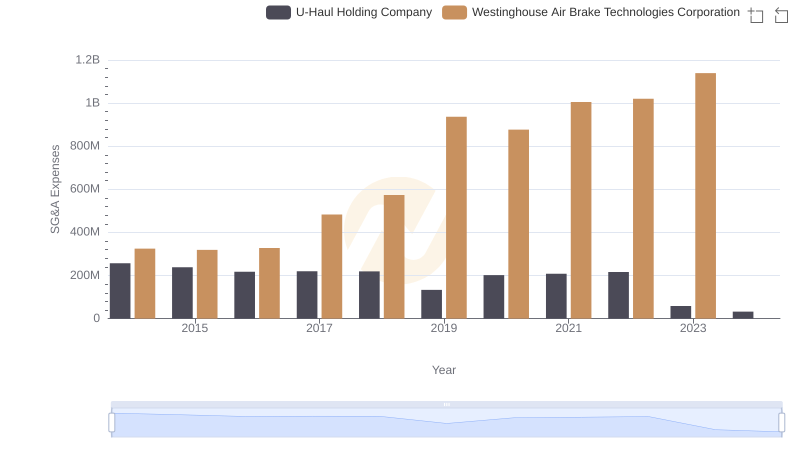

| __timestamp | Rentokil Initial plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 935700000 | 324539000 |

| Thursday, January 1, 2015 | 965700000 | 319173000 |

| Friday, January 1, 2016 | 1197600000 | 327505000 |

| Sunday, January 1, 2017 | 1329600000 | 482852000 |

| Monday, January 1, 2018 | 1364000000 | 573644000 |

| Tuesday, January 1, 2019 | 322500000 | 936600000 |

| Wednesday, January 1, 2020 | 352000000 | 877100000 |

| Friday, January 1, 2021 | 348600000 | 1005000000 |

| Saturday, January 1, 2022 | 479000000 | 1020000000 |

| Sunday, January 1, 2023 | 2870000000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

In pursuit of knowledge

In the world of corporate finance, understanding a company's spending patterns can reveal much about its strategic priorities. This analysis compares the Selling, General, and Administrative (SG&A) expenses of two industry giants: Rentokil Initial plc and Westinghouse Air Brake Technologies Corporation, from 2014 to 2023.

Rentokil Initial plc, a leader in pest control and hygiene services, has seen its SG&A expenses grow by approximately 200% over the past decade, peaking in 2023. This surge reflects its aggressive expansion and market consolidation strategies. In contrast, Westinghouse Air Brake Technologies Corporation, a key player in the rail industry, has maintained a more stable SG&A spending pattern, with a modest increase of around 250% over the same period.

These trends highlight the differing strategic approaches of the two companies, with Rentokil focusing on growth and Westinghouse prioritizing operational efficiency. Understanding these patterns provides valuable insights into their future trajectories and market positioning.

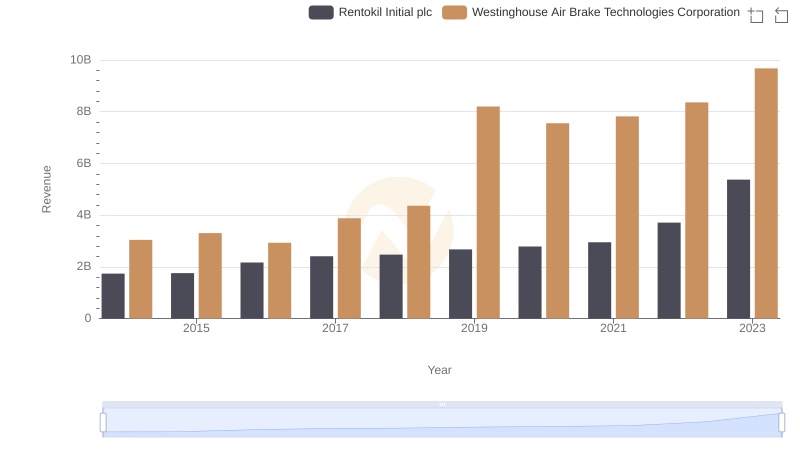

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Rentokil Initial plc Performance Compared

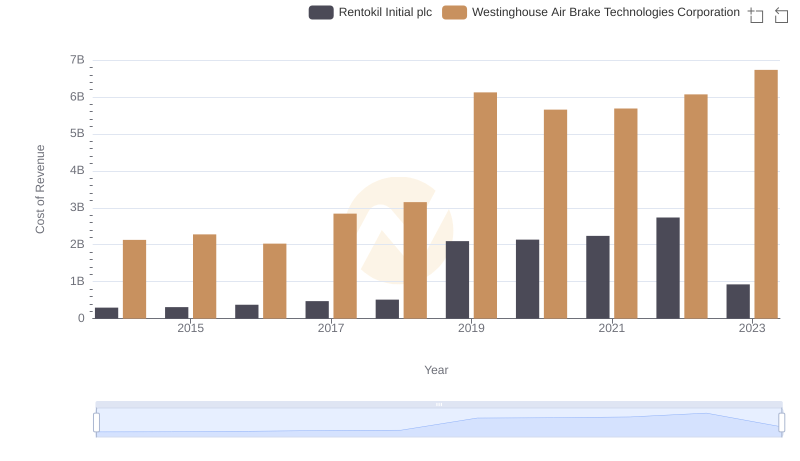

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Rentokil Initial plc

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

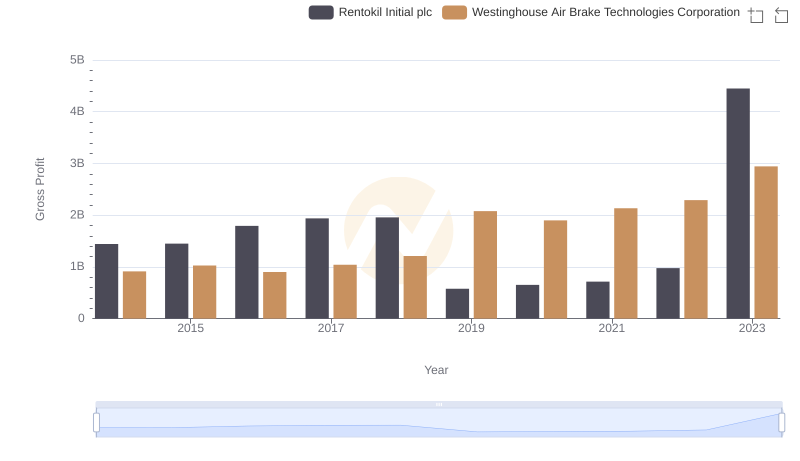

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Rentokil Initial plc

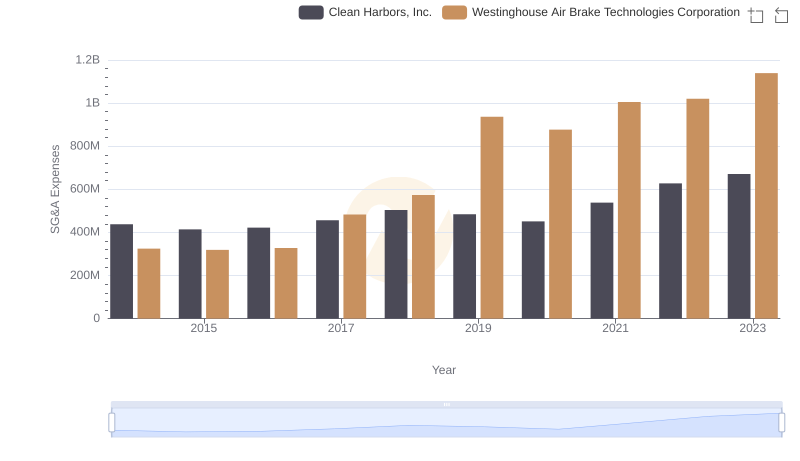

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Clean Harbors, Inc.

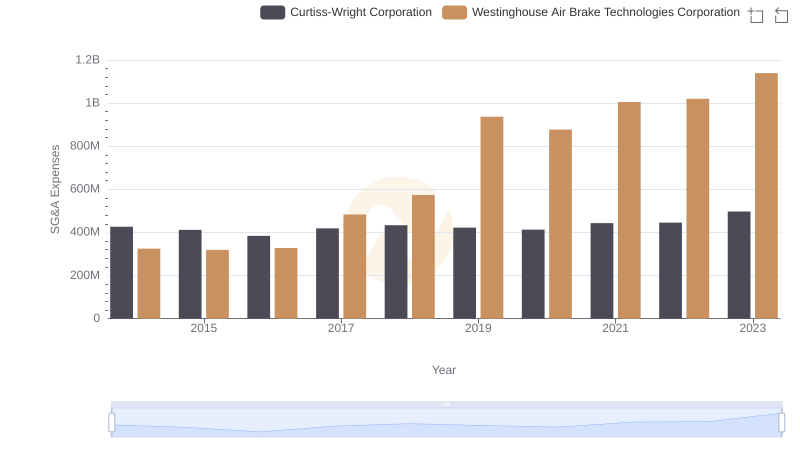

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Curtiss-Wright Corporation

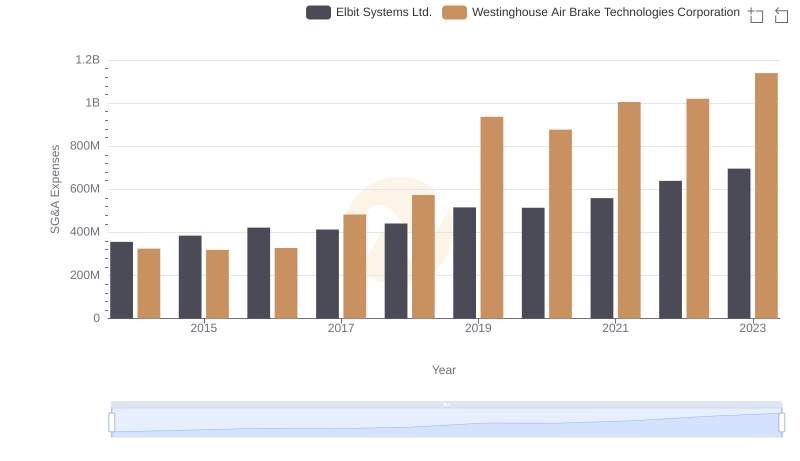

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Elbit Systems Ltd. Trends and Insights

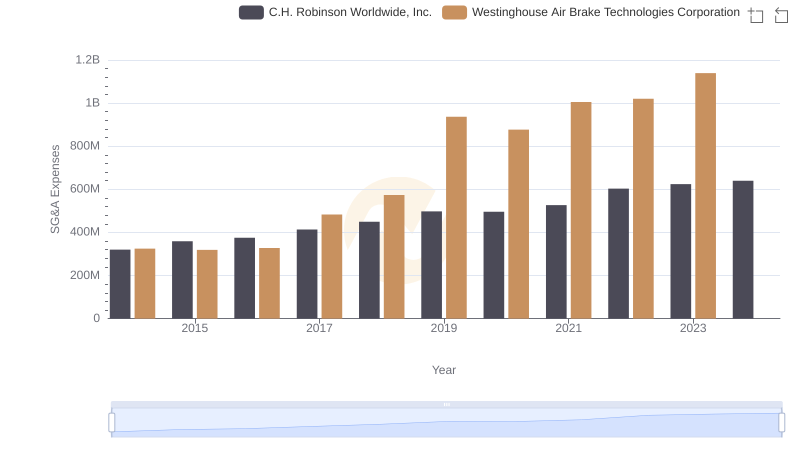

Westinghouse Air Brake Technologies Corporation and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

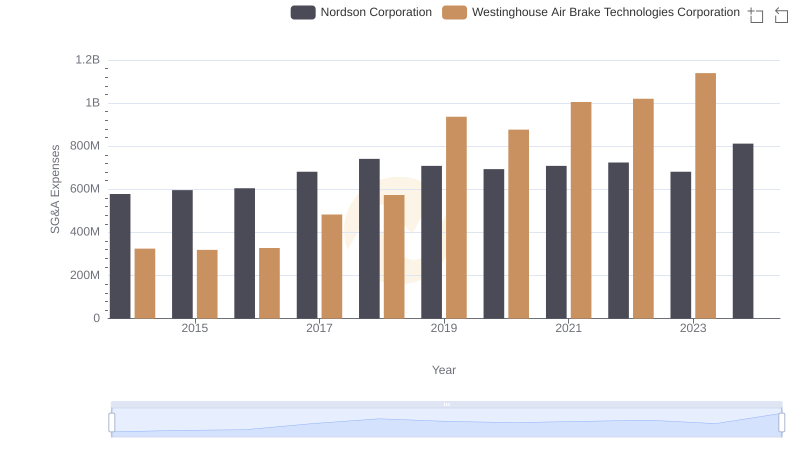

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Nordson Corporation

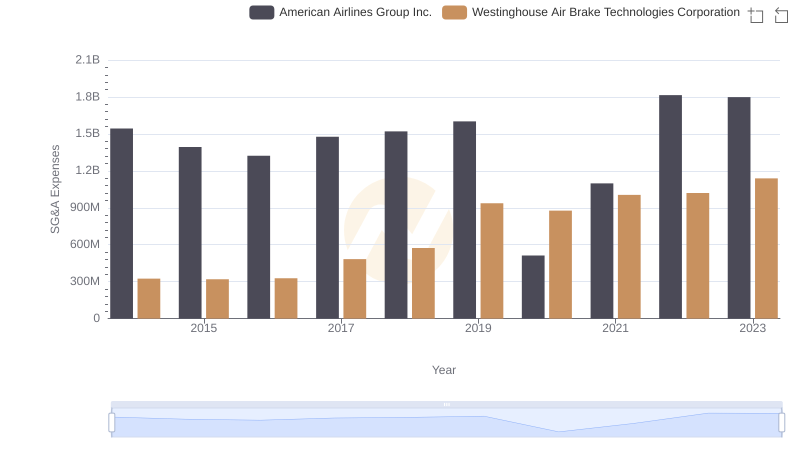

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and American Airlines Group Inc.