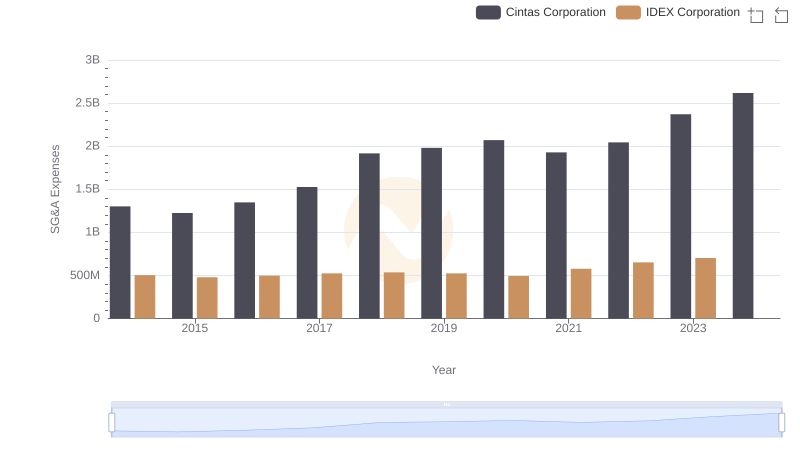

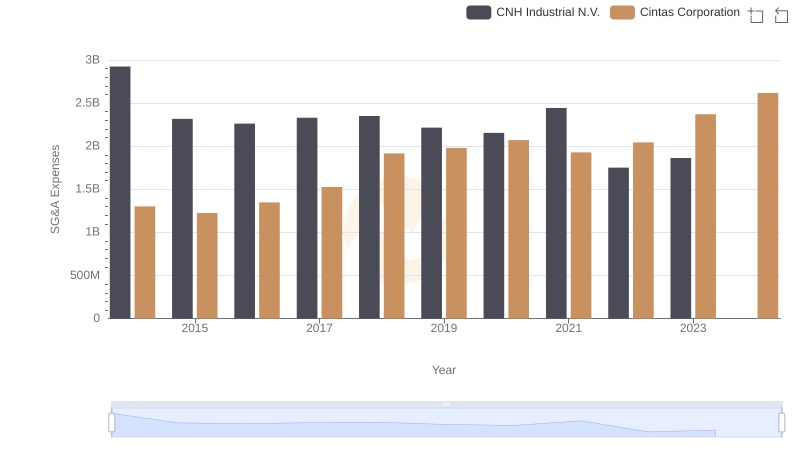

| __timestamp | Cintas Corporation | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 534537000 |

| Thursday, January 1, 2015 | 1224930000 | 591738000 |

| Friday, January 1, 2016 | 1348122000 | 705995000 |

| Sunday, January 1, 2017 | 1527380000 | 780517000 |

| Monday, January 1, 2018 | 1916792000 | 1210717000 |

| Tuesday, January 1, 2019 | 1980644000 | 1546227000 |

| Wednesday, January 1, 2020 | 2071052000 | 1663712000 |

| Friday, January 1, 2021 | 1929159000 | 1875869000 |

| Saturday, January 1, 2022 | 2044876000 | 2077372000 |

| Sunday, January 1, 2023 | 2370704000 | 2425253000 |

| Monday, January 1, 2024 | 2617783000 |

Unleashing insights

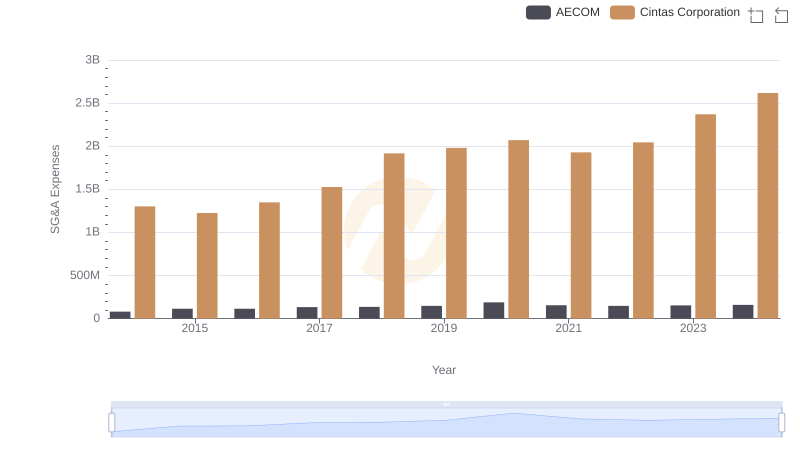

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for effective cost management. This analysis delves into the SG&A trends of Cintas Corporation and ZTO Express (Cayman) Inc. from 2014 to 2023.

Cintas Corporation has demonstrated a consistent upward trajectory in SG&A expenses, with a notable increase of approximately 101% over the decade. This growth reflects strategic investments in operational efficiency and market expansion.

ZTO Express, on the other hand, has shown a remarkable surge, with SG&A expenses growing by over 350% from 2014 to 2023. This rapid increase underscores the company's aggressive expansion strategy in the logistics sector.

While Cintas continues its upward trend into 2024, data for ZTO Express is currently unavailable, highlighting the need for ongoing monitoring.

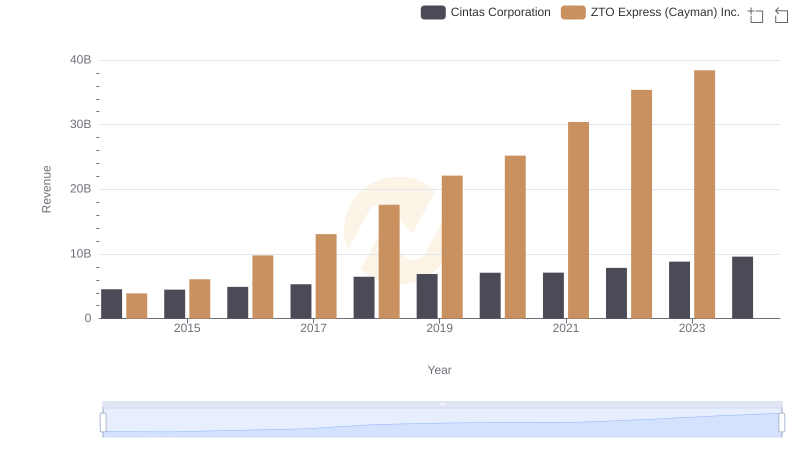

Annual Revenue Comparison: Cintas Corporation vs ZTO Express (Cayman) Inc.

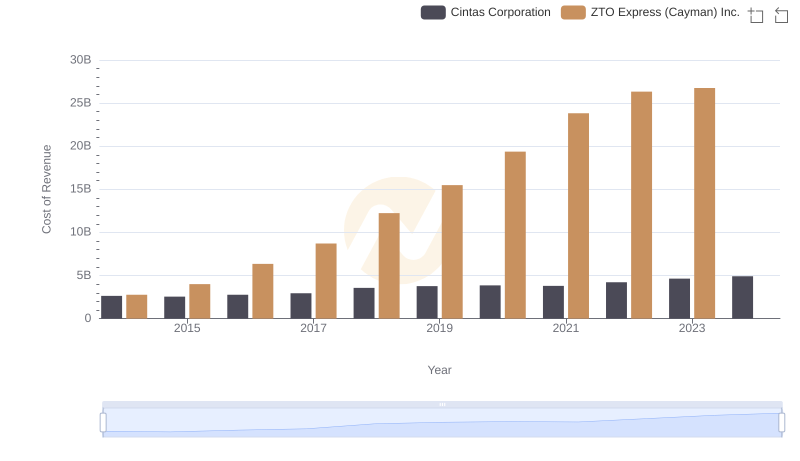

Cost of Revenue Trends: Cintas Corporation vs ZTO Express (Cayman) Inc.

Operational Costs Compared: SG&A Analysis of Cintas Corporation and IDEX Corporation

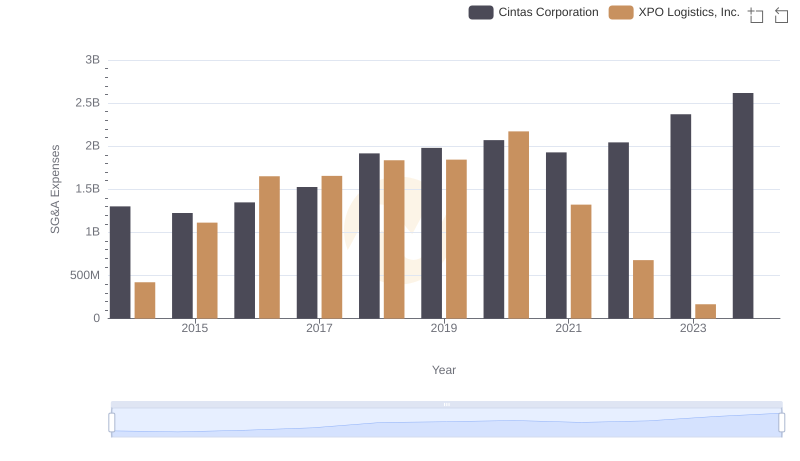

SG&A Efficiency Analysis: Comparing Cintas Corporation and XPO Logistics, Inc.

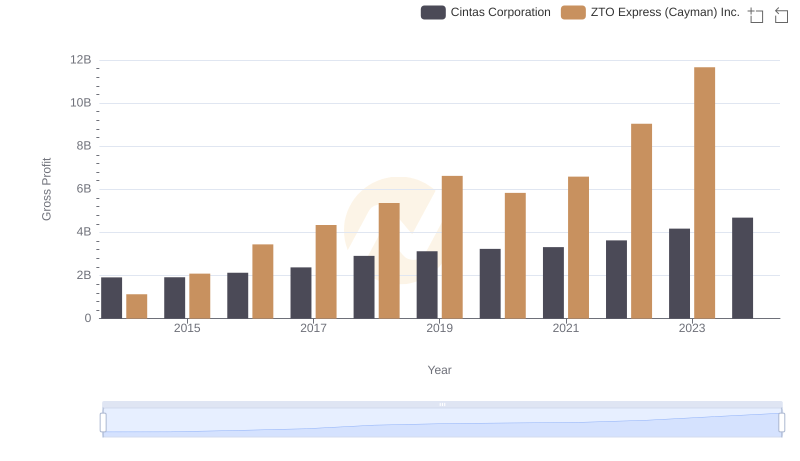

Cintas Corporation vs ZTO Express (Cayman) Inc.: A Gross Profit Performance Breakdown

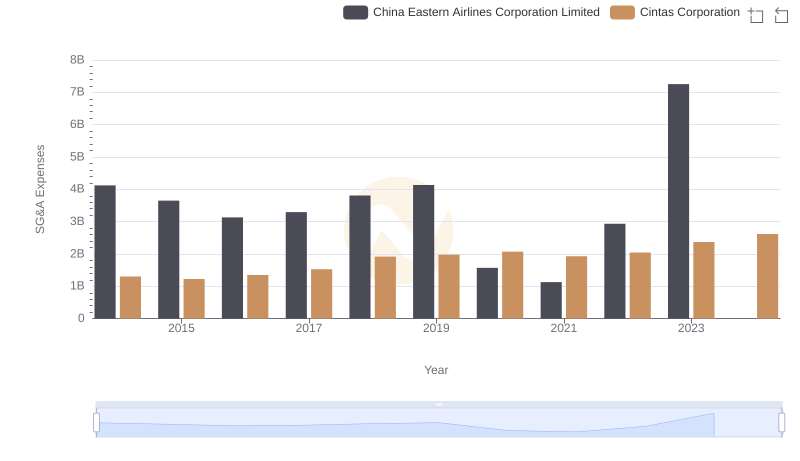

Cintas Corporation and China Eastern Airlines Corporation Limited: SG&A Spending Patterns Compared

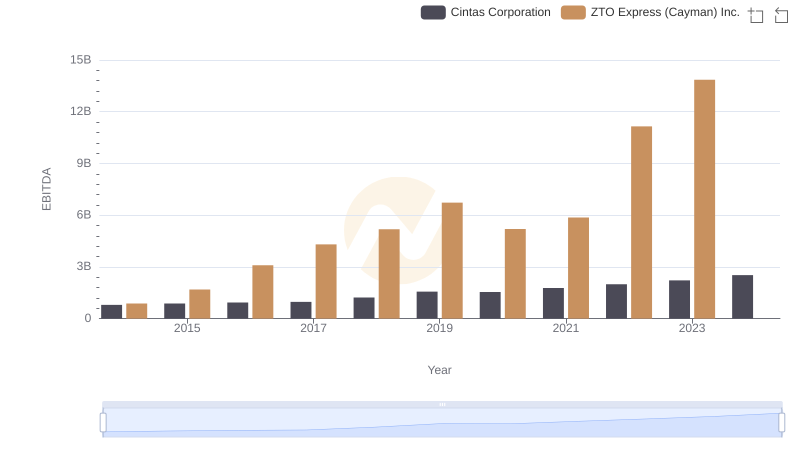

A Side-by-Side Analysis of EBITDA: Cintas Corporation and ZTO Express (Cayman) Inc.

Cintas Corporation or CNH Industrial N.V.: Who Manages SG&A Costs Better?

SG&A Efficiency Analysis: Comparing Cintas Corporation and AECOM