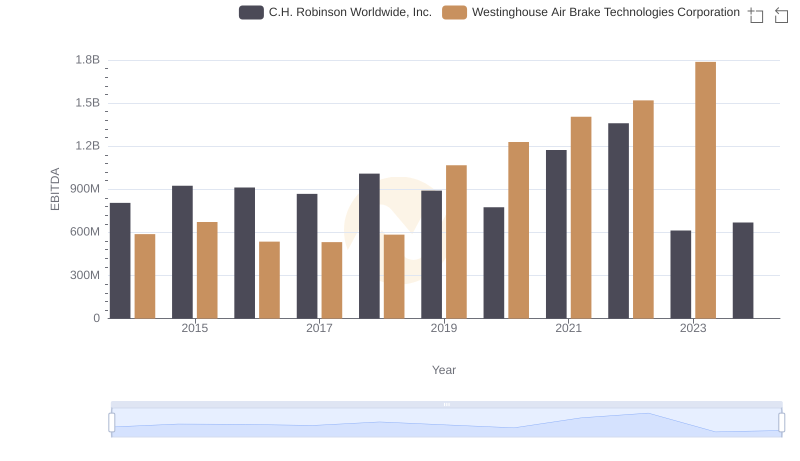

| __timestamp | C.H. Robinson Worldwide, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 324539000 |

| Thursday, January 1, 2015 | 358760000 | 319173000 |

| Friday, January 1, 2016 | 375061000 | 327505000 |

| Sunday, January 1, 2017 | 413404000 | 482852000 |

| Monday, January 1, 2018 | 449610000 | 573644000 |

| Tuesday, January 1, 2019 | 497806000 | 936600000 |

| Wednesday, January 1, 2020 | 496122000 | 877100000 |

| Friday, January 1, 2021 | 526371000 | 1005000000 |

| Saturday, January 1, 2022 | 603415000 | 1020000000 |

| Sunday, January 1, 2023 | 624266000 | 1139000000 |

| Monday, January 1, 2024 | 639624000 | 1248000000 |

Infusing magic into the data realm

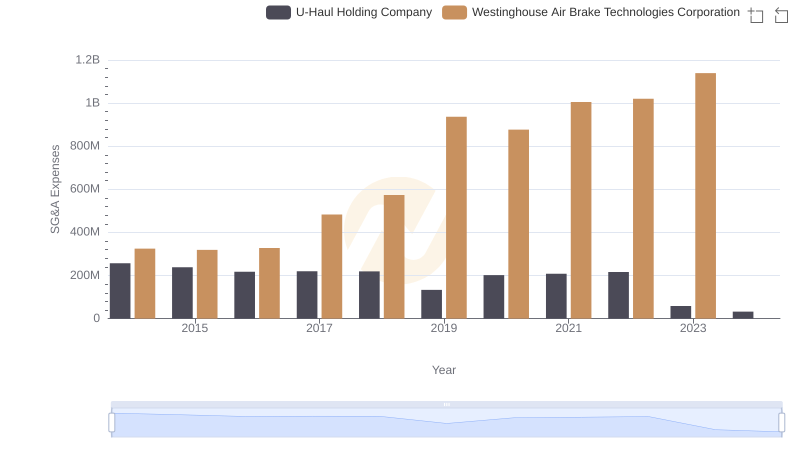

In the ever-evolving landscape of corporate America, understanding the spending patterns of industry leaders can offer valuable insights. Over the past decade, C.H. Robinson Worldwide, Inc. and Westinghouse Air Brake Technologies Corporation have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, C.H. Robinson's SG&A expenses grew by approximately 100%, reflecting a strategic expansion in their operations. In contrast, Westinghouse Air Brake Technologies saw a staggering 250% increase, peaking in 2023. This surge underscores their aggressive growth strategy and market adaptation.

Interestingly, while C.H. Robinson maintained a steady upward trajectory, Westinghouse's expenses fluctuated more dramatically, hinting at potential strategic pivots or market challenges. The absence of data for Westinghouse in 2024 leaves room for speculation on their future direction.

These patterns not only highlight the companies' strategic priorities but also offer a glimpse into the broader economic forces at play.

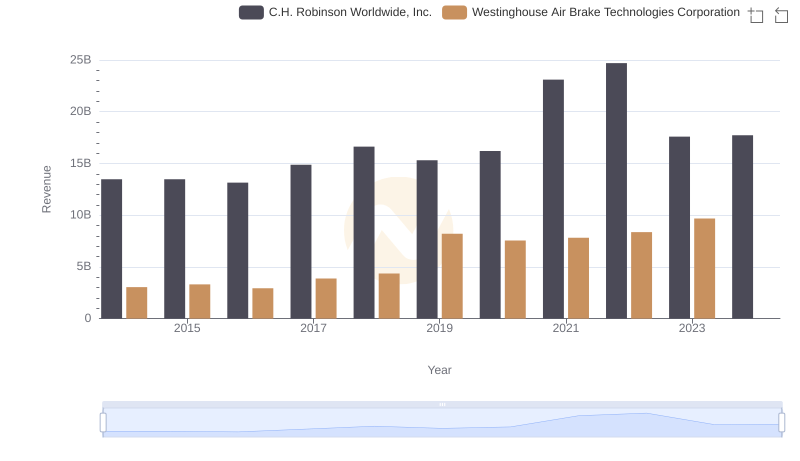

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs C.H. Robinson Worldwide, Inc.

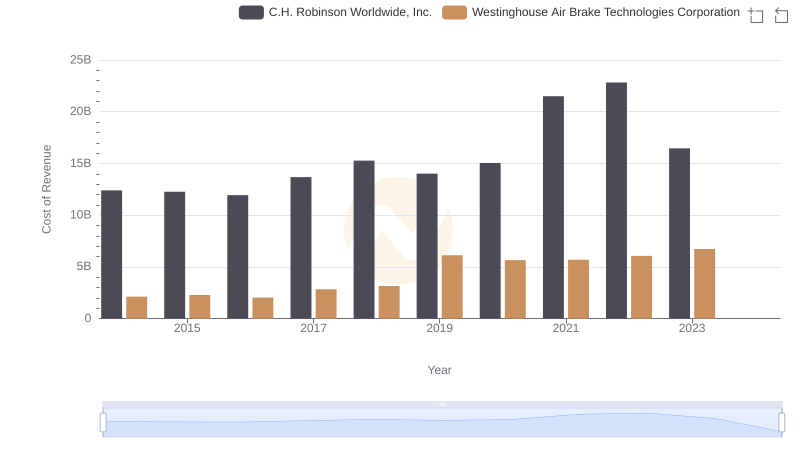

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.

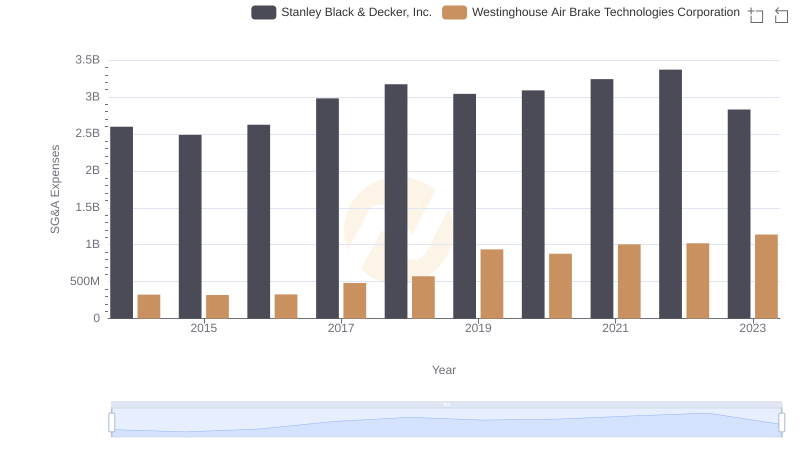

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

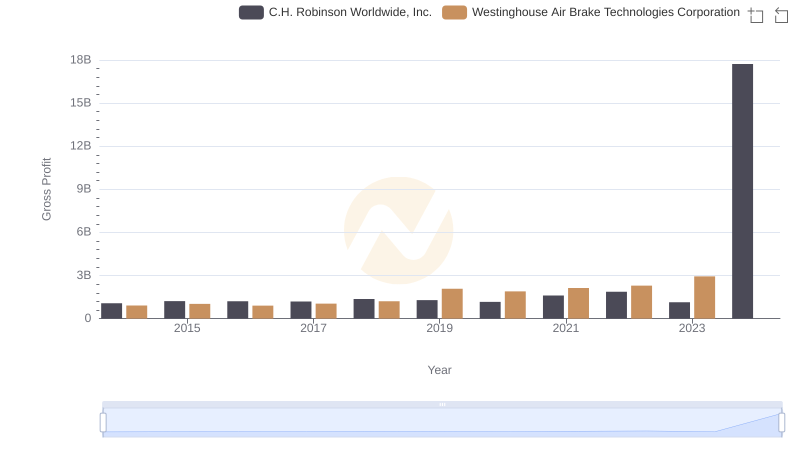

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: A Detailed Gross Profit Analysis

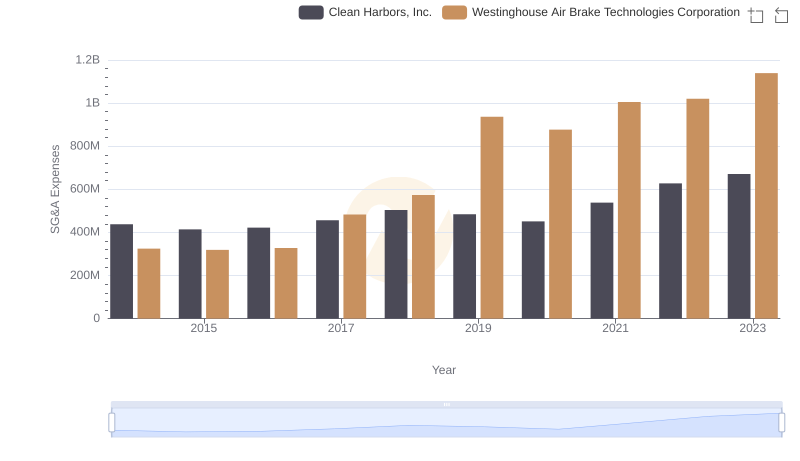

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Clean Harbors, Inc.

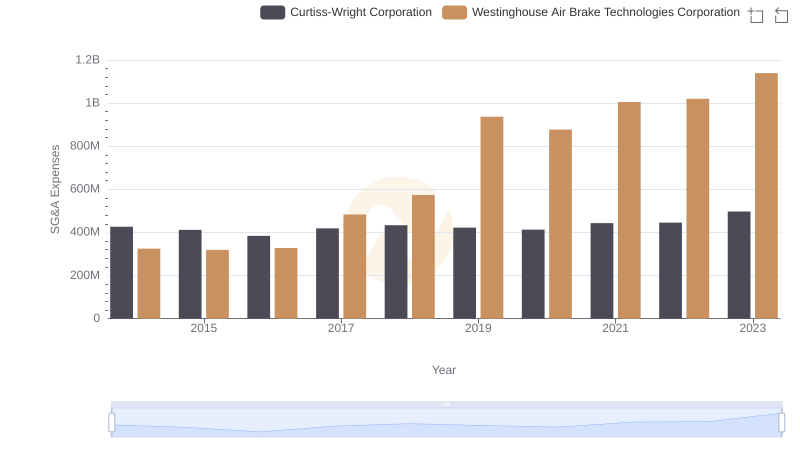

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

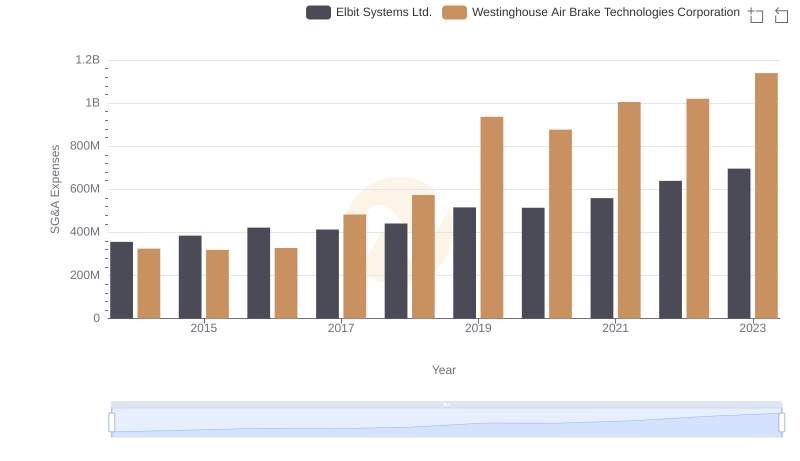

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd. Trends and Insights

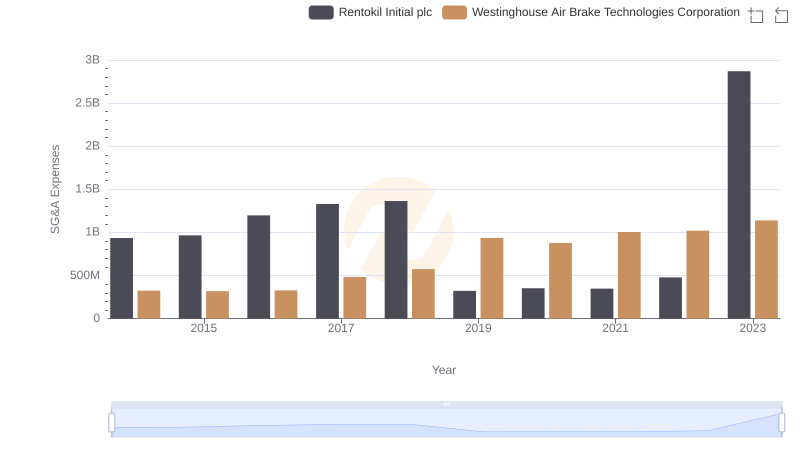

Westinghouse Air Brake Technologies Corporation and Rentokil Initial plc: SG&A Spending Patterns Compared

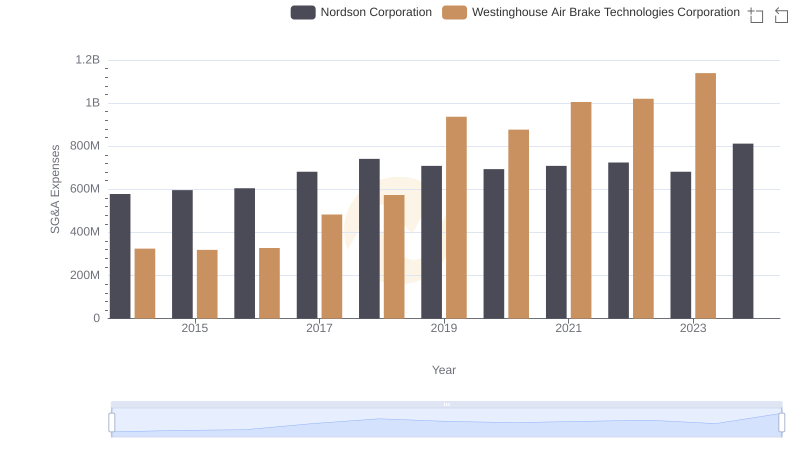

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Nordson Corporation

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs C.H. Robinson Worldwide, Inc.