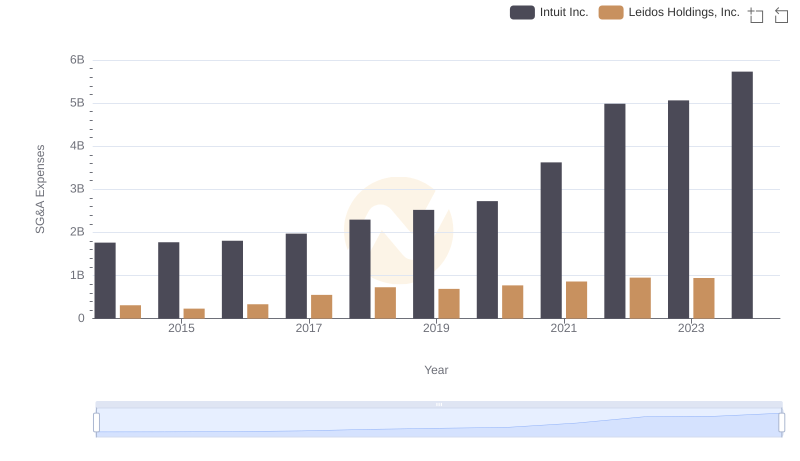

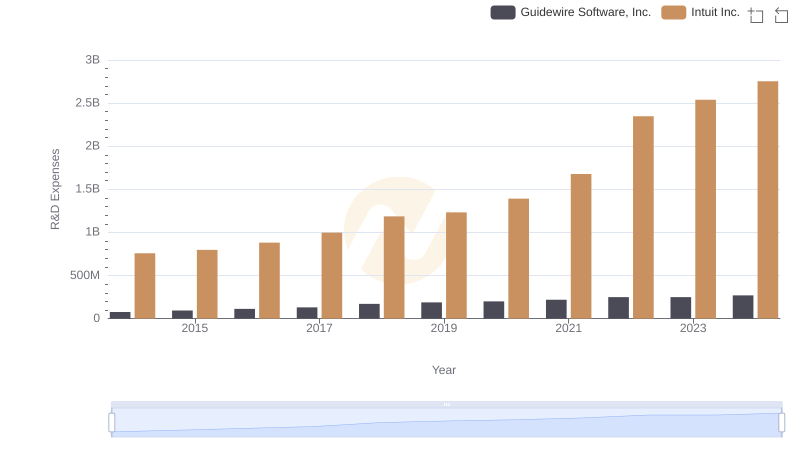

| __timestamp | Guidewire Software, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 106699000 | 1762000000 |

| Thursday, January 1, 2015 | 123420000 | 1771000000 |

| Friday, January 1, 2016 | 143679000 | 1807000000 |

| Sunday, January 1, 2017 | 165790000 | 1973000000 |

| Monday, January 1, 2018 | 200033000 | 2298000000 |

| Tuesday, January 1, 2019 | 205152000 | 2524000000 |

| Wednesday, January 1, 2020 | 227603000 | 2727000000 |

| Friday, January 1, 2021 | 254303000 | 3626000000 |

| Saturday, January 1, 2022 | 302002000 | 4986000000 |

| Sunday, January 1, 2023 | 357955000 | 5062000000 |

| Monday, January 1, 2024 | 366553000 | 5730000000 |

In pursuit of knowledge

In the ever-evolving landscape of software giants, Intuit Inc. and Guidewire Software, Inc. have carved distinct paths in managing their Selling, General, and Administrative (SG&A) expenses. Over the past decade, from 2014 to 2024, Intuit's SG&A costs have surged by over 225%, reflecting its aggressive expansion and market dominance. In contrast, Guidewire's expenses have grown by approximately 243%, indicating its strategic investments in growth and innovation.

This comparison highlights the diverse strategies employed by these companies in navigating the competitive software industry.

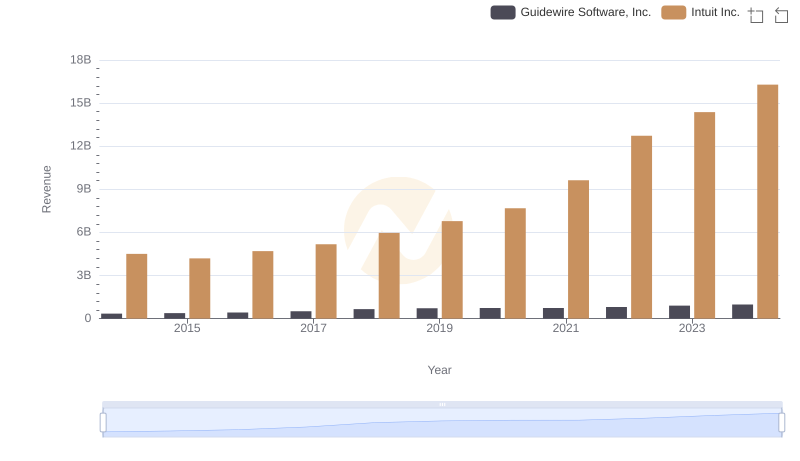

Intuit Inc. vs Guidewire Software, Inc.: Annual Revenue Growth Compared

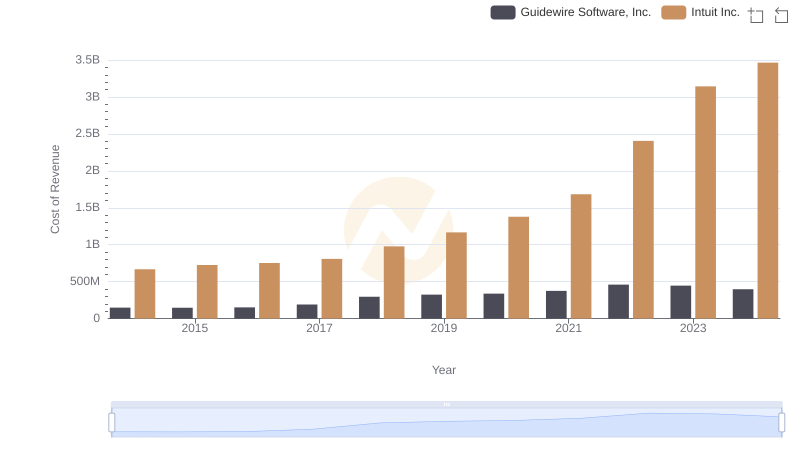

Analyzing Cost of Revenue: Intuit Inc. and Guidewire Software, Inc.

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Leidos Holdings, Inc.

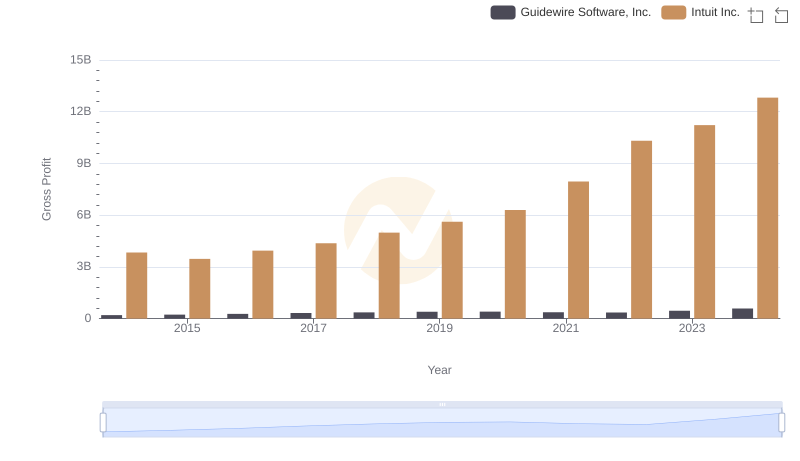

Gross Profit Analysis: Comparing Intuit Inc. and Guidewire Software, Inc.

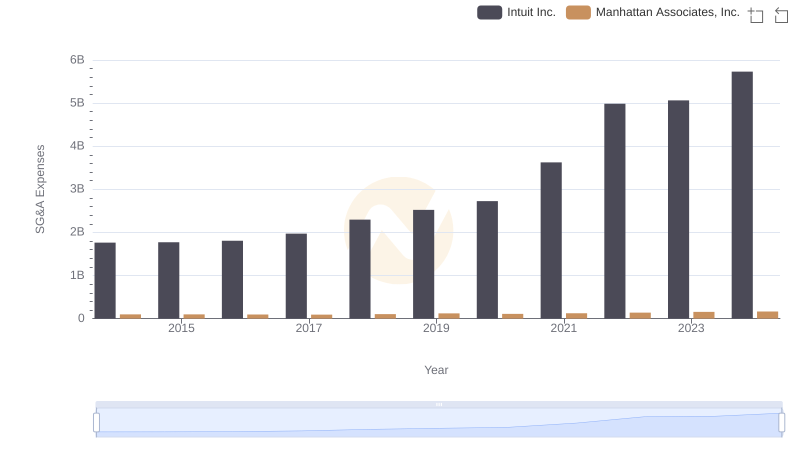

Intuit Inc. vs Manhattan Associates, Inc.: SG&A Expense Trends

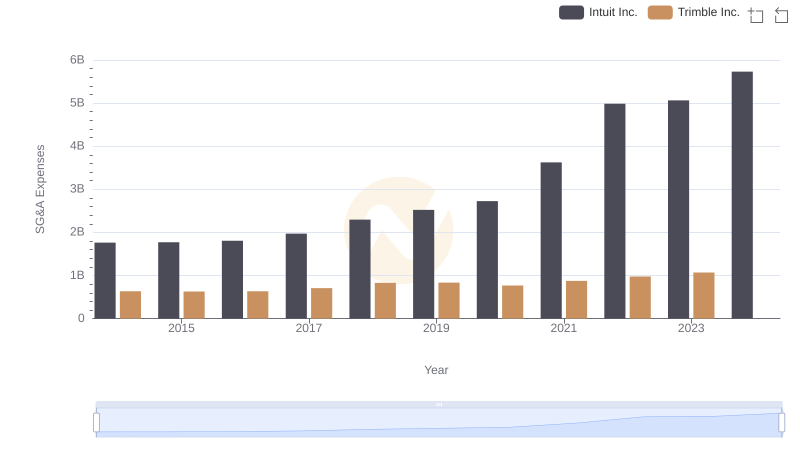

Intuit Inc. or Trimble Inc.: Who Manages SG&A Costs Better?

Research and Development Expenses Breakdown: Intuit Inc. vs Guidewire Software, Inc.

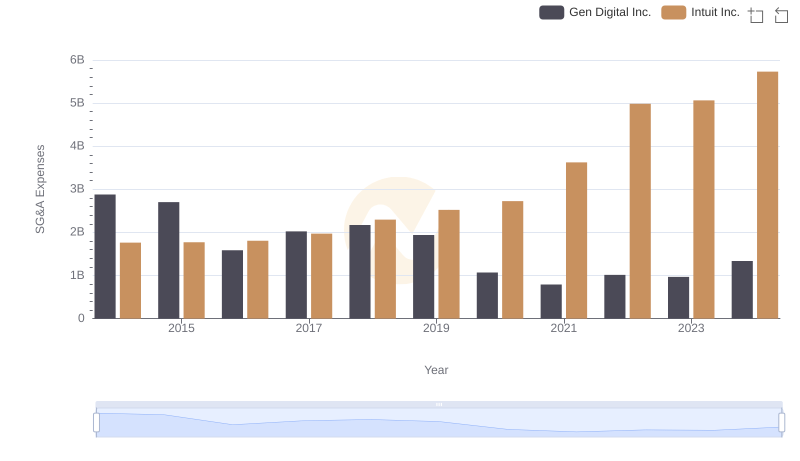

Breaking Down SG&A Expenses: Intuit Inc. vs Gen Digital Inc.

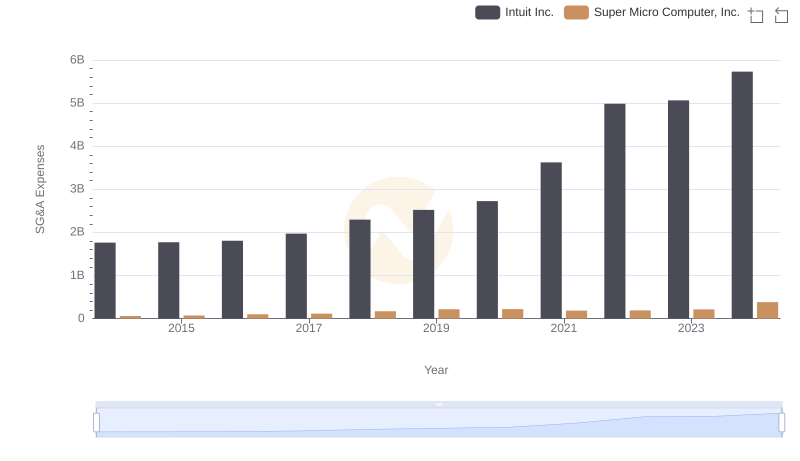

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Super Micro Computer, Inc.

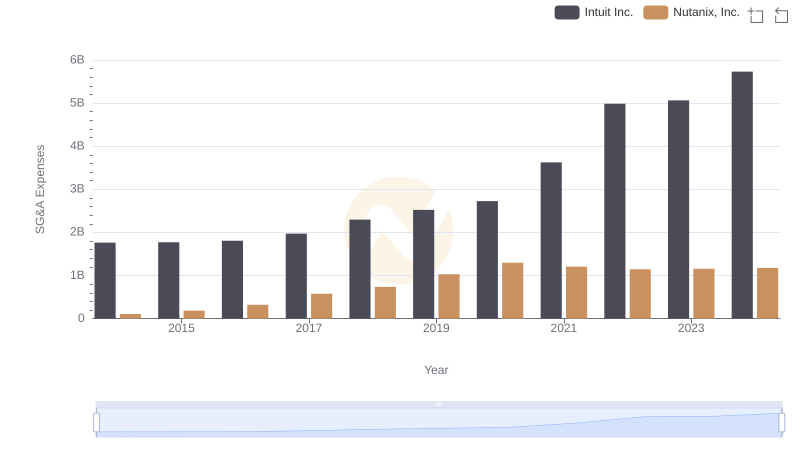

Who Optimizes SG&A Costs Better? Intuit Inc. or Nutanix, Inc.

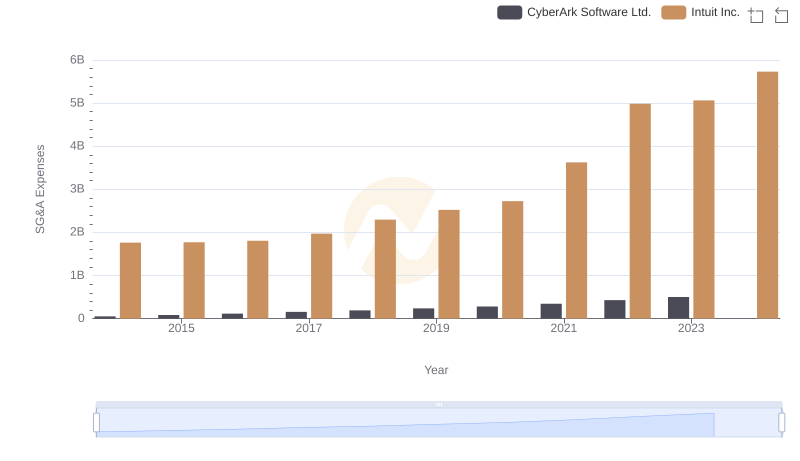

SG&A Efficiency Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

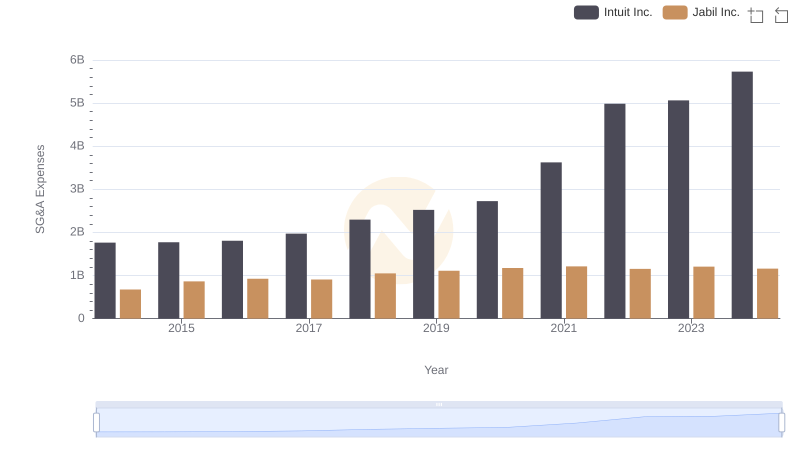

Intuit Inc. vs Jabil Inc.: SG&A Expense Trends