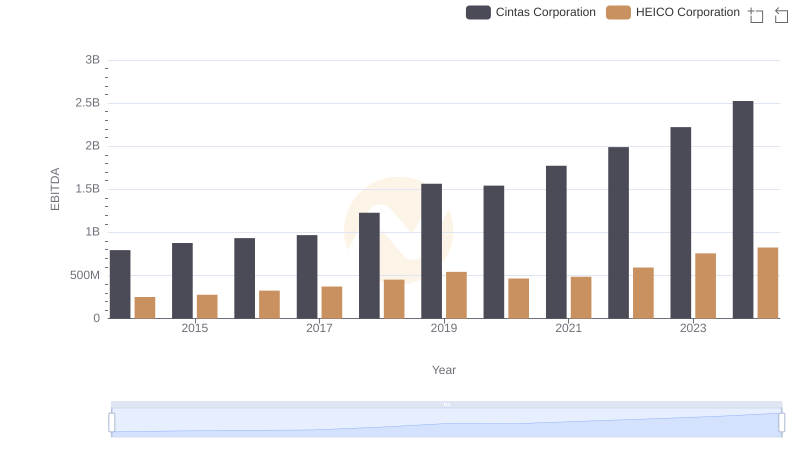

| __timestamp | Cintas Corporation | HEICO Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 194924000 |

| Thursday, January 1, 2015 | 1224930000 | 204523000 |

| Friday, January 1, 2016 | 1348122000 | 250147000 |

| Sunday, January 1, 2017 | 1527380000 | 268067000 |

| Monday, January 1, 2018 | 1916792000 | 314470000 |

| Tuesday, January 1, 2019 | 1980644000 | 356743000 |

| Wednesday, January 1, 2020 | 2071052000 | 305479000 |

| Friday, January 1, 2021 | 1929159000 | 334523000 |

| Saturday, January 1, 2022 | 2044876000 | 365915000 |

| Sunday, January 1, 2023 | 2370704000 | 516292000 |

| Monday, January 1, 2024 | 2617783000 | 677271000 |

In pursuit of knowledge

In the competitive landscape of corporate America, understanding the financial strategies of leading companies is crucial. Cintas Corporation and HEICO Corporation, two giants in their respective industries, have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2024, Cintas Corporation's SG&A expenses have surged by approximately 101%, reflecting a strategic expansion and investment in operational efficiencies. In contrast, HEICO Corporation, while smaller in scale, has seen its SG&A expenses grow by about 247%, indicating a robust growth trajectory and possibly aggressive market penetration strategies.

The year 2023 marked a significant leap for both companies, with Cintas reaching a peak of $2.37 billion and HEICO climbing to $516 million. These trends highlight the dynamic nature of corporate financial management and the varying strategies employed by industry leaders.

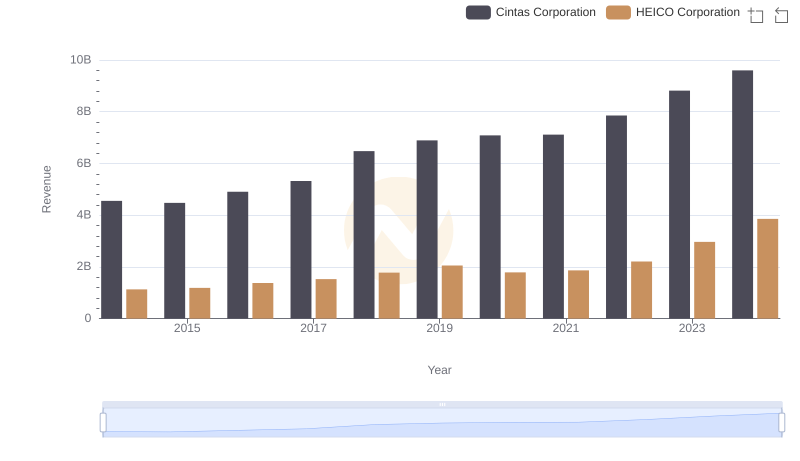

Breaking Down Revenue Trends: Cintas Corporation vs HEICO Corporation

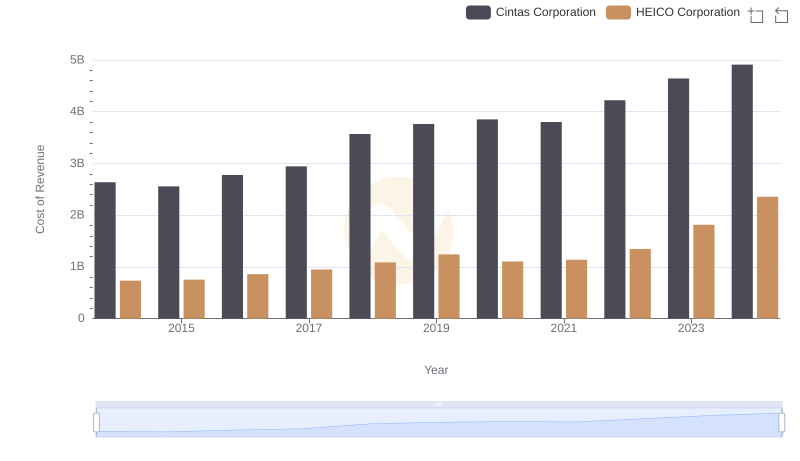

Cintas Corporation vs HEICO Corporation: Efficiency in Cost of Revenue Explored

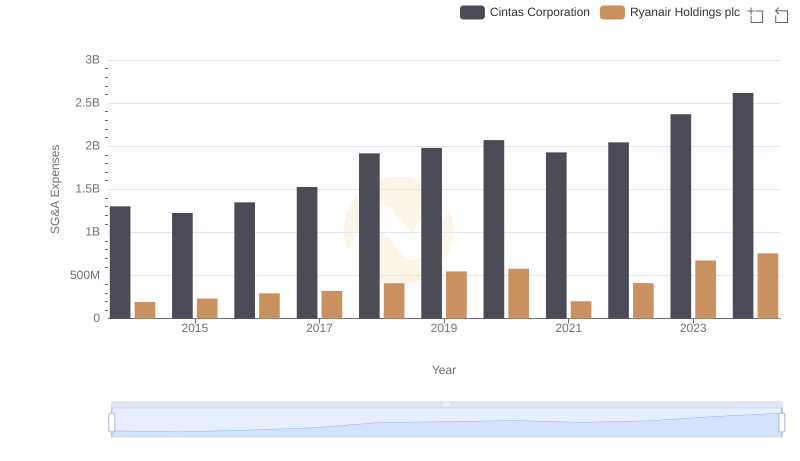

Comparing SG&A Expenses: Cintas Corporation vs Ryanair Holdings plc Trends and Insights

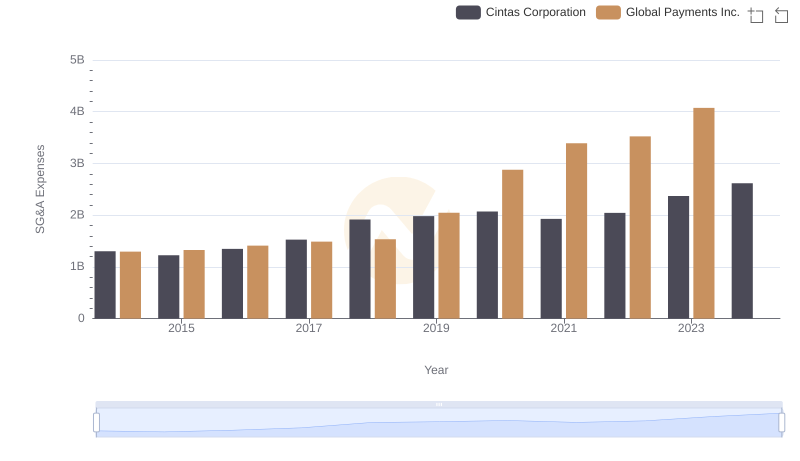

Cintas Corporation and Global Payments Inc.: SG&A Spending Patterns Compared

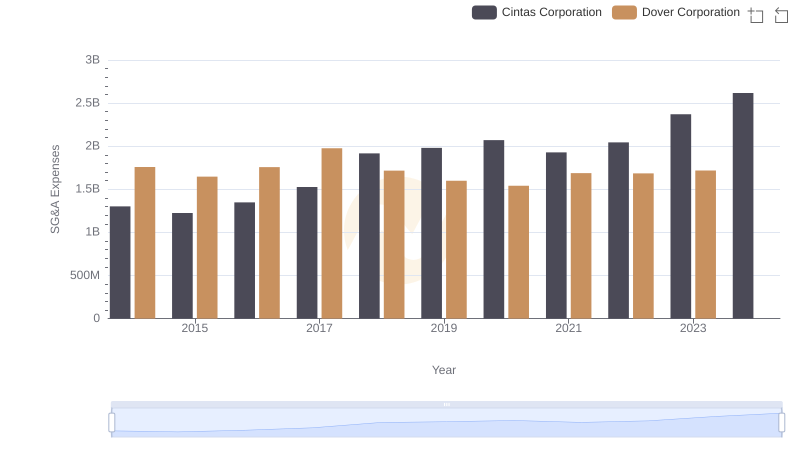

Cintas Corporation and Dover Corporation: SG&A Spending Patterns Compared

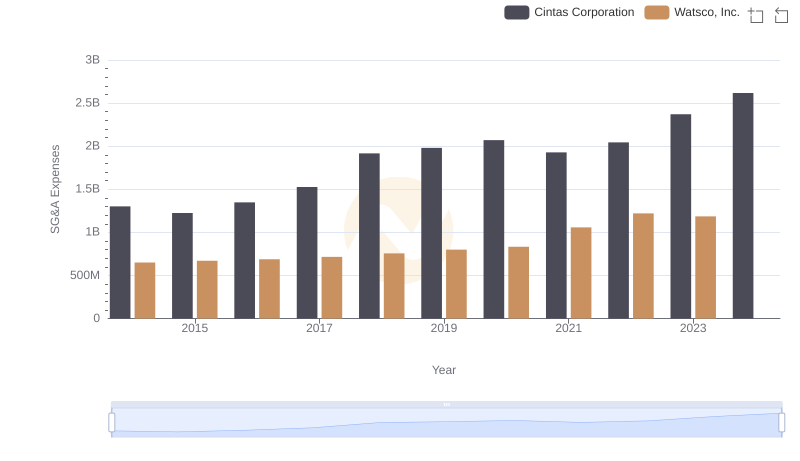

Cintas Corporation vs Watsco, Inc.: SG&A Expense Trends

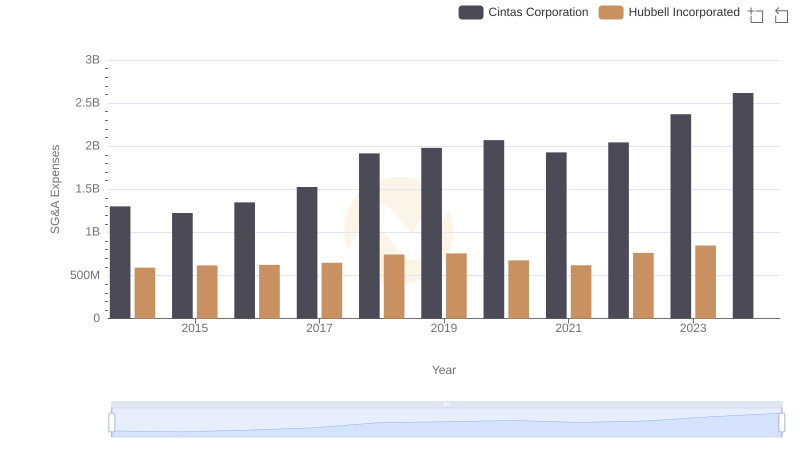

SG&A Efficiency Analysis: Comparing Cintas Corporation and Hubbell Incorporated

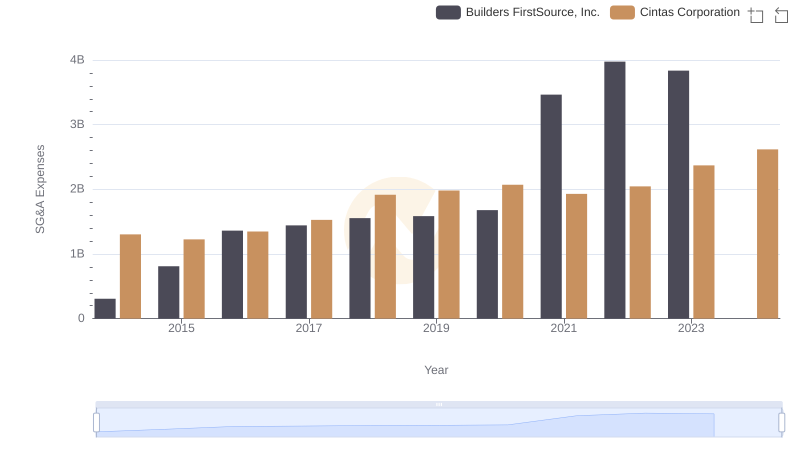

Breaking Down SG&A Expenses: Cintas Corporation vs Builders FirstSource, Inc.

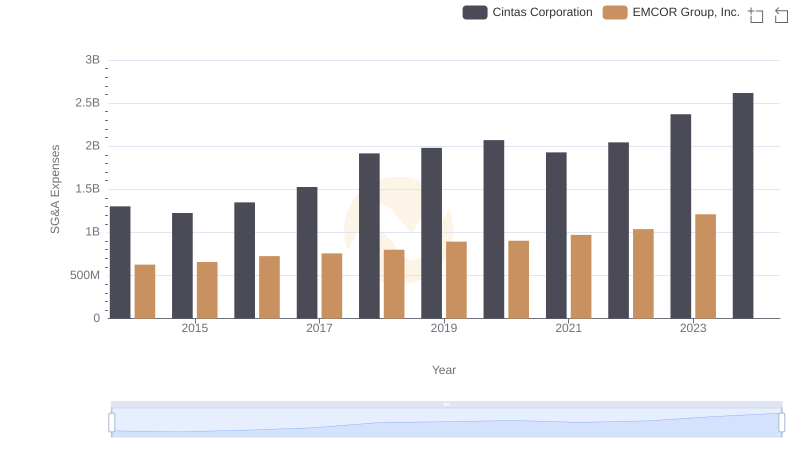

Comparing SG&A Expenses: Cintas Corporation vs EMCOR Group, Inc. Trends and Insights

A Professional Review of EBITDA: Cintas Corporation Compared to HEICO Corporation