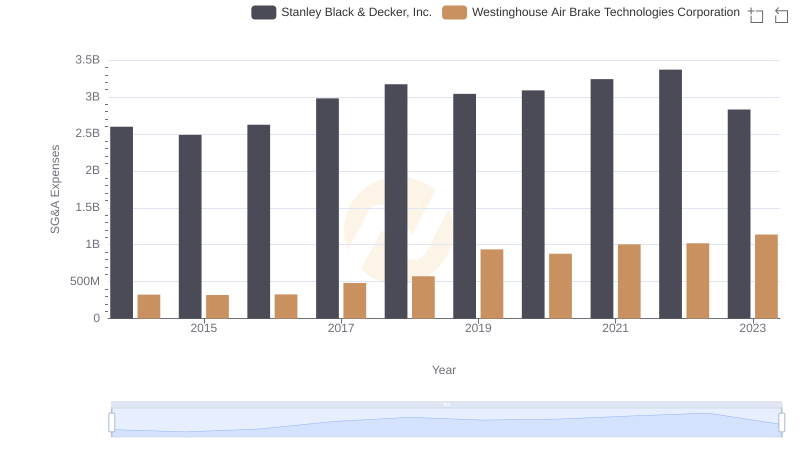

| __timestamp | Elbit Systems Ltd. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 356171000 | 324539000 |

| Thursday, January 1, 2015 | 385059000 | 319173000 |

| Friday, January 1, 2016 | 422390000 | 327505000 |

| Sunday, January 1, 2017 | 413560000 | 482852000 |

| Monday, January 1, 2018 | 441362000 | 573644000 |

| Tuesday, January 1, 2019 | 516149000 | 936600000 |

| Wednesday, January 1, 2020 | 514638000 | 877100000 |

| Friday, January 1, 2021 | 559113000 | 1005000000 |

| Saturday, January 1, 2022 | 639067000 | 1020000000 |

| Sunday, January 1, 2023 | 696022000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of global industries, understanding the financial strategies of leading companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd. over the past decade.

From 2014 to 2023, Westinghouse Air Brake Technologies Corporation saw a staggering 250% increase in SG&A expenses, peaking at $1.14 billion in 2023. This growth reflects strategic investments in operational efficiency and market expansion. In contrast, Elbit Systems Ltd. experienced a more modest 95% rise, reaching $696 million in 2023. This steady growth indicates a focus on sustainable development and cost management.

These trends highlight differing financial strategies, with Westinghouse prioritizing aggressive growth and Elbit Systems focusing on stability. Investors and analysts should consider these insights when evaluating potential opportunities in these sectors.

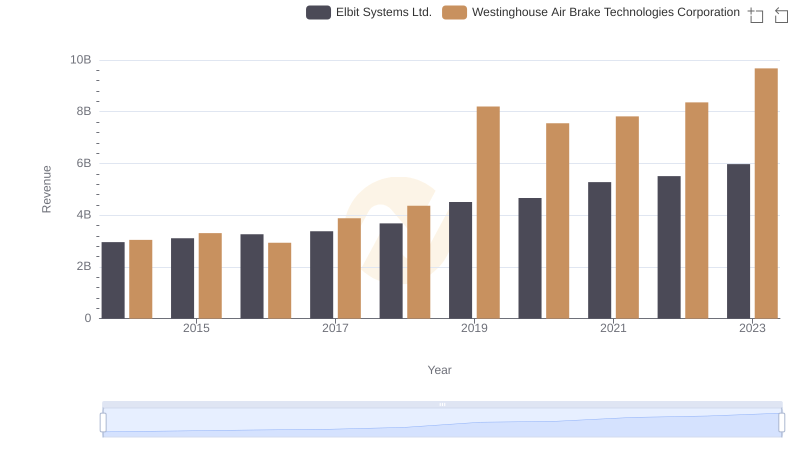

Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd.: A Comprehensive Revenue Analysis

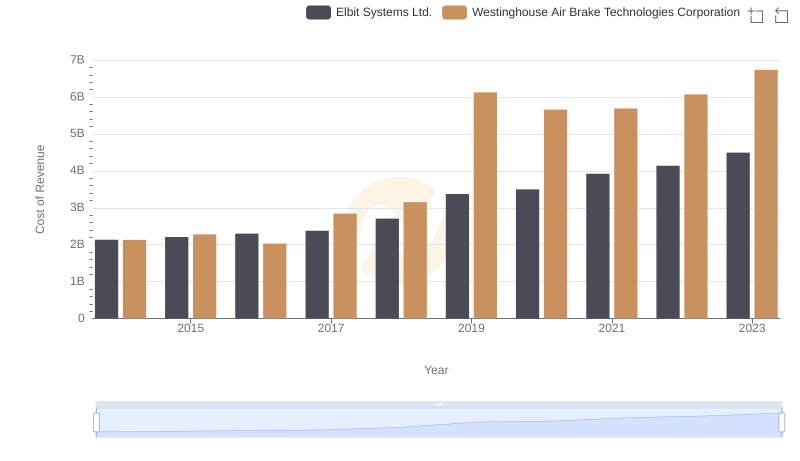

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd.

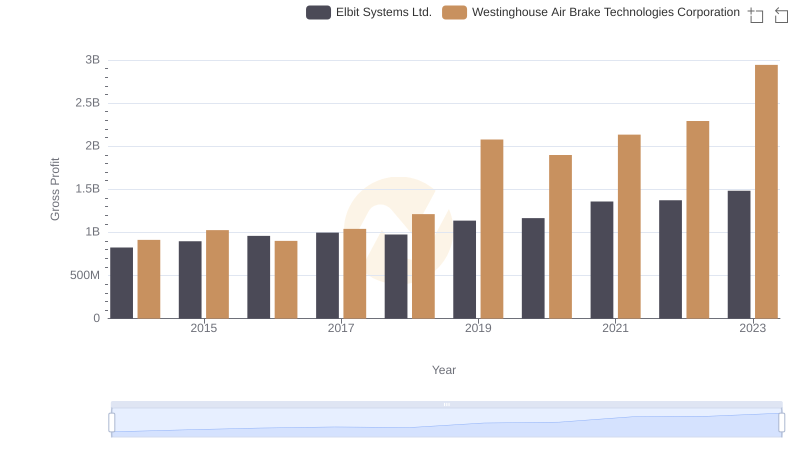

Westinghouse Air Brake Technologies Corporation and Elbit Systems Ltd.: A Detailed Gross Profit Analysis

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

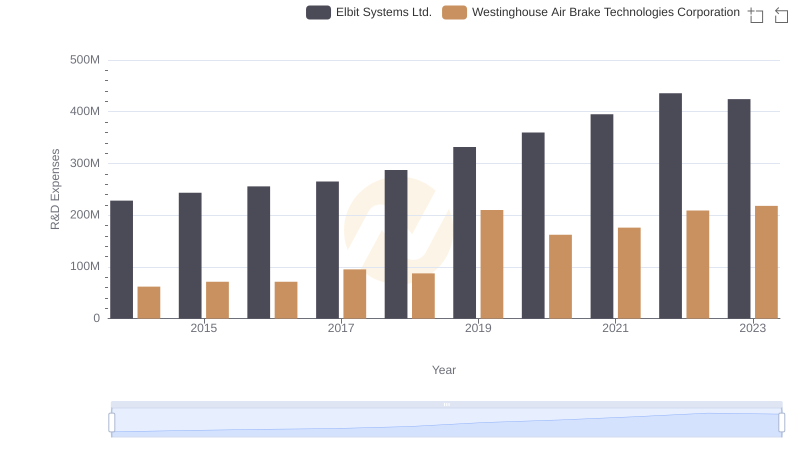

Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd.: Strategic Focus on R&D Spending

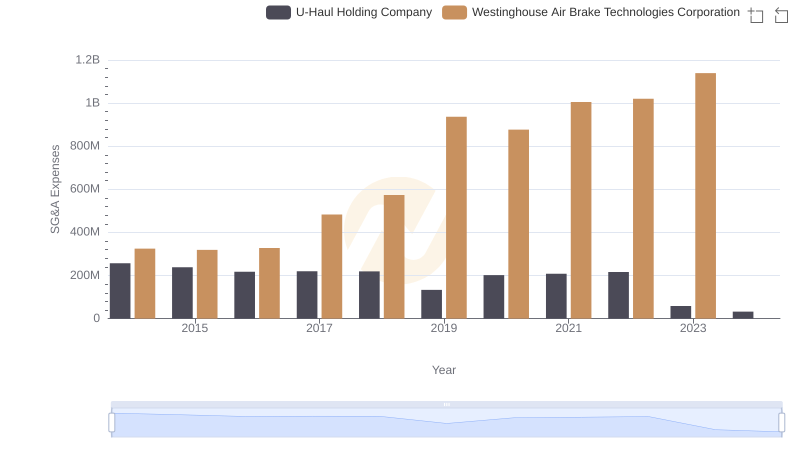

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

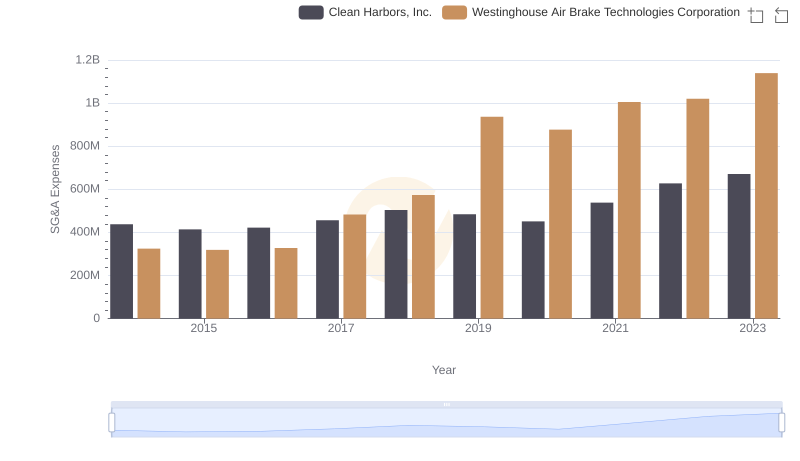

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Clean Harbors, Inc.

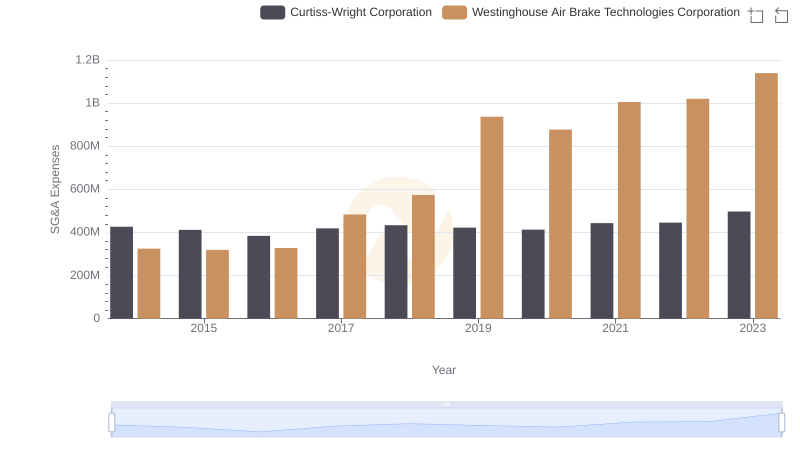

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

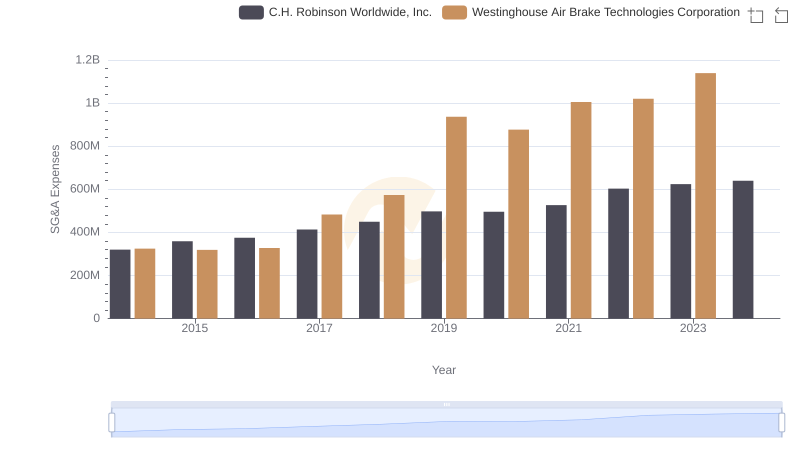

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

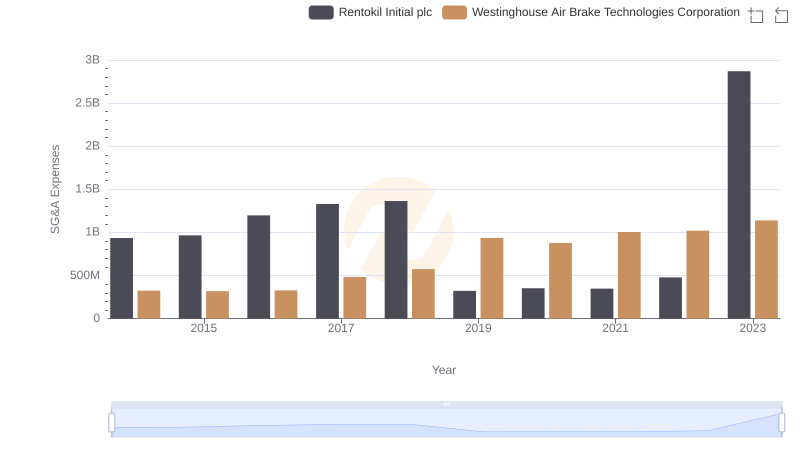

Westinghouse Air Brake Technologies Corporation and Rentokil Initial plc: SG&A Spending Patterns Compared

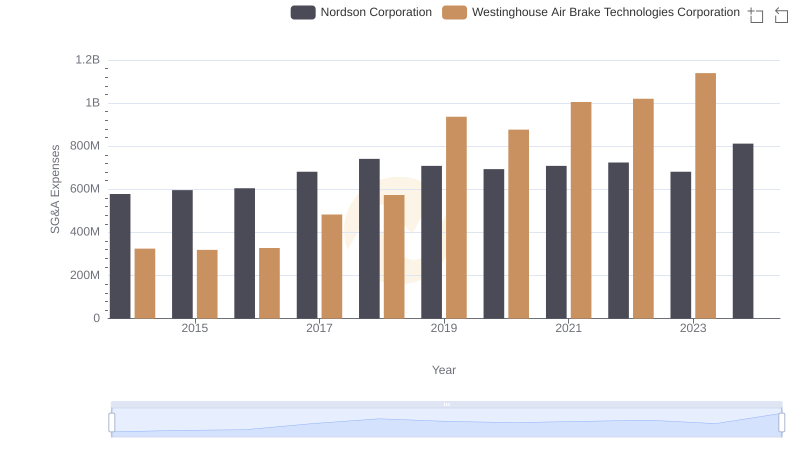

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Nordson Corporation