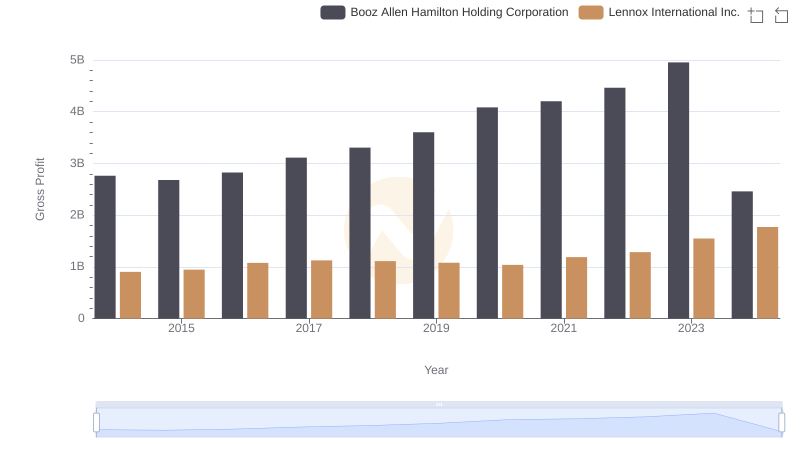

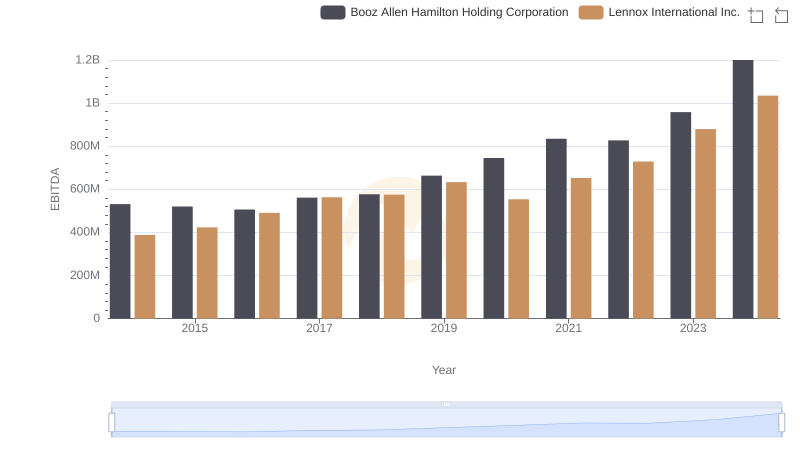

| __timestamp | Booz Allen Hamilton Holding Corporation | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 573700000 |

| Thursday, January 1, 2015 | 2159439000 | 580500000 |

| Friday, January 1, 2016 | 2319592000 | 621000000 |

| Sunday, January 1, 2017 | 2568511000 | 637700000 |

| Monday, January 1, 2018 | 2719909000 | 608200000 |

| Tuesday, January 1, 2019 | 2932602000 | 585900000 |

| Wednesday, January 1, 2020 | 3334378000 | 555900000 |

| Friday, January 1, 2021 | 3362722000 | 598900000 |

| Saturday, January 1, 2022 | 3633150000 | 627200000 |

| Sunday, January 1, 2023 | 4341769000 | 705500000 |

| Monday, January 1, 2024 | 1281443000 | 730600000 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Booz Allen Hamilton Holding Corporation and Lennox International Inc. have demonstrated contrasting trends in their SG&A expenditures. From 2014 to 2023, Booz Allen Hamilton's SG&A expenses surged by approximately 95%, peaking in 2023, while Lennox International saw a modest increase of around 23% over the same period.

This divergence highlights Booz Allen Hamilton's aggressive expansion and operational strategies, as opposed to Lennox's more conservative approach. Notably, 2024 data shows a significant drop for Booz Allen Hamilton, indicating potential strategic shifts or cost-cutting measures. Such insights are invaluable for investors and analysts seeking to understand the financial health and strategic direction of these industry giants.

Comparing Revenue Performance: Lennox International Inc. or Booz Allen Hamilton Holding Corporation?

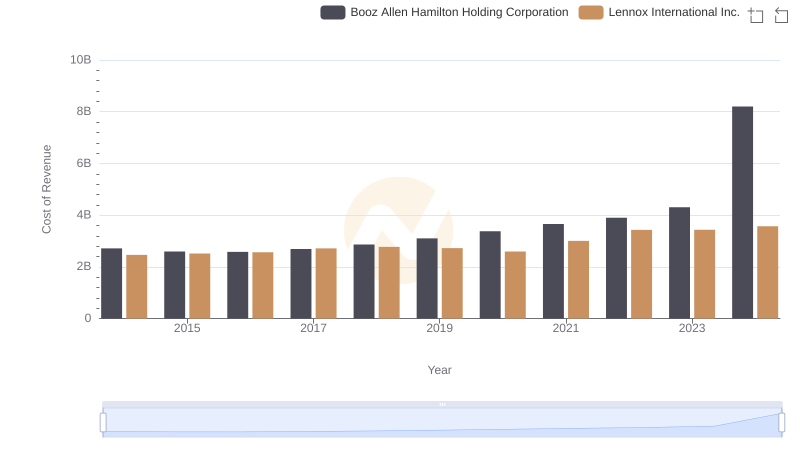

Analyzing Cost of Revenue: Lennox International Inc. and Booz Allen Hamilton Holding Corporation

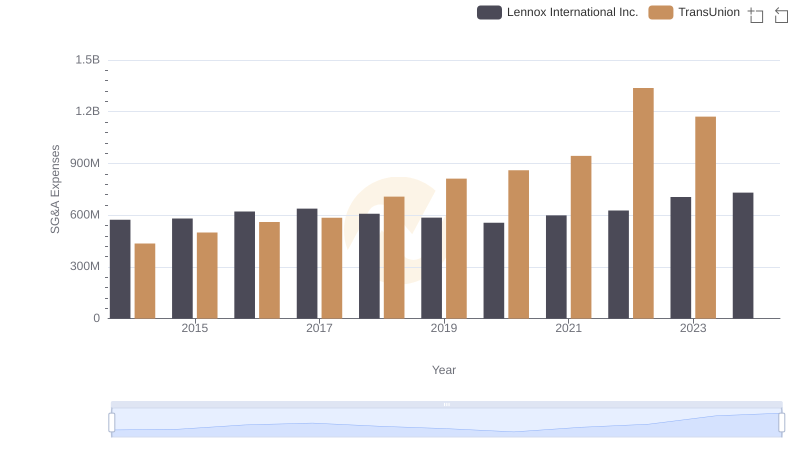

SG&A Efficiency Analysis: Comparing Lennox International Inc. and TransUnion

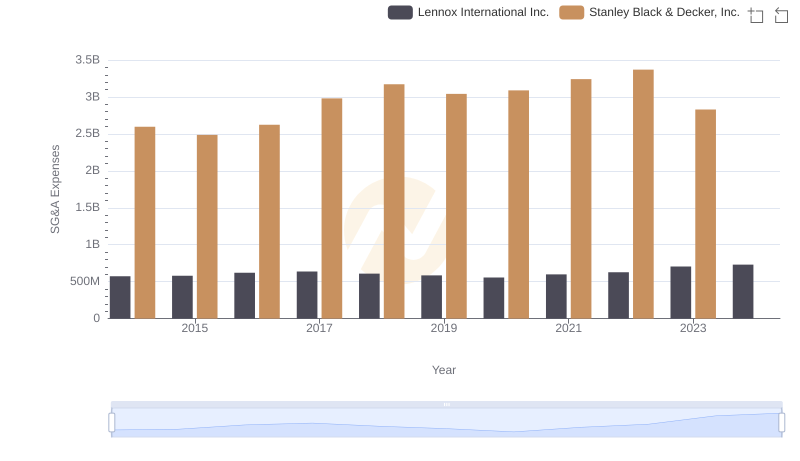

Who Optimizes SG&A Costs Better? Lennox International Inc. or Stanley Black & Decker, Inc.

Gross Profit Trends Compared: Lennox International Inc. vs Booz Allen Hamilton Holding Corporation

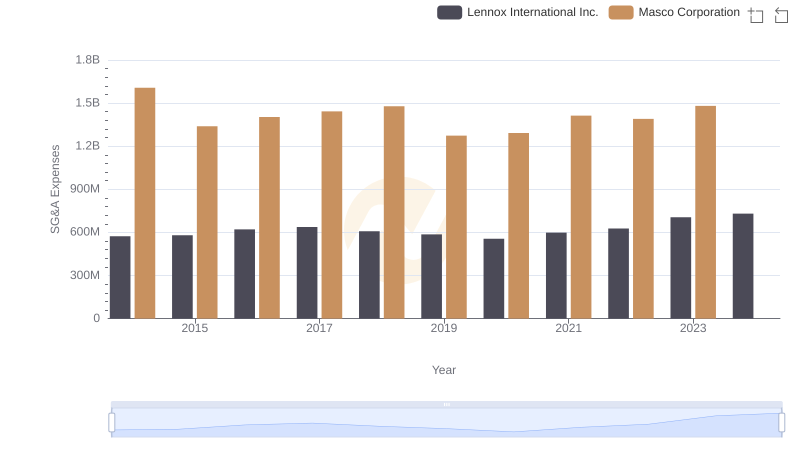

Lennox International Inc. or Masco Corporation: Who Manages SG&A Costs Better?

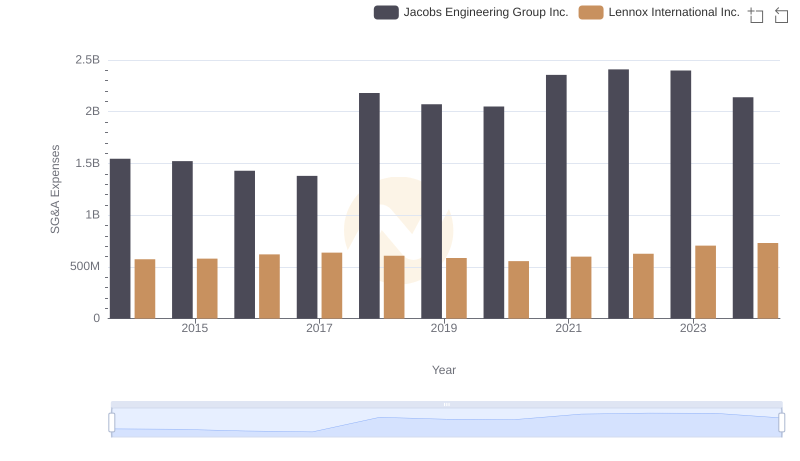

SG&A Efficiency Analysis: Comparing Lennox International Inc. and Jacobs Engineering Group Inc.

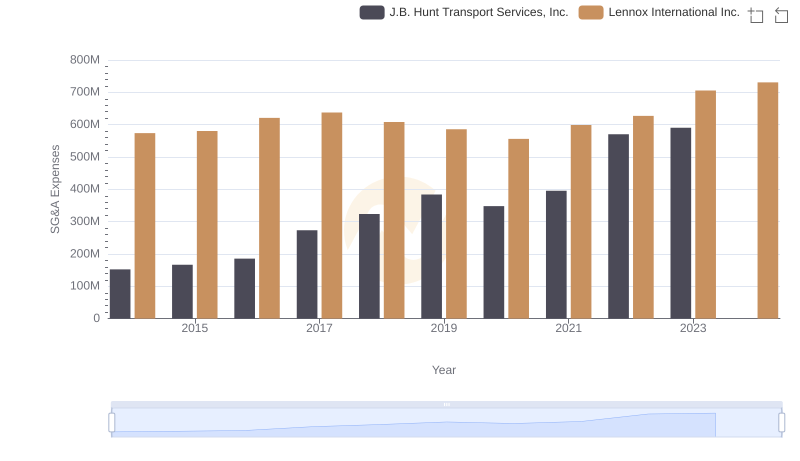

SG&A Efficiency Analysis: Comparing Lennox International Inc. and J.B. Hunt Transport Services, Inc.

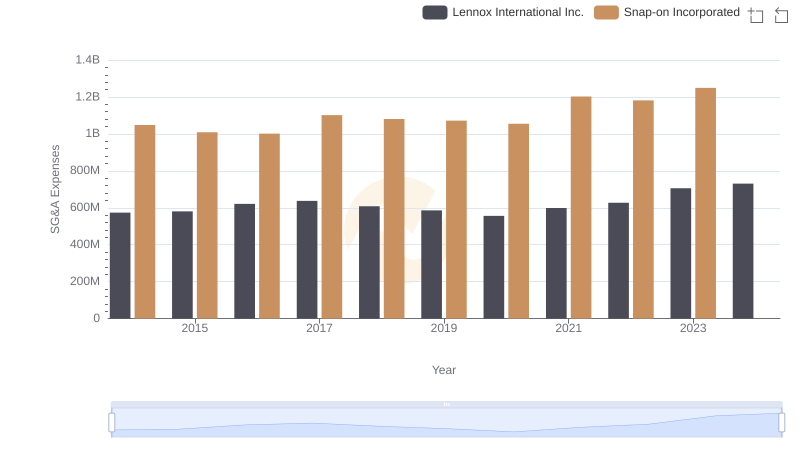

Breaking Down SG&A Expenses: Lennox International Inc. vs Snap-on Incorporated

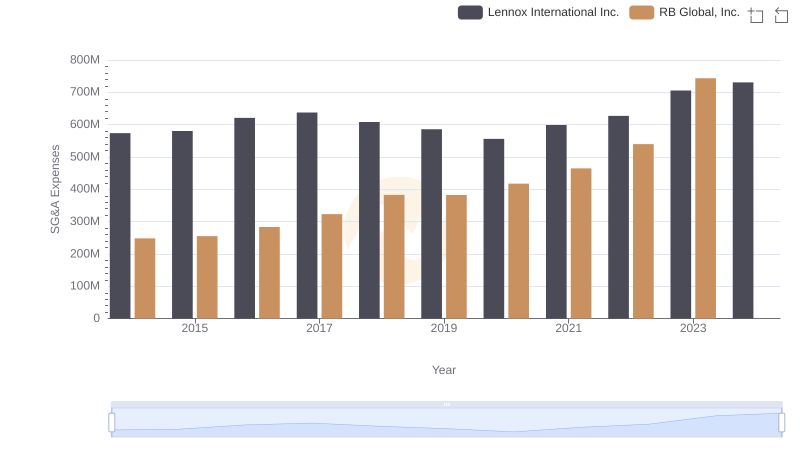

Operational Costs Compared: SG&A Analysis of Lennox International Inc. and RB Global, Inc.

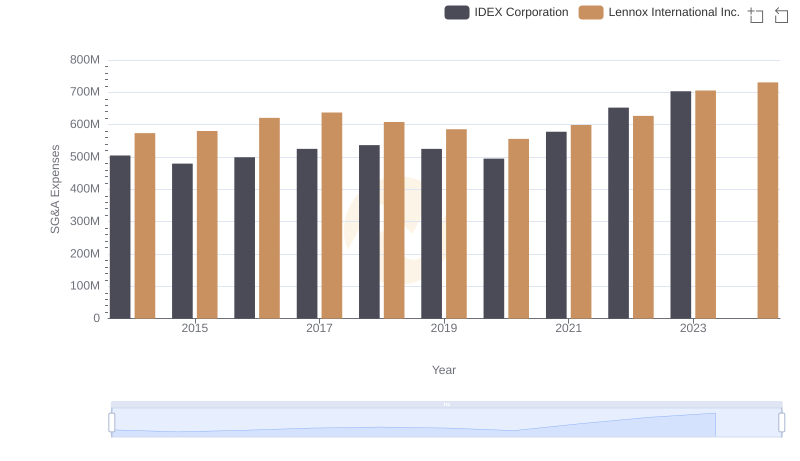

Lennox International Inc. vs IDEX Corporation: SG&A Expense Trends

A Side-by-Side Analysis of EBITDA: Lennox International Inc. and Booz Allen Hamilton Holding Corporation