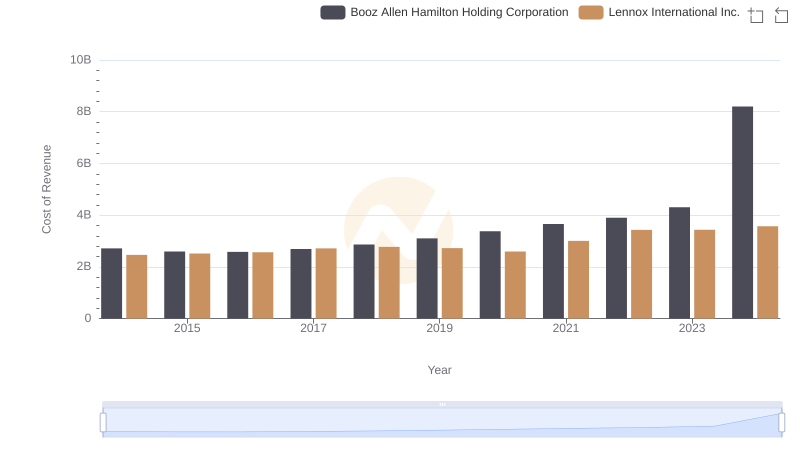

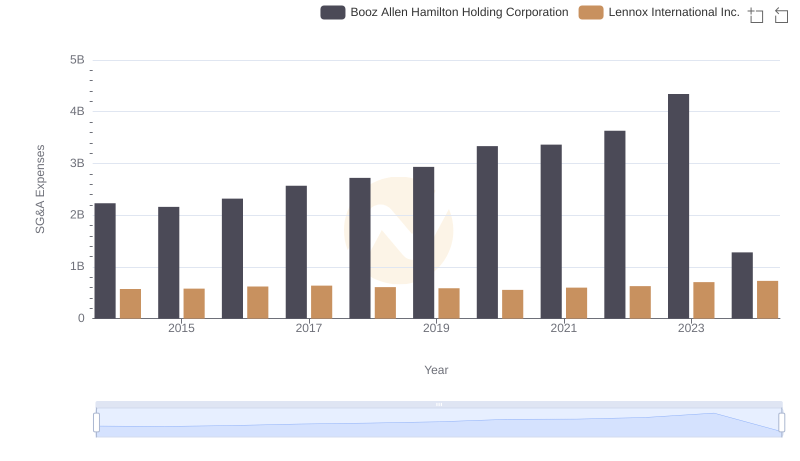

| __timestamp | Booz Allen Hamilton Holding Corporation | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2762580000 | 903300000 |

| Thursday, January 1, 2015 | 2680921000 | 947400000 |

| Friday, January 1, 2016 | 2825712000 | 1076500000 |

| Sunday, January 1, 2017 | 3112302000 | 1125200000 |

| Monday, January 1, 2018 | 3304750000 | 1111200000 |

| Tuesday, January 1, 2019 | 3603571000 | 1079800000 |

| Wednesday, January 1, 2020 | 4084661000 | 1040100000 |

| Friday, January 1, 2021 | 4201408000 | 1188400000 |

| Saturday, January 1, 2022 | 4464078000 | 1284700000 |

| Sunday, January 1, 2023 | 4954101000 | 1547800000 |

| Monday, January 1, 2024 | 2459049000 | 1771900000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding gross profit trends is crucial for investors and analysts alike. This analysis compares the financial trajectories of Lennox International Inc. and Booz Allen Hamilton Holding Corporation from 2014 to 2024.

Booz Allen Hamilton has demonstrated a robust growth trajectory, with its gross profit increasing by approximately 79% from 2014 to 2023. However, a notable dip is projected in 2024, with profits expected to fall by nearly 50% compared to the previous year. In contrast, Lennox International has shown a steady upward trend, with a 92% increase in gross profit over the same period. This consistent growth highlights Lennox's resilience and strategic prowess in navigating market challenges.

While Booz Allen's recent decline raises questions, Lennox's consistent growth offers a promising outlook for stakeholders. Understanding these trends provides valuable insights into the financial health and strategic direction of these industry leaders.

Comparing Revenue Performance: Lennox International Inc. or Booz Allen Hamilton Holding Corporation?

Analyzing Cost of Revenue: Lennox International Inc. and Booz Allen Hamilton Holding Corporation

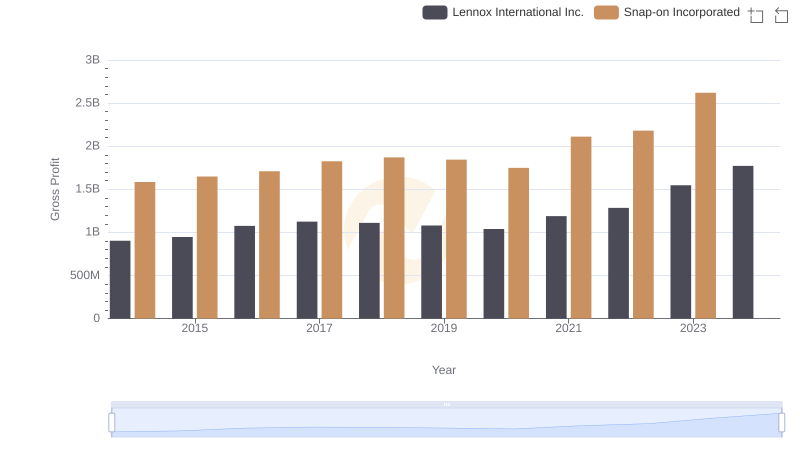

Lennox International Inc. vs Snap-on Incorporated: A Gross Profit Performance Breakdown

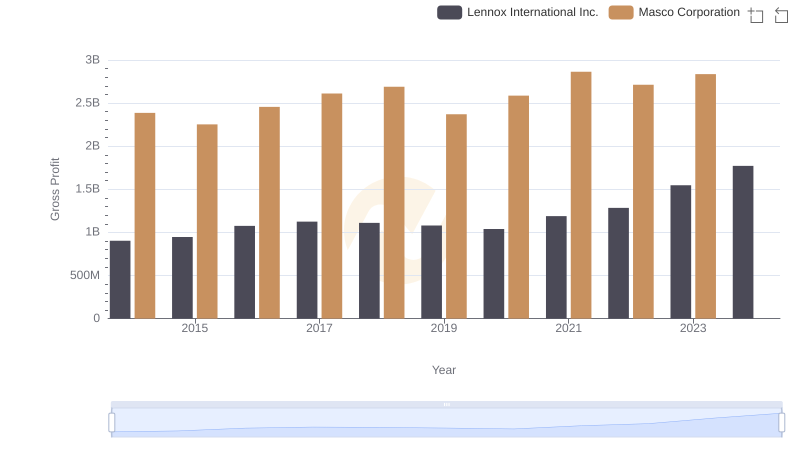

Gross Profit Trends Compared: Lennox International Inc. vs Masco Corporation

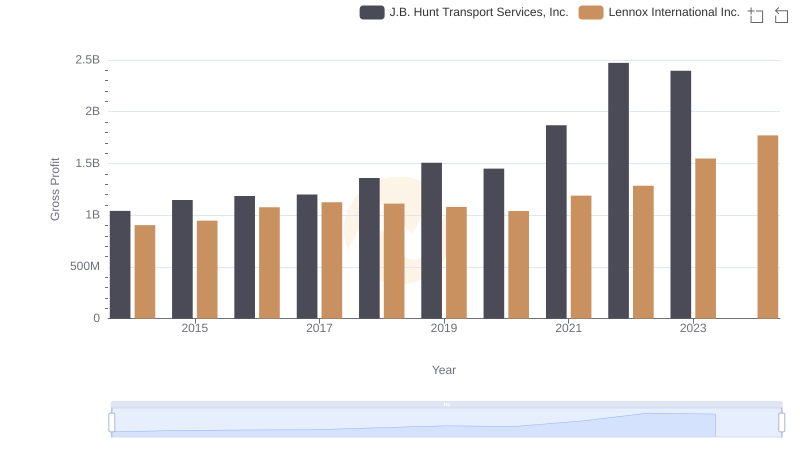

Lennox International Inc. and J.B. Hunt Transport Services, Inc.: A Detailed Gross Profit Analysis

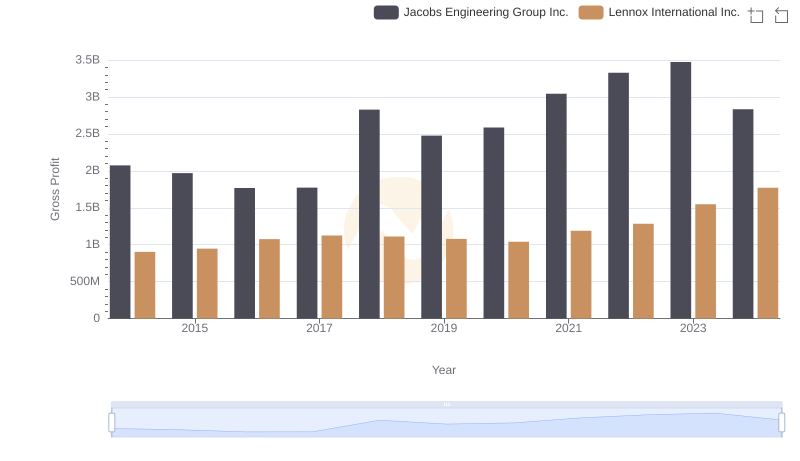

Who Generates Higher Gross Profit? Lennox International Inc. or Jacobs Engineering Group Inc.

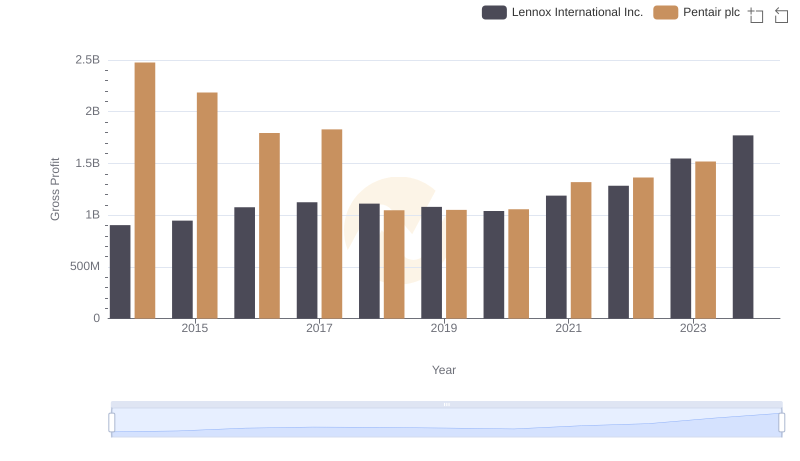

Gross Profit Analysis: Comparing Lennox International Inc. and Pentair plc

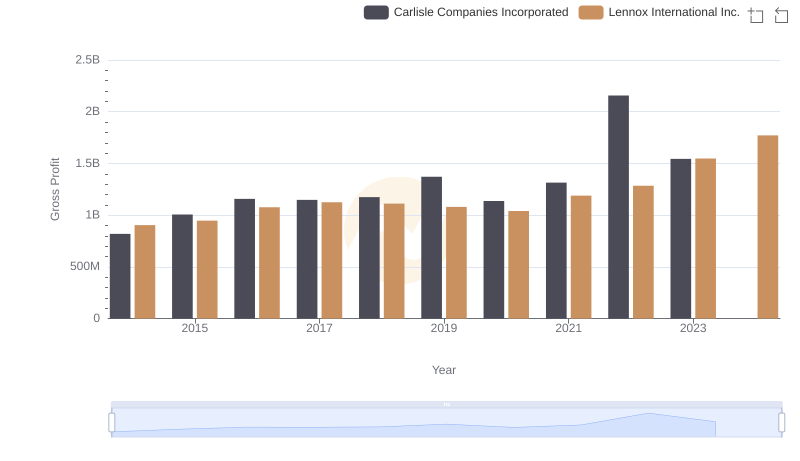

Gross Profit Trends Compared: Lennox International Inc. vs Carlisle Companies Incorporated

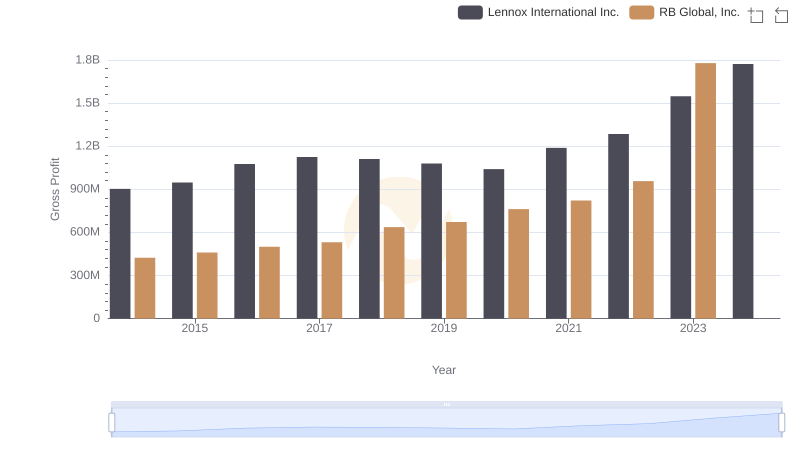

Lennox International Inc. vs RB Global, Inc.: A Gross Profit Performance Breakdown

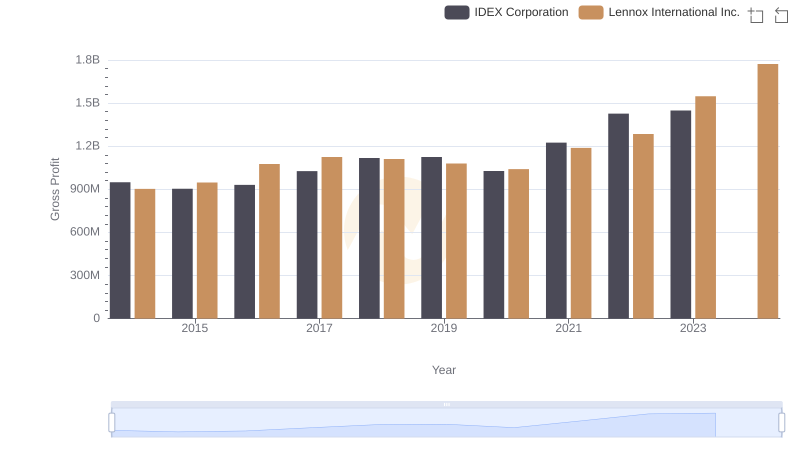

Gross Profit Comparison: Lennox International Inc. and IDEX Corporation Trends

Selling, General, and Administrative Costs: Lennox International Inc. vs Booz Allen Hamilton Holding Corporation

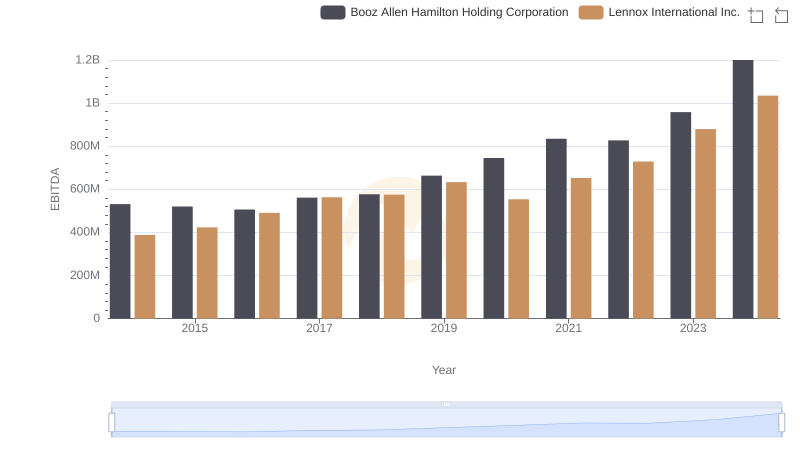

A Side-by-Side Analysis of EBITDA: Lennox International Inc. and Booz Allen Hamilton Holding Corporation