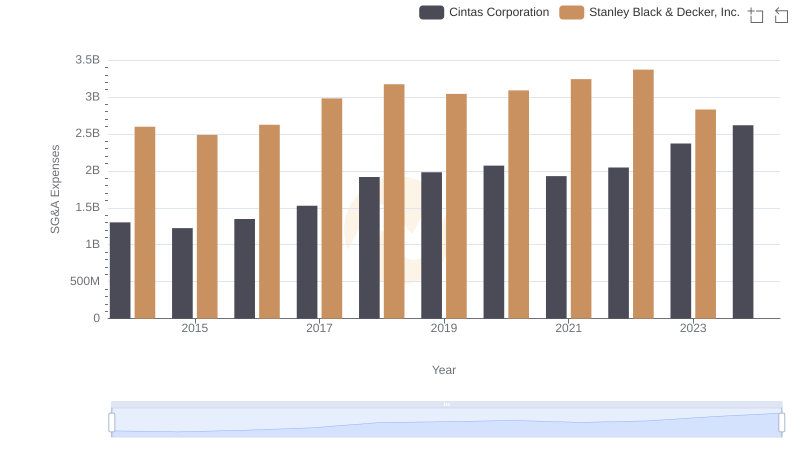

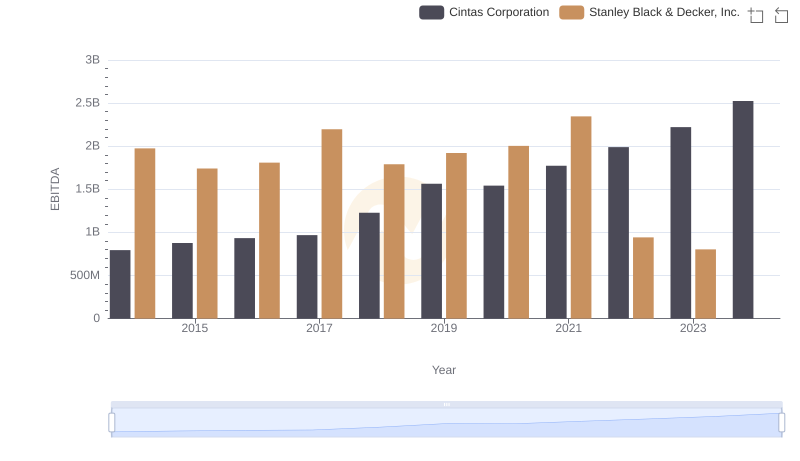

| __timestamp | Cintas Corporation | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 2595900000 |

| Thursday, January 1, 2015 | 1224930000 | 2486400000 |

| Friday, January 1, 2016 | 1348122000 | 2623900000 |

| Sunday, January 1, 2017 | 1527380000 | 2980100000 |

| Monday, January 1, 2018 | 1916792000 | 3171700000 |

| Tuesday, January 1, 2019 | 1980644000 | 3041000000 |

| Wednesday, January 1, 2020 | 2071052000 | 3089600000 |

| Friday, January 1, 2021 | 1929159000 | 3240400000 |

| Saturday, January 1, 2022 | 2044876000 | 3370000000 |

| Sunday, January 1, 2023 | 2370704000 | 2829300000 |

| Monday, January 1, 2024 | 2617783000 | 3310500000 |

Unveiling the hidden dimensions of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cintas Corporation and Stanley Black & Decker, Inc. have been at the forefront of this financial balancing act since 2014. Over the past decade, Cintas has demonstrated a remarkable ability to control its SG&A costs, with an average annual increase of just 8%. In contrast, Stanley Black & Decker's SG&A expenses have grown by approximately 3% annually.

From 2014 to 2023, Cintas saw a 100% increase in SG&A expenses, peaking at $2.37 billion in 2023. Meanwhile, Stanley Black & Decker's costs fluctuated, reaching a high of $3.37 billion in 2022 before dropping to $2.83 billion in 2023. This data suggests that Cintas has been more consistent in managing its expenses, potentially giving it a competitive edge in the market.

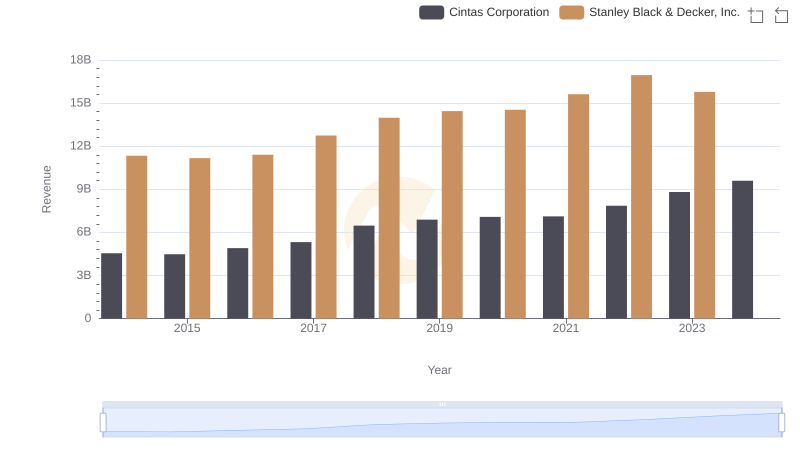

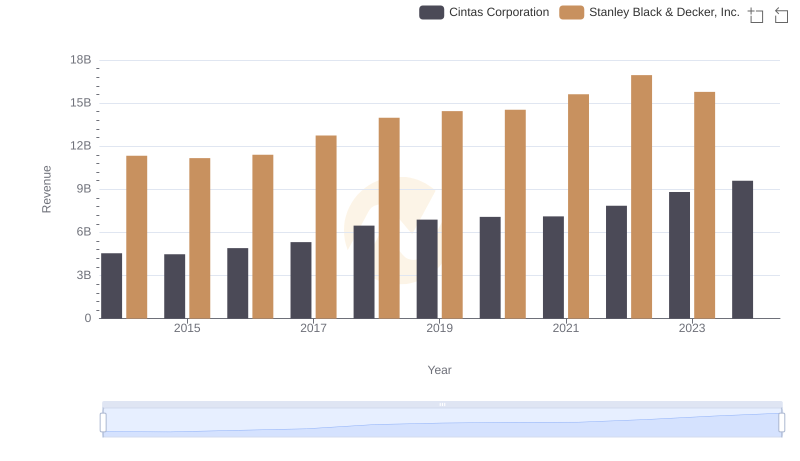

Cintas Corporation or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

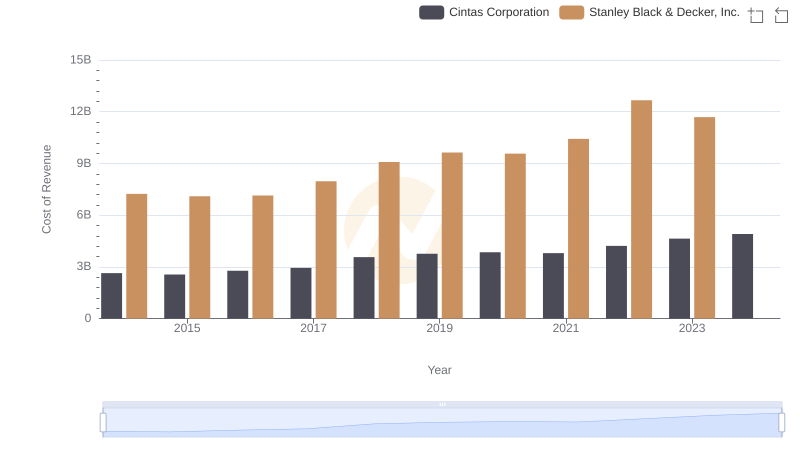

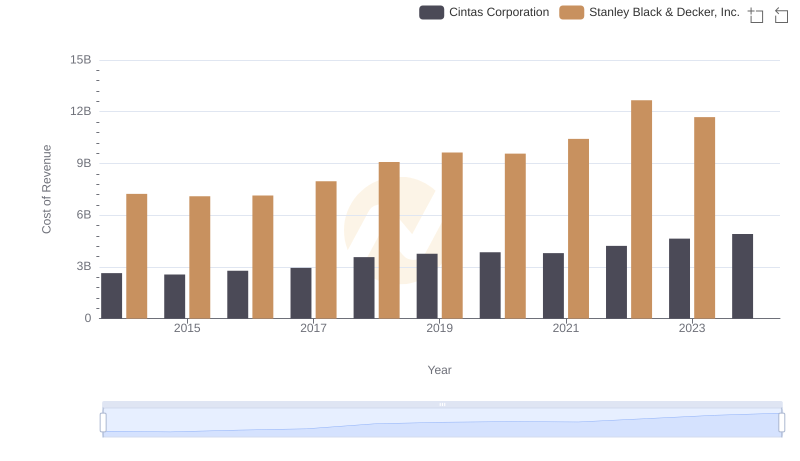

Cost of Revenue: Key Insights for Cintas Corporation and Stanley Black & Decker, Inc.

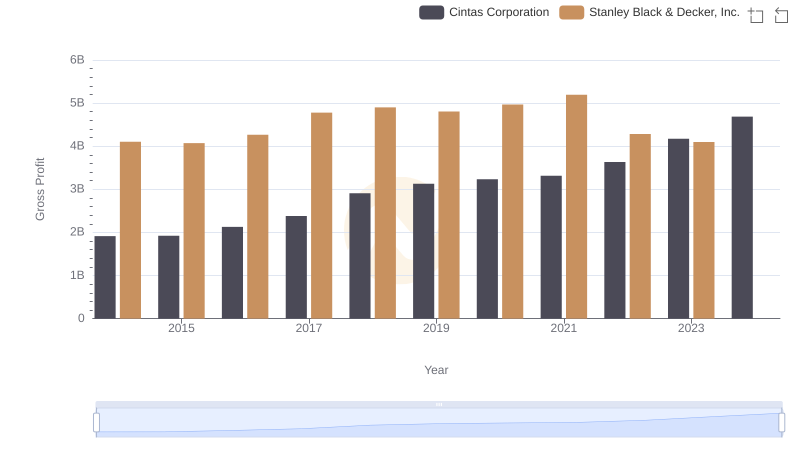

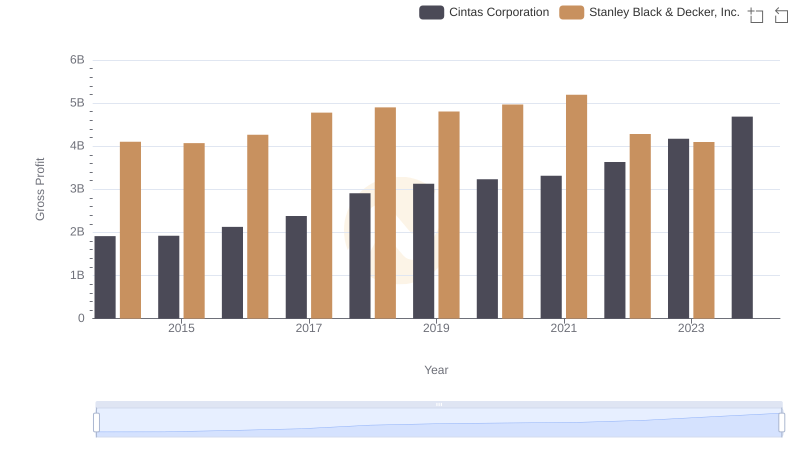

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Stanley Black & Decker, Inc.

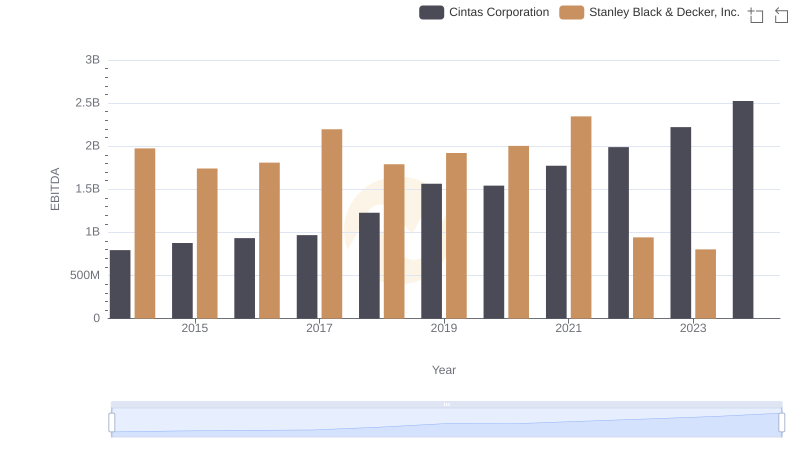

Cintas Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

Breaking Down Revenue Trends: Cintas Corporation vs Stanley Black & Decker, Inc.

Analyzing Cost of Revenue: Cintas Corporation and Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

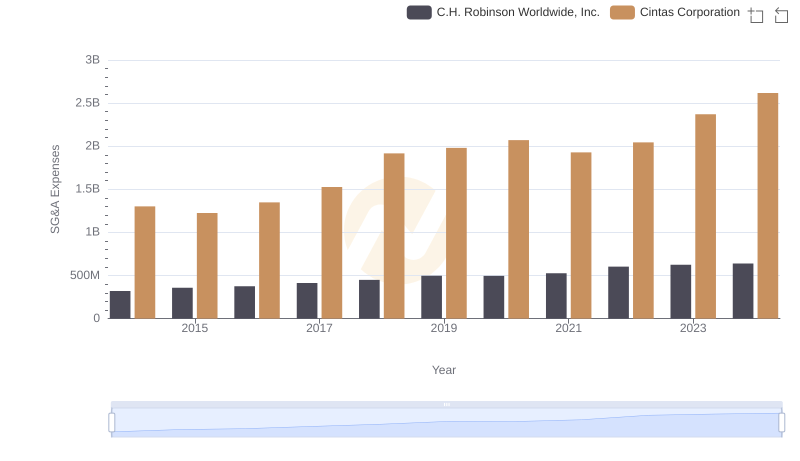

Cintas Corporation or C.H. Robinson Worldwide, Inc.: Who Manages SG&A Costs Better?

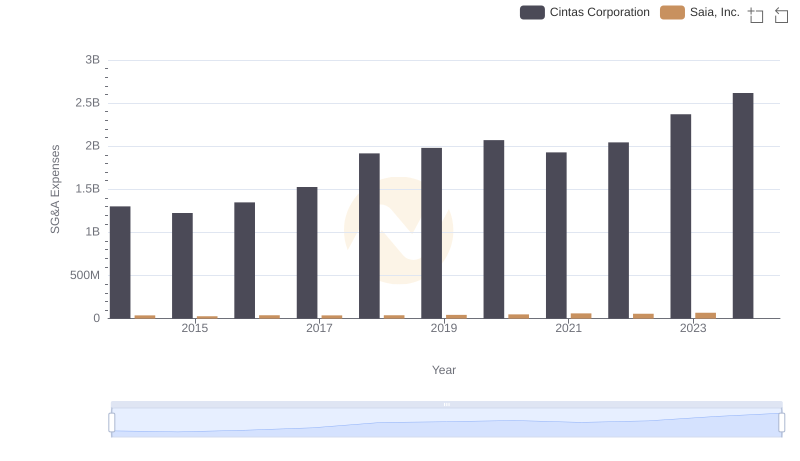

Selling, General, and Administrative Costs: Cintas Corporation vs Saia, Inc.

Comprehensive EBITDA Comparison: Cintas Corporation vs Stanley Black & Decker, Inc.