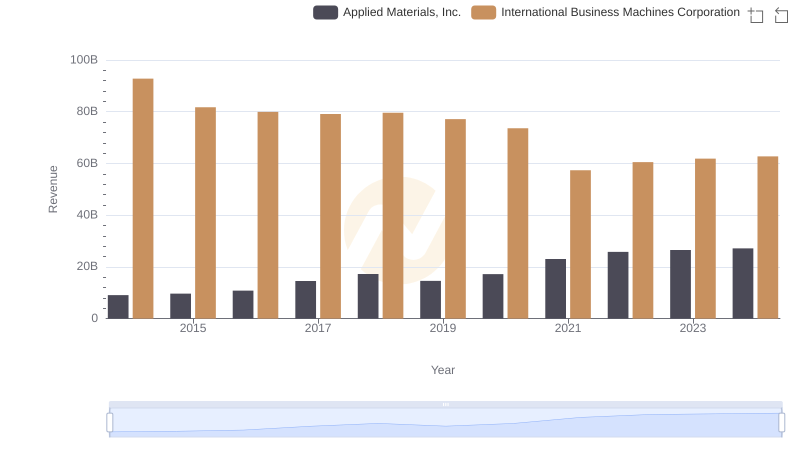

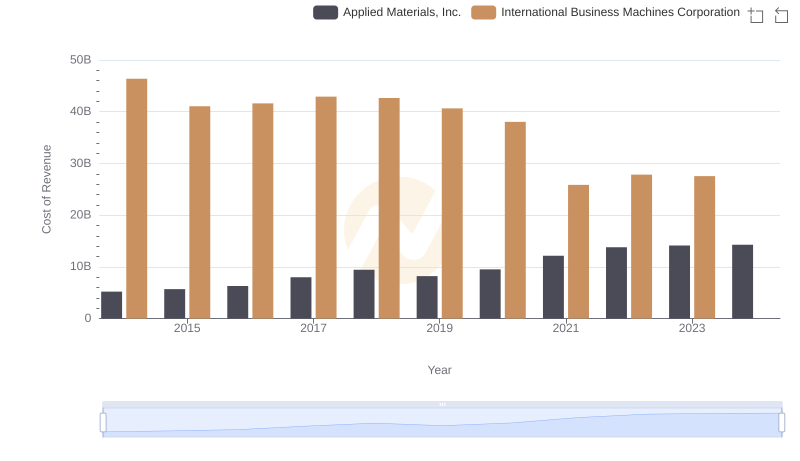

| __timestamp | Applied Materials, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3843000000 | 46407000000 |

| Thursday, January 1, 2015 | 3952000000 | 40684000000 |

| Friday, January 1, 2016 | 4511000000 | 38516000000 |

| Sunday, January 1, 2017 | 6532000000 | 36943000000 |

| Monday, January 1, 2018 | 7817000000 | 36936000000 |

| Tuesday, January 1, 2019 | 6386000000 | 31533000000 |

| Wednesday, January 1, 2020 | 7692000000 | 30865000000 |

| Friday, January 1, 2021 | 10914000000 | 31486000000 |

| Saturday, January 1, 2022 | 11993000000 | 32687000000 |

| Sunday, January 1, 2023 | 12384000000 | 34300000000 |

| Monday, January 1, 2024 | 12897000000 | 35551000000 |

In pursuit of knowledge

In the ever-evolving landscape of technology, the financial performance of industry giants like International Business Machines Corporation (IBM) and Applied Materials, Inc. offers a fascinating glimpse into their strategic maneuvers. Over the past decade, from 2014 to 2024, IBM's gross profit has shown a steady decline, dropping from a peak of approximately $46 billion in 2014 to around $35.5 billion in 2024. This represents a decrease of nearly 23%, reflecting the challenges faced by the company in adapting to new market dynamics.

Conversely, Applied Materials has experienced a robust growth trajectory. Starting at $3.8 billion in 2014, their gross profit surged to $12.9 billion by 2024, marking an impressive increase of over 230%. This growth underscores Applied Materials' successful expansion and innovation in semiconductor manufacturing. The contrasting trends between these two companies highlight the shifting paradigms in the tech industry, where agility and innovation are key to sustained success.

Comparing Revenue Performance: International Business Machines Corporation or Applied Materials, Inc.?

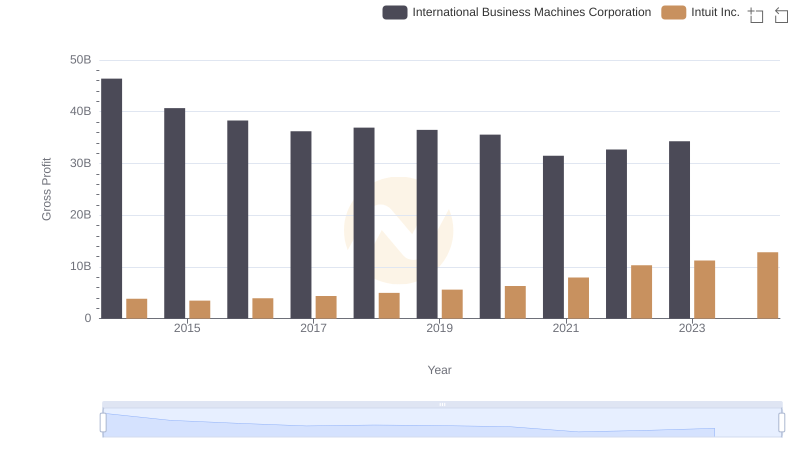

Gross Profit Comparison: International Business Machines Corporation and Intuit Inc. Trends

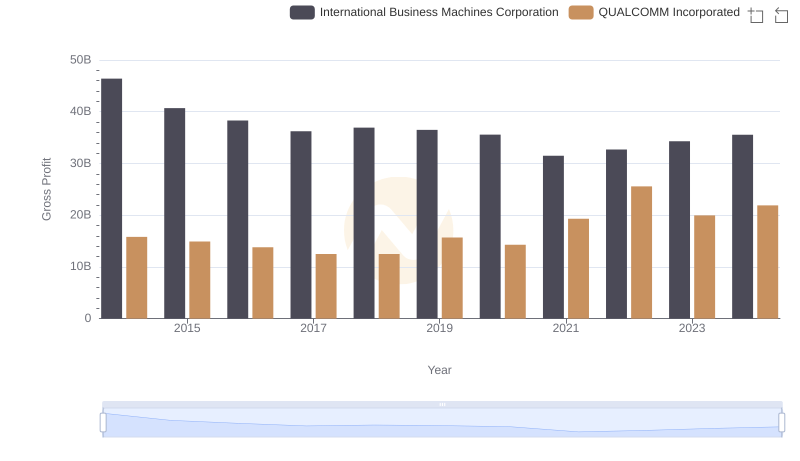

Gross Profit Trends Compared: International Business Machines Corporation vs QUALCOMM Incorporated

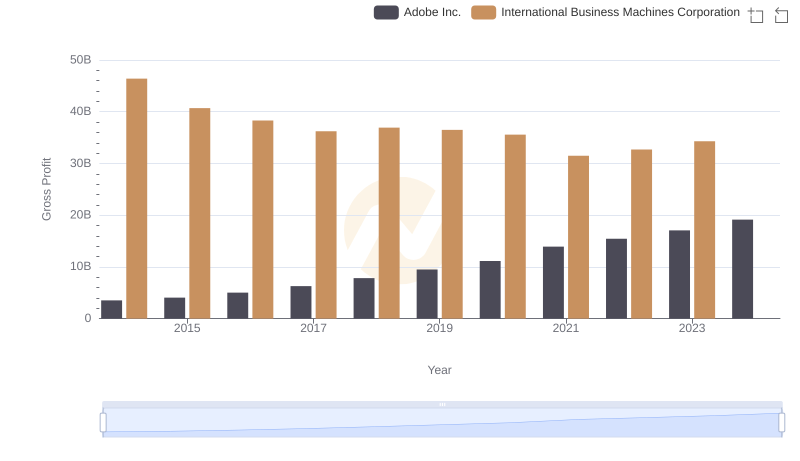

Gross Profit Trends Compared: International Business Machines Corporation vs Adobe Inc.

Cost of Revenue: Key Insights for International Business Machines Corporation and Applied Materials, Inc.

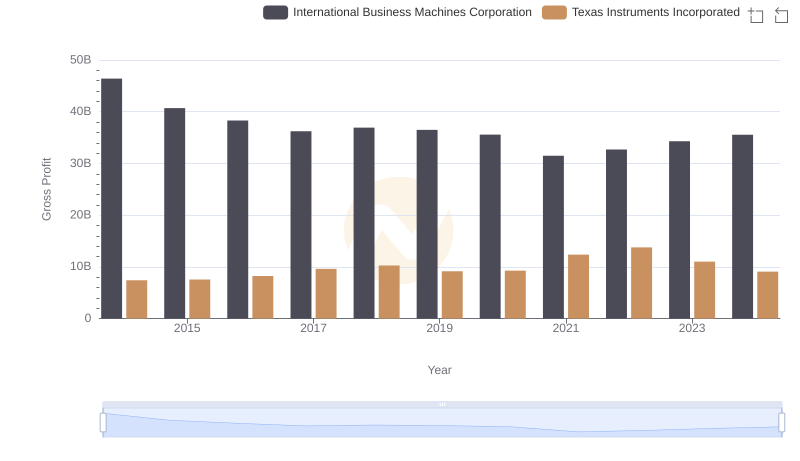

Gross Profit Comparison: International Business Machines Corporation and Texas Instruments Incorporated Trends

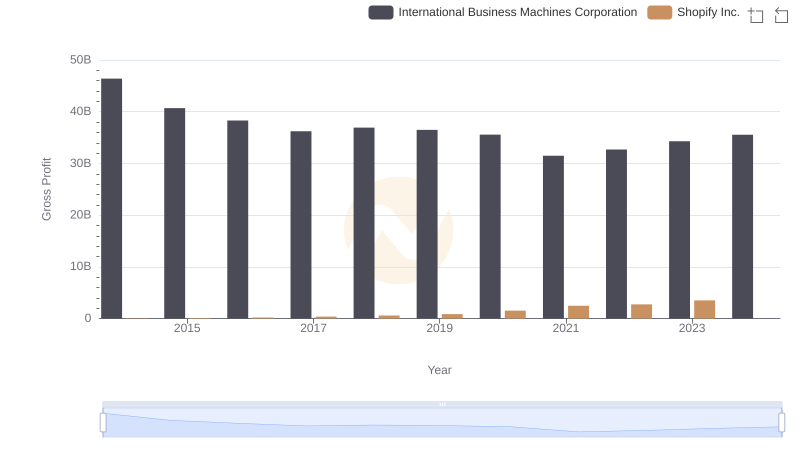

International Business Machines Corporation and Shopify Inc.: A Detailed Gross Profit Analysis

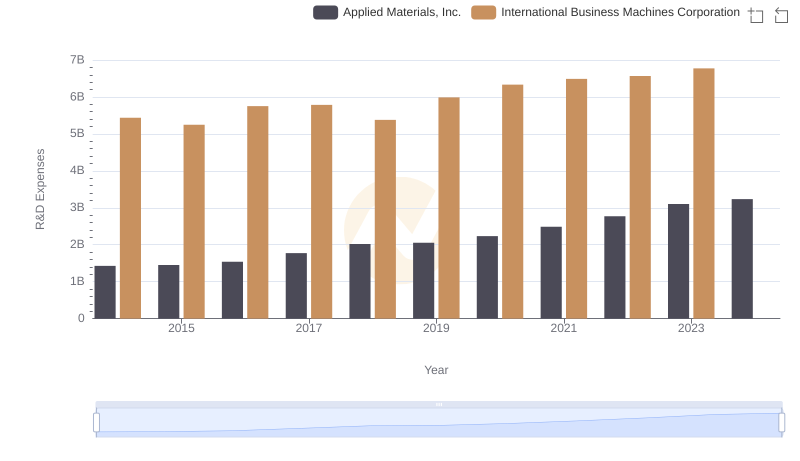

R&D Spending Showdown: International Business Machines Corporation vs Applied Materials, Inc.

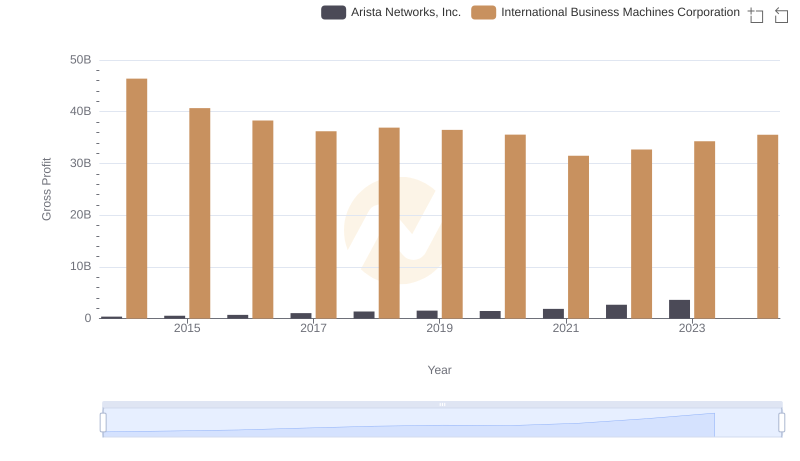

Who Generates Higher Gross Profit? International Business Machines Corporation or Arista Networks, Inc.

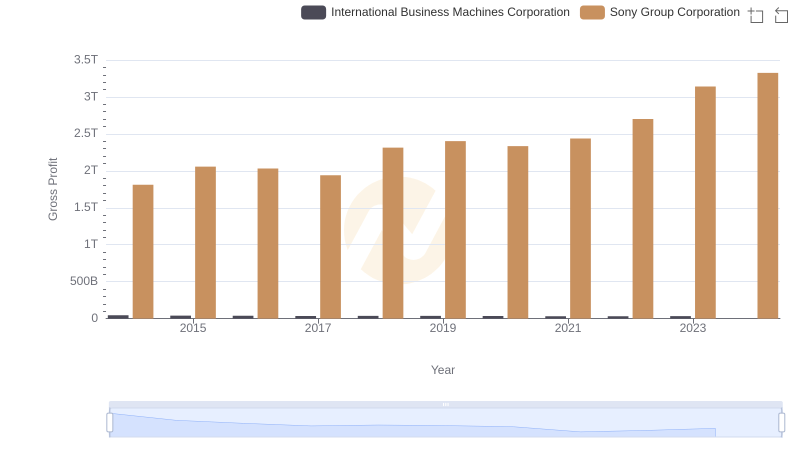

Who Generates Higher Gross Profit? International Business Machines Corporation or Sony Group Corporation

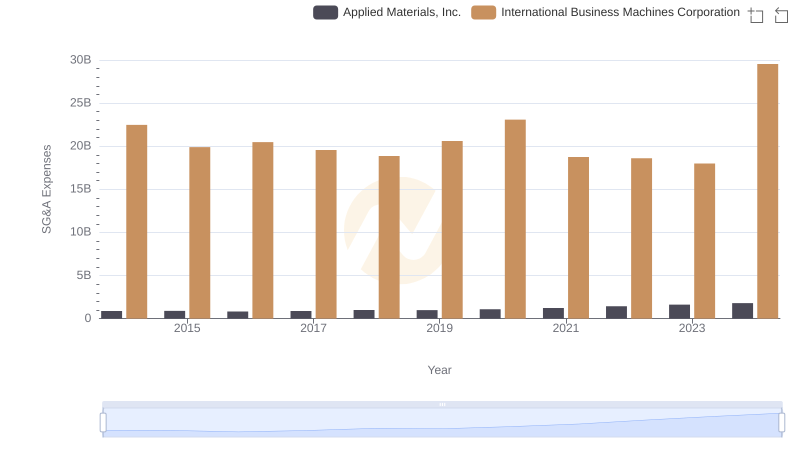

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Applied Materials, Inc.

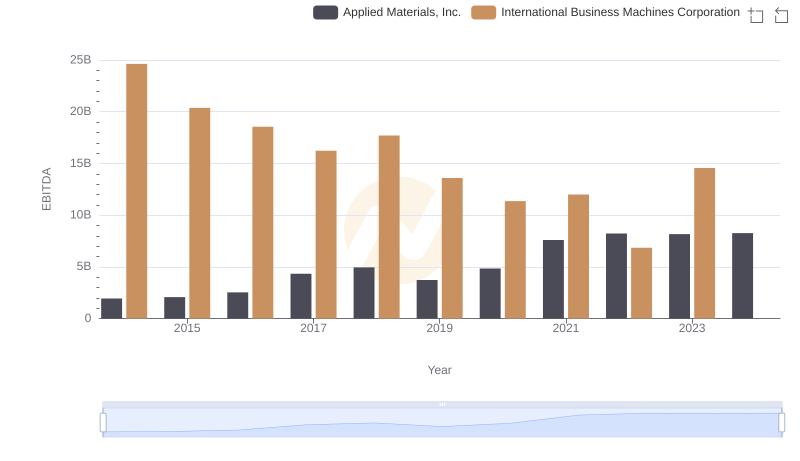

EBITDA Performance Review: International Business Machines Corporation vs Applied Materials, Inc.