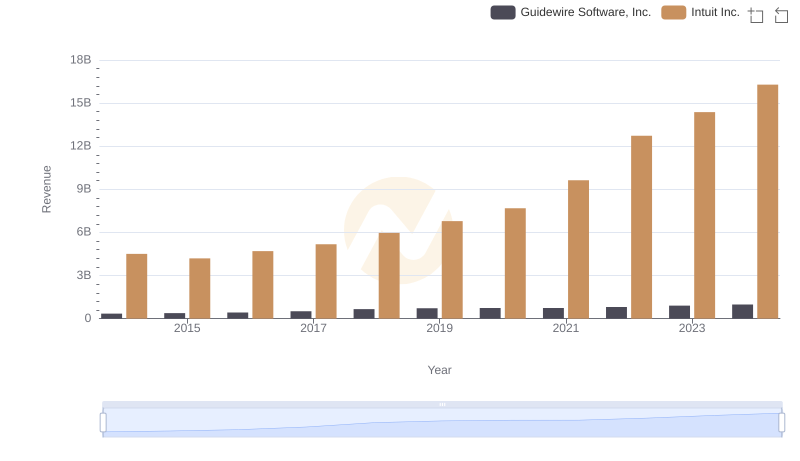

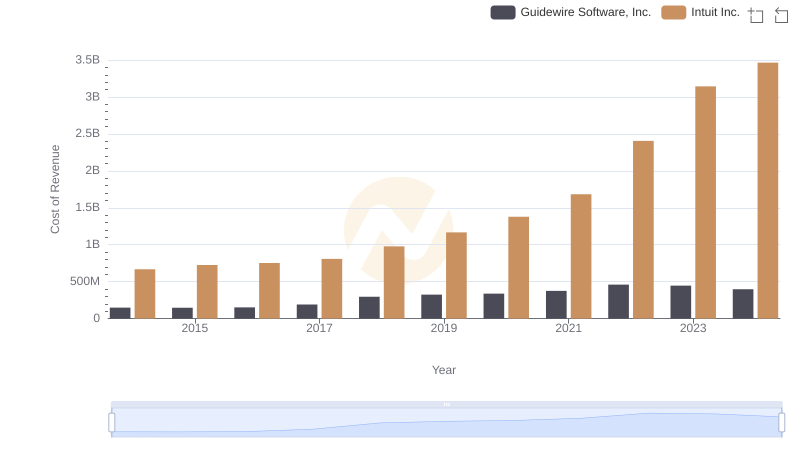

| __timestamp | Guidewire Software, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 201299000 | 3838000000 |

| Thursday, January 1, 2015 | 233353000 | 3467000000 |

| Friday, January 1, 2016 | 272612000 | 3942000000 |

| Sunday, January 1, 2017 | 322725000 | 4368000000 |

| Monday, January 1, 2018 | 364360000 | 4987000000 |

| Tuesday, January 1, 2019 | 395164000 | 5617000000 |

| Wednesday, January 1, 2020 | 404292000 | 6301000000 |

| Friday, January 1, 2021 | 368213000 | 7950000000 |

| Saturday, January 1, 2022 | 352220000 | 10320000000 |

| Sunday, January 1, 2023 | 458211000 | 11225000000 |

| Monday, January 1, 2024 | 583361000 | 12820000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of financial technology, Intuit Inc. and Guidewire Software, Inc. have emerged as key players. Over the past decade, from 2014 to 2024, these companies have demonstrated significant growth in gross profit, reflecting their strategic prowess and market adaptability.

Intuit Inc., a leader in financial software, has seen its gross profit soar by approximately 234%, from $3.8 billion in 2014 to an impressive $12.8 billion in 2024. This growth underscores Intuit's ability to innovate and capture market share in a competitive industry.

Meanwhile, Guidewire Software, Inc., specializing in software for the insurance sector, has experienced a more modest yet steady increase of around 190%, with gross profit rising from $201 million to $583 million over the same period. This growth trajectory highlights Guidewire's resilience and niche market strength.

The data reveals a compelling narrative of growth and competition, offering valuable insights into the financial technology sector's dynamics.

Intuit Inc. vs Guidewire Software, Inc.: Annual Revenue Growth Compared

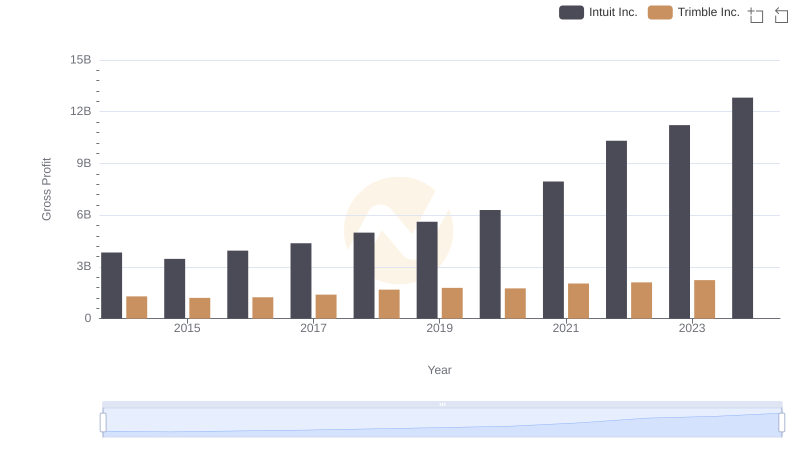

Key Insights on Gross Profit: Intuit Inc. vs Trimble Inc.

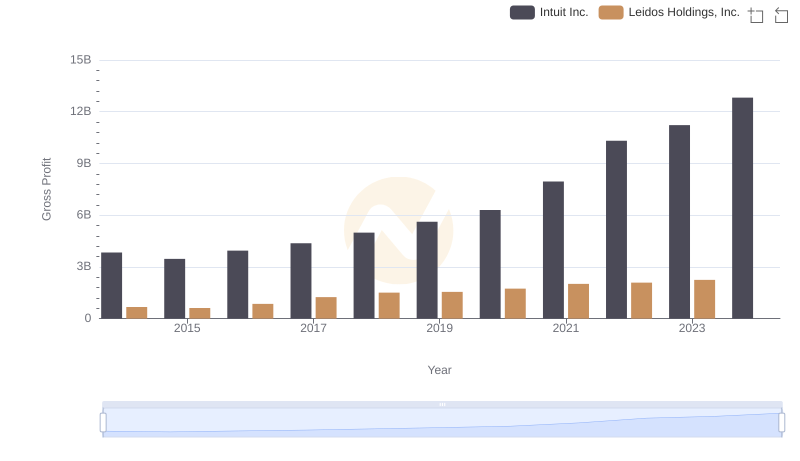

Intuit Inc. and Leidos Holdings, Inc.: A Detailed Gross Profit Analysis

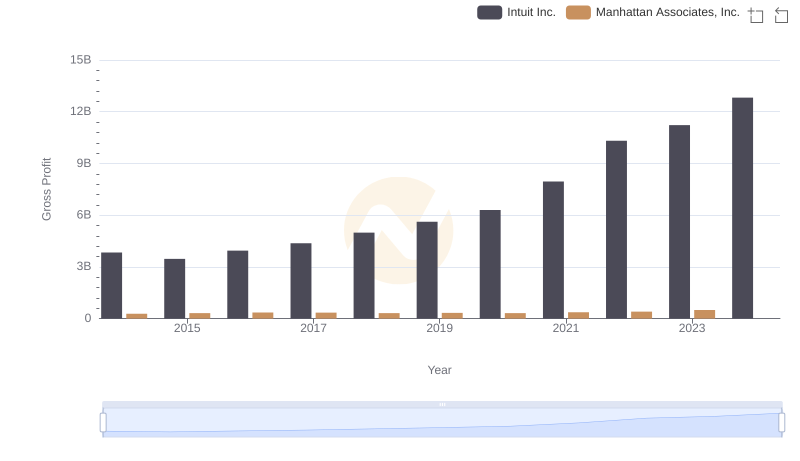

Gross Profit Trends Compared: Intuit Inc. vs Manhattan Associates, Inc.

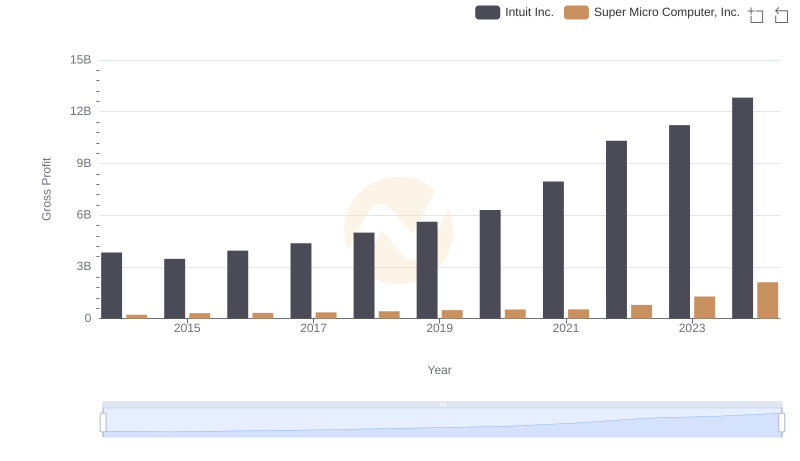

Gross Profit Analysis: Comparing Intuit Inc. and Super Micro Computer, Inc.

Analyzing Cost of Revenue: Intuit Inc. and Guidewire Software, Inc.

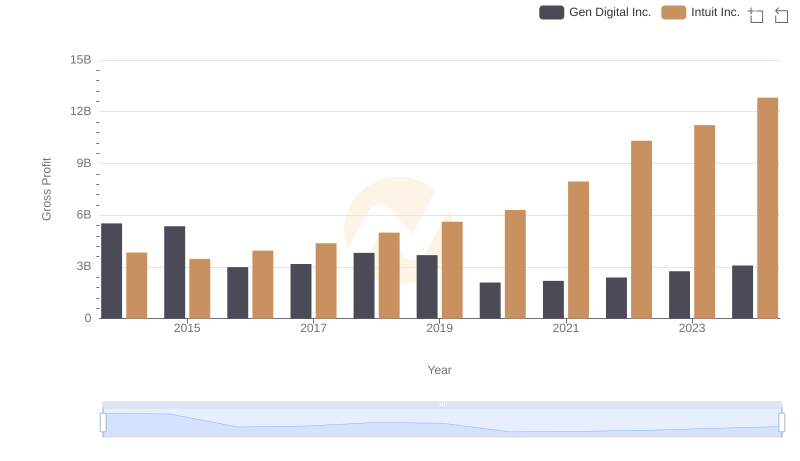

Intuit Inc. vs Gen Digital Inc.: A Gross Profit Performance Breakdown

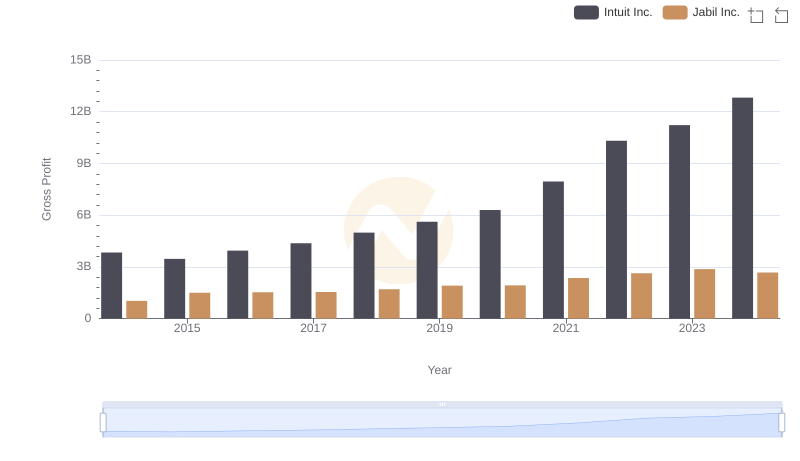

Gross Profit Trends Compared: Intuit Inc. vs Jabil Inc.

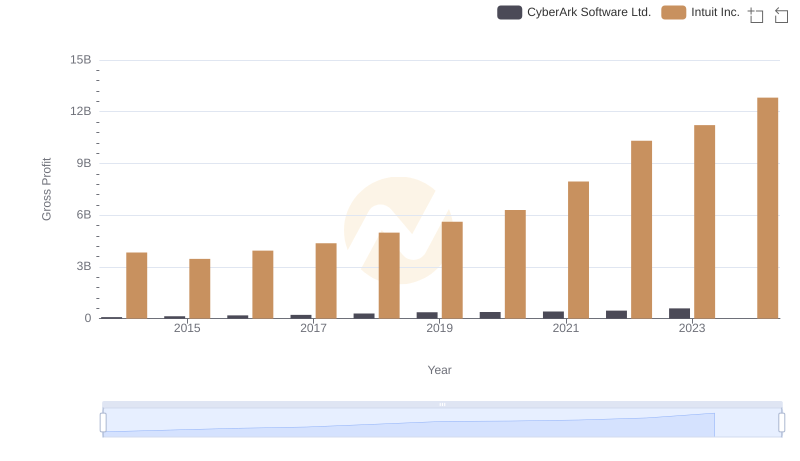

Gross Profit Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

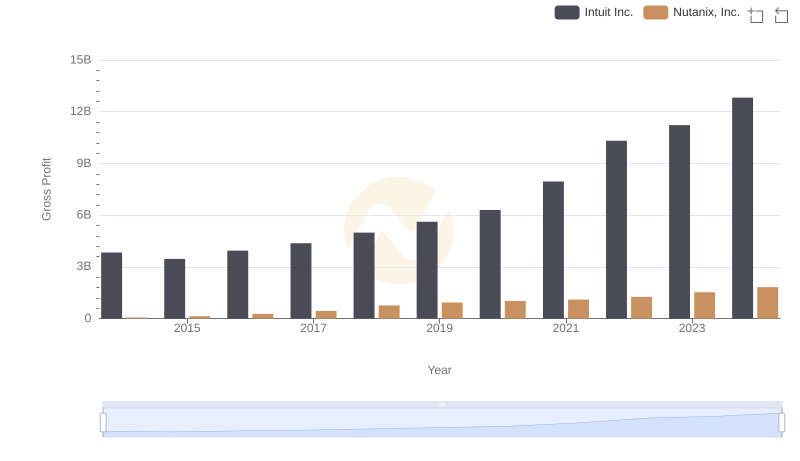

Key Insights on Gross Profit: Intuit Inc. vs Nutanix, Inc.

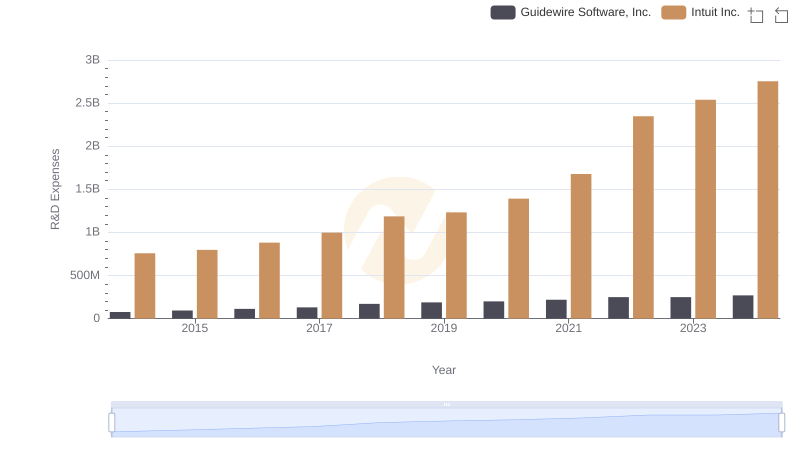

Research and Development Expenses Breakdown: Intuit Inc. vs Guidewire Software, Inc.

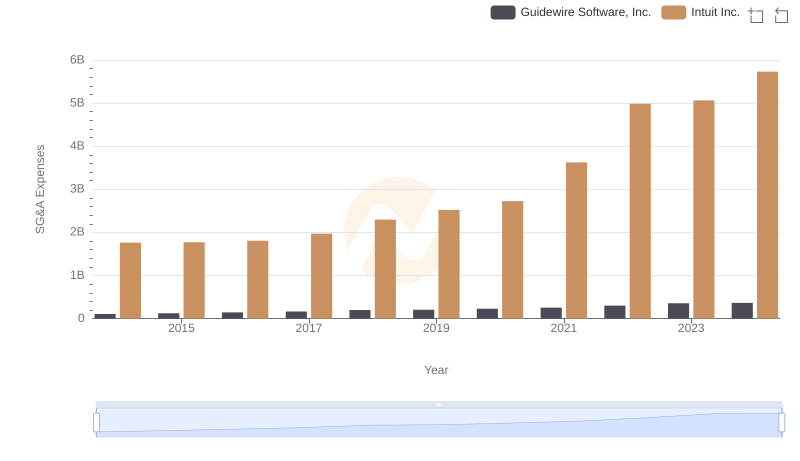

Selling, General, and Administrative Costs: Intuit Inc. vs Guidewire Software, Inc.