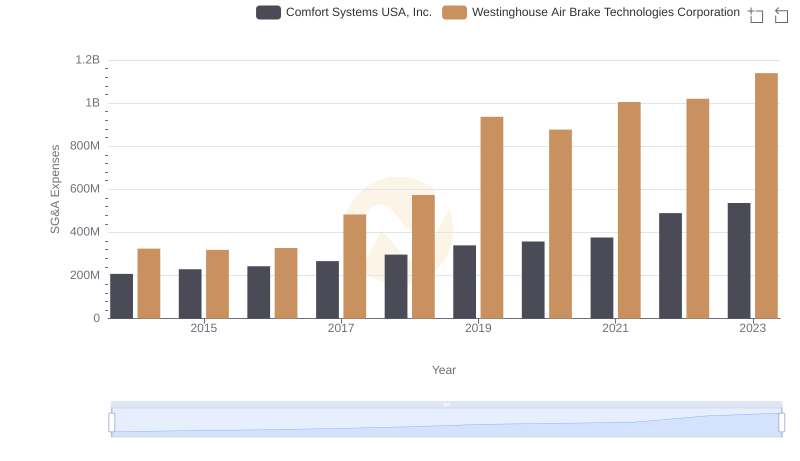

| __timestamp | Clean Harbors, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 437921000 | 324539000 |

| Thursday, January 1, 2015 | 414164000 | 319173000 |

| Friday, January 1, 2016 | 422015000 | 327505000 |

| Sunday, January 1, 2017 | 456648000 | 482852000 |

| Monday, January 1, 2018 | 503747000 | 573644000 |

| Tuesday, January 1, 2019 | 484054000 | 936600000 |

| Wednesday, January 1, 2020 | 451044000 | 877100000 |

| Friday, January 1, 2021 | 537962000 | 1005000000 |

| Saturday, January 1, 2022 | 627391000 | 1020000000 |

| Sunday, January 1, 2023 | 671161000 | 1139000000 |

| Monday, January 1, 2024 | 739629000 | 1248000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Westinghouse Air Brake Technologies Corporation and Clean Harbors, Inc., from 2014 to 2023.

Over the past decade, Westinghouse Air Brake Technologies Corporation has seen a significant rise in SG&A expenses, peaking at approximately 1.14 billion in 2023, marking a 250% increase from 2014. In contrast, Clean Harbors, Inc. experienced a more moderate growth, with expenses rising by about 53% over the same period, reaching around 671 million in 2023.

These trends highlight differing strategic approaches. Westinghouse's aggressive expansion and investment in administrative capabilities contrast with Clean Harbors' more conservative cost management. Investors and stakeholders should consider these dynamics when evaluating long-term growth and profitability.

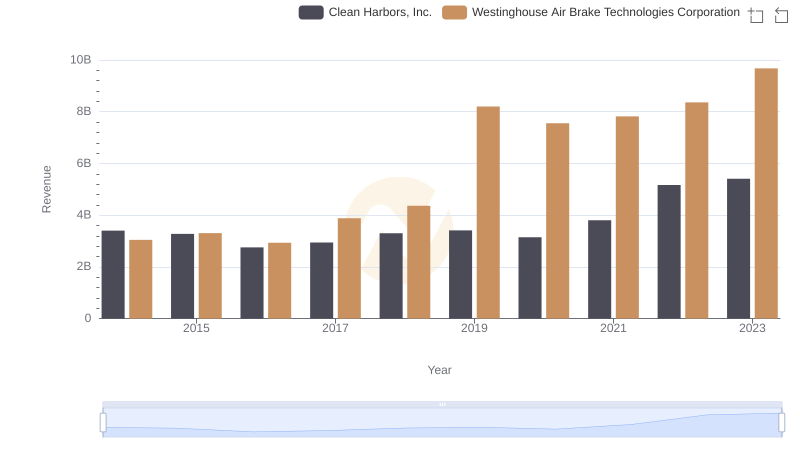

Annual Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

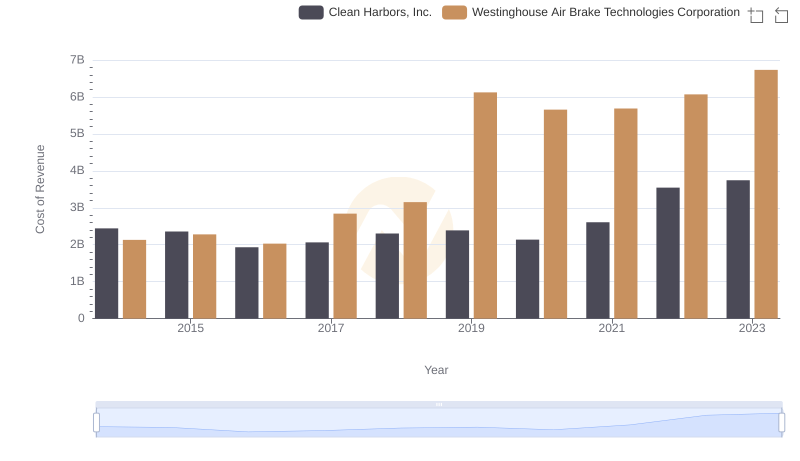

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: SG&A Expense Trends

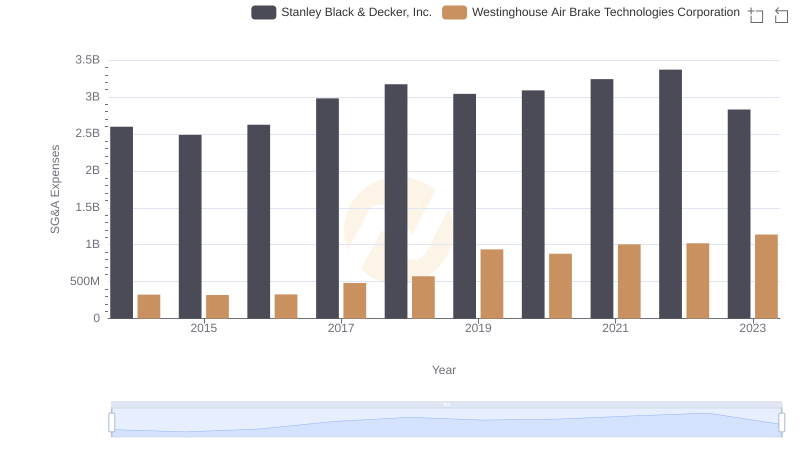

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

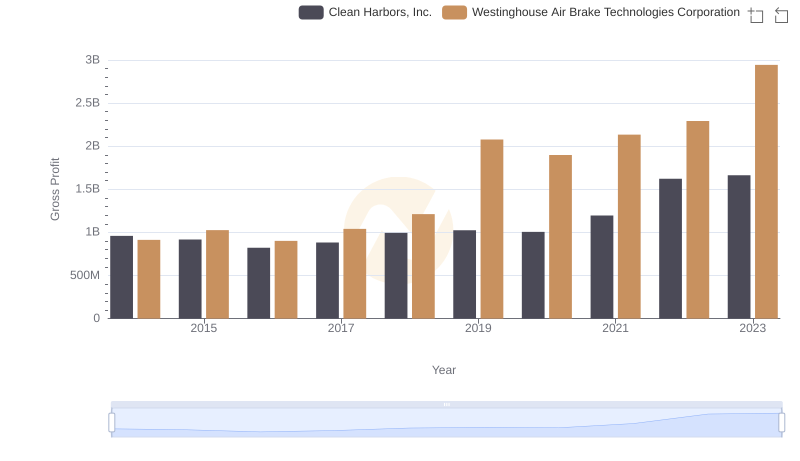

Key Insights on Gross Profit: Westinghouse Air Brake Technologies Corporation vs Clean Harbors, Inc.

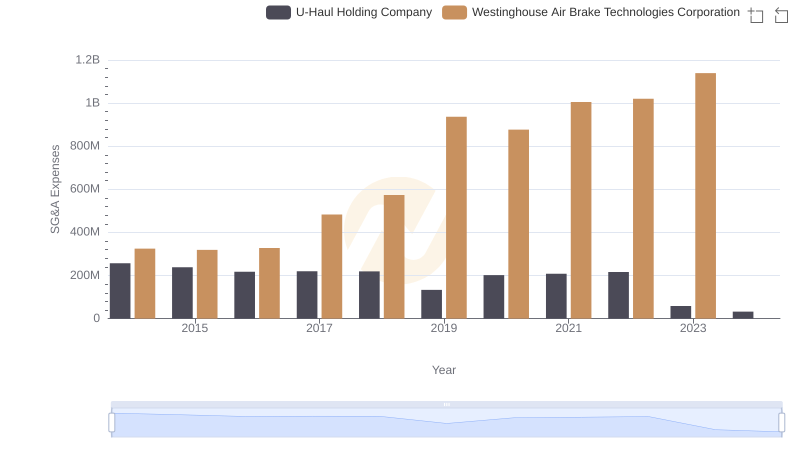

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

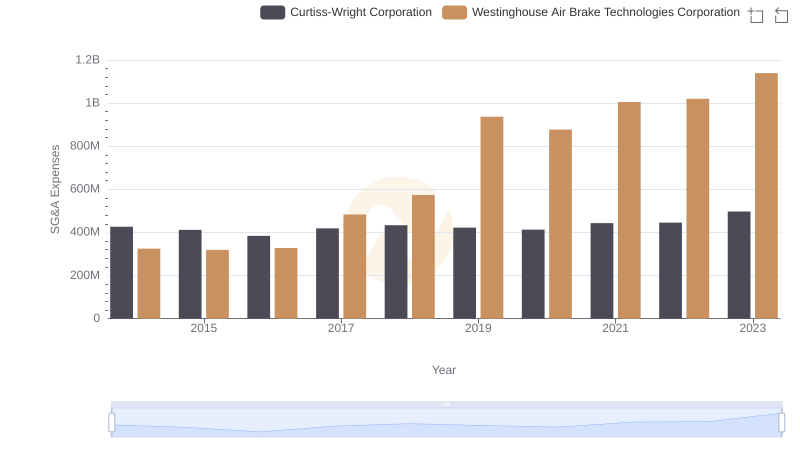

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

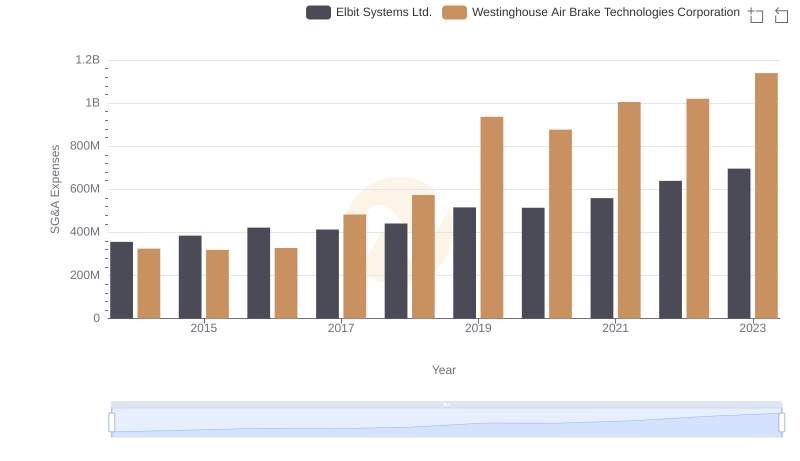

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd. Trends and Insights

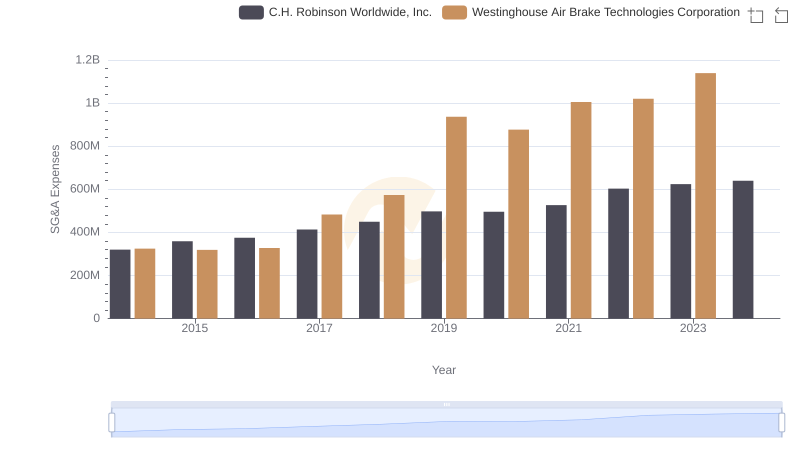

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

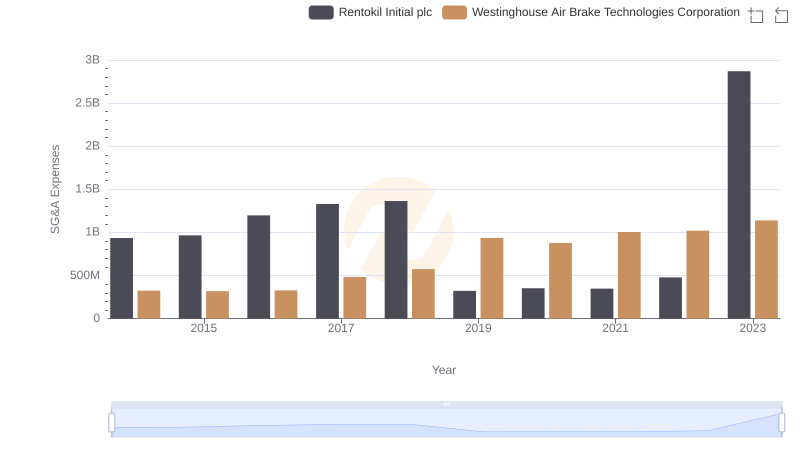

Westinghouse Air Brake Technologies Corporation and Rentokil Initial plc: SG&A Spending Patterns Compared

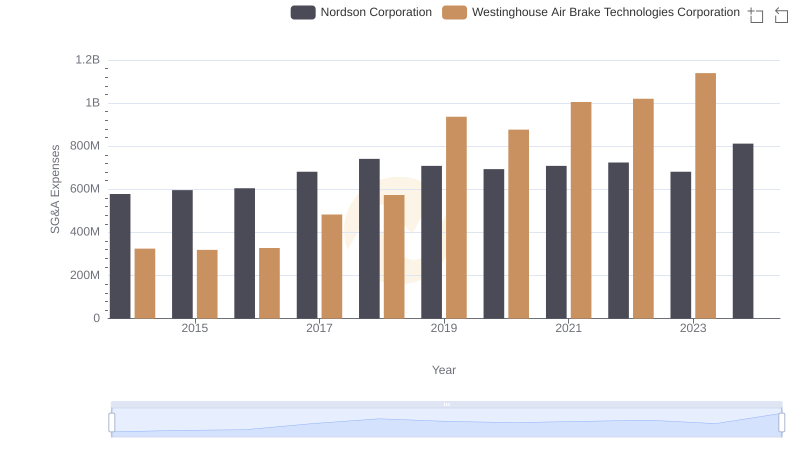

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Nordson Corporation