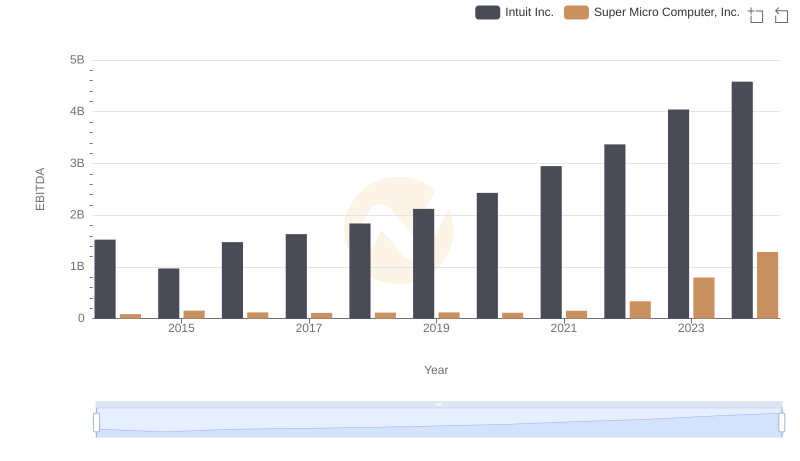

| __timestamp | Intuit Inc. | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 61029000 |

| Thursday, January 1, 2015 | 1771000000 | 73228000 |

| Friday, January 1, 2016 | 1807000000 | 100681000 |

| Sunday, January 1, 2017 | 1973000000 | 115331000 |

| Monday, January 1, 2018 | 2298000000 | 170176000 |

| Tuesday, January 1, 2019 | 2524000000 | 218382000 |

| Wednesday, January 1, 2020 | 2727000000 | 219078000 |

| Friday, January 1, 2021 | 3626000000 | 186222000 |

| Saturday, January 1, 2022 | 4986000000 | 192561000 |

| Sunday, January 1, 2023 | 5062000000 | 214610000 |

| Monday, January 1, 2024 | 5730000000 | 383111000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. Over the past decade, Intuit Inc. and Super Micro Computer, Inc. have showcased contrasting trajectories in their Selling, General, and Administrative (SG&A) expenses. Intuit's SG&A expenses have surged by over 225% from 2014 to 2024, reflecting its aggressive growth strategy and market expansion. In contrast, Super Micro Computer, Inc. has maintained a more conservative increase of approximately 530%, albeit from a much smaller base, indicating a steady yet cautious approach to scaling operations.

This analysis highlights the strategic differences between a tech giant and a rising player in the industry. As Intuit continues to invest heavily in its operations, Super Micro Computer, Inc. focuses on sustainable growth. These insights provide a window into how companies navigate financial strategies in a competitive market.

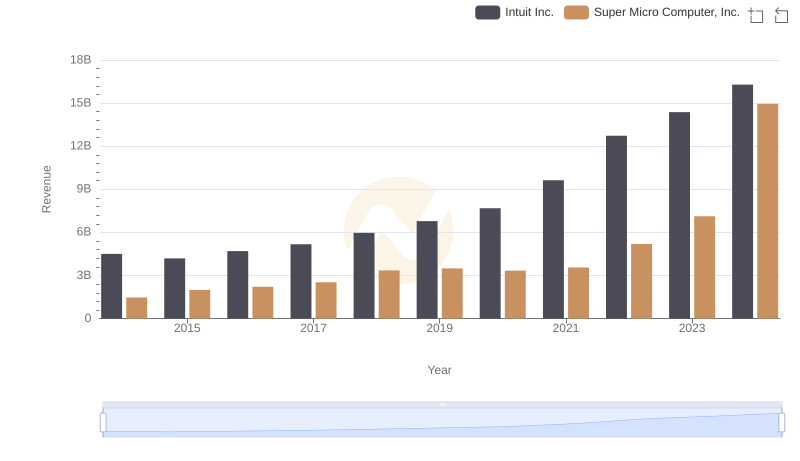

Breaking Down Revenue Trends: Intuit Inc. vs Super Micro Computer, Inc.

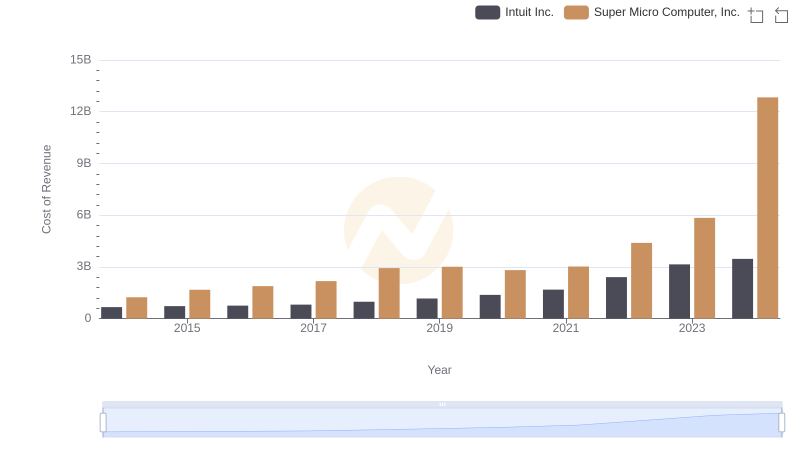

Cost of Revenue: Key Insights for Intuit Inc. and Super Micro Computer, Inc.

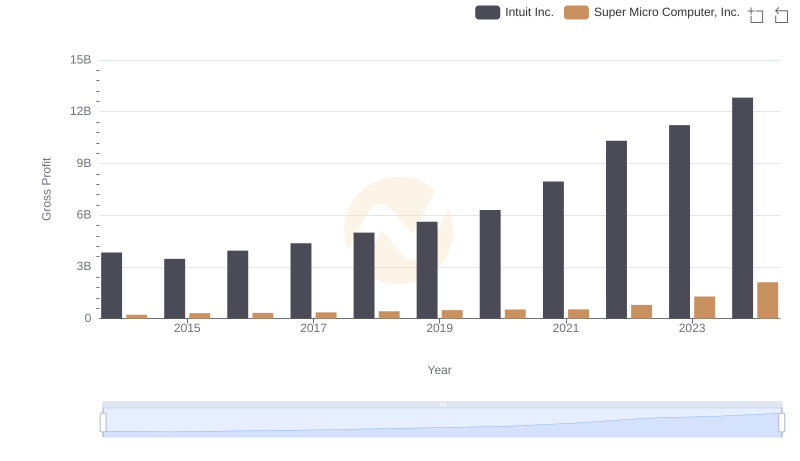

Gross Profit Analysis: Comparing Intuit Inc. and Super Micro Computer, Inc.

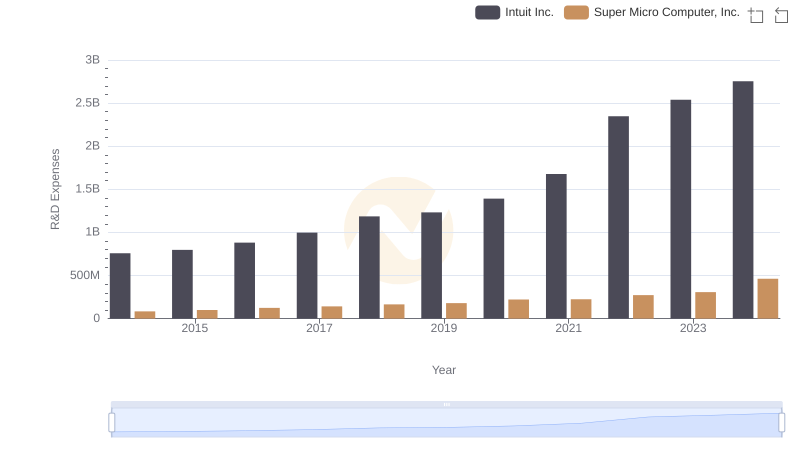

Intuit Inc. or Super Micro Computer, Inc.: Who Invests More in Innovation?

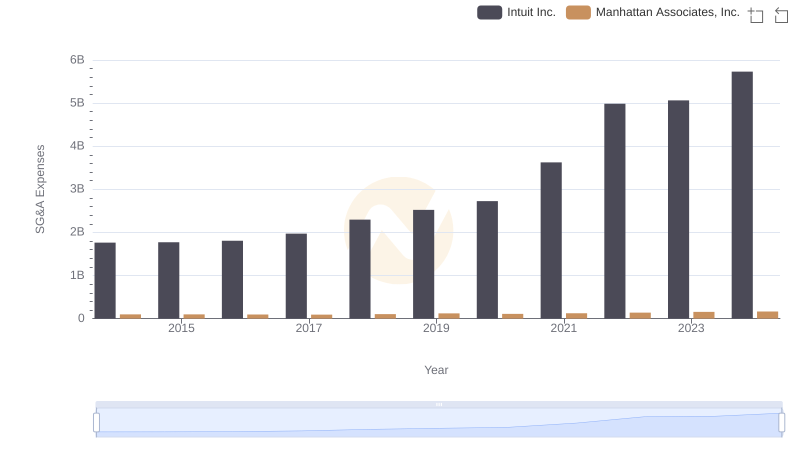

Intuit Inc. vs Manhattan Associates, Inc.: SG&A Expense Trends

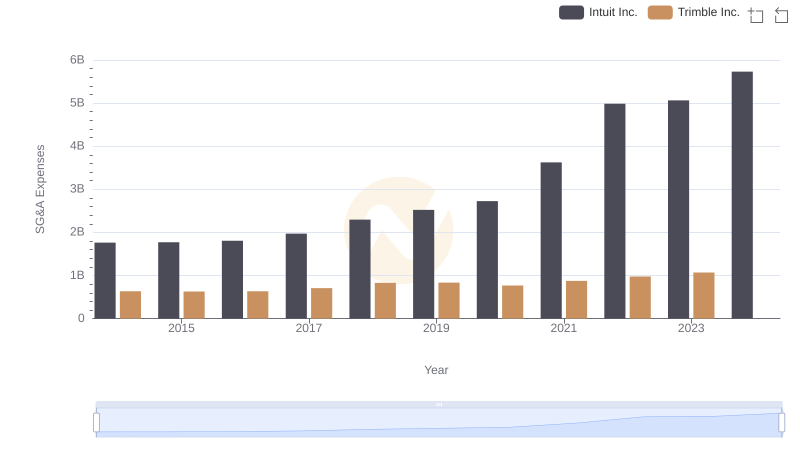

Intuit Inc. or Trimble Inc.: Who Manages SG&A Costs Better?

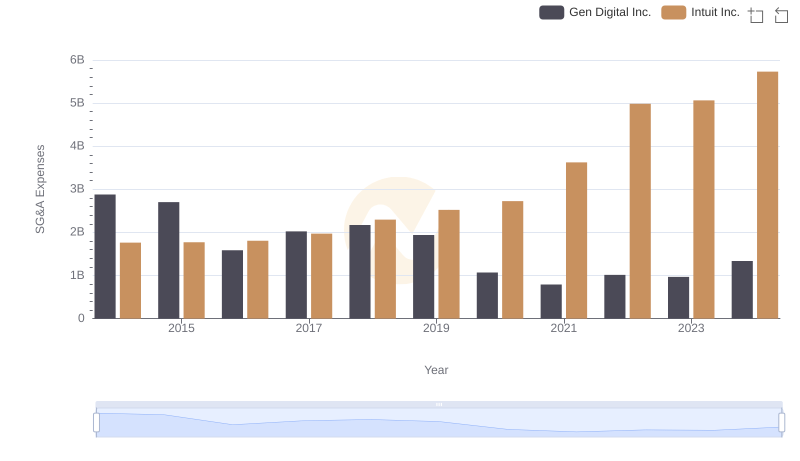

Breaking Down SG&A Expenses: Intuit Inc. vs Gen Digital Inc.

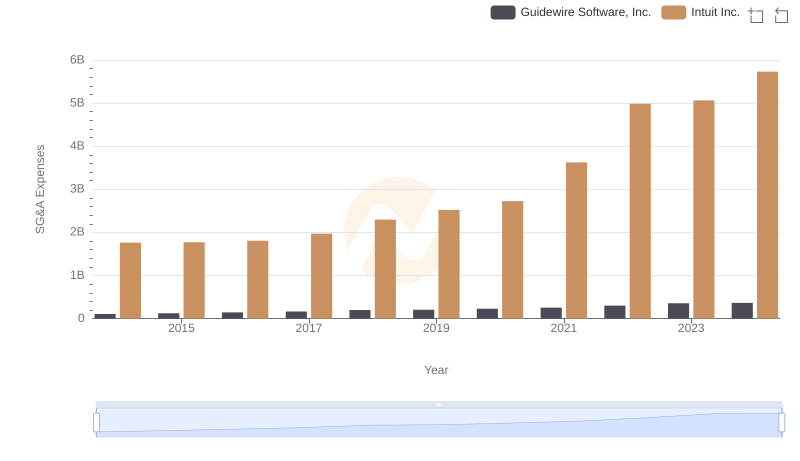

Selling, General, and Administrative Costs: Intuit Inc. vs Guidewire Software, Inc.

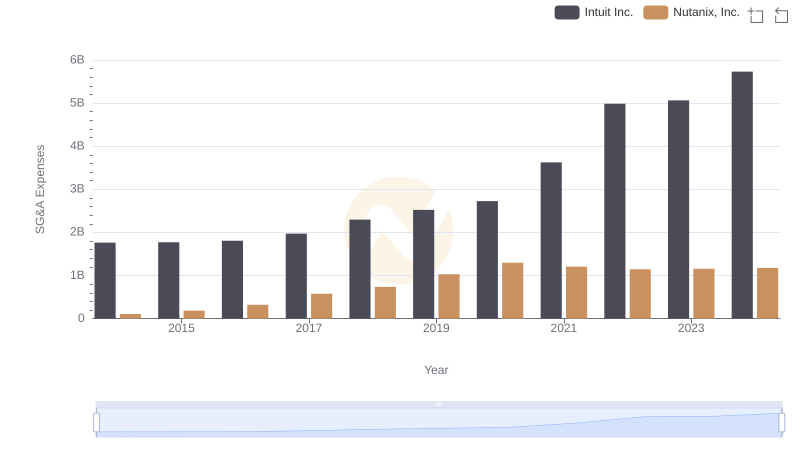

Who Optimizes SG&A Costs Better? Intuit Inc. or Nutanix, Inc.

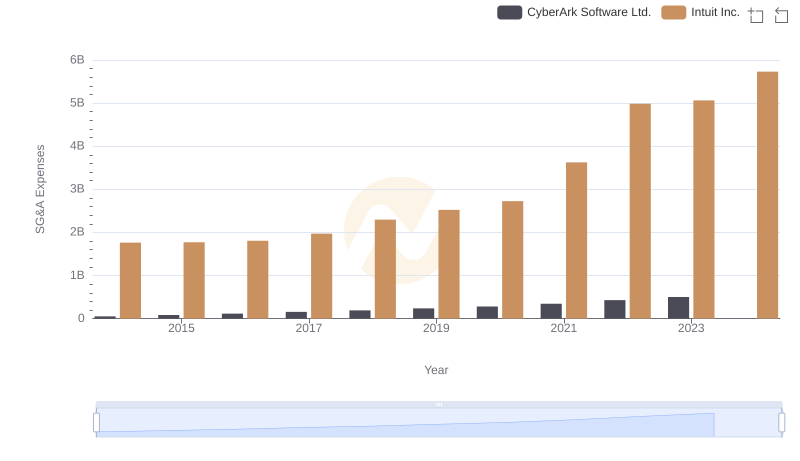

SG&A Efficiency Analysis: Comparing Intuit Inc. and CyberArk Software Ltd.

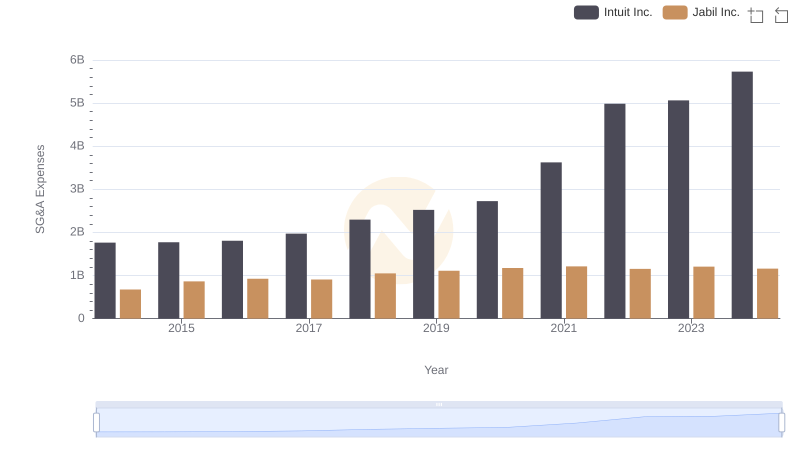

Intuit Inc. vs Jabil Inc.: SG&A Expense Trends

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Super Micro Computer, Inc.