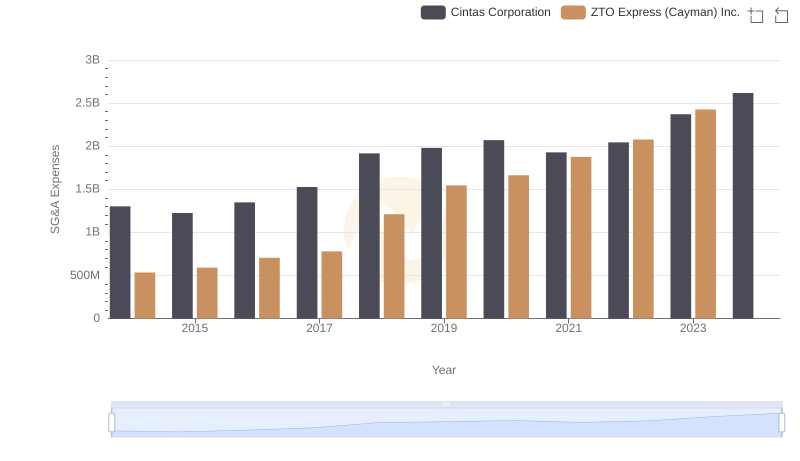

| __timestamp | CNH Industrial N.V. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2925000000 | 1302752000 |

| Thursday, January 1, 2015 | 2317000000 | 1224930000 |

| Friday, January 1, 2016 | 2262000000 | 1348122000 |

| Sunday, January 1, 2017 | 2330000000 | 1527380000 |

| Monday, January 1, 2018 | 2351000000 | 1916792000 |

| Tuesday, January 1, 2019 | 2216000000 | 1980644000 |

| Wednesday, January 1, 2020 | 2155000000 | 2071052000 |

| Friday, January 1, 2021 | 2443000000 | 1929159000 |

| Saturday, January 1, 2022 | 1752000000 | 2044876000 |

| Sunday, January 1, 2023 | 1863000000 | 2370704000 |

| Monday, January 1, 2024 | 2617783000 |

Data in motion

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Cintas Corporation and CNH Industrial N.V. have shown distinct trends in their SG&A management. Cintas Corporation has consistently improved, reducing its SG&A expenses relative to revenue, culminating in a 22% increase in efficiency by 2023. In contrast, CNH Industrial N.V. experienced fluctuations, with a notable 40% drop in 2022, indicating potential challenges in cost management. The data reveals that while Cintas has steadily optimized its expenses, CNH Industrial's performance has been more volatile. This analysis underscores the importance of strategic cost management in maintaining a competitive edge. As we look to 2024, Cintas continues its upward trajectory, while CNH Industrial's data remains incomplete, leaving room for speculation.

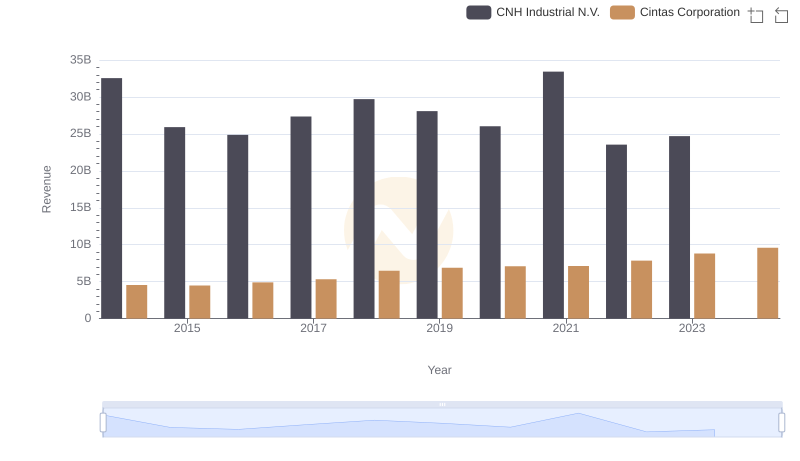

Cintas Corporation and CNH Industrial N.V.: A Comprehensive Revenue Analysis

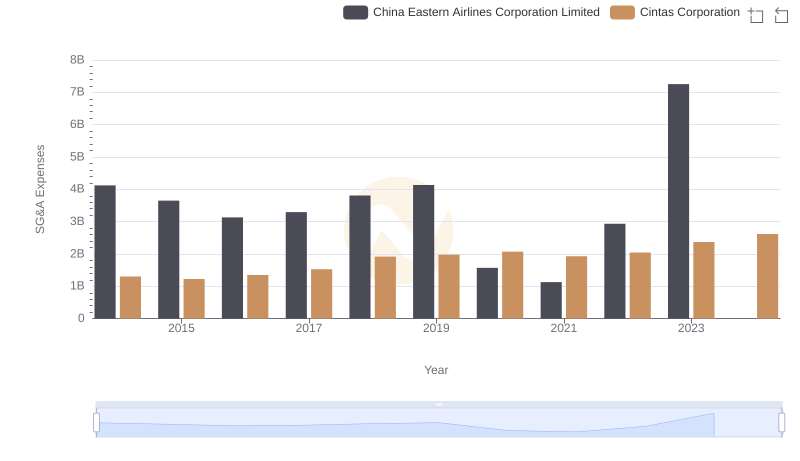

Cintas Corporation and China Eastern Airlines Corporation Limited: SG&A Spending Patterns Compared

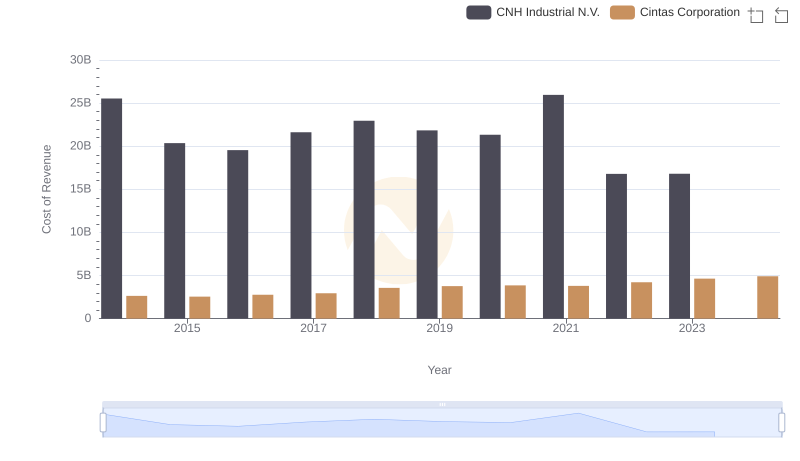

Cost of Revenue: Key Insights for Cintas Corporation and CNH Industrial N.V.

Cost Management Insights: SG&A Expenses for Cintas Corporation and ZTO Express (Cayman) Inc.

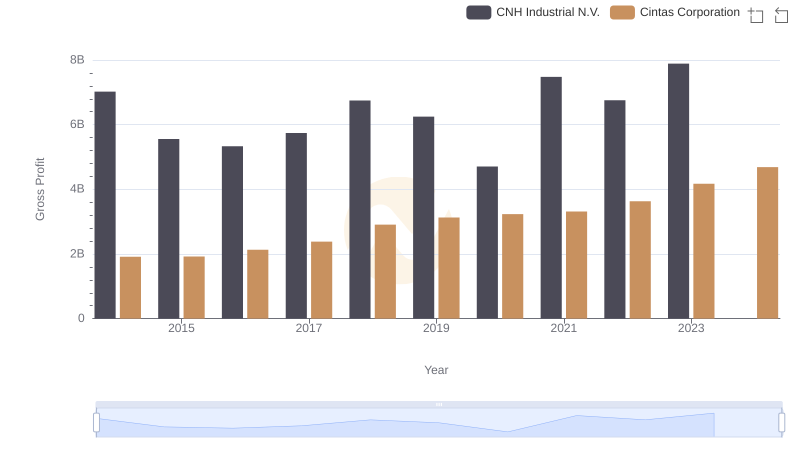

Who Generates Higher Gross Profit? Cintas Corporation or CNH Industrial N.V.

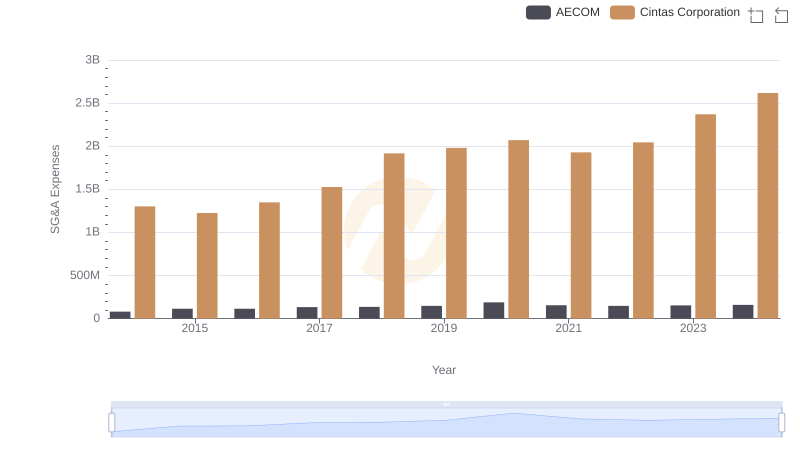

SG&A Efficiency Analysis: Comparing Cintas Corporation and AECOM

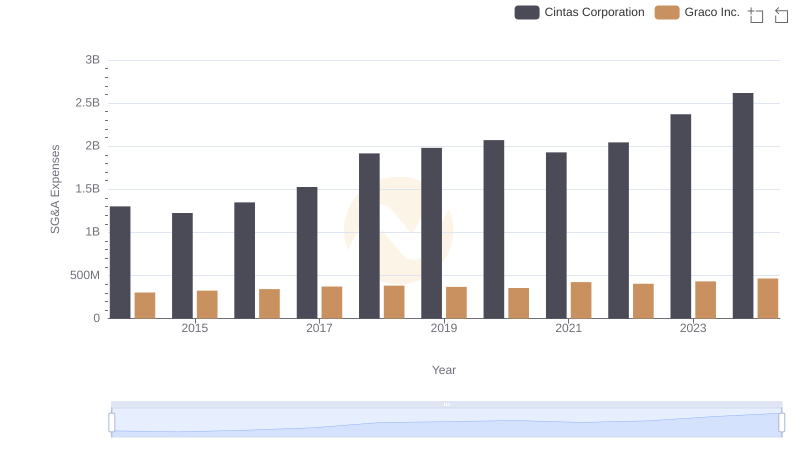

Comparing SG&A Expenses: Cintas Corporation vs Graco Inc. Trends and Insights

Breaking Down SG&A Expenses: Cintas Corporation vs Comfort Systems USA, Inc.

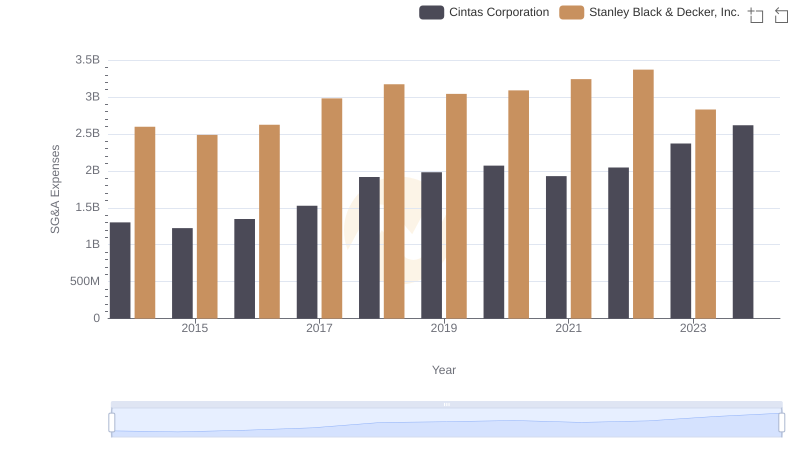

Cintas Corporation or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?