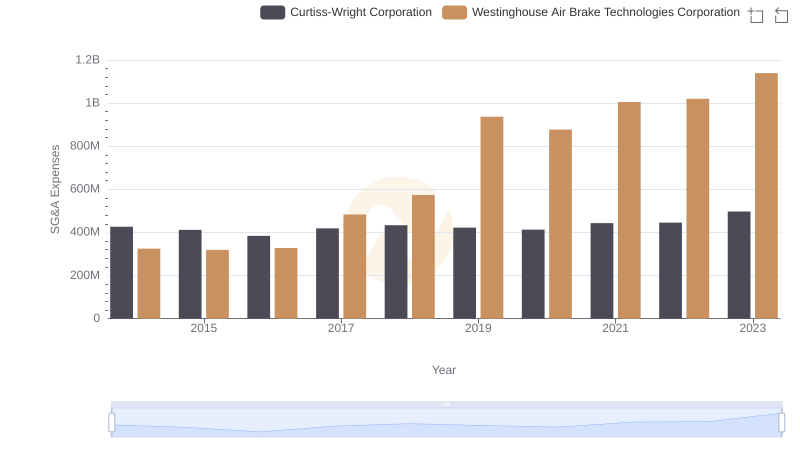

| __timestamp | Curtiss-Wright Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 401669000 | 588370000 |

| Thursday, January 1, 2015 | 412042000 | 672301000 |

| Friday, January 1, 2016 | 405217000 | 535893000 |

| Sunday, January 1, 2017 | 441085000 | 532795000 |

| Monday, January 1, 2018 | 493171000 | 584199000 |

| Tuesday, January 1, 2019 | 530221000 | 1067300000 |

| Wednesday, January 1, 2020 | 414499000 | 1229400000 |

| Friday, January 1, 2021 | 509134000 | 1405000000 |

| Saturday, January 1, 2022 | 548202000 | 1519000000 |

| Sunday, January 1, 2023 | 630635000 | 1787000000 |

| Monday, January 1, 2024 | 674592000 | 1609000000 |

Igniting the spark of knowledge

In the competitive landscape of industrial technology, Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation have showcased remarkable financial trajectories over the past decade. From 2014 to 2023, Westinghouse's EBITDA surged by approximately 204%, reaching a peak in 2023. This growth reflects its strategic expansions and robust market positioning. In contrast, Curtiss-Wright demonstrated a steady increase of about 57% in the same period, highlighting its consistent operational efficiency.

This analysis provides a clear view of how these industrial giants have navigated economic challenges and opportunities, setting the stage for future financial strategies.

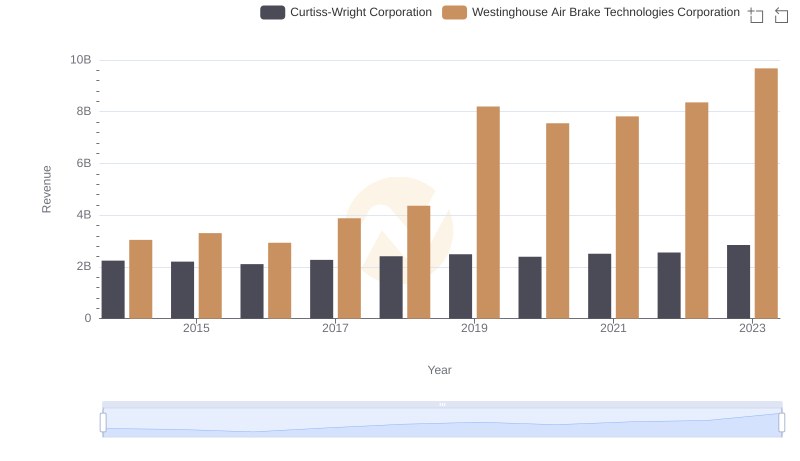

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or Curtiss-Wright Corporation

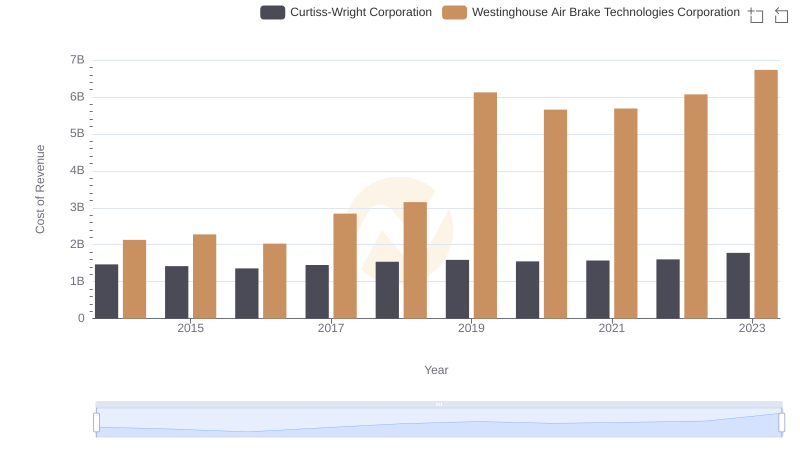

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: Efficiency in Cost of Revenue Explored

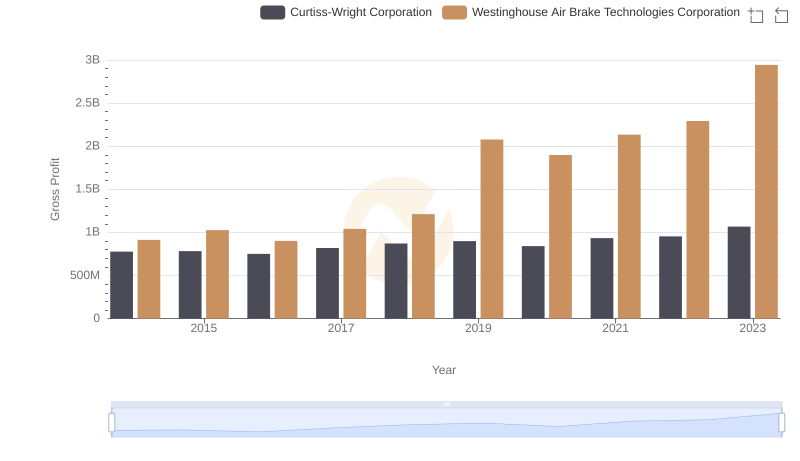

Westinghouse Air Brake Technologies Corporation vs Curtiss-Wright Corporation: A Gross Profit Performance Breakdown

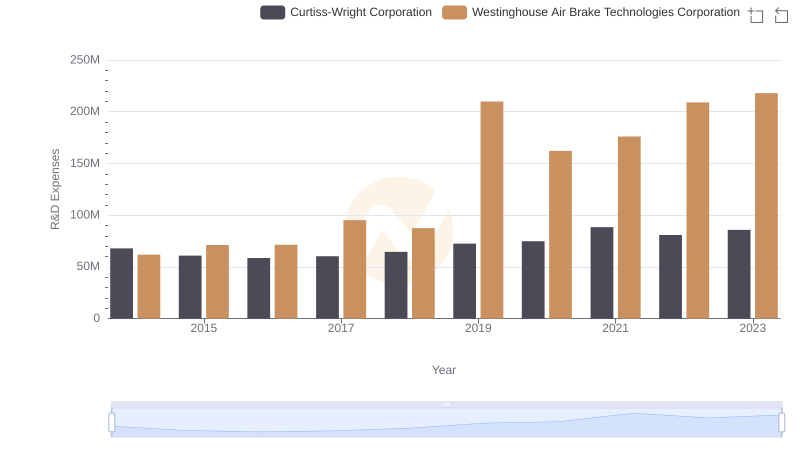

R&D Insights: How Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation Allocate Funds

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

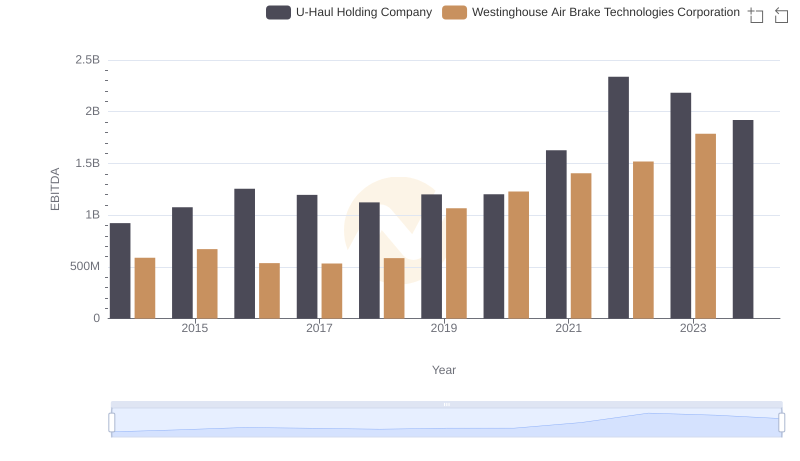

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company

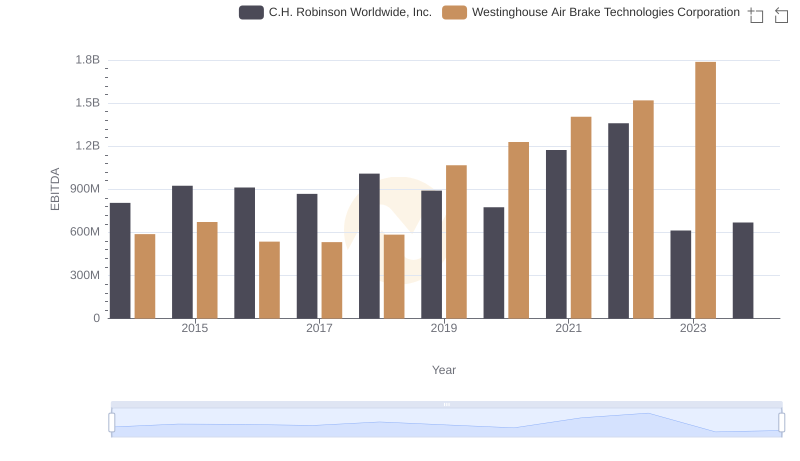

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs C.H. Robinson Worldwide, Inc.