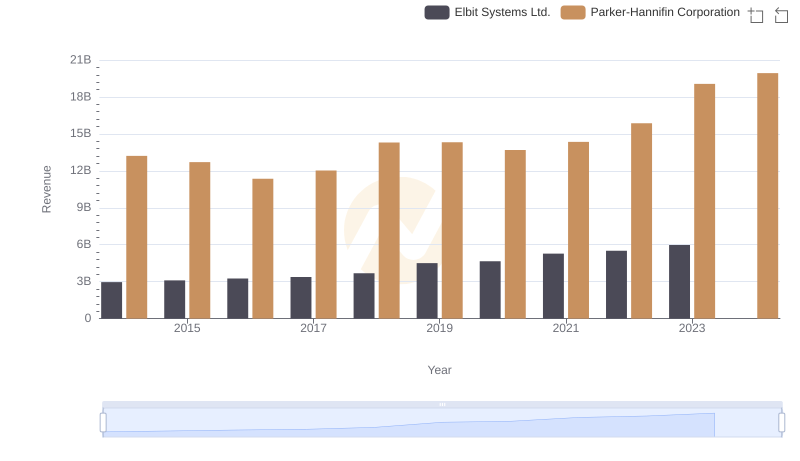

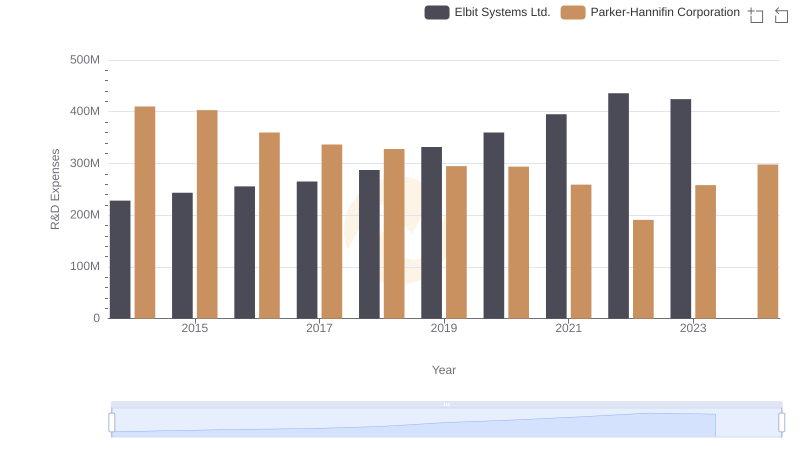

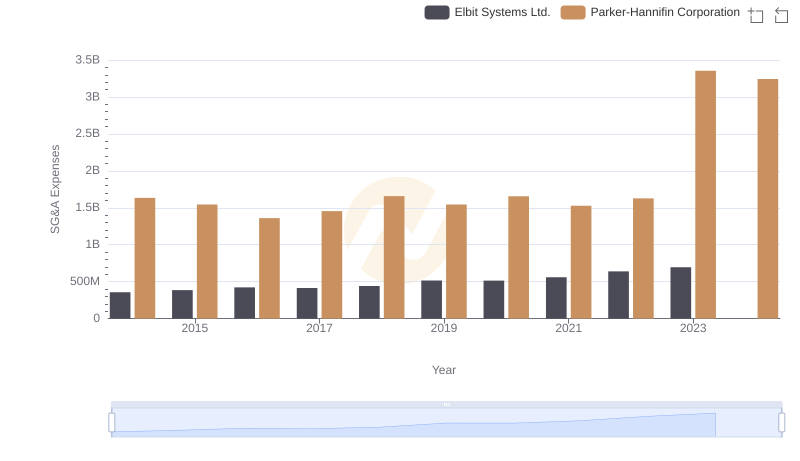

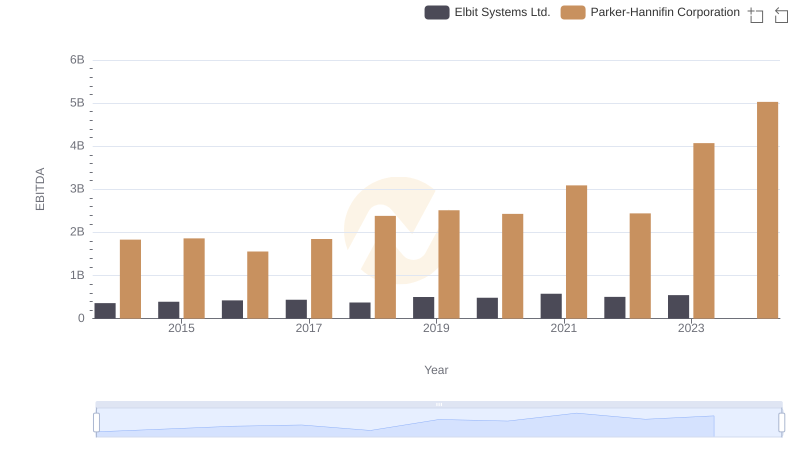

| __timestamp | Elbit Systems Ltd. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 825097000 | 3027744000 |

| Thursday, January 1, 2015 | 897053000 | 3056499000 |

| Friday, January 1, 2016 | 959583000 | 2537369000 |

| Sunday, January 1, 2017 | 997920000 | 2840350000 |

| Monday, January 1, 2018 | 976179000 | 3539551000 |

| Tuesday, January 1, 2019 | 1136467000 | 3616840000 |

| Wednesday, January 1, 2020 | 1165107000 | 3409002000 |

| Friday, January 1, 2021 | 1358048000 | 3897960000 |

| Saturday, January 1, 2022 | 1373283000 | 4474341000 |

| Sunday, January 1, 2023 | 1482954000 | 6429302000 |

| Monday, January 1, 2024 | 7127790000 |

In pursuit of knowledge

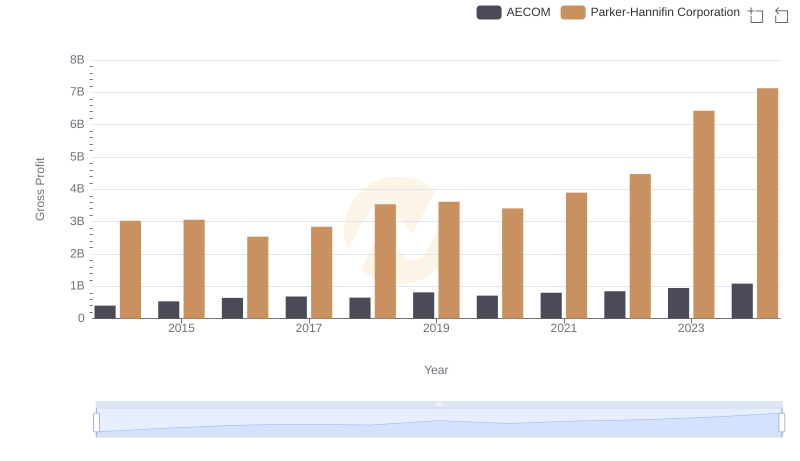

In the world of industrial and defense sectors, Parker-Hannifin Corporation and Elbit Systems Ltd. have carved out significant niches. Over the past decade, Parker-Hannifin has consistently outperformed Elbit Systems in terms of gross profit, showcasing a robust growth trajectory. From 2014 to 2023, Parker-Hannifin's gross profit surged by over 110%, peaking at approximately $6.43 billion in 2023. In contrast, Elbit Systems demonstrated a steady, albeit slower, growth of around 80%, reaching nearly $1.48 billion in the same year.

This comparison highlights Parker-Hannifin's strategic prowess in scaling operations and capturing market share, while Elbit Systems maintains a steady course in the defense sector. The data for 2024 is incomplete, but the trends suggest Parker-Hannifin's continued dominance. Investors and industry watchers should keep an eye on these trends as they reflect broader market dynamics.

Comparing Revenue Performance: Parker-Hannifin Corporation or Elbit Systems Ltd.?

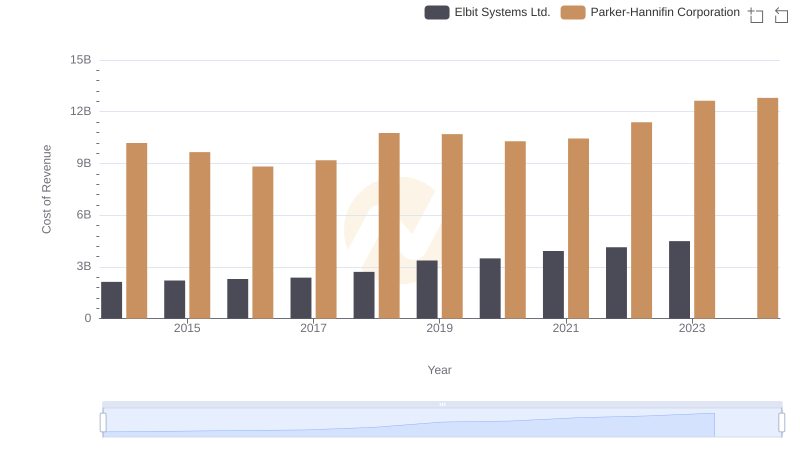

Cost of Revenue Trends: Parker-Hannifin Corporation vs Elbit Systems Ltd.

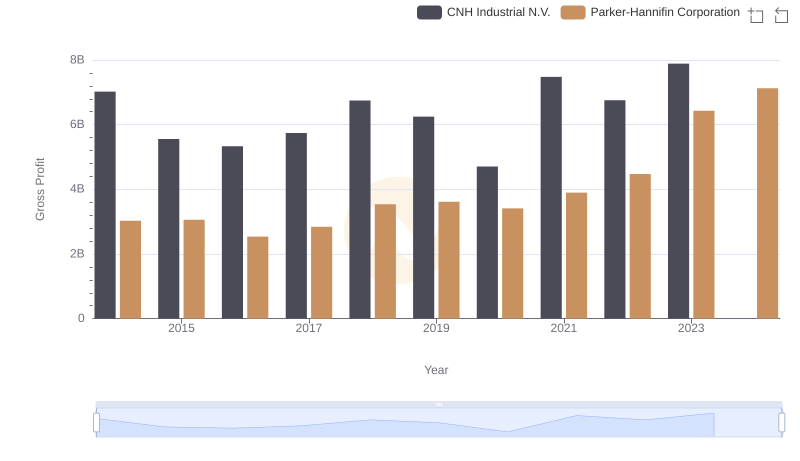

Parker-Hannifin Corporation and CNH Industrial N.V.: A Detailed Gross Profit Analysis

Gross Profit Comparison: Parker-Hannifin Corporation and AECOM Trends

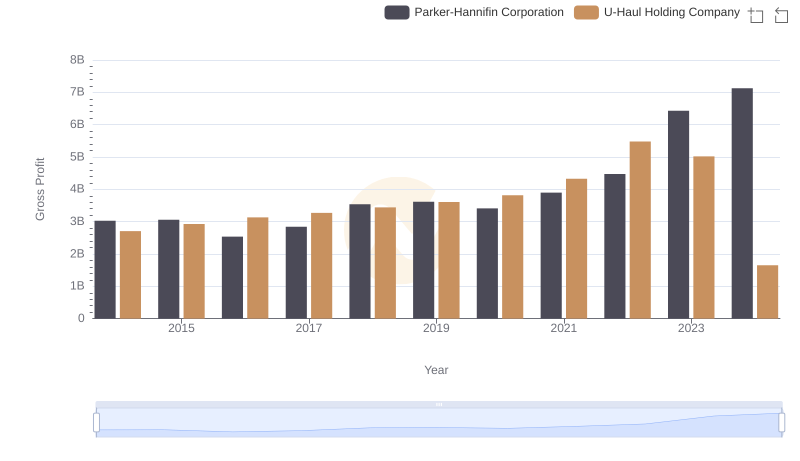

Gross Profit Trends Compared: Parker-Hannifin Corporation vs U-Haul Holding Company

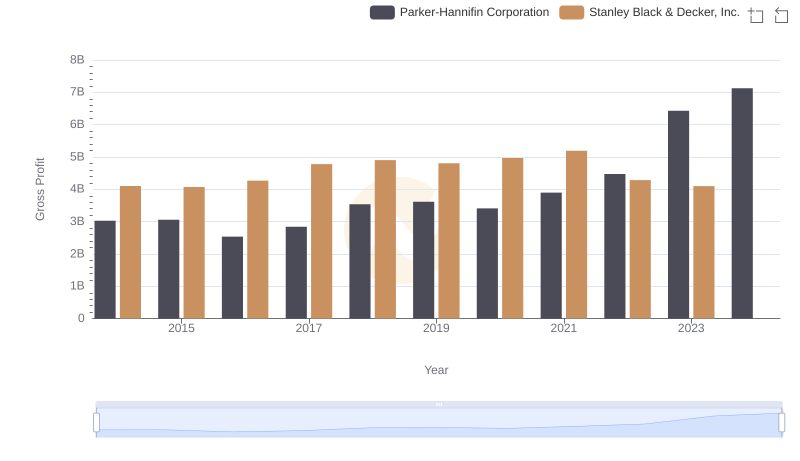

Gross Profit Comparison: Parker-Hannifin Corporation and Stanley Black & Decker, Inc. Trends

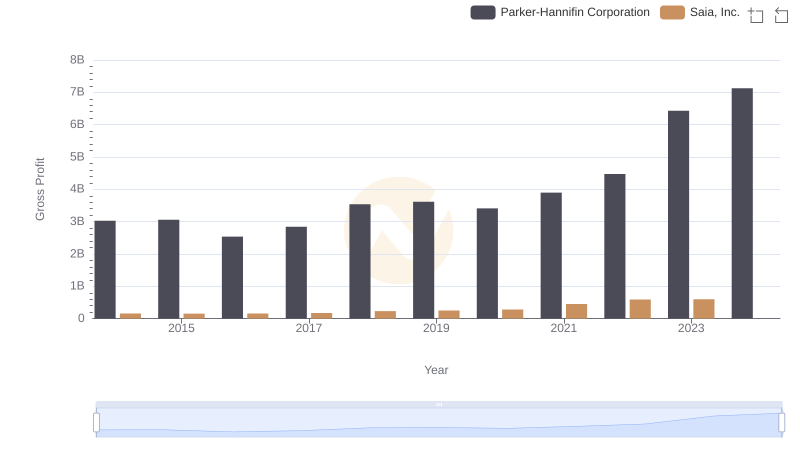

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Saia, Inc.

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Curtiss-Wright Corporation

Parker-Hannifin Corporation vs Elbit Systems Ltd.: Strategic Focus on R&D Spending

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Elbit Systems Ltd.

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs Elbit Systems Ltd.