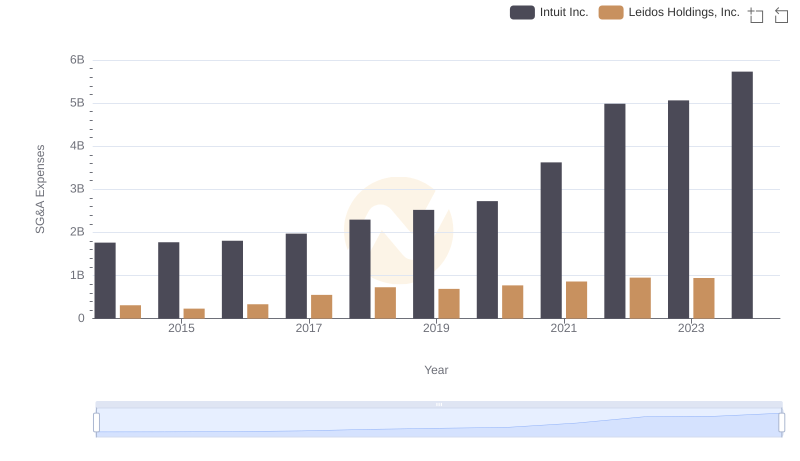

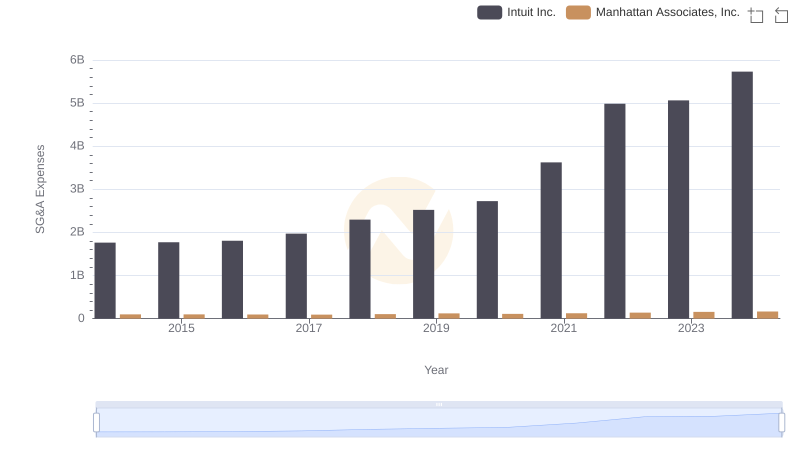

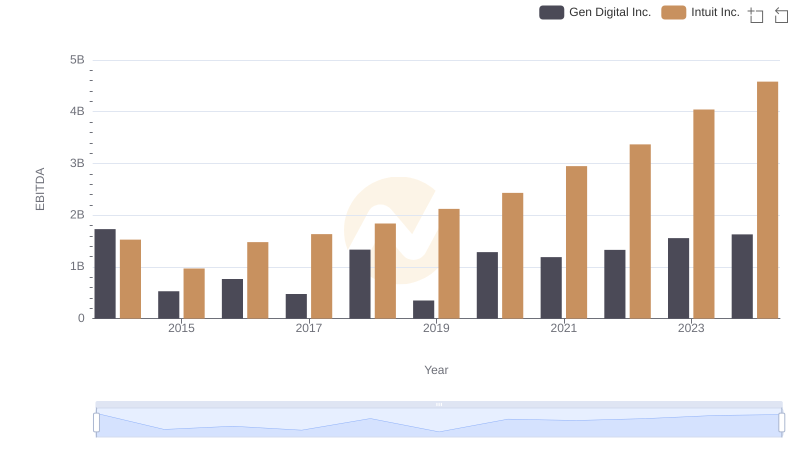

| __timestamp | Gen Digital Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2880000000 | 1762000000 |

| Thursday, January 1, 2015 | 2702000000 | 1771000000 |

| Friday, January 1, 2016 | 1587000000 | 1807000000 |

| Sunday, January 1, 2017 | 2023000000 | 1973000000 |

| Monday, January 1, 2018 | 2171000000 | 2298000000 |

| Tuesday, January 1, 2019 | 1940000000 | 2524000000 |

| Wednesday, January 1, 2020 | 1069000000 | 2727000000 |

| Friday, January 1, 2021 | 791000000 | 3626000000 |

| Saturday, January 1, 2022 | 1014000000 | 4986000000 |

| Sunday, January 1, 2023 | 968000000 | 5062000000 |

| Monday, January 1, 2024 | 1337000000 | 5730000000 |

In pursuit of knowledge

In the ever-evolving landscape of financial technology, Intuit Inc. and Gen Digital Inc. have emerged as key players, each with a unique approach to managing Selling, General, and Administrative (SG&A) expenses. Over the past decade, Intuit has consistently outpaced Gen Digital, with SG&A expenses growing by approximately 225% from 2014 to 2024. This growth reflects Intuit's strategic investments in innovation and customer acquisition.

Conversely, Gen Digital's SG&A expenses have seen a more volatile trajectory, peaking in 2014 and then experiencing a significant decline of around 67% by 2020. This fluctuation suggests a period of restructuring and cost optimization. By 2024, Gen Digital's expenses began to stabilize, indicating a potential shift towards sustainable growth.

This comparative analysis highlights the contrasting strategies of these two industry leaders, offering valuable insights into their financial management and market positioning.

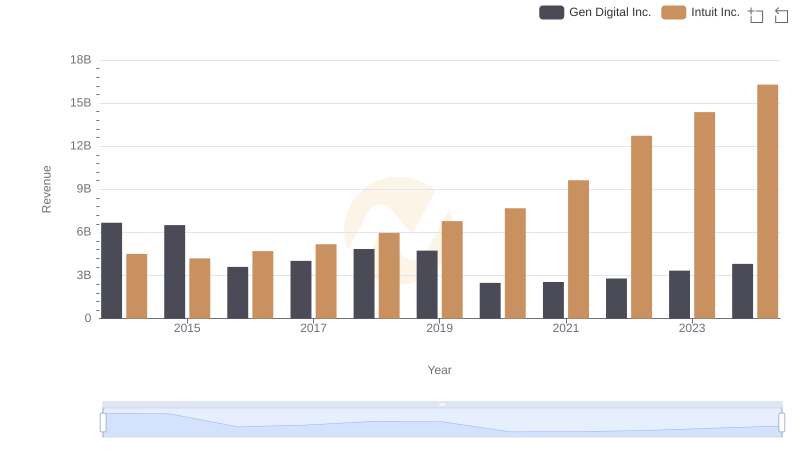

Intuit Inc. or Gen Digital Inc.: Who Leads in Yearly Revenue?

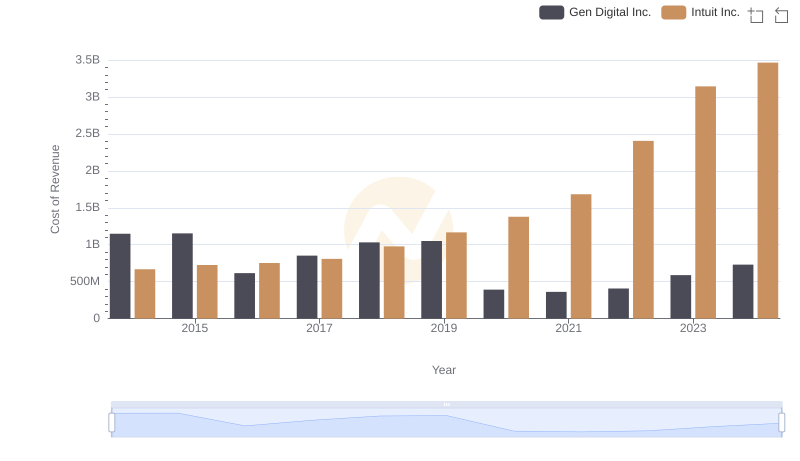

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Gen Digital Inc.

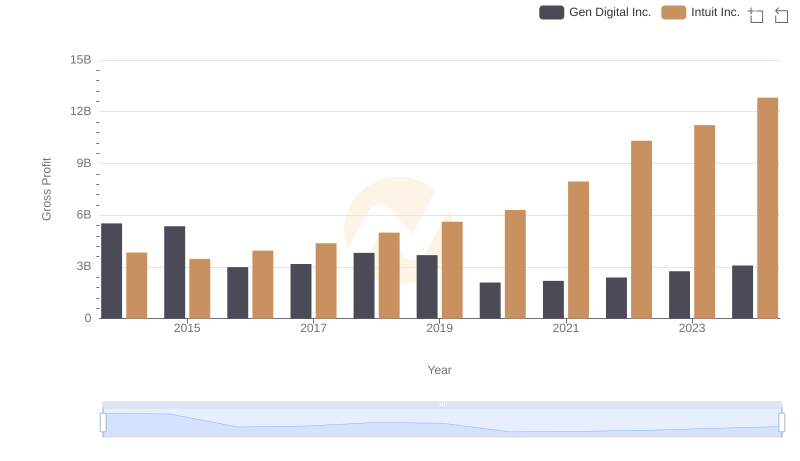

Intuit Inc. vs Gen Digital Inc.: A Gross Profit Performance Breakdown

Intuit Inc. and Teradyne, Inc.: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Leidos Holdings, Inc.

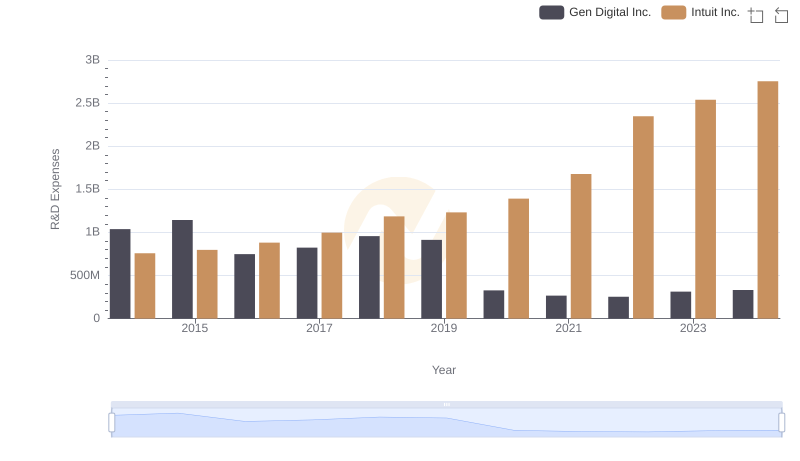

Research and Development Investment: Intuit Inc. vs Gen Digital Inc.

Intuit Inc. vs Manhattan Associates, Inc.: SG&A Expense Trends

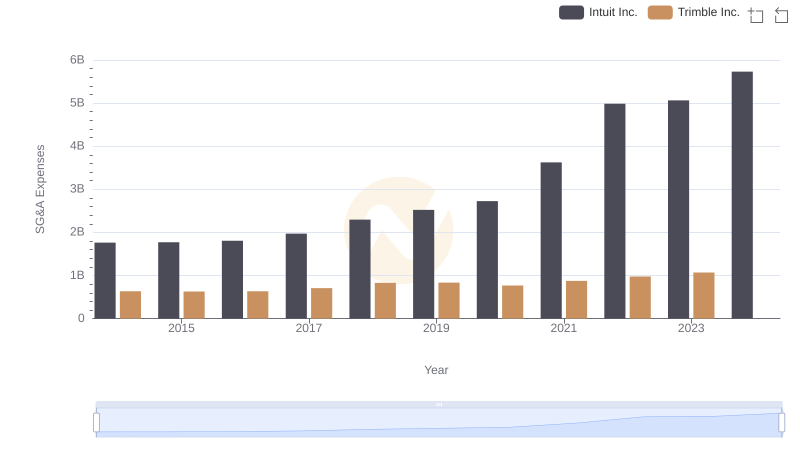

Intuit Inc. or Trimble Inc.: Who Manages SG&A Costs Better?

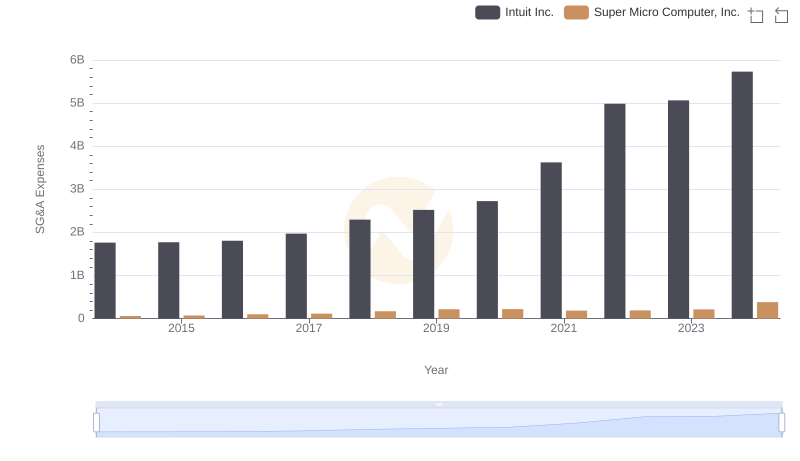

Operational Costs Compared: SG&A Analysis of Intuit Inc. and Super Micro Computer, Inc.

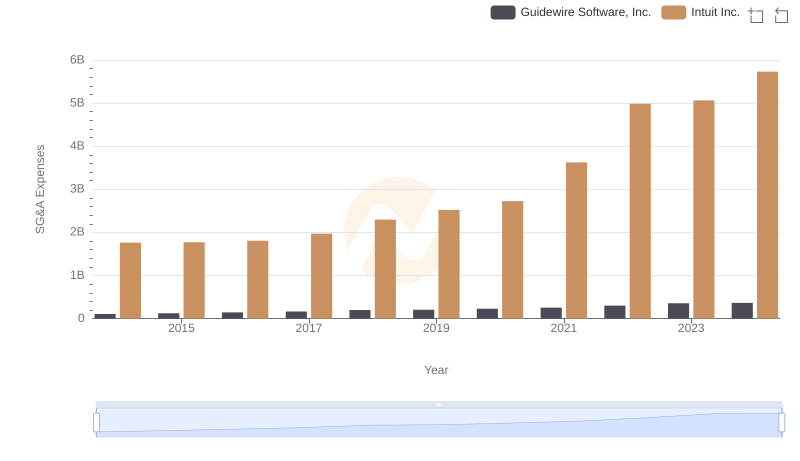

Selling, General, and Administrative Costs: Intuit Inc. vs Guidewire Software, Inc.

EBITDA Metrics Evaluated: Intuit Inc. vs Gen Digital Inc.

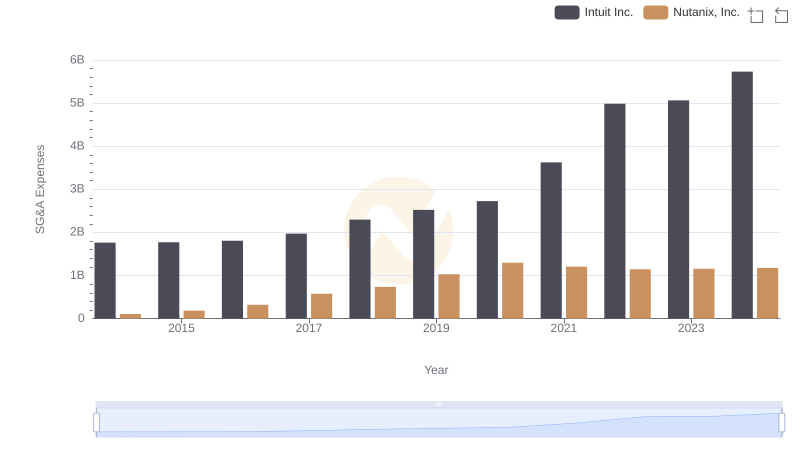

Who Optimizes SG&A Costs Better? Intuit Inc. or Nutanix, Inc.