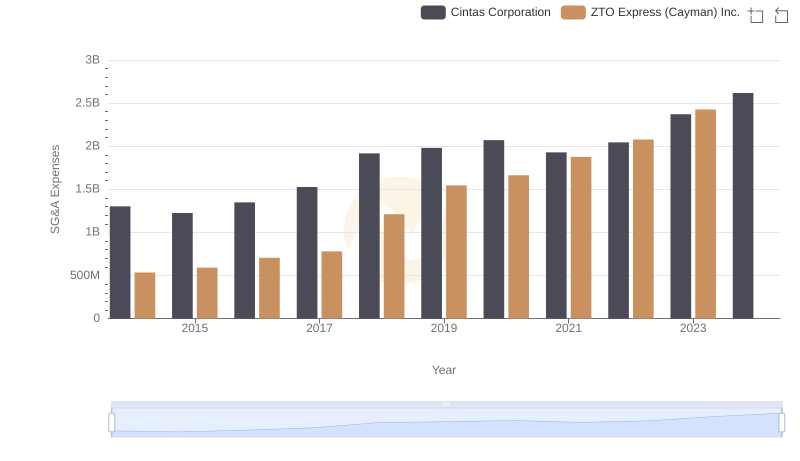

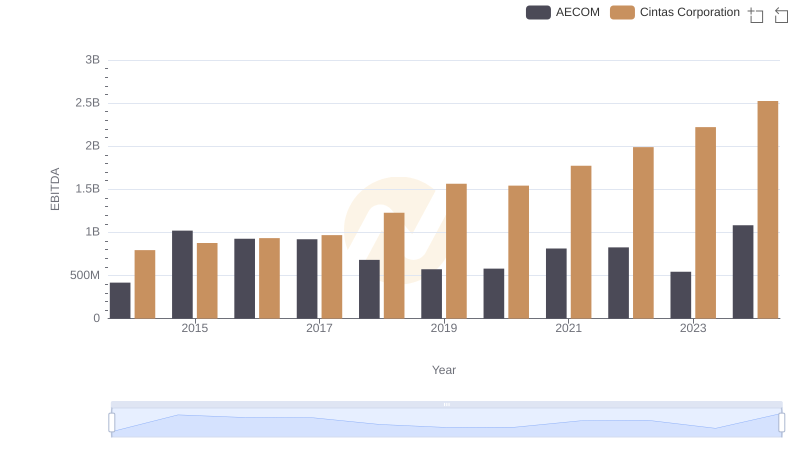

| __timestamp | AECOM | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 80908000 | 1302752000 |

| Thursday, January 1, 2015 | 113975000 | 1224930000 |

| Friday, January 1, 2016 | 115088000 | 1348122000 |

| Sunday, January 1, 2017 | 133309000 | 1527380000 |

| Monday, January 1, 2018 | 135787000 | 1916792000 |

| Tuesday, January 1, 2019 | 148123000 | 1980644000 |

| Wednesday, January 1, 2020 | 188535000 | 2071052000 |

| Friday, January 1, 2021 | 155072000 | 1929159000 |

| Saturday, January 1, 2022 | 147309000 | 2044876000 |

| Sunday, January 1, 2023 | 153575000 | 2370704000 |

| Monday, January 1, 2024 | 160105000 | 2617783000 |

In pursuit of knowledge

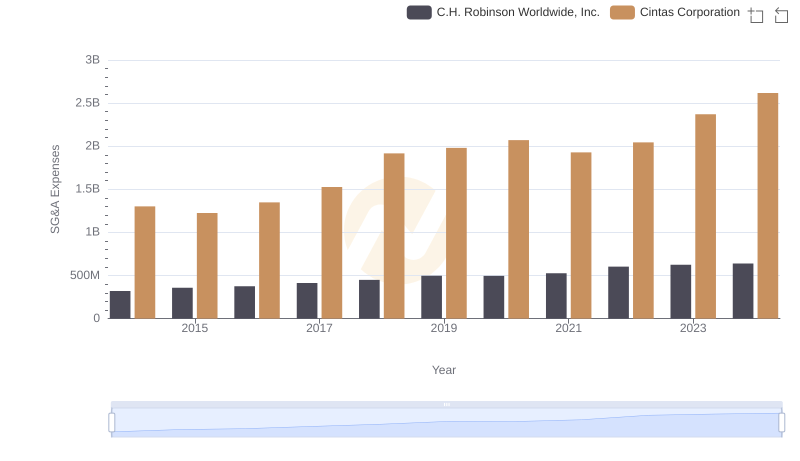

In the competitive landscape of corporate America, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Cintas Corporation and AECOM have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2024, Cintas Corporation's SG&A expenses surged by approximately 101%, reflecting its aggressive expansion and operational scaling. In contrast, AECOM's expenses grew by a modest 98%, indicating a more conservative approach.

Cintas's consistent increase, peaking at $2.62 billion in 2024, underscores its strategic investments in growth and market penetration. Meanwhile, AECOM's steadier rise, reaching $160 million in 2024, suggests a focus on maintaining operational efficiency.

This analysis highlights the diverse strategies of two industry leaders, offering valuable insights into their financial stewardship and market strategies.

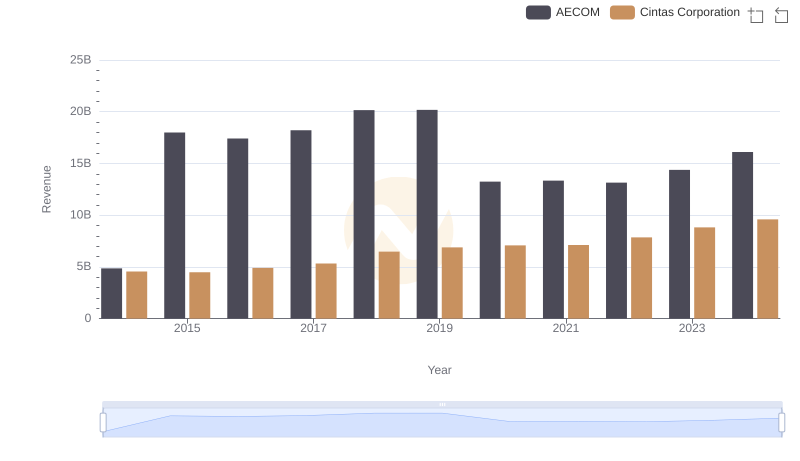

Breaking Down Revenue Trends: Cintas Corporation vs AECOM

Cost Management Insights: SG&A Expenses for Cintas Corporation and ZTO Express (Cayman) Inc.

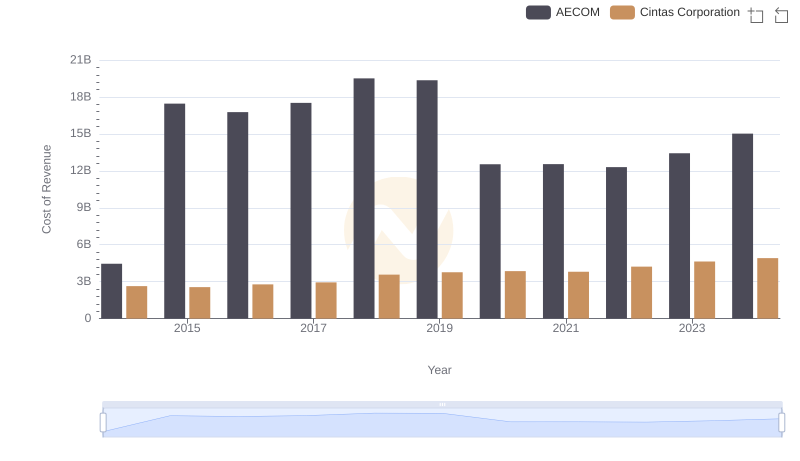

Cost Insights: Breaking Down Cintas Corporation and AECOM's Expenses

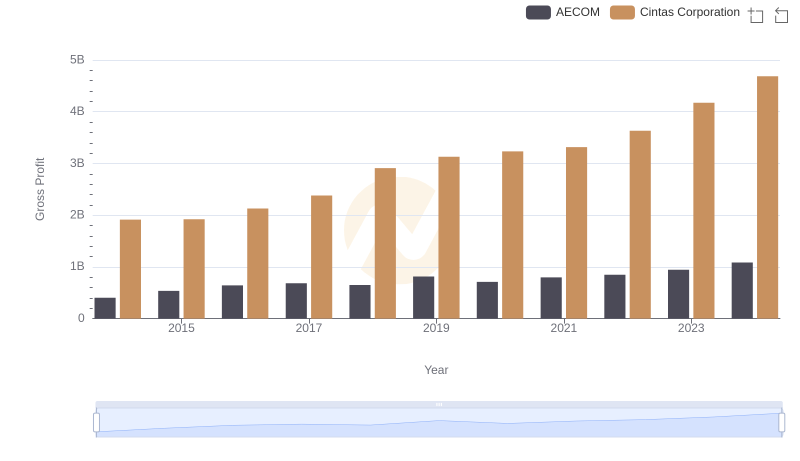

Gross Profit Trends Compared: Cintas Corporation vs AECOM

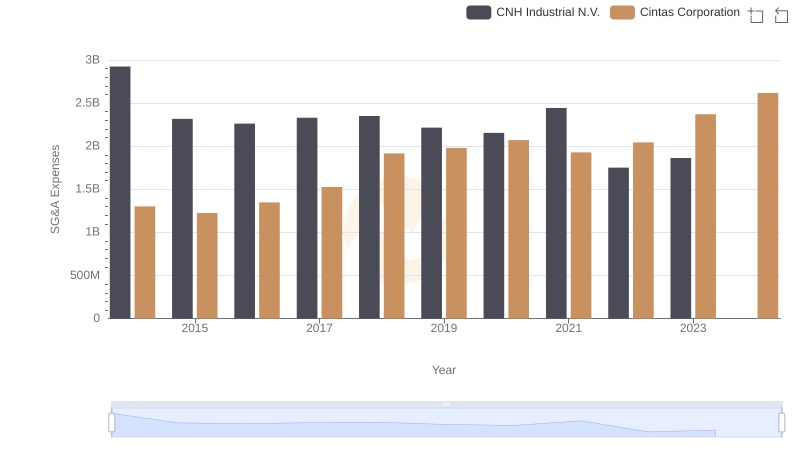

Cintas Corporation or CNH Industrial N.V.: Who Manages SG&A Costs Better?

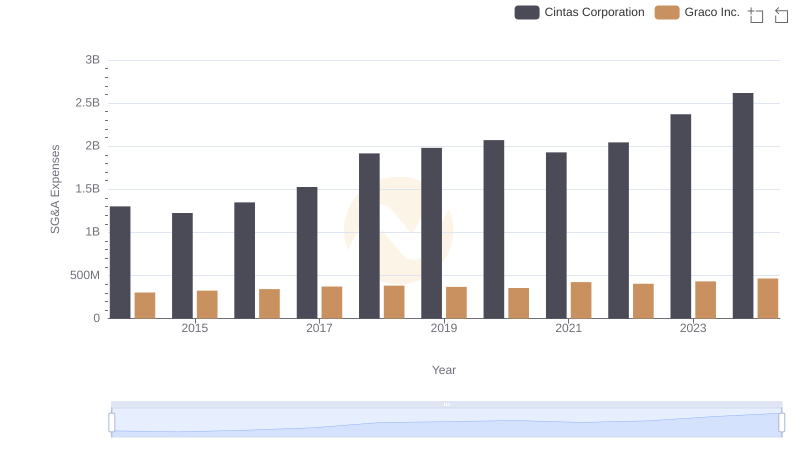

Comparing SG&A Expenses: Cintas Corporation vs Graco Inc. Trends and Insights

Breaking Down SG&A Expenses: Cintas Corporation vs Comfort Systems USA, Inc.

Professional EBITDA Benchmarking: Cintas Corporation vs AECOM

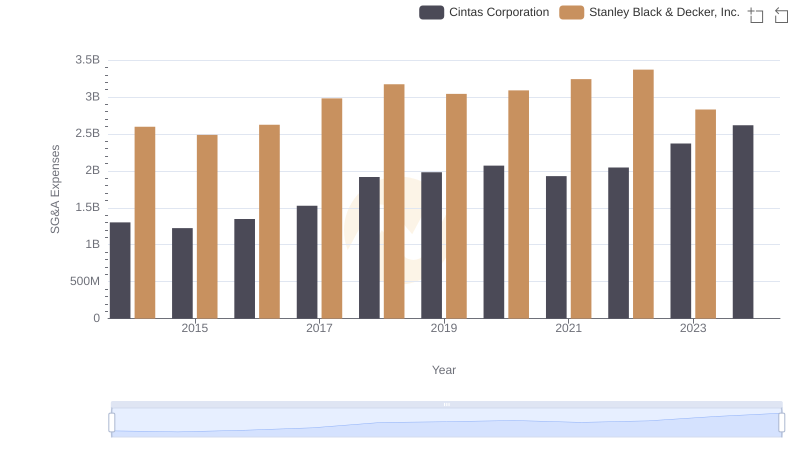

Cintas Corporation or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

Cintas Corporation or C.H. Robinson Worldwide, Inc.: Who Manages SG&A Costs Better?