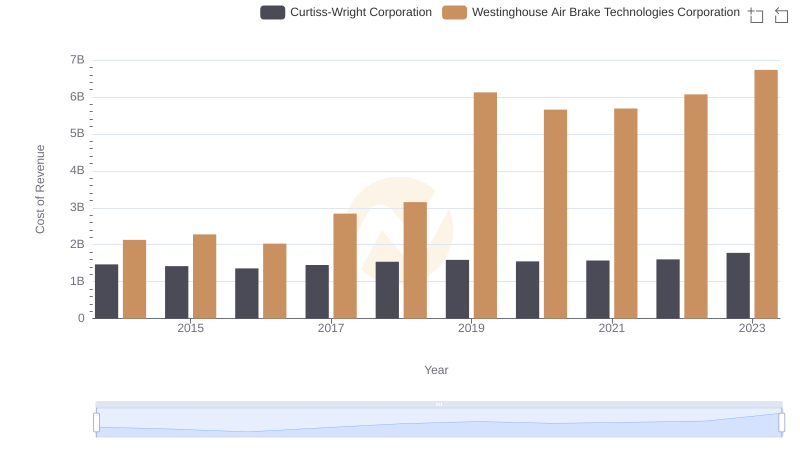

| __timestamp | Curtiss-Wright Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2243126000 | 3044454000 |

| Thursday, January 1, 2015 | 2205683000 | 3307998000 |

| Friday, January 1, 2016 | 2108931000 | 2931188000 |

| Sunday, January 1, 2017 | 2271026000 | 3881756000 |

| Monday, January 1, 2018 | 2411835000 | 4363547000 |

| Tuesday, January 1, 2019 | 2487961000 | 8200000000 |

| Wednesday, January 1, 2020 | 2391336000 | 7556100000 |

| Friday, January 1, 2021 | 2505931000 | 7822000000 |

| Saturday, January 1, 2022 | 2557025000 | 8362000000 |

| Sunday, January 1, 2023 | 2845373000 | 9677000000 |

| Monday, January 1, 2024 | 3121189000 | 10387000000 |

Cracking the code

In the competitive landscape of the industrial sector, two giants, Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation, have been vying for revenue supremacy since 2014. Over the past decade, Westinghouse has consistently outpaced Curtiss-Wright, boasting an average revenue nearly 2.5 times higher. By 2023, Westinghouse's revenue surged to approximately $9.7 billion, marking a 218% increase from 2014, while Curtiss-Wright's revenue grew by 27% to around $2.8 billion.

This trend highlights Westinghouse's robust growth trajectory, particularly between 2018 and 2023, where it saw a remarkable 122% increase. Meanwhile, Curtiss-Wright's steady yet modest growth reflects its stable market presence. As these corporations continue to innovate and expand, the revenue gap underscores the dynamic shifts within the industrial sector, offering insights into strategic business maneuvers and market positioning.

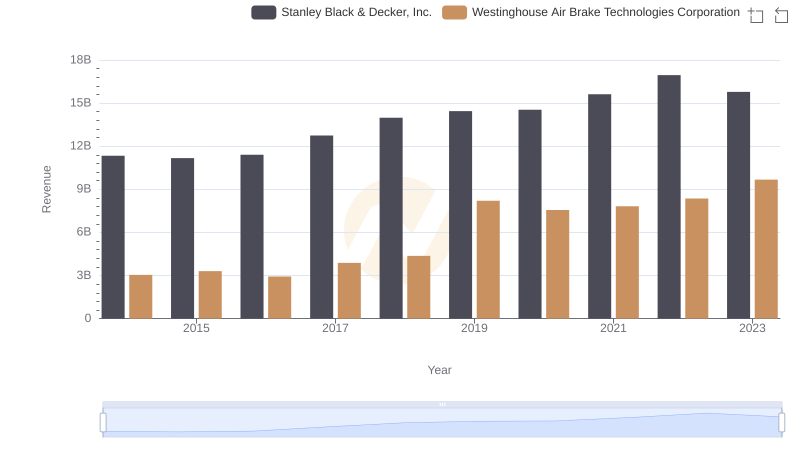

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Westinghouse Air Brake Technologies Corporation and Saia, Inc.: A Comprehensive Revenue Analysis

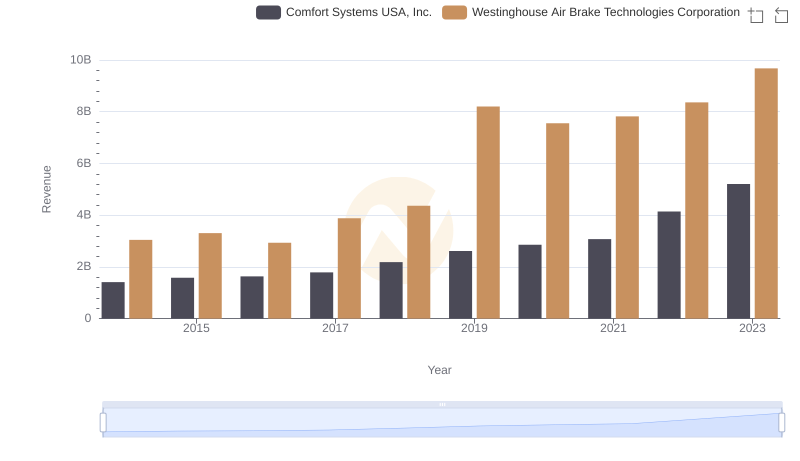

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Comfort Systems USA, Inc. Performance Compared

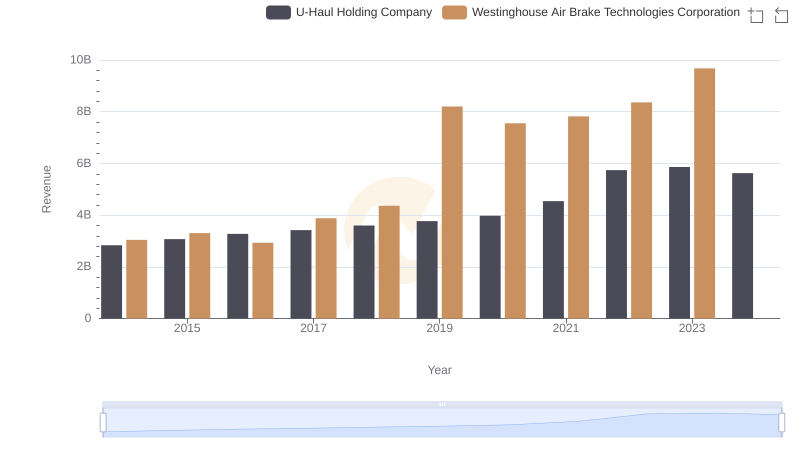

Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company: Annual Revenue Growth Compared

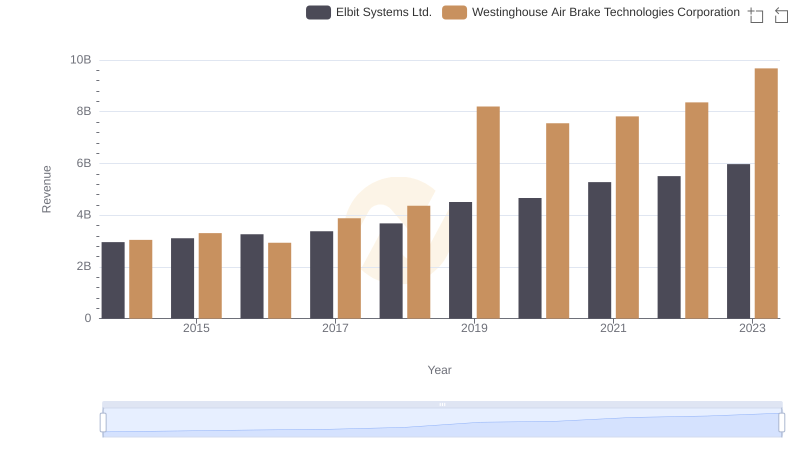

Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd.: A Comprehensive Revenue Analysis

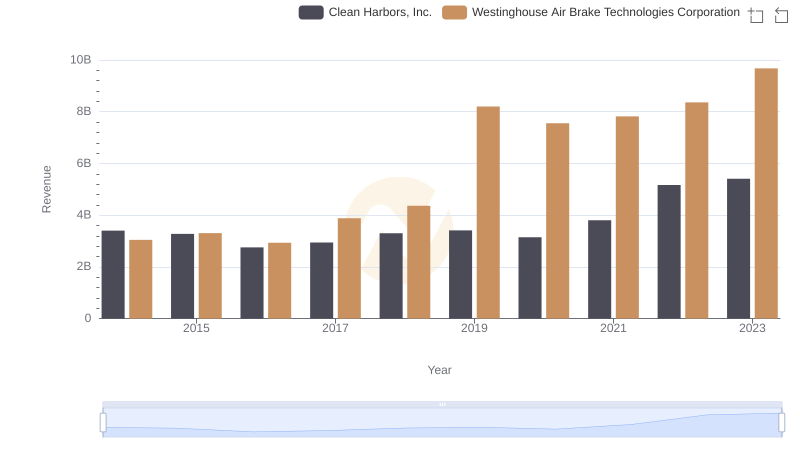

Annual Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

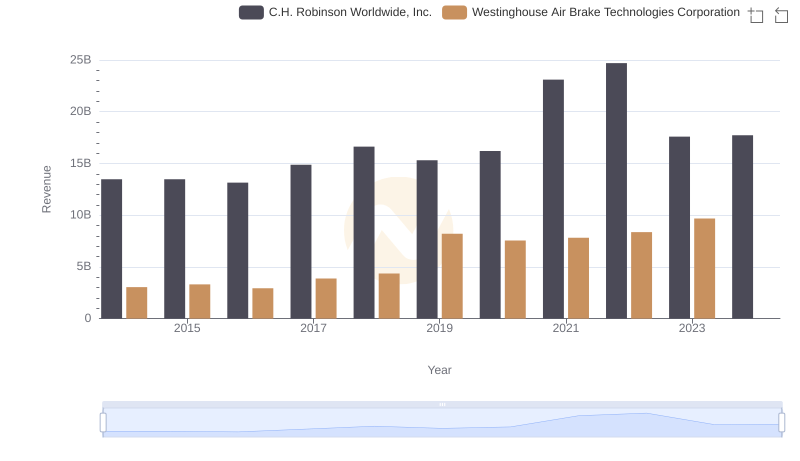

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs C.H. Robinson Worldwide, Inc.

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: Efficiency in Cost of Revenue Explored

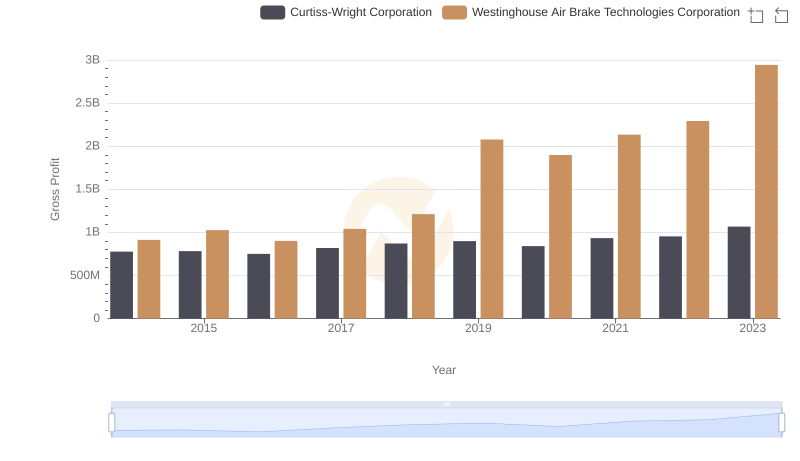

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

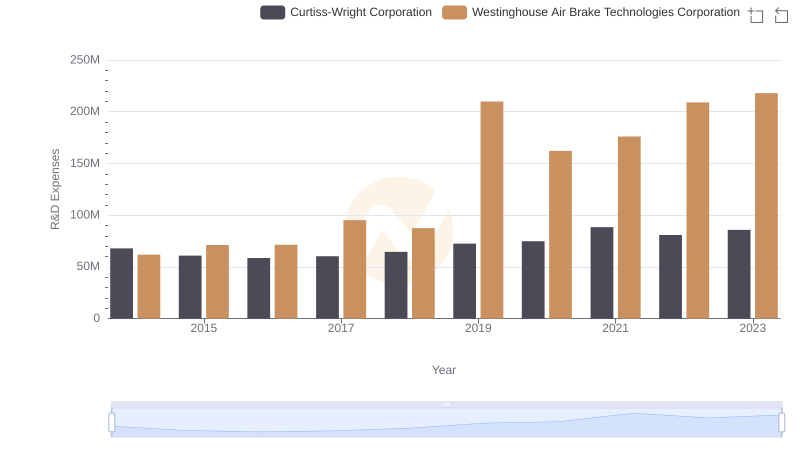

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation Allocate Funds

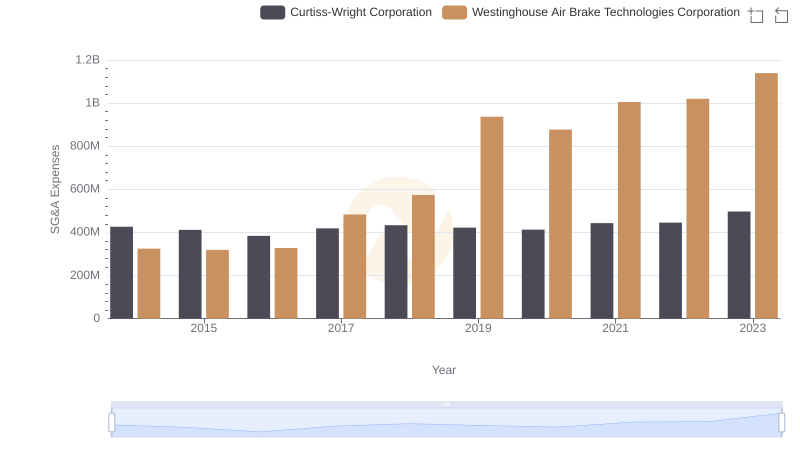

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

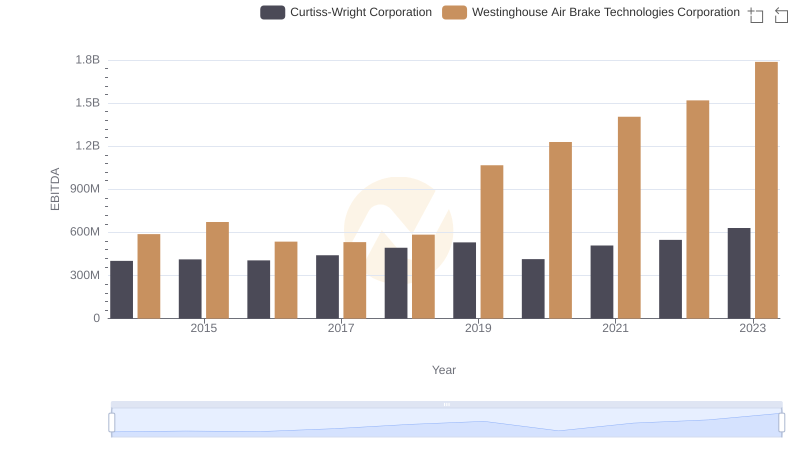

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Curtiss-Wright Corporation