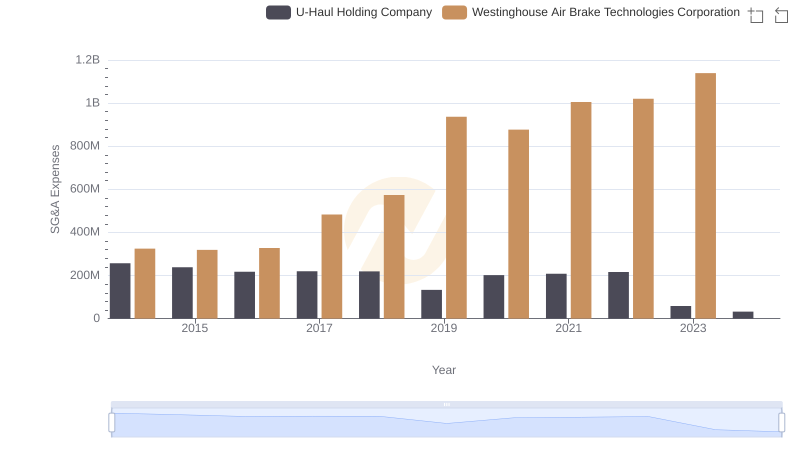

| __timestamp | Nordson Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 577993000 | 324539000 |

| Thursday, January 1, 2015 | 596234000 | 319173000 |

| Friday, January 1, 2016 | 605068000 | 327505000 |

| Sunday, January 1, 2017 | 681299000 | 482852000 |

| Monday, January 1, 2018 | 741408000 | 573644000 |

| Tuesday, January 1, 2019 | 708990000 | 936600000 |

| Wednesday, January 1, 2020 | 693552000 | 877100000 |

| Friday, January 1, 2021 | 708953000 | 1005000000 |

| Saturday, January 1, 2022 | 724176000 | 1020000000 |

| Sunday, January 1, 2023 | 681244000 | 1139000000 |

| Monday, January 1, 2024 | 812128000 | 1248000000 |

Unleashing the power of data

In the competitive landscape of industrial manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Nordson Corporation and Westinghouse Air Brake Technologies Corporation have showcased distinct trajectories in their SG&A spending.

From 2014 to 2023, Nordson Corporation maintained a relatively stable SG&A expense, averaging around 680 million annually. Notably, 2024 projections suggest a significant increase of approximately 19%, indicating potential strategic shifts or expansions.

Conversely, Westinghouse Air Brake Technologies Corporation exhibited a more volatile pattern. Starting at 320 million in 2014, their SG&A expenses surged by over 250% by 2023, peaking at 1.14 billion. This dramatic rise could reflect aggressive growth strategies or increased operational complexities.

While Nordson's 2024 data is available, Westinghouse's is notably absent, leaving room for speculation on their future financial strategies.

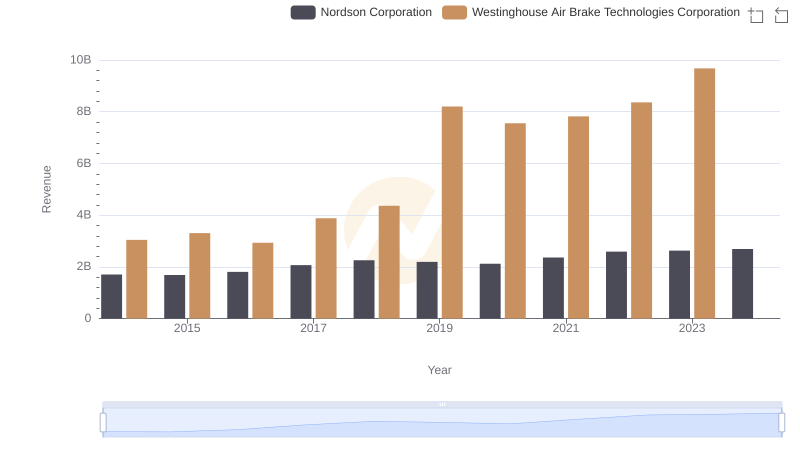

Annual Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Nordson Corporation

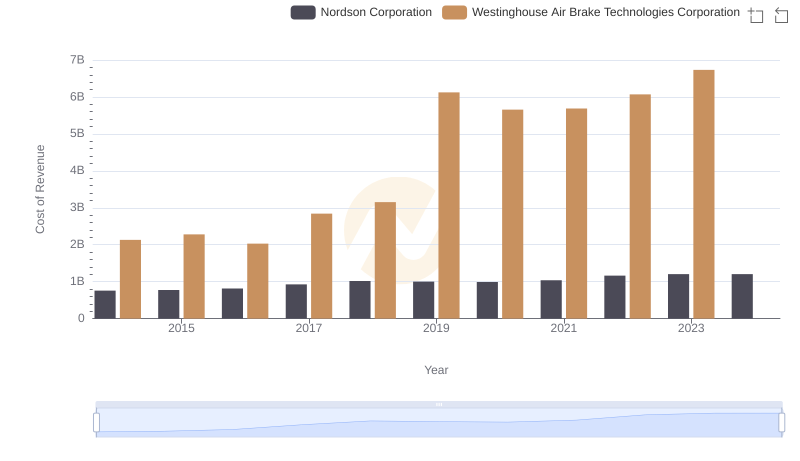

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Nordson Corporation's Expenses

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

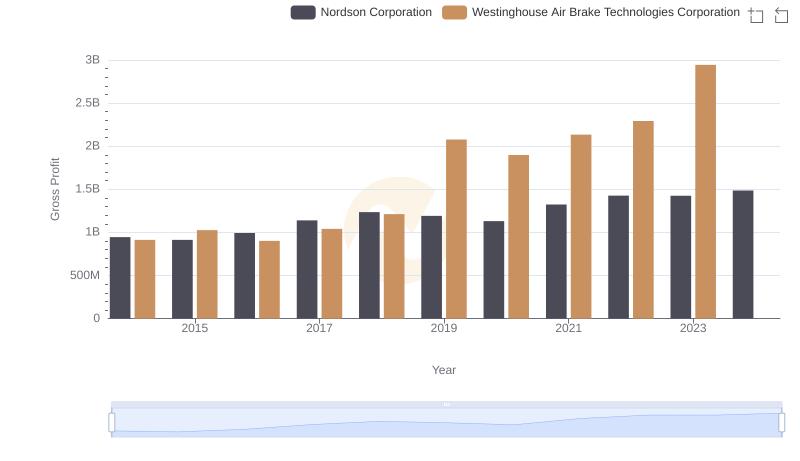

Westinghouse Air Brake Technologies Corporation vs Nordson Corporation: A Gross Profit Performance Breakdown

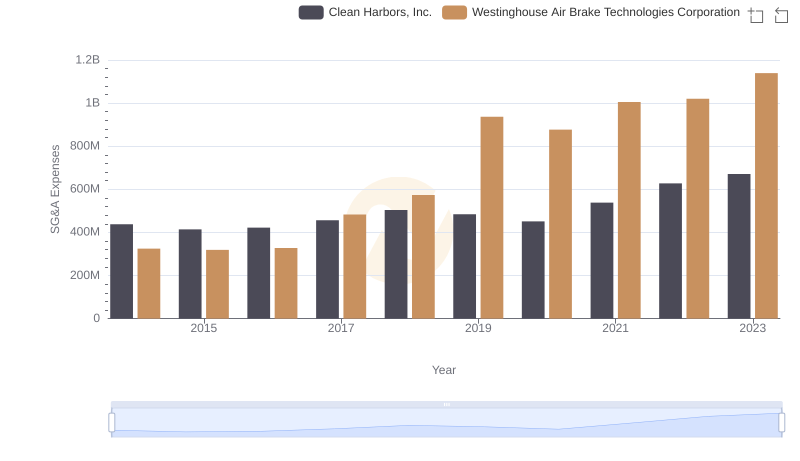

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Clean Harbors, Inc.

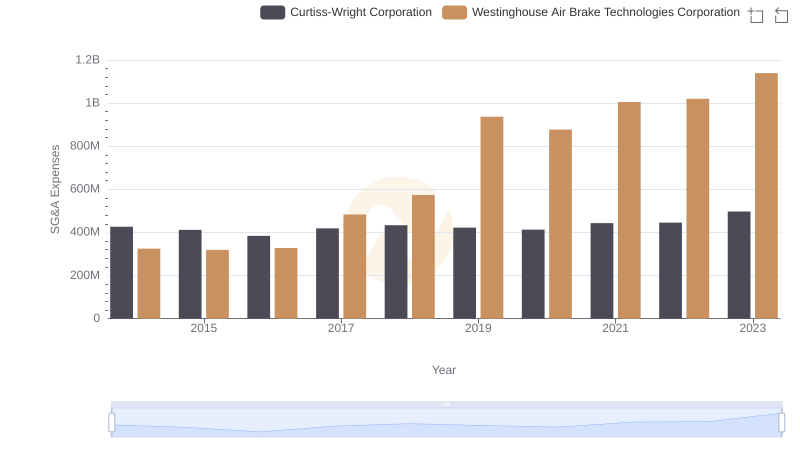

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

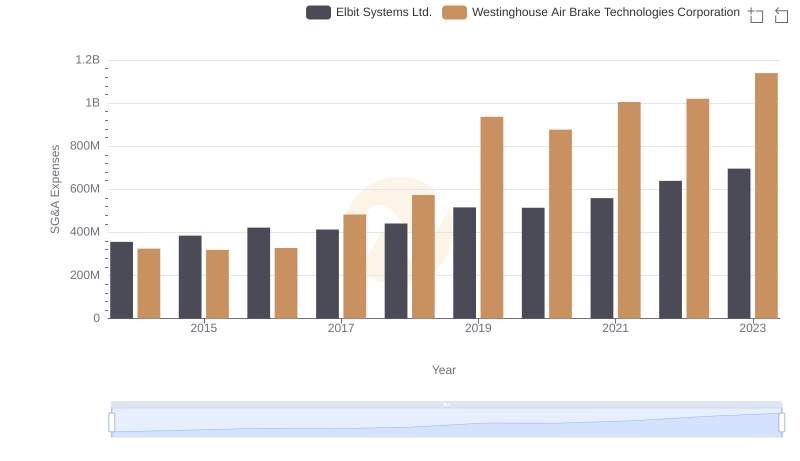

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd. Trends and Insights

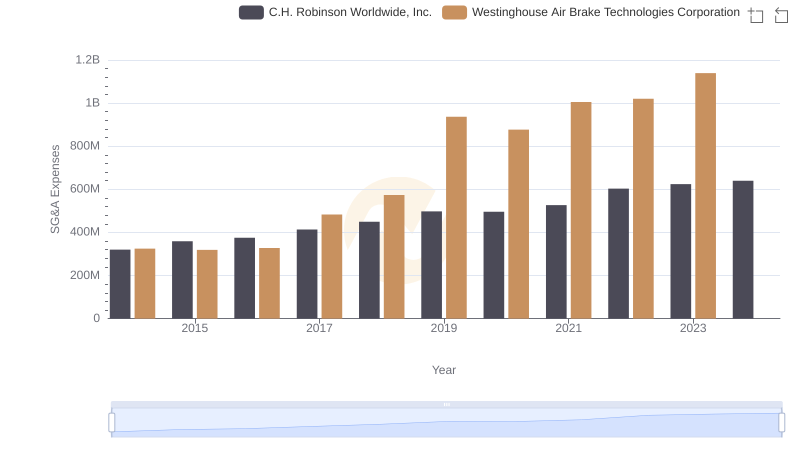

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

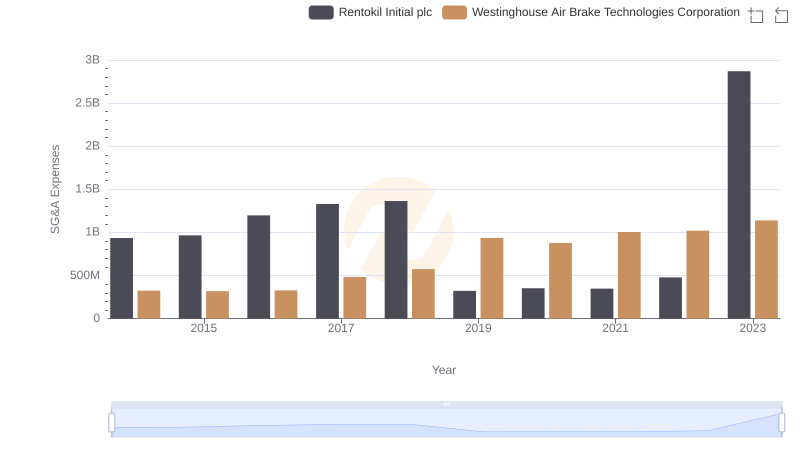

Westinghouse Air Brake Technologies Corporation and Rentokil Initial plc: SG&A Spending Patterns Compared

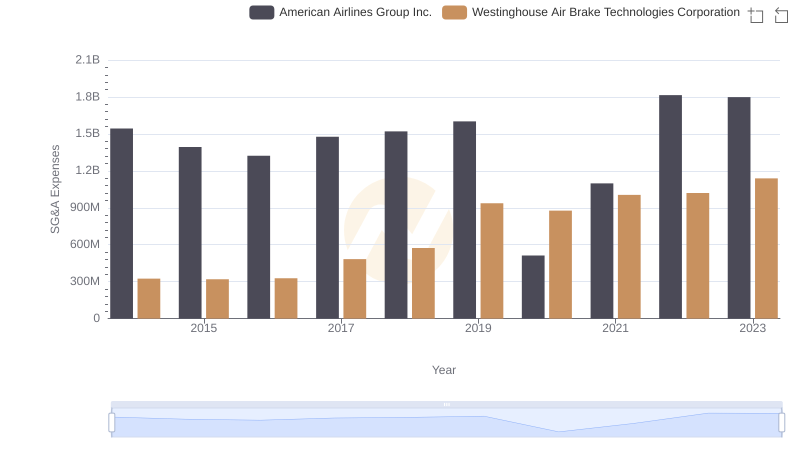

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and American Airlines Group Inc.